公司重新上市

Search documents

汇绿生态实控人方套现2.88亿 2021重新上市净利降3年

Zhong Guo Jing Ji Wang· 2025-10-21 06:53

Core Viewpoint - The major shareholder of Huylv Ecological (001267.SZ), Ningbo Huining Investment Co., Ltd., has completed its share reduction plan, reducing its holdings by 21,186,870 shares, which is 2.70% of the total share capital [2][3]. Share Reduction Plan - Ningbo Huining initially held 145,354,943 shares, accounting for 18.54% of the total share capital, and planned to reduce its holdings by up to 23,524,939 shares within a specified period [2]. - The reduction was executed through both centralized bidding and block trading, with a maximum of 7,841,646 shares (1%) through centralized bidding and 15,683,293 shares (2%) through block trading [2]. - The actual reduction occurred from October 15 to October 17, 2025, with a total of 18,846,516 shares reduced, representing 2.40% of the total share capital [2]. Financial Impact - The average selling price during the reduction was 13.60 CNY per share, resulting in approximately 288 million CNY in cash proceeds for Ningbo Huining [3]. - The final shareholding of Ningbo Huining after the reduction is 126,508,427 shares [2]. Company Background - Huylv Ecological was re-listed on the Shenzhen Stock Exchange on November 17, 2021, after previously being delisted due to consecutive years of losses [5]. - The company has experienced a decline in net profit for three consecutive years since its re-listing, with revenues decreasing from 8.14 billion CNY in 2020 to 5.87 billion CNY in 2024 [6]. - The company conducted a non-public offering in 2022, raising approximately 332 million CNY after expenses [7].

汇绿生态实控人方拟减持 2021重新上市净利降3年后升

Zhong Guo Jing Ji Wang· 2025-06-27 07:45

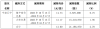

Group 1 - The major shareholder of Huylv Ecological (001267) plans to reduce its stake by 23,524,939 shares, accounting for up to 3% of the total share capital, within three months starting from July 18, 2025 [1] - After the share reduction, the actual controller and its concerted actors will still hold 393,734,960 shares, representing 50.21% of the total share capital, ensuring no change in control [1] - The major shareholder, Ningbo Huining Investment Co., Ltd., is controlled by Li Xiaoming, who holds 54.5989% of its shares [1] Group 2 - Huylv Ecological was re-listed on the Shenzhen Stock Exchange on November 17, 2021, after being suspended and delisted due to continuous losses from 2001 to 2003 [2] - The company had a total share count of 700 million shares upon re-listing, with Tianfeng Securities acting as the sponsor [2] Group 3 - In Q1 2025, Huylv Ecological reported revenue of 309 million yuan, a year-on-year increase of 210.40%, and a net profit attributable to shareholders of 19.83 million yuan, up 549.69% [3] - The company has experienced a decline in net profit for three consecutive years since its re-listing in 2021, with revenues from 2020 to 2024 being 814 million, 775 million, 611 million, 685 million, and 587 million yuan respectively [3] Group 4 - In 2022, Huylv Ecological raised approximately 332.32 million yuan through a non-public offering of 75,446,428 shares at a price of 4.48 yuan per share [4] - The net proceeds from the offering were confirmed by an audit report issued by Zhongxun Zhonghuan Accounting Firm [4]