柜类产品

Search documents

江山欧派涨2.00%,成交额3723.62万元,主力资金净流入153.87万元

Xin Lang Cai Jing· 2025-11-14 06:13

Core Viewpoint - Jiangshan Oupai's stock price has shown fluctuations, with a recent increase of 2.00% to 15.27 CNY per share, despite a year-to-date decline of 16.14% [1] Group 1: Stock Performance - As of November 14, Jiangshan Oupai's stock price is 15.27 CNY, with a trading volume of 37.24 million CNY and a turnover rate of 1.39%, resulting in a total market capitalization of 2.705 billion CNY [1] - The stock has experienced a 3.46% increase over the last five trading days, a 6.04% increase over the last 20 days, and a 3.88% increase over the last 60 days [1] - The company has appeared on the "Dragon and Tiger List" twice this year, with the most recent instance on July 22, where it recorded a net buy of -33.79 million CNY [1] Group 2: Financial Performance - For the period from January to September 2025, Jiangshan Oupai reported a revenue of 1.284 billion CNY, a year-on-year decrease of 43.11%, and a net profit attributable to shareholders of -41.49 million CNY, a decline of 125.37% [2] - Cumulative cash dividends since the company's A-share listing amount to 1.034 billion CNY, with 617 million CNY distributed over the past three years [3] Group 3: Shareholder Information - As of September 30, 2025, Jiangshan Oupai has 12,200 shareholders, an increase of 10.16% from the previous period, with an average of 14,529 circulating shares per shareholder, a decrease of 9.23% [2] - Notable new shareholders include Noan Multi-Strategy Mixed A and Huaxia Zhuoxin One-Year Open Debt Initiated Fund, which rank as the fifth and eighth largest circulating shareholders, respectively [3]

江山欧派前三季度营业收入12.84亿元 净亏损4149.2万元

Huan Qiu Wang· 2025-10-24 02:58

Core Insights - Jiangshan Oupai reported a significant decline in revenue and net profit for Q3 2025, with a revenue of 416 million yuan, down 48.92% year-on-year, and a net loss of approximately 51.58 million yuan [1] - For the first three quarters of 2025, the total revenue was 1.28 billion yuan, a decrease of 43.11% compared to the same period last year, with a net loss of about 41.49 million yuan [1] Revenue Breakdown - The revenue from laminated doors was 615 million yuan, down 51.47% year-on-year [1] - The revenue from solid wood composite doors was 184 million yuan, down 50.77% year-on-year [1] - Cabinet products generated 93 million yuan, down 37.98% year-on-year [1] - Other products accounted for 241 million yuan, down 12.14% year-on-year [1] - Franchise service fees increased to 107 million yuan, up 21.02% year-on-year [1] Reasons for Decline - The decline in net profit is attributed to an overall downturn in the industry, shrinking market demand, and intense competition [1] - Price adjustments on some products led to a decrease in gross margin [1] - Fixed costs such as depreciation and personnel expenses did not decrease in line with the revenue drop [1] - The company also made provisions for asset impairment [1]

江山欧派(603208) - 江山欧派关于2025年前三季度主要经营情况的公告

2025-10-23 10:00

根据上海证券交易所《上市公司行业信息披露指引第十五号——家具制造 (2022 年修订)》的有关规定,江山欧派门业股份有限公司(以下简称"公司) 现将 2025 年前三季度主要经营情况报告如下: | | | 江山欧派门业股份有限公司 关于 2025 年前三季度主要经营情况的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 注:上述表中数据尾差系四舍五入所致。 二、报告期代理经销商变动情况 2025 年前三季度代理经销商变动情况 | 类型 | 2025 | 年年初数量 | 2025 1-9 | 年 | 月新 | 2025 年 1-9 | | 月取 | 2025 年 | 9 月 30 日数 | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | | | (家) | 开拓(家) | | | 消(家) | | | 量(家) | | | 代理经销商 | | 63,170 | | 10,631 | | | 118 | | 73,683 | | | 合 ...

江山欧派跌2.06%,成交额3443.99万元,主力资金净流出513.94万元

Xin Lang Cai Jing· 2025-10-16 05:52

Core Viewpoint - Jiangshan Oupai's stock price has experienced a significant decline this year, with a year-to-date drop of 19.00% and a recent 5-day decline of 5.33% [1][2] Company Overview - Jiangshan Oupai, established on July 31, 2006, and listed on February 10, 2017, is primarily engaged in the research, production, sales, and service of wooden doors [1] - The company's revenue composition includes: 45.39% from laminated molded doors, 20.73% from other products, 15.64% from solid wood composite doors, 7.43% from franchise service fees, 7.32% from cabinet products, and 3.49% from other sources [1] Financial Performance - For the first half of 2025, Jiangshan Oupai reported revenue of 868 million yuan, a year-on-year decrease of 39.82%, and a net profit attributable to shareholders of 10.08 million yuan, down 90.39% year-on-year [2] - The company has distributed a total of 1.034 billion yuan in dividends since its A-share listing, with 617 million yuan distributed over the past three years [3] Shareholder Information - As of June 30, 2025, Jiangshan Oupai had 11,100 shareholders, a decrease of 3.12% from the previous period, with an average of 16,006 circulating shares per shareholder, an increase of 3.22% [2] - Among the top ten circulating shareholders, the fifth largest is招商行业精选股票 (000746) with 2.8688 million shares, unchanged from the previous period, while招商瑞智优选混合 (LOF) (161728) is a new entrant holding 892,400 shares [3]

江山欧派涨2.03%,成交额5769.00万元,主力资金净流入343.58万元

Xin Lang Cai Jing· 2025-10-09 05:43

Core Insights - Jiangshan Oupai's stock price increased by 2.03% on October 9, reaching 15.60 CNY per share, with a total market capitalization of 2.764 billion CNY [1] - The company has experienced a year-to-date stock price decline of 14.33%, but has seen a recent uptick of 2.03% over the last five trading days [1] Financial Performance - For the first half of 2025, Jiangshan Oupai reported a revenue of 868 million CNY, a year-on-year decrease of 39.82%, and a net profit attributable to shareholders of 10.08 million CNY, down 90.39% year-on-year [2] - Cumulative cash dividends since the company's A-share listing amount to 1.034 billion CNY, with 617 million CNY distributed over the past three years [3] Shareholder Information - As of June 30, 2025, the number of shareholders decreased by 3.12% to 11,100, while the average circulating shares per person increased by 3.22% to 16,006 shares [2] - Notable institutional shareholders include招商行业精选股票 (000746) and招商瑞智优选混合 (LOF) (161728), with the latter being a new entrant among the top ten circulating shareholders [3] Business Overview - Jiangshan Oupai, established on July 31, 2006, specializes in the research, production, sales, and service of wooden doors, with its main revenue sources being laminated doors (45.39%) and other products [2] - The company operates within the light industry manufacturing sector, specifically in customized home furnishings, and is associated with concepts such as new urbanization and small-cap stocks [2]

江山欧派: 江山欧派关于2025年半年度主要经营情况的公告

Zheng Quan Zhi Xing· 2025-08-29 16:52

Core Viewpoint - Jiangshan Oupai Door Industry Co., Ltd. reported a significant decline in revenue and gross profit margins for the first half of 2025, indicating challenges in the furniture manufacturing sector [2][3]. Group 1: Main Business Performance by Product - The total revenue for the first half of 2025 was RMB 836.66 million, a decrease of 39.36% year-on-year [2]. - The gross profit margin for the overall business was 17.51%, down from the previous year [2]. - The revenue from plywood doors was RMB 405.42 million, down 49.84% year-on-year, with a gross profit margin of 12.31% [2]. - The revenue from solid wood composite doors was RMB 139.67 million, down 44.69% year-on-year, with a gross profit margin of 9.22% [2]. - The revenue from cabinet products was RMB 65.41 million, down 29.69% year-on-year, with a gross profit margin of 8.52% [2]. - Other products generated revenue of RMB 159.76 million, down 6.90% year-on-year, with a gross profit margin of 9.54% [2]. - Franchise service fees contributed RMB 66.40 million, an increase of 22.32% year-on-year, with a gross profit margin of 94.69% [2]. Group 2: Main Business Performance by Channel - Revenue from the agency distribution channel was RMB 493.86 million, down 44.42% year-on-year, with a gross profit margin of 8.52% [3]. - Revenue from the direct engineering channel was RMB 192.73 million, down 51.46% year-on-year, with a gross profit margin of 14.28% [3]. - Revenue from foreign trade exports was RMB 83.66 million, an increase of 109.82% year-on-year, with a gross profit margin of 121.90% [3]. - Franchise service channel revenue was RMB 66.40 million, with a gross profit margin of 94.69% [3]. Group 3: Changes in Agency Distributors - The total number of agency distributors was 72,092, with 9,010 new openings and 88 closures during the reporting period [4].

江山欧派(603208) - 江山欧派关于2025年半年度主要经营情况的公告

2025-08-28 10:18

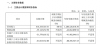

| | | 江山欧派门业股份有限公司 关于 2025 年半年度主要经营情况的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 根据上海证券交易所《上市公司行业信息披露指引第十五号——家具制造 (2022 年修订)》的有关规定,江山欧派门业股份有限公司(以下简称"公司) 现将 2025 年半年度主要经营情况报告如下: 一、报告期经营情况 2025 年半年度代理经销商变动情况 注:由于代理商渠道和经销商渠道收入合并披露,相应的代理商和经销商数量也合并披露;公司对代 理经销商无开店要求。 注:上述表中数据尾差系四舍五入所致。 (二)2025 年半年度主营业务分渠道情况 单位:人民币万元 分产品 营业收入 营业成本 毛利率 (%) 营业收入同 比增减(%) 营业成本同 比增减(%) 毛利率同比 增减(%) 夹板模压门 40,541.52 35,551.76 12.31 -49.84 -44.54 -8.38 实木复合门 13,967.47 12,679.67 9.22 -44.69 -40.76 -6.02 柜类产品 6,540. ...

江山欧派(603208) - 江山欧派关于2024年度及2025年第一季度主要经营情况的公告

2025-04-29 09:20

证券代码:603208 证券简称:江山欧派 公告编号:2025-020 债券代码:113625 债券简称:江山转债 (二)2025 年第一季度主营业务分产品情况 江山欧派门业股份有限公司 关于 2024 年度及 2025 年第一季度 主要经营情况的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 根据上海证券交易所《上市公司行业信息披露指引第十五号——家具制造 (2022 年修订)》的有关规定,江山欧派门业股份有限公司(以下简称"公司) 现将 2024 年度及 2025 年第一季度主要经营情况报告如下: 一、报告期经营情况 (一)2024 年度主营业务分产品情况 注:上述表中数据尾差系四舍五入所致。 分产品 营业收入 营业成本 毛利率 (%) 营业收入同 比增减(%) 营业成本同 比增减(%) 毛利率同比 增减(%) 夹板模压门 168,868.96 133,430.61 20.99 -22.16 -17.21 -4.72 实木复合门 48,146.83 42,271.47 12.20 -41.95 -36.11 -8.0 ...