Prenetics(PRE)

Search documents

Prenetics Announces Oversubscribed Approximately $48 Million Equity Offering with Potential for $216 Million in Total Proceeds to Fuel IM8's Global Expansion and Bitcoin Treasury Strategy

Globenewswire· 2025-10-27 14:12

Core Insights - Prenetics Global Limited has successfully priced a public offering of approximately $48 million, which includes Class A and Class B warrants, with potential total proceeds of up to $216 million if all warrants are exercised [1][2][12] - The company’s flagship brand, IM8, has achieved $100 million in annual recurring revenue within just 11 months of launch, marking the fastest growth in the supplements industry [4][20] - Prenetics aims to reach $1 billion in annual revenue and $1 billion in Bitcoin holdings within the next five years, supported by a strategic focus on its IM8 brand and Bitcoin treasury initiatives [6][7][15] Financial Overview - The public offering consists of 2,992,596 Class A ordinary shares and warrants, priced at $16.08 per share, with gross proceeds expected to be around $48 million before fees [1][2] - IM8 is projected to generate over $8.6 million in monthly revenue for October 2025, leading to an annual run rate of approximately $103 million [14] - Prenetics will hold approximately $100 million in cash and 275 BTC valued at $31 million as of October 27, 2025, totaling $131 million in liquidity [15][21] Strategic Partnerships - The offering has attracted a distinguished group of investors, including Kraken, American Ventures, and Jihan Wu's GPTX, enhancing Prenetics' strategic value in the cryptocurrency and health sectors [3][5] - Notable investors like Aryna Sabalenka and Adrian Cheng are expected to amplify IM8's global reach and cultural influence [7][20] Market Positioning - Prenetics is positioned at the intersection of health innovation and digital assets, being the first consumer health company to establish a Bitcoin treasury [21] - The company is targeting the $704 billion global supplements market expected by 2030, leveraging its rapid growth and strategic partnerships [4][20]

Prenetics Announces Oversubscribed Approximately $48 Million Equity Offering with Potential for $216 Million in Total Proceeds to Fuel IM8’s Global Expansion and Bitcoin Treasury Strategy

Globenewswire· 2025-10-27 14:12

Core Insights - Prenetics Global Limited has successfully priced a public offering of approximately $48 million, involving 2,992,596 Class A ordinary shares and warrants [1][2] - The company aims to leverage its rapid growth in the health supplement sector, particularly through its brand IM8, which achieved $100 million in annual recurring revenue within 11 months of launch [5][21] - Prenetics is strategically focusing on its IM8 brand while considering divestment of other business units to maximize shareholder value [7] Financial Overview - The offering includes a double warrant structure, with Class A and Class B warrants exercisable at premiums of 50% and 100% respectively, potentially raising total proceeds to approximately $216 million if fully exercised [2] - IM8 is projected to generate revenues between $160 million and $200 million in 2026, with a current monthly revenue run rate of over $8.6 million [15][13] - Following the offering, Prenetics will hold approximately $100 million in cash and 275 BTC valued at $31 million, totaling $131 million in liquidity [16] Strategic Partnerships - The offering was supported by notable investors including Kraken, American Ventures, and Jihan Wu's GPTX, enhancing Prenetics' strategic positioning in the cryptocurrency and health sectors [3][6] - Aryna Sabalenka, a world-renowned tennis champion, has increased her stake in Prenetics, further aligning her brand with the company's mission [4][8] Market Positioning - IM8 is recognized as the fastest-growing supplement brand globally, with significant traction across multiple markets, targeting a share of the $704 billion global supplements market expected by 2030 [5][21] - The company is pioneering a Bitcoin treasury strategy, purchasing 1 BTC daily, which positions it at the intersection of health innovation and digital assets [22]

Prenetics Announces $48.0 Million Equity Offering to Fuel IM8’s Global Expansion and Bitcoin Treasury Strategy

Globenewswire· 2025-10-27 13:52

Core Viewpoint - Prenetics Global Limited has successfully priced a public offering to raise approximately $48 million, which will be used for global expansion and strategic Bitcoin accumulation as part of its health and wealth strategy [1][3]. Group 1: Offering Details - The offering includes 2,992,596 Class A ordinary shares and associated warrants at a combined price of $16.08 per share [1]. - Class A Common Warrants have an exercise price of $24.12 per share, while Class B Common Warrants are priced at $32.16 per share, representing premiums of 50% and 100% respectively [2]. - The offering is expected to close on October 28, 2025, pending customary closing conditions [3]. Group 2: Use of Proceeds - Proceeds from the offering will be allocated to the global expansion of IM8, Prenetics' flagship consumer brand, which has achieved rapid growth [3]. - The company is also focusing on accumulating Bitcoin, having established a Bitcoin Treasury and purchasing 1 Bitcoin per day, totaling 275 BTC as of October 27, 2025 [8]. Group 3: Company Background - Prenetics is recognized as a leading health sciences company, co-founded with David Beckham, and has rapidly grown its IM8 brand to reach $100 million in annual recurring revenue within 11 months of launch [7]. - The company is pioneering the intersection of health innovation and digital assets, positioning itself uniquely in the market [8].

Morning Market Movers: CLIK, RNA, DYN, SLGB See Big Swings

RTTNews· 2025-10-27 13:03

Core Insights - Premarket trading is showing notable activity with significant price movements indicating potential trading opportunities before the market opens [1] Premarket Gainers - Click Holdings Limited (CLIK) is up 81% at $11.17 [3] - Avidity Biosciences, Inc. (RNA) is up 43% at $70.72 [3] - Dyne Therapeutics, Inc. (DYN) is up 37% at $23.58 [3] - Zenas BioPharma, Inc. (ZBIO) is up 21% at $29.00 [3] - ProPetro Holding Corp. (PUMP) is up 18% at $7.47 [3] - PepGen Inc. (PEPG) is up 17% at $5.35 [3] - Unusual Machines, Inc. (UMAC) is up 15% at $14.85 [3] - Semler Scientific, Inc. (SMLR) is up 14% at $27.32 [3] - ETHZilla Corporation (ETHZ) is up 13% at $20.51 [3] - Relmada Therapeutics, Inc. (RLMD) is up 13% at $2.38 [3] Premarket Losers - Smart Logistics Global Limited (SLGB) is down 37% at $3.21 [4] - MaxsMaking Inc. (MAMK) is down 22% at $4.08 [4] - Prenetics Global Limited (PRE) is down 14% at $14.40 [4] - United States Antimony Corporation (UAMY) is down 14% at $10.22 [4] - NeurAxis, Inc. (NRXS) is down 12% at $3.01 [4] - Obook Holdings Inc. (OWLS) is down 9% at $11.39 [4] - Qualigen Therapeutics, Inc. (QLGN) is down 9% at $3.30 [4] - Critical Metals Corp. (CRML) is down 8% at $13.70 [4] - Neuphoria Therapeutics Inc. (NEUP) is down 8% at $5.73 [4] - Beam Therapeutics Inc. (BEAM) is down 7% at $25.86 [4]

Prenetics Global Limited Announces Proposed Public Offering

Globenewswire· 2025-10-25 00:30

Core Viewpoint - Prenetics Global Limited has initiated a public offering of its Class A Ordinary Shares and common warrants to fund the global expansion of its IM8 brand and to accumulate Bitcoin as part of its health and wealth strategy [1][6]. Group 1: Offering Details - The offering is subject to market conditions, and there is no assurance regarding its completion or the actual size and terms [2]. - Dominari Securities LLC is the sole placement agent for the offering, which is made under an effective shelf registration statement declared effective by the SEC on September 11, 2025 [3]. Group 2: Company Overview - Prenetics is a leading health sciences company co-founded with David Beckham, focusing on health and longevity through its IM8 brand, which is one of the fastest-growing supplement brands globally [6]. - The company has established a Bitcoin Treasury, purchasing 1 Bitcoin per day, totaling 272 BTC as of October 24, 2025, positioning itself at the intersection of health innovation and digital assets [6].

Stonegate Capital Partners Initiates Coverage on Pensana PLC (PRE)

Newsfile· 2025-10-16 13:10

Group 1 - Stonegate Capital Partners has initiated coverage on Pensana PLC, highlighting its unique position as one of the few developers outside China pursuing a full mine-to-magnet model in the rare earth supply chain [1][6] - Pensana is advancing a U.S.-facing downstream strategy that aligns with Western supply chain security goals, moving away from a traditional "dig-and-ship" approach [1][6] - The company has established a memorandum of understanding with ReElement Technologies, which provides a direct pathway for Longonjo feedstock to be refined and separated in the United States, linking production to magnet manufacturing [1][6] Group 2 - Offtake agreements and memorandums of understanding already cover multiples of Stage 1 capacity, indicating strong demand for Pensana's high-specification product [1][6] - Longonjo is fully financed and under construction, with Stage 1 expected to produce approximately 20,000 tonnes of MREC in 2026, increasing to around 40,000 tonnes in 2027, benefiting from the Lobito rail and hydro power [1][6] - Pensana's strategy aligns with U.S. 2027 magnet-supply objectives, and management is considering a potential Nasdaq uplisting to enhance institutional access and trading liquidity [1][6]

Prenetics Global Limited (PRE) Is Up 13.52% in One Week: What You Should Know

ZACKS· 2025-10-13 17:01

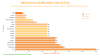

Core Viewpoint - Momentum investing focuses on following a stock's recent price trends, with the aim of buying high and selling higher, capitalizing on established price movements [1] Company Overview: Prenetics Global Limited (PRE) - Prenetics Global Limited currently holds a Momentum Style Score of A, indicating strong potential for momentum investing [3] - The company has a Zacks Rank of 2 (Buy), suggesting it is positioned for outperformance in the market [4] Price Performance - Over the past week, PRE shares have increased by 13.52%, significantly outperforming the Zacks Medical - Biomedical and Genetics industry, which rose by 3.65% [6] - In a longer timeframe, PRE's monthly price change is 37.87%, compared to the industry's 6.23% [6] - Over the past quarter, PRE shares have risen by 75.6%, and over the last year, they have increased by 223.78%, while the S&P 500 has only moved 4.67% and 14.71%, respectively [7] Trading Volume - The average 20-day trading volume for PRE is 137,788 shares, which serves as a bullish indicator when combined with rising stock prices [8] Earnings Outlook - In the past two months, one earnings estimate for PRE has increased, while none have decreased, leading to a consensus estimate improvement from -$2.71 to -$2.56 [10] - For the next fiscal year, one estimate has moved upwards with no downward revisions during the same period [10] Conclusion - Given the strong price performance, positive earnings outlook, and high Momentum Style Score, PRE is recommended as a solid momentum pick for investors [12]

Prenetics: A Cautious Buy Based On Strong Sales Growth

Seeking Alpha· 2025-10-09 04:58

Core Insights - Prenetics Global Limited (NASDAQ: PRE) is transitioning from a diagnostics company to a health sciences company, driven by strong sales growth of its product IM8 [1] Company Overview - Prenetics is characterized as a young and small company, indicating potential for growth and development in the health sciences sector [1] Sales Performance - The transition to a health sciences company is primarily based on the robust sales growth of IM8, suggesting a successful product performance that could enhance the company's market position [1]

Prenetics' IM8 Launches Daily Ultimate Longevity, First Supplement to Target All 12 Hallmarks of Aging

Globenewswire· 2025-10-08 12:04

Core Insights - Prenetics Global Limited has launched Daily Ultimate Longevity, a supplement targeting all 12 hallmarks of aging, reinforcing IM8's rapid growth in the supplement industry [1][3][4] - IM8 has achieved a compound annual growth rate of 2,457%, with monthly revenue increasing from approximately $600,000 to $6.6 million within nine months [1][4] - The global longevity market is projected to reach $314 billion by 2030, positioning IM8 at the forefront of this expanding market [7] Company Overview - Prenetics is a leading consumer health sciences company, with IM8 being one of the fastest-growing supplement brands co-founded by David Beckham [1][11] - The company maintains a strong financial foundation with over $90 million in liquid assets, including approximately $60 million in cash and 255.4 Bitcoin valued at around $31.6 million [10] Product Details - Daily Ultimate Longevity is formulated with IM8's proprietary 5-Complex System, delivering therapeutic doses of clinically-validated ingredients in a powder format [3][5][8] - The product is designed to target key aging pathways such as cellular senescence and mitochondrial dysfunction, supported by human clinical research [5][6][8] - It is priced at $149 for a one-time purchase and $119 per month for subscription, reflecting its premium positioning in the market [9] Market Positioning - The launch of Daily Ultimate Longevity is seen as a category-defining innovation in the rapidly growing longevity market [7][8] - The product's formulation includes high-dose glycine, taurine, and other key ingredients aimed at comprehensive cellular support and energy enhancement [8][12]

Prenetics Completes $72 Million ACT Exit, Bolsters Cash and Bitcoin Treasury to Accelerate IM8’s Path to $100 Million ARR

Globenewswire· 2025-10-07 12:30

Core Insights - Prenetics Global Limited has completed the divestment of ACT Genomics to Delta Electronics, marking a strategic exit from the clinical diagnostics sector to focus on consumer health initiatives [1][5] - The divestment has significantly improved Prenetics' financial position, with total proceeds from the transaction amounting to $46 million, enhancing cash reserves to over $60 million while maintaining a debt-free balance sheet [2][5] - The company is poised for growth with its flagship consumer health brand, IM8, projected to achieve an annualized revenue run-rate of $100 million within its first year [3][5] Financial Position - Prenetics received $39.9 million in cash from the $72 million transaction, with an additional $6.3 million held in escrow for future distribution [2] - The total cash reserves now exceed $60 million, excluding Bitcoin holdings, providing a strong foundation for growth [2][5] - The company maintains a debt-free balance sheet, which positions it well for future investments [2][5] Consumer Health Initiatives - IM8 is on track to become one of the fastest-growing supplement brands, demonstrating strong market demand and execution [3][5] - The strategic shift allows Prenetics to focus entirely on high-growth consumer health business [5] Bitcoin Treasury Strategy - Prenetics holds 255.4 BTC, valued at $31.6 million, with an unrealized profit of $3.86 million, reflecting a 13.9% return on investment [4][7] - The company has implemented a disciplined strategy of purchasing 1 BTC daily since August 2025, with all holdings securely custodied at Kraken [4][7] - Prenetics is pioneering the intersection of healthcare innovation and digital asset adoption through its Bitcoin treasury strategy [6]