工业化智能升级

Search documents

资金逆势加码这一方向,什么信号?

Zhong Guo Zheng Quan Bao· 2025-10-22 12:53

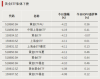

Group 1: Gold ETF Performance - On October 22, gold ETFs collectively declined due to falling international gold prices, with the top ten decliners all being gold ETFs [4][5] - Despite the significant drop in gold ETFs this week, there is a trend of "buying on dips," with multiple gold ETFs receiving increased capital inflows [2][6] - The specific declines in gold ETFs include: - Gold ETF AU (518860.SH): -4.22% - Bank of China Shanghai Gold ETF (518890.SH): -4.19% - Gold ETF (159934.SZ): -4.13% [5] Group 2: Bond ETF Activity - Several bond ETFs are actively traded, with the Short-term Bond ETF (511360) achieving a transaction volume of 38.747 billion yuan, the highest in the market [10][11] - The turnover rates for the Sci-Tech Bond ETFs from Huatai and Guotai both exceeded 100% [10] Group 3: Market Outlook - Companies are optimistic about the market direction over the next 6 to 12 months, driven by the expansion of profit effects since last year's "9.24" event and the acceleration of medium to long-term capital inflows [12] - Key investment opportunities include the AI industry chain, resilient external demand, and financial sectors amid active capital markets [12][9]