Beyond Meat(BYND)

Search documents

WTI Longs Need Larger Price Gains to Unwind in Profit

Investing· 2025-10-23 06:42

Core Insights - The article provides a market analysis covering key currency pairs and indices, including the British Pound against the US Dollar, the US Dollar against the Japanese Yen, the Nasdaq 100, and Gold Spot against the US Dollar [1] Group 1: Currency Analysis - The British Pound has shown fluctuations against the US Dollar, indicating potential trading opportunities [1] - The US Dollar's performance against the Japanese Yen reflects broader market trends and investor sentiment [1] Group 2: Index and Commodity Analysis - The Nasdaq 100 continues to be a focal point for investors, with its movements suggesting underlying economic conditions [1] - Gold Spot prices against the US Dollar are analyzed, highlighting the precious metal's role as a safe haven in volatile markets [1]

What's Driving Beyond Meat's 11% After-Hours Drop? - Beyond Meat (NASDAQ:BYND), Roundhill ETF Trust Roundhill Meme Stock ETF (ARCA:MEME)

Benzinga· 2025-10-23 05:50

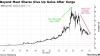

Beyond Meat Inc. (NASDAQ:BYND) shares dropped 11.17% to $3.18 in after-hours trading on Wednesday.Check out the current price of BYND stock here.Short Squeeze RallyShares surged 127% on Monday and 146.26% on Tuesday following the stock's addition to the Roundhill Meme Stock ETF (NYSE:MEME).The rally was sparked by the stock's addition to the ETF, along with a distribution partnership with Walmart Inc. (NYSE:WMT) and a debt restructuring.Beyond Meat carries approximately $1.2 billion in long-term debt agains ...

逼空浪潮中上演”反向狙击“:Beyond Meat(BYND.US)空头不信邪 押注meme狂...

Xin Lang Cai Jing· 2025-10-23 05:24

Core Viewpoint - Beyond Meat's stock price surged over 1300% in four days, reaching a 14-month high, leading to significant losses for short sellers [1][3] Group 1: Stock Performance - The stock experienced a rapid increase from historical lows, with a peak rise of 112% during trading, followed by a 1.1% drop on Wednesday and a post-market decline of over 10% to $3.20 [3] - Short sellers faced a loss exceeding $12 million since last week's closing low, with cumulative losses for the year surpassing $45 million [1][3] Group 2: Market Dynamics - The current short selling environment is characterized by dual operations: some short sellers are forced to cover their positions due to being squeezed, while others are increasing their short positions, anticipating a correction [3] - Despite a recent decrease in the proportion of short interest relative to float, over 5 million shares have been added to short positions in the past 30 days, indicating increasing market divergence [3] Group 3: Influencing Factors - The stock's surge began last Friday and continued into Monday, driven by social media promotion from trader Demitri Semenikhin, reminiscent of the GameStop phenomenon during the pandemic [3] - Walmart's announcement to expand Beyond Meat product availability to over 2,000 stores further fueled the stock price increase [3] Group 4: Market Sentiment - The situation is compared to the GameStop event, highlighting the extreme volatility of stocks in distress when speculative funds enter the market [3] - The divergence in short seller strategies underscores the growing market divide regarding high-valuation stocks [3]

Beyond Meat speculators are betting on even more stock gains after an 850% spike. 2 options-trading stats show how risky this is.

Yahoo Finance· 2025-10-23 01:36

Options activity suggests traders don't think the rally in Beyond Meat stock is done yet. Data shows that some traders anticipate further gains through the end of this week. It's risky to pile in at these levels, and two data points suggest investors should be cautious. Beyond Meat stock has seen volatile trading on Wednesday after days of stellar gains, but options trading activity show that some investors still see big gains ahead. A retail trader who goes by Capybara Stocks online has been at th ...

逼空浪潮中上演”反向狙击“:Beyond Meat(BYND.US)空头不信邪 押注meme狂潮必然崩塌?

Zhi Tong Cai Jing· 2025-10-23 01:24

Core Insights - Beyond Meat's stock price surged over 1300% within four days, reaching a 14-month high, leading to significant losses for short sellers [1][3] - The stock's rapid increase triggered short sellers to cover their positions, while some opted to increase their short positions due to the perceived unsustainability of the price rise [3] Group 1: Stock Performance - The stock price rebounded sharply from historical lows, with a peak increase of 112% during trading, followed by a decline of over 10% after hours to $3.20 [3] - Short sellers faced a cumulative loss exceeding $45 million this year, with losses expanding by over $120 million from last week's closing low [1][3] Group 2: Market Dynamics - The recent price surge was initiated by a social media recommendation from trader Demitri Semenikhin, reminiscent of the GameStop phenomenon during the pandemic [3] - Walmart's announcement to expand Beyond Meat products to over 2000 stores further fueled the stock's price increase [3] Group 3: Short Selling Activity - S3Partners reported that short interest in Beyond Meat has increased by over 5 million shares in the past 30 days, indicating growing divergence in market sentiment [3] - The current situation reflects a dual approach among short sellers, with some being forced to cover while others believe a price correction is imminent [3]

The retail trader driving Beyond Meat's meme rally told us his new price target for the stock — and cautioned against chasing gains

Yahoo Finance· 2025-10-23 00:04

Core Viewpoint - Beyond Meat has experienced a significant stock surge driven by retail traders, reminiscent of the GameStop phenomenon, with shares rising from a low to nearly $7 in a short period [1][2]. Company Analysis - The stock's recent performance is attributed to a combination of a short squeeze and retail trading frenzy rather than fundamental valuation [2][3]. - Semenikhin believes that the stock could stabilize in a trading range of $6-8 based on fundamentals, but current trading dynamics are not reflecting this [2]. Market Sentiment - The rally in Beyond Meat's stock has shown signs of exhaustion, with a peak increase of nearly 80% during the session, which later adjusted to a 4% gain by midday [3]. - High strike price call options are being traded, indicating that some traders still anticipate further short-squeeze potential despite recent gains [4]. Financial Position - A recent debt-for-equity swap with bondholders has been misinterpreted as a negative development, but it is viewed as a positive move that strengthens Beyond Meat's financial position and sets the stage for potential stock price increases [4]. Community Impact - The rally has highlighted the power of the retail trading community, showcasing how collective action can significantly influence stock prices in a short timeframe [5].

X @s4mmy

s4mmy· 2025-10-22 23:33

… and it’s gone. https://t.co/Nd7rqzqPJNThe Kobeissi Letter (@KobeissiLetter):This is insanity:At 5:15 AM ET, Beyond Meat, $BYND, became a $3.5 BILLION company, just 6 days after hitting a record low of $195 million.~7 hours later, the stock erased a +160% gain and was down as much as -31% on the day, worth $1 billion.What is happening here? https://t.co/iSCOF4yPll ...

X @Investopedia

Investopedia· 2025-10-22 23:30

Market Trends - The meme stock frenzy has caused significant volatility for Beyond Meat and Krispy Kreme in recent days [1]

Many using meme stock options when they can't use margins, says Mike Khouw

Youtube· 2025-10-22 23:12

Core Insights - Beyond Meat's stock has experienced extreme volatility, surging by as much as 112% and then dropping nearly 30%, ultimately closing near the flatline. The stock has increased more than fivefold since Monday, primarily due to its inclusion in a new meme ETF [1]. Group 1: Stock Performance - Beyond Meat's stock has quintupled since Monday, driven by its addition to the meme ETF [1]. - The meme ETF, which began trading on October 8th, has seen a decline of over 9% since its launch [1]. Group 2: Options Market Activity - Beyond Meat's options trading volume was significantly high, with over 3.3 million contracts traded in a single day, indicating strong interest from traders [4]. - The stock traded over 11 times its average daily put volume, suggesting a notable level of bearish sentiment among options traders [3][4]. - A specific block of 5,000 October 24th weekly puts was traded at a strike price of 26, indicating a bet on the stock's decline [4]. Group 3: Market Context - Other meme stocks, such as Donut and Sweet Greens, are also seeing increased activity in the options market, with some stocks trading significantly above their average daily volumes [3][4]. - Many traders are utilizing options for leverage in stocks priced under $5, as margin trading may not be available for these lower-priced shares [5].

Beyond Meat: 'Classic Meme Cocktail' — Or 'Fake-Meat Humble Pie'?

Benzinga· 2025-10-22 22:54

Core Viewpoint - Beyond Meat, Inc. has experienced significant stock price volatility driven by retail investor interest and social media buzz, raising questions about the sustainability of this rally [1][2]. Group 1: Stock Performance - Beyond Meat shares saw over two billion shares traded on a single day, with a peak increase of 112% reaching $7.69 before experiencing a decline [4]. - By the end of the trading day, Beyond Meat's stock was down by 1.1%, and in extended trading, it fell further by 21% to $2.82 [5]. Group 2: Market Dynamics - The stock's rally has been characterized as "meme-like," with significant retail trading activity and mentions across various channels, indicating a strong presence in retail investor forums [2][3]. - Market analysts anticipate continued volatility in Beyond Meat's stock price, influenced by retail investor sentiment and updated short interest data [6].