Innovation-driven Strategy

Search documents

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

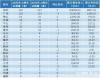

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].