金融板块

Search documents

中证A500ETF(159338)盘中净流入超6.4亿份,重磅会议定调利好,资金抢筹A股核心资产

Mei Ri Jing Ji Xin Wen· 2025-12-12 06:54

Group 1 - The central economic work conference held on December 10-11 in Beijing emphasized the continuation of a more proactive fiscal policy, maintaining necessary fiscal deficits, total debt scale, and expenditure, while addressing local fiscal difficulties [1] - The conference also highlighted the need for a moderately loose monetary policy, utilizing various policy tools such as reserve requirement ratio cuts and interest rate reductions flexibly and efficiently [1] - China Galaxy Securities indicated that the conference provided initial direction for next year's economic work, with A-share investment focusing on several key areas: technology innovation, "anti-involution," large consumption, financial sector support, real estate chain stabilization, and overseas expansion [1] Group 2 - The cash flow ETF (159399) saw a net inflow of 642 million units, indicating strong capital interest [1] - The China Securities A500 ETF (159338) is noted for its leading customer base, with total accounts being more than three times that of its closest competitor, suggesting a growing preference among investors [2]

重磅会议定调积极,A500ETF基金(512050)连续8日吸金超29亿元,换手率同类第一

Sou Hu Cai Jing· 2025-12-12 02:09

Group 1 - The A-share market is experiencing fluctuations, with the A500 ETF (512050) slightly down by 0.26% as of 9:54 AM, while maintaining a high turnover rate of 5.28%, indicating active trading [1] - The A500 ETF has seen a continuous inflow of funds for 8 consecutive days, accumulating over 2.9 billion yuan, reflecting investor confidence in the upcoming spring market [1] - The Central Economic Work Conference held on December 10-11 emphasized the continuation of proactive fiscal policies and flexible monetary policies to address local financial difficulties and stimulate economic growth [1] Group 2 - China Galaxy Securities highlights key investment areas for A-shares following the Central Economic Work Conference, including technology innovation, "anti-involution" measures, consumer sectors, financial institutions, real estate, and overseas expansion [2] - The technology innovation theme is expected to be a major investment focus, particularly for companies with genuine technological barriers, aligning with national strategies [2] - The consumer sector is currently valued at historically low levels, with favorable policies anticipated to boost both performance and valuations [2] Group 3 - The A500 ETF (512050) offers investors a convenient way to access core A-share assets, benefiting from low fees (0.2% total fee), good liquidity (average daily trading volume over 5 billion yuan), and a large scale (over 20 billion yuan) [3] - The ETF tracks the CSI A500 Index, employing a balanced industry allocation and leading company selection strategy, covering all 35 sub-industries, and favoring sectors like AI, pharmaceuticals, and renewable energy [3] - Investors are encouraged to consider related products such as the A500 ETF (512050) and the A500 Enhanced ETF (512370) for diversified exposure [3]

资金逆势加码这一方向,什么信号?

Zhong Guo Zheng Quan Bao· 2025-10-22 12:53

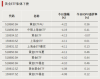

Group 1: Gold ETF Performance - On October 22, gold ETFs collectively declined due to falling international gold prices, with the top ten decliners all being gold ETFs [4][5] - Despite the significant drop in gold ETFs this week, there is a trend of "buying on dips," with multiple gold ETFs receiving increased capital inflows [2][6] - The specific declines in gold ETFs include: - Gold ETF AU (518860.SH): -4.22% - Bank of China Shanghai Gold ETF (518890.SH): -4.19% - Gold ETF (159934.SZ): -4.13% [5] Group 2: Bond ETF Activity - Several bond ETFs are actively traded, with the Short-term Bond ETF (511360) achieving a transaction volume of 38.747 billion yuan, the highest in the market [10][11] - The turnover rates for the Sci-Tech Bond ETFs from Huatai and Guotai both exceeded 100% [10] Group 3: Market Outlook - Companies are optimistic about the market direction over the next 6 to 12 months, driven by the expansion of profit effects since last year's "9.24" event and the acceleration of medium to long-term capital inflows [12] - Key investment opportunities include the AI industry chain, resilient external demand, and financial sectors amid active capital markets [12][9]

A股分析师前瞻:海外扰动最大时刻或将过去,10月下旬修复行情将缓慢展开

Xuan Gu Bao· 2025-10-19 13:50

Core Viewpoint - The overall sentiment among brokerage strategies is optimistic about the market outlook, with a focus on balanced asset allocation and the importance of monitoring new strategic themes related to resource and supply chain security in China [1][2]. Group 1: Market Sentiment and Strategic Shifts - The recent experience from TACO and increased confidence in China have led to investor hesitation in reallocating assets, creating opportunities in dividend sectors [1]. - The easing of tensions in U.S.-China relations, particularly with Trump's recent comments on tariffs, suggests that the most disruptive period may be passing, which could enhance market risk appetite [2][3]. - The upcoming political events and economic reports, including the Fourth Plenary Session and third-quarter earnings, are expected to catalyze positive market sentiment [1][2]. Group 2: Sector Focus and Investment Opportunities - Analysts emphasize the importance of focusing on sectors that are likely to benefit from internal certainty, such as technology growth and future industry investments, particularly in the context of a potential "slow bull market" [2][3]. - The construction of a "stable market mechanism" and improvements in investor return systems are highlighted as key factors supporting the current market dynamics, differentiating this cycle from previous ones [2][3]. - There is a recommendation to pay attention to low-valued sectors that may attract capital inflows, particularly in the context of a structural rebalancing of the market [2][3].