stal Financial (CCB)

Search documents

Is Coastal Financial Corporation (CCB) an Attractive Investment?

Yahoo Finance· 2025-12-17 13:00

Core Insights - Riverwater Partners' "Micro Opportunities Strategy" reported solid absolute returns in Q3 2025 but lagged behind the benchmark due to not keeping pace with the market rally [1] - The strategy continues to focus on quality companies amid a volatile environment [1] Company Highlights - Coastal Financial Corporation (NASDAQ:CCB) is a bank holding company for Coastal Community Bank, with a one-month return of 12.76% and a 52-week gain of 44.49% [2] - As of December 16, 2025, Coastal Financial Corporation's stock closed at $114.93 per share, with a market capitalization of $1.738 billion [2] - Riverwater Partners maintained an overweight position in community banks, expecting benefits from a steepening yield curve and improving net interest margins [3] - Coastal Financial Corporation remained a top holding for Riverwater Partners, although the position was trimmed during the quarter to manage exposure and harvest gains [3] Hedge Fund Interest - Coastal Financial Corporation was held by 15 hedge fund portfolios at the end of Q3 2025, a decrease from 16 in the previous quarter [4] - While Coastal Financial Corporation is recognized for its potential, the company is not among the 30 most popular stocks among hedge funds, with certain AI stocks being viewed as having greater upside potential [4]

stal Financial (CCB) - 2025 Q3 - Quarterly Report

2025-11-07 14:27

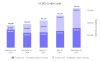

Financial Performance - Net income for the three months ended September 30, 2025, was $13.6 million, or $0.88 per diluted share, compared to $13.5 million, or $0.97 per diluted share, for the same period in 2024[155]. - Net interest income for the three months ended September 30, 2025, was $77.9 million, an increase of $5.6 million, or 7.8%, compared to $72.3 million for the same period in 2024[160]. - Net interest income for the nine months ended September 30, 2025, was $230.7 million, an increase of $30.0 million, or 15.0%, compared to $200.7 million for the same period in 2024[175]. - Noninterest income for the three months ended September 30, 2025, was $66.8 million, a decrease of $12.0 million, or 15.2%, from $78.8 million in the same quarter of 2024[202]. - For the nine months ended September 30, 2025, noninterest income was $172.9 million, down $61.2 million or 26.1% from $234.1 million in the prior year, primarily due to lower BaaS indemnification income[204]. Loan and Deposit Growth - Total loans increased by $163.5 million, or 4.6%, during the three months ended September 30, 2025, with community bank loans up by $39.6 million, or 2.1%, and CCBX loans up by $123.9 million, or 7.4%[151]. - Loans receivable totaled $3.70 billion as of September 30, 2025, an increase of $217.3 million, or 6.2%, compared to December 31, 2024[251]. - Total deposits as of September 30, 2025, were $3.97 billion, an increase of $387.2 million, or 10.8%, compared to $3.59 billion as of December 31, 2024[302]. - CCBX total deposits increased by $310.9 million, or 15.1%, to $2.37 billion as of September 30, 2025, compared to $2.06 billion as of December 31, 2024[303]. Interest Income and Expense - Interest income from interest-earning deposits with other banks increased by $3.2 million, or 67.5%, to $8.0 million for the quarter ended September 30, 2025[162]. - Interest expense decreased by $1.8 million to $31.1 million for the quarter ended September 30, 2025, with interest on deposits at $30.5 million, down from $32.1 million in the prior year[163]. - The average rate paid on total deposits decreased to 3.04% for the three months ended September 30, 2025, down from 3.59% for the same period in 2024[309]. Credit Quality and Losses - The provision for credit losses for the nine months ended September 30, 2025, was $143.6 million, a decrease of $69.4 million compared to $213.0 million for the same period in 2024[198]. - Net charge-offs for the nine months ended September 30, 2025, totaled $146.8 million, compared to $158.7 million for the same period in 2024[290]. - The allowance for credit losses as a percentage of loans was 4.69% at September 30, 2025, compared to 5.03% at September 30, 2024[192]. Asset Management - As of September 30, 2025, total assets were $4.55 billion, total loans receivable were $3.70 billion, total deposits were $3.97 billion, and total shareholders' equity was $475.3 million[149]. - Total interest earning assets for Q3 2025 were $4.41 billion, generating interest income of $109.03 million, compared to $3.88 billion and $105.17 million in Q3 2024[170]. - The company sold $3.66 billion in CCBX loans during the nine months ended September 30, 2025, as part of its strategy to optimize the CCBX portfolio[246]. Operational Efficiency - The efficiency ratio improved to 48.50% for the three months ended September 30, 2025, down from 60.98% in the previous quarter[346]. - Return on average assets improved to 1.19% for the three months ended September 30, 2025, up from 0.99% in the previous quarter[346]. - Return on average equity increased to 11.52% for the three months ended September 30, 2025, compared to 9.72% in the previous quarter[346]. Noninterest Expenses - Total noninterest expense for the nine months ended September 30, 2025, was $215.0 million, an increase of $36.0 million or 20.2% from $178.9 million in the prior year[212]. - Salaries and employee benefits for the three months ended September 30, 2025, increased by $3.1 million or 18.1% to $20.1 million compared to $17.1 million in 2024[211]. - Noninterest expenses for CCBX increased by $25.4 million, or 20.0%, to $152.2 million as of September 30, 2025, compared to $126.9 million as of September 30, 2024[246]. Strategic Initiatives - Six existing partner programs are being expanded to include new products such as lines of credit and credit cards, with Robinhood's deposit program expected to ramp up in Q4 2025[154]. - The company expects to continue selling CCBX loans as part of its ongoing strategy to manage the loan portfolio and credit quality[267]. - The company has portfolio limits with partners to manage loan concentration risk, with capital call lines outstanding balance totaling $177.5 million as of September 30, 2025[338].

stal Financial (CCB) - 2025 Q3 - Earnings Call Presentation

2025-11-07 12:00

Financial Performance - Diluted EPS 为 $088,高于上一季度的 $071[19] - 净收入为 $136 million,比上一季度增长 232%,比去年同期增长 10%[19] - 核心税前拨备前净收入 (PPNR) 为 $191 million,比上一季度增长 246%,比去年同期增长 155%[19] - 总收入增长 211%,达到 $1447 million[12,19] - 核心净收入增长 13%,达到 $529 million[12,19] Balance Sheet - 贷款总额(扣除递延费用)增加 $1635 million,即 46%,达到 $370 billion[12,19] - 存款增加 $590 million,即 15%,达到 $397 billion[12,19] - 有形账面价值增长 28%,达到每股 $3145[19] - 将 $6723 million 的存款转移到表外,用于 FDIC 保险和流动性目的,产生 $311000 的非利息收入[12,19] CCBX (Banking as a Service) - CCBX 贷款销售额为 $162 billion,高于上一季度的 $130 billion[19] - CCBX 贷款总额增长 $1239 million,即 74%[61] - CCBX 存款增长 $148 million,即 06%[61] - BaaS 项目费用收入同比增长 465%[37,52] Capital and Liquidity - 现金和即时借款能力合计 $135 billion[27] - 相当于 2025 年 9 月 30 日存款总额的 340%[27] - 一级杠杆资本为 105%[27] - 普通股一级风险资本为 123%[19,27]

Coastal Financial Corporation (CCB) Q3 Earnings Lag Estimates

ZACKS· 2025-10-29 13:20

Core Insights - Coastal Financial Corporation (CCB) reported quarterly earnings of $0.88 per share, missing the Zacks Consensus Estimate of $0.89 per share, and down from $0.97 per share a year ago, representing an earnings surprise of -1.12% [1] - The company posted revenues of $144.68 million for the quarter ended September 2025, exceeding the Zacks Consensus Estimate by 12.15%, but down from $152.26 million year-over-year [2] - Coastal Financial shares have increased approximately 23.5% year-to-date, outperforming the S&P 500's gain of 17.2% [3] Earnings Outlook - The current consensus EPS estimate for the upcoming quarter is $1.19 on revenues of $136.7 million, and for the current fiscal year, it is $3.38 on revenues of $524.7 million [7] - The estimate revisions trend for Coastal Financial was mixed ahead of the earnings release, resulting in a Zacks Rank 3 (Hold) for the stock, indicating expected performance in line with the market [6] Industry Context - The Zacks Industry Rank for Banks - West is currently in the top 11% of over 250 Zacks industries, suggesting a favorable outlook for the sector [8]

stal Financial (CCB) - 2025 Q3 - Quarterly Results

2025-10-29 11:12

Financial Performance - Net income for Q3 2025 was $13.6 million, or $0.88 per diluted share, compared to $11.0 million, or $0.71 per diluted share in Q2 2025, and $13.5 million, or $0.97 per diluted share in Q3 2024[1]. - Return on average assets (ROA) for Q3 2025 was 1.19%, an increase of 0.20% from Q2 2025 and a decrease of 0.15% from Q3 2024[8]. - Net interest income for the quarter ended September 30, 2025 was $77.9 million, an increase of $1.2 million, or 1.5%, from the previous quarter and an increase of $5.6 million, or 7.8%, from the same quarter last year[32]. - Noninterest income was $66.8 million for the three months ended September 30, 2025, an increase of $24.1 million from the previous quarter, primarily due to a $23.7 million increase in total BaaS income[38]. - Total shareholders' equity increased by $13.6 million since June 30, 2025, primarily due to net earnings[49]. Asset and Loan Growth - Loans receivable increased by $163.5 million, representing a 4.6% rise, while deposits grew by $59.0 million, or 1.5%[2]. - Average loans receivable increased by $68.7 million to $1.80 billion as of September 30, 2025, despite selling $1.62 billion in loans during the same quarter[9]. - The community bank's net loans increased by $39.6 million, or 2.1%, to $1.90 billion in Q3 2025[29]. - Total assets increased by $72.5 million, or 1.6%, to $4.55 billion at September 30, 2025, driven by a $163.5 million increase in loans receivable[46]. - Total liabilities stood at $4,077,799 thousand, up from $4,018,850 thousand in the previous quarter, reflecting an increase of 1.5%[70]. Noninterest Expenses and Efficiency - Total noninterest expense decreased by $2.7 million, or 3.7%, to $70.2 million compared to $72.8 million in Q2 2025[3]. - Noninterest expenses decreased compared to Q2 2025 but increased compared to Q3 2024, primarily due to higher salaries and employee benefits[8]. - The efficiency ratio improved to 48.50% in Q3 2025 from 60.98% in Q2 2025[12]. - The increase in noninterest expenses compared to the same quarter last year was largely due to a $3.1 million increase in salary and employee benefits and a $1.5 million increase in data processing and software licenses[42]. Credit Quality and Allowance for Losses - Nonperforming assets to total assets ratio improved to 1.31% from 1.36% in Q2 2025[6]. - The allowance for credit losses was $173.8 million, representing 4.69% of loans receivable at September 30, 2025, compared to 4.65% in the previous quarter and 5.03% a year ago[51]. - Net charge-offs totaled $49.2 million for the quarter ended September 30, 2025, slightly down from $49.3 million in the previous quarter and up from $48.8 million year-over-year[52]. - The ratio of nonperforming loans to loans receivable improved to 1.61% from 1.72% in June 2025 and 1.94% in September 2024[59]. - CCBX recorded net charge-offs of $49.2 million for the quarter, indicating a higher level of expected losses compared to community bank loans[60]. BaaS Program and Income - Total BaaS program fee income was $7.6 million, an increase of $764,000, or 11.3%, from Q2 2025[3]. - The net BaaS loan income for the quarter ended September 30, 2025 was $36.8 million, reflecting an increase from the previous quarter[37]. - BaaS program income for the three months ended September 30, 2025, was $7,554,000, with no nonrecurring income reported for this period[85]. - BaaS loan interest income increased to $69.6 million for the quarter ended September 30, 2025, compared to $68.3 million in the previous quarter, reflecting a growth trend[106]. - BaaS indemnification income, which includes credit and fraud enhancements, totaled $57.5 million for the quarter ended September 30, 2025, compared to $34.1 million in the previous quarter[106]. Deposits and Funding - Average deposits were $3.97 billion, an increase of $40.7 million, or 1.0%, over Q2 2025[3]. - Total Community Bank deposits rose by $44.2 million, or 2.8%, to $1.60 billion as of September 30, 2025, with noninterest bearing deposits accounting for $499.7 million, or 31.3% of total deposits[31]. - Cost of funds decreased to 3.07% for the quarter ended September 30, 2025, down six basis points from the previous quarter and 55 basis points from the same quarter last year[36]. - Uninsured deposits increased to $617.9 million as of September 30, 2025, compared to $579.9 million at the end of the previous quarter[48]. - The company had a cash balance of $43.9 million as of September 30, 2025, with additional borrowing capacity of $707.1 million from various sources[47].

Coastal Financial Corporation Announces Third Quarter 2025 Results

Globenewswire· 2025-10-29 11:00

Core Insights - Coastal Financial Corporation reported a net income of $13.6 million for Q3 2025, an increase from $11.0 million in Q2 2025 and $13.5 million in Q3 2024, translating to earnings per diluted share of $0.88 [1][4] - The company experienced a 4.6% increase in loans receivable, amounting to $163.5 million, and a 1.5% growth in deposits totaling $59.0 million during the same quarter [2][4] Financial Performance - Interest and dividend income reached $109.0 million, up from $107.8 million in Q2 2025 and $105.2 million in Q3 2024 [5] - Net interest income was $77.9 million, reflecting a 1.5% increase from $76.7 million in Q2 2025 and a 7.8% increase from $72.3 million in Q3 2024 [38] - Noninterest income totaled $66.8 million, compared to $42.7 million in Q2 2025 and $78.8 million in Q3 2024 [5] Loan and Deposit Growth - Average deposits were $3.97 billion, an increase of $40.7 million or 1.0% from Q2 2025, primarily driven by CCBX partner programs [6] - The community bank segment saw net loans increase by $39.6 million, or 2.1%, to $1.90 billion [34] CCBX Segment Performance - The CCBX segment reported a total of 29 relationships, with 2 partners in testing, 4 in implementation, and 2 signed letters of intent as of September 30, 2025 [20][24] - CCBX loans increased by $123.9 million, or 7.4%, to $1.80 billion despite selling $1.62 billion in loans during the quarter [24][27] Cost Management and Efficiency - Total noninterest expense decreased by $2.7 million, or 3.7%, to $70.2 million compared to Q2 2025, mainly due to lower legal and professional expenses [6] - The efficiency ratio improved to 48.50% from 60.98% in Q2 2025, indicating better operational efficiency [17] Credit Quality - Nonperforming assets to total assets ratio improved to 1.31% from 1.36% in Q2 2025, while the allowance for credit losses to nonperforming loans ratio was 290.8% [8][12] - The company reported gross charge-offs of $54.5 million for the quarter, slightly up from $53.8 million in Q2 2025 [8] Management Outlook - The company anticipates further growth in the BaaS space with new partner engagements and continued investment in technology and risk management infrastructure [18] - Credit quality remains a central focus, with a strategy to manage the balance sheet effectively in response to interest rate changes [18]

Earnings Preview: Coastal Financial Corporation (CCB) Q3 Earnings Expected to Decline

ZACKS· 2025-10-20 15:00

Core Viewpoint - Coastal Financial Corporation (CCB) is anticipated to report a year-over-year decline in earnings due to lower revenues for the quarter ended September 2025, with the consensus outlook indicating potential impacts on its near-term stock price [1][3]. Earnings Expectations - The consensus estimate for Coastal Financial's quarterly earnings is $0.89 per share, reflecting a year-over-year decrease of 8.3%. Revenues are projected to be $129 million, down 15.3% from the same quarter last year [3]. - The earnings report could lead to a stock price increase if the actual results exceed expectations, while a miss could result in a decline [2]. Estimate Revisions - The consensus EPS estimate has remained unchanged over the last 30 days, indicating that analysts have not significantly reassessed their initial estimates during this period [4]. - The Most Accurate Estimate for Coastal Financial is lower than the Zacks Consensus Estimate, resulting in an Earnings ESP of -2.83%, suggesting a bearish outlook from analysts [13]. Earnings Surprise Prediction - The Zacks Earnings ESP model indicates that a positive or negative reading can predict the deviation of actual earnings from the consensus estimate, with positive readings being more predictive of earnings beats [10][11]. - Coastal Financial's combination of a negative Earnings ESP and a Zacks Rank of 3 makes it challenging to predict an earnings beat conclusively [13]. Historical Performance - In the last reported quarter, Coastal Financial was expected to post earnings of $0.87 per share but only achieved $0.71, resulting in a surprise of -18.39%. Over the past four quarters, the company has only beaten consensus EPS estimates once [14][15]. Industry Comparison - In the Zacks Banks - West industry, First Hawaiian (FHB) is expected to report earnings of $0.52 per share for the same quarter, indicating a year-over-year increase of 8.3%. Its revenue is projected to be $218.28 million, up 4% from the previous year [19][20].

Coastal Names Seasoned Fintech Leader Brandon Soto as New Chief Financial Officer

Globenewswire· 2025-09-22 20:50

Core Insights - Coastal Financial Corporation has appointed Brandon Soto as Chief Financial Officer, effective October 1, 2025, bringing extensive experience from Square Financial Services [1][2] Group 1: Appointment and Background - Brandon Soto's appointment signifies a commitment to operational excellence and regulatory stewardship, aiming to scale both fintech and community banking divisions [2] - Soto has over two decades of experience in major financial institutions and fintech, enhancing the company's strategic foresight [2] Group 2: Previous Experience - As CFO of Square Financial Services, Soto managed all financial operations, including the successful submission of the bank's charter application, securing approvals from regulatory bodies [3] - His leadership at Square ensured compliance with capital requirements and positioned the bank for strategic growth [3] - Soto has held significant roles at various institutions, including Green Dot Bank and Sallie Mae Bank, focusing on financial infrastructure and operational management [4] Group 3: Educational Background - Soto holds an MBA and a Graduate Certificate in Accounting from Westminster University, along with a Bachelor of Science in Finance and Accounting from the University of Utah [5] - He is a licensed CPA in Utah and has completed the McKinsey Hispanic & Latino Executive Leadership Program, highlighting his dedication to leadership development [5] Group 4: Vision and Leadership - Soto's approach emphasizes economic empowerment and financial inclusion, aligning with Coastal's mission to modernize operations and create lasting value for customers and shareholders [6] - The CEO of Coastal expressed enthusiasm for Soto's appointment, indicating it aligns with the bank's goals of serving communities effectively [6] Group 5: Company Overview - Coastal Financial Corporation is based in Everett, Washington, with assets totaling $4.48 billion and operates 14 branches across Snohomish, Island, and King Counties [7] - The bank provides banking services through its CCBX segment, catering to digital financial service providers [7]

Coastal Financial Stock: Slashing The EPS Estimate And Downgrading To Sell (NASDAQ:CCB)

Seeking Alpha· 2025-09-19 03:11

Group 1 - Coastal Financial Corporation (NASDAQ: CCB) has seen a significant increase in stock price since the last report released in March, despite the company's earnings missing expectations [1] - The hold rating on Coastal Financial Corporation remains in place due to the discrepancy between stock performance and earnings results [1]

Coastal Expands Executive Team with Key Leadership Appointments

Globenewswire· 2025-08-13 13:30

Core Insights - Coastal Financial Corporation has appointed four new executives to enhance its leadership team, focusing on growth in digital banking and community initiatives [1][7] - The new executives include Ryan Hall as Chief Product Officer, Michael Costigan as Chief Commercial Officer, Freddy Rivas as Chief Credit Officer, and Chris Morgan as Chief Information Security Officer, each bringing significant industry experience [2][3] Executive Profiles - Ryan Hall has a strong background in product strategy and innovation, previously leading product development at SoFi Bank and working with The Boston Consulting Group [3] - Michael Costigan comes from OnePay, where he was instrumental in raising $40 million in Series B funding and expanding customer growth channels [4] - Freddy Rivas has over 20 years of experience in commercial banking, most recently serving as Chief Risk Officer at Santander, focusing on credit policy and portfolio management [5] - Chris Morgan previously scaled the security function at Even Responsible Finance and OnePay, and has experience with national security programs at the Federal Reserve System [6] Company Overview - Coastal Financial Corporation is based in Everett, Washington, with total assets of $4.48 billion and operates 14 branches across Snohomish, Island, and King Counties [7]