Resource Expansion

Search documents

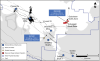

Wesdome Intersects New Zone at Kiena’s Dubuisson Deposit

Globenewswire· 2025-10-27 10:30

Core Insights - Wesdome Gold Mines Ltd. has announced the discovery of a new mineralized zone at the Dubuisson deposit, which is located east of the Kiena Deep deposit in the Kiena Mine Complex, Val-d'Or, Québec [1][2][3] Exploration Results - Drill hole DB-25-068 intersected 4.1 g/t Au over 25.8 metres (core length), indicating significant resource expansion potential [2][3] - The new zone is approximately 100 metres below and lateral to the Dubuisson North Zone, interpreted to be between the Dubuisson North and South zones, suggesting a compelling opportunity for depth expansion [2][3] - The intercept includes higher-grade intervals, such as 6.1 g/t Au over 6.1 metres, highlighting the potential for future bulk-tonnage mineralization at Kiena [3][4] Company Statements - Anthea Bath, President and CEO, emphasized the strong potential for expansion at the Dubuisson deposit, noting the intercept's grade, width, and proximity to existing infrastructure [3] - Jono Lawrence, Senior VP Exploration and Resources, mentioned that the 2025 drilling campaign has completed 41 holes totaling 11,361 metres, indicating the underexplored nature of the Dubuisson deposit [3][4] Technical Details - The Dubuisson deposit currently hosts a probable reserve of 36,400 ounces at 5.8 g/t Au, an indicated resource of 18,000 ounces at 4.6 g/t Au, and an inferred resource of 55,600 ounces at 5.4 g/t Au [4] - The mineralization style at Dubuisson is characterized by quartz-tourmaline veins within diorite intrusive units, distinct from the Kiena Deep deposit [5][6] Future Plans - A follow-up hole is planned before the end of the current barge drilling season, with a larger barge-based drilling program scheduled to commence in summer 2026 [3][4]

Aston Bay and American West Metals Intersect Copper Mineralization Outside of Proposed Pit Designs at the Storm Project, Nunavut, Canada

Accessnewswire· 2025-10-20 11:00

Core Insights - The latest diamond drilling at the Cyclone Deposit has revealed high-grade copper intervals, indicating potential for resource expansion [1] - Significant assay results include drill hole PFS-002 intersecting 12.1m at 5.6% copper and drill hole PFS-001 intersecting 18.2m at 1.1% copper, both outside current pit designs [1] - Reverse Circulation drilling results support the potential for resource upgrade and expansion across multiple deposits [1] Group 1: Drilling Results - Drill hole PFS-002 reported 12.1m at 5.6% copper, including 0.5m at 27.3% copper [1] - Drill hole PFS-001 showed 18.2m at 1.1% copper, with notable intervals of 7.1m at 2.2% copper [1] - High-grade intervals were found near the surface, suggesting additional resource potential [1] Group 2: Resource Expansion Potential - Assays from resource drilling around Cyclone, Chinook, Thunder, and Cirrus Deposits indicate thick copper intervals [1] - Positive implications for resource expansion at Storm are highlighted by the drilling results [1] - Ongoing mine development workstreams include permitting and Pre-Feasibility Study for potential mine development [1]

Dakota Gold Continues to Intersect Significant Gold Mineralization in Ongoing 2025 Richmond Hill Drill Campaign

Newsfile· 2025-10-16 10:30

Core Insights - Dakota Gold Corp. continues to report significant gold mineralization from its ongoing 2025 drilling campaign at the Richmond Hill Oxide Heap Leach Gold Project, with high-grade gold being intercepted in the northern project area, supporting plans for initial mining operations [1][3] - The company is conducting a core drilling campaign aimed at completing a Feasibility Study, with a total of 27,500 meters (~90,000 feet) planned for the 2025 campaign [1][3] Drilling Results - Recent assay results from 32 infill and metallurgical drill holes indicate promising mineralization, particularly in the northern project area, which is targeted for the initial stages of mining [1][3] - Notable drill results include RH25C-241, which intersected 3.72 grams per tonne (g/t) gold over 20.5 meters, and RH25C-209 with 1.40 g/t Au over 73.5 meters, demonstrating the low-risk nature of the deposit [5][8] Future Plans - The ongoing drilling is expected to provide critical data for the Feasibility Study, enhancing geological resource understanding and supporting the transition to commercial production by 2029 [3][11] - The company anticipates further assay results from expansion and infill drilling in the northeast project area before the end of the year, with potential for resource expansion based on prior drilling [5][8]

New Found Gold Intersects High-Grade Gold Mineralization in Dome Zone Step-Out Program: 10.4 g/t Au over 20.50m and 7.47 g/t Au over 13.40m

Newsfile· 2025-10-15 21:00

Core Insights - New Found Gold Corp. announced high-grade gold mineralization results from its ongoing 2025 drill program at the Queensway Gold Project in Newfoundland and Labrador, Canada [1][3] - Significant drill results include 10.4 g/t Au over 20.50 m and 7.47 g/t Au over 13.40 m from the Dome zone, indicating potential for resource expansion [7][9] - The 2025 drill program aims to convert inferred mineral resources to indicated resources, with results expected to be included in a mineral resource update scheduled for H1/26 [3][4] Drill Results Summary - The news release includes results from 11,187 m of drilling across 79 diamond drill holes completed in Q3/25, focusing on infill and exploration at the AFZ Core [4][5] - Key highlights from the Dome zone include: - 10.4 g/t Au over 20.50 m (NFGC-25-2299) - 7.47 g/t Au over 13.40 m (NFGC-25-2265) [7][9] - Lotto zone results include: - 40.6 g/t Au over 2.80 m (NFGC-25-2268) - 30.5 g/t Au over 2.05 m (NFGC-25-2263) [7] - Lotto North zone results include: - 33.8 g/t Au over 2.05 m (NFGC-25-2292) - 8.26 g/t Au over 4.40 m (NFGC-25-2331) [7] Future Plans - The 2025 Queensway drill program, which commenced in May 2025, is approximately 70% complete, with a focus on the AFZ Core area [14][15] - Infill drilling is ongoing to convert remaining inferred resources to indicated resources, with completion expected in Q4/25 [15][16] - Additional drilling in 2026 will target the expansion of the newly identified high-grade domain at the Dome zone [10][12]

Expansion of Near Surface High-Grade Oxide Mineralization at Rangefront Zone Reinforces Growth Potential at Black Pine Gold Project, Idaho

Globenewswire· 2025-10-15 10:00

Core Insights - Liberty Gold Corp. has reported strong results from its ongoing 40,000 meter feasibility reverse circulation drill program at the Black Pine Gold Project in southeastern Idaho, aimed at resource infill, technical compliance, and resource expansion [2][3] Drilling Results - Recent drilling results from 14 holes totaling 2,979 meters confirm the growth of the Rangefront Zone, expanding the near-surface oxide gold zone to over 150 meters wide (north-south) and over 200 meters wide (east-west) [3][10] - Significant drill results include: - 0.41 g/t Au over 41.1 meters in LBP1145 at 45 meters below surface - 0.92 g/t Au over 35.1 meters in LBP1141 - 0.28 g/t Au over 125 meters in LBP1136 - 0.20 g/t Au over 53.3 meters in LBP1141 - 0.37 g/t Au over 71.6 meters in LBP1144 [10][12] Resource Expansion Potential - The newly expanded near-surface oxide gold zone introduces potential changes to mining economics and sequencing strategy, as previously defined in the 2024 Preliminary Feasibility Study [3][10] - The Rangefront area is emerging as a cornerstone growth area for the Black Pine Project, strategically located adjacent to infrastructure and the proposed leach pad [10][12] Future Plans - Additional metallurgical drilling is planned for Q4 2025 to improve coverage of the expanded resource areas for the Feasibility Study [10] - Approximately 50 additional RC and core holes and 15,000 meters of drilling are planned for 2025 [10][12] Historical Context - The Rangefront Area has seen 14,289 meters of drilling completed in 2025, with another 15,000 meters planned, building on the 14,817 meters drilled in 2024, which were not included in the 2024 Preliminary Feasibility Study [12][13] - The currently defined Rangefront Area is a 1,500 x 1,200 x 300 meters thick zone of continuous oxide gold mineralization, with a resource estimate of 1,619,000 Indicated and 296,000 inferred ounces of gold [13]

Expansion of Near Surface High-Grade Oxide Mineralization at Rangefront Zone Reinforces Growth Potential at Black Pine Gold Project, Idaho

Globenewswire· 2025-10-15 10:00

Core Viewpoint - Liberty Gold Corp. has reported strong results from its ongoing 40,000 meter feasibility reverse circulation drill program at the Black Pine Gold Project, indicating significant resource expansion and improved mining economics [2][3][6]. Drilling Results - The latest results from 14 holes totaling 2,979 meters confirm the growth of the Rangefront Zone, expanding the near-surface oxide gold zone to over 150 meters wide (north-south) and over 200 meters wide (east-west) [3][10]. - Notable drill results include: - 0.41 g/t Au over 41.1 meters in LBP1145 at 45 meters below surface - 0.92 g/t Au over 35.1 meters in LBP1141 - 0.28 g/t Au over 125 meters in LBP1136 - 0.20 g/t Au over 53.3 meters in LBP1141 - 0.37 g/t Au over 71.6 meters in LBP1144 [10][12]. Resource and Feasibility Study - The currently defined Rangefront Area is a 1,500 x 1,200 x 300 meters thick zone of continuous oxide gold mineralization, with a 2024 Preliminary Feasibility Study resource estimate of 1,619,000 Indicated and 296,000 inferred ounces of gold [13]. - The ongoing drilling is expected to inform an updated Resource Study planned to begin in Q4 2025, with approximately 15,000 meters of additional drilling planned for 2025 [12][13]. Economic Potential - The Rangefront Zone is positioned as a cornerstone growth area for the Black Pine Project, strategically located adjacent to infrastructure and the proposed leach pad, which may lead to significant changes in mining economics and sequencing strategy [3][6][10]. - The metallurgical column leach testing has shown a weighted average gold extraction of 86.9%, indicating the leach-amenable nature of the oxide material [13]. Future Plans - Additional metallurgical drilling is planned for Q4 2025 to improve coverage of the expanded resource areas for the Feasibility Study [10]. - The company plans to continue drilling through the winter, with approximately 50 additional RC and core holes planned for 2025 [10][12].

[Video Enhanced] Argenta Silver Step-out Hole Hits High-Grade Silver as Atenea Exploration Target Comes into Focus

Thenewswire· 2025-09-26 18:15

Core Insights - Argenta Silver reported promising assay results from its El Quevar Project, indicating the continuity of the Yaxtché Deposit and the discovery of a new target named Atenea [4][5][7] Company Overview - Argenta Silver, a relatively new company established 10 months ago, has a market capitalization of CAD $240 million and has seen its share price increase by 460% since trading began [2][3] - The company was acquired for USD 3.5 million in October 2024, following the previous operator's asset sales due to liquidity issues [2] Recent Developments - The latest assay results from September 23, 2025, show significant silver grades, including 545 g/t over 43.20 meters in drill hole QVD-414, and 314 g/t over 2.00 meters in the new Atenea target [5][7] - The ongoing drilling program aims to expand the known resource and explore new areas, with 40% of capital allocated for resource expansion and 60% for aggressive exploration [9] Market Context - The silver market has been in a deficit for four consecutive years, with an annual shortfall of approximately 240 million ounces, contributing to rising silver prices [11][12] - Global silver inventories are at multi-year lows, creating a supply-demand imbalance that supports higher silver prices [12] Resource Estimates - The foundational Mineral Resource Estimate of the Yaxtché deposit includes an indicated resource of 45.3 million ounces of silver at a grade of 482 g/t and an inferred resource of 4.1 million ounces at 417 g/t [14]

Pan American Silver Reports Discovery of Multiple High-Grade Silver, Base Metal Zones at La Colorada Mine in Mexico

Yahoo Finance· 2025-09-19 04:21

Core Insights - Pan American Silver Corp. has reported significant discoveries of high-grade silver and base metal zones at its La Colorada mine in Zacatecas, Mexico, indicating strong potential for resource expansion and improved economics [1][3] Exploration Results - The exploration program involved drilling approximately 65,000 metres across 170 holes from November 2024 to June 2025, extending the NC2 and Mariana vein systems eastward [1][2] - The Mariana vein now has a strike length of approximately 1,000 metres and a vertical extent over 350 metres, while the NC2 vein system exceeds 2,000 metres on strike with a vertical extent over 500 metres [2] - Significant intercepts confirm the high-grade nature of the mineralization, with hole S-10-25 intersecting both veins 400 metres east of known mineralization and identifying a new skarn target at depth [2] New Discoveries - In the southeastern sector, drilling has extended the Cristina and San Geronimo vein systems, defining mineralization that spans approximately 500 metres along strike and 500 metres vertically [3] - A new style of high-grade silver and base metal replacement mineralization was discovered at the contact between volcanic and sedimentary rocks, representing a high-potential exploration target [3] Company Overview - Pan American Silver Corp. engages in the exploration, extraction, processing, refining, and reclamation of mines across several countries, including Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil, focusing on silver, gold, zinc, lead, and copper deposits [4]

Osisko Gaspé Expansion Hole Intersects 133.7 Metres Averaging 1.04% Cu

Globenewswire· 2025-09-18 10:00

Core Insights - Osisko Metals has announced new drill results from the Gaspé Copper Project, indicating significant growth potential in the deposit with high-grade results from recent drilling [1][2][4] Summary by Category Drill Results - New analytical results include 26 mineralized intercepts from six new drill holes, with infill intercepts aimed at upgrading inferred mineral resources to measured or indicated categories [4][5] - Drill hole 30-1110 returned 1091.5 metres averaging 0.20% Cu, 1.52 g/t Ag, and 0.017% Mo (0.28% CuEq), confirming continuity of mineralization [13][7] - Drill hole 30-1109 showed 133.7 metres averaging 1.04% Cu, indicating a higher-grade zone [7][11] - Drill hole 30-1106 revealed a higher-grade interval of 33.8 metres averaging 1.04% Cu and 3.60 g/t Ag [10][12] Mineral Resource Expansion - The current drill program aims to convert the November 2024 Mineral Resource Estimate (MRE) to Measured and Indicated categories and test for expansion deeper into the stratigraphy [17][16] - The Gaspé Copper Project hosts the largest undeveloped copper resource in eastern North America, with current Indicated Mineral Resources of 824 million tonnes averaging 0.34% CuEq [26][29] Geological Context - Mineralization at Gaspé Copper is of porphyry copper/skarn type, characterized by disseminations and stockworks of chalcopyrite with pyrite or pyrrhotite [15][19] - The drilling has identified multiple intersections of mineralized material, suggesting a "layer cake" distribution from surface to significant depths [9][10] Future Outlook - The company plans to include potential depth extensions to the deposit in the next scheduled MRE update in Q1 2026, focusing on areas previously under-drilled [17][16] - Historical drilling data suggests the potential for a higher-grade tabular deposit around the E Zone horizon, which may extend eastward [12][2]

First Majestic (AG) Reports Positive Exploration Results At San Dimas

Yahoo Finance· 2025-09-12 07:35

Group 1 - First Majestic Silver Corp. (NYSE:AG) is recognized as one of the best silver mining stocks to buy according to hedge funds, highlighting its strong market position [1] - The company reported positive exploration results from its San Dimas Silver/Gold Mine in Durango, Mexico, following expanded drilling efforts that intersected high-grade silver and gold mineralization [1][2] - The Coronado vein, recently discovered in the West Block, produced a significant high-grade intercept, indicating the potential for new mineral resources [1][2] Group 2 - San Dimas is a key asset in First Majestic's long-term expansion strategy, with ongoing drilling campaigns expected to enhance resource expansion [2] - The discovery of the Coronado vein contributes positively to the mineralization profile of the district, reinforcing the mine's status as a superior asset [2]