FGFR3 ADC等药物

Search documents

重磅会议召开!新一轮催化即将展开?

Ge Long Hui A P P· 2025-10-16 11:20

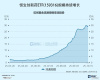

Core Viewpoint - The innovative drug sector is experiencing a counter-trend rise despite a pullback in AI technology, with significant interest in upcoming events like the ESMO conference, which is expected to showcase breakthroughs from Chinese pharmaceutical companies [1][2]. Group 1: Market Performance - The Hang Seng Innovative Drug ETF (159316) increased by 2.81%, while the low-fee Hong Kong Stock Connect Medical ETF (513200) rose by 1.32% [1]. - The upcoming ESMO conference from October 17 to 21, 2025, in Berlin is anticipated to be a crucial platform for domestic pharmaceutical companies to present their achievements and secure new business development (BD) partnerships [1][2]. Group 2: International Expansion - The outbound licensing transactions of Chinese biopharmaceutical companies exceeded $50 billion in the first half of the year, surpassing the total for 2024, and reached $87.4 billion by August 2025 [3]. - The quality of outbound transactions has significantly improved, with upfront payments reaching $4.16 billion by August 2025, nearing the total of $4.91 billion for 2024 [4]. - There were 21 major transactions exceeding $1 billion in total value in the first eight months of 2025, almost matching the 23 transactions for the entire year of 2024 [4]. Group 3: Technological Advancements - ADC drugs remain the primary focus for outbound transactions, with 14 ADC-related deals completed in the first eight months of 2025, including a record $13 billion collaboration between Qihuang Dejian and Biohaven [5]. - The metabolic field, particularly GLP-1 products, has emerged as a new hotspot for outbound transactions, with companies like Hansoh Pharmaceutical and Lianbang Pharmaceutical achieving over $2 billion in overseas licensing [6]. Group 4: Future Drivers - The next 5-10 years are expected to present historic development opportunities for the Chinese innovative drug industry [12]. - Chinese companies have demonstrated international competitiveness in ADC research, with significant collaborations indicating global trust in their capabilities [13]. - The dual-track payment system of medical insurance and commercial insurance is facilitating rapid market entry for innovative drugs, despite some price pressures from insurance [15]. Group 5: Investment Opportunities - The innovative drug sector is categorized into three main areas: platform giants, explosive biotech firms, and international pioneers, each representing different investment opportunities [16]. - The Hang Seng Innovative Drug ETF (159316) has seen a net inflow of 849 million yuan over the past 20 days, with a total fund size of 2.961 billion yuan [16].