实木复合门

Search documents

2026年中国室内门行业特征、供需及市场规模洞察: 行业整体维持低位运行[图]

Chan Ye Xin Xi Wang· 2026-02-16 01:01

Core Insights - The indoor door industry in China is experiencing a decline in both production and market demand, with a projected production of 96.37 million units and a demand of 91.686 million units in 2025, reflecting a year-on-year decrease of 2.16% in production [10][11] - The market size for indoor doors is expected to be approximately 68.81 billion yuan in 2025, showing a slight decrease compared to previous years [10][11] Industry Overview - Indoor doors are defined as doors installed within residential spaces, categorized into bedroom doors, bathroom doors, and kitchen doors, contrasting with outdoor doors [2][3] - The market has traditionally been dominated by handcrafted wooden doors, but advancements in technology have led to the development of metal composite doors and other varieties [2][3] Industry Characteristics - The indoor door industry is highly correlated with the real estate cycle, with demand reliant on new housing completions and renovations of existing properties [4][5] - The industry faces low entry barriers, resulting in a large number of small manufacturers and low market concentration, leading to significant product homogeneity and intense price competition [4][5] Policy Background - From 2024 to 2025, numerous policies related to indoor doors are being introduced, focusing on environmental regulations, standard upgrades, and incentives for renovation of existing properties [6][7] - Key policies include the release of the "General Technical Requirements for Wooden Doors and Windows" and local subsidies for renovating old housing [6][7] Industry Chain - The upstream of the indoor door industry includes raw material suppliers such as wood, resin, steel, and glass, while the midstream consists of manufacturers like TATA and MengTian, who design and produce the doors [8] - The downstream market is primarily driven by residential and commercial real estate, linking demand closely to housing completions and renovations [8] Current Development Status - The indoor door industry saw steady growth from 2017 to 2021, but has since entered a phase of decline due to a downturn in the real estate market and reduced demand for renovations [10][11] - The industry is currently in a deep adjustment phase, with both production and demand continuing to decrease [10][11] Competitive Landscape - The indoor door market is characterized by increasing competition from home furnishing companies entering the sector, with many small enterprises facing challenges in management and production efficiency [14][15] - The industry struggles with issues such as outdated manufacturing processes, insufficient R&D capabilities, and severe product homogeneity [14][15] Development Trends - The indoor door industry is shifting towards smart home integration, with leading brands introducing smart door products featuring advanced security and monitoring capabilities [17] - There is a growing emphasis on green and low-carbon practices, driven by stricter environmental standards and consumer demand for sustainable products [17]

江山欧派涨2.00%,成交额3723.62万元,主力资金净流入153.87万元

Xin Lang Cai Jing· 2025-11-14 06:13

Core Viewpoint - Jiangshan Oupai's stock price has shown fluctuations, with a recent increase of 2.00% to 15.27 CNY per share, despite a year-to-date decline of 16.14% [1] Group 1: Stock Performance - As of November 14, Jiangshan Oupai's stock price is 15.27 CNY, with a trading volume of 37.24 million CNY and a turnover rate of 1.39%, resulting in a total market capitalization of 2.705 billion CNY [1] - The stock has experienced a 3.46% increase over the last five trading days, a 6.04% increase over the last 20 days, and a 3.88% increase over the last 60 days [1] - The company has appeared on the "Dragon and Tiger List" twice this year, with the most recent instance on July 22, where it recorded a net buy of -33.79 million CNY [1] Group 2: Financial Performance - For the period from January to September 2025, Jiangshan Oupai reported a revenue of 1.284 billion CNY, a year-on-year decrease of 43.11%, and a net profit attributable to shareholders of -41.49 million CNY, a decline of 125.37% [2] - Cumulative cash dividends since the company's A-share listing amount to 1.034 billion CNY, with 617 million CNY distributed over the past three years [3] Group 3: Shareholder Information - As of September 30, 2025, Jiangshan Oupai has 12,200 shareholders, an increase of 10.16% from the previous period, with an average of 14,529 circulating shares per shareholder, a decrease of 9.23% [2] - Notable new shareholders include Noan Multi-Strategy Mixed A and Huaxia Zhuoxin One-Year Open Debt Initiated Fund, which rank as the fifth and eighth largest circulating shareholders, respectively [3]

草案造假曝光!面临3180万元罚单

Shen Zhen Shang Bao· 2025-11-08 03:46

Core Viewpoint - Fuhuang Steel Structure (002743) faces administrative penalties from the Anhui Securities Regulatory Bureau due to alleged violations of information disclosure laws related to its planned acquisition of 100% equity in Hefei Zhongke Junda Vision Technology Co., Ltd. for 1.14 billion yuan, which was abruptly terminated [1][2]. Summary by Sections Acquisition and Allegations - The acquisition plan was announced in December 2024 but was terminated on June 20, 2025, the last day for notifying shareholders [1]. - The investigation revealed that the draft report disclosed by Fuhuang Steel Structure contained false records regarding Zhongke Vision's financial data and omitted significant related party transactions [2]. Financial Misrepresentation - Zhongke Vision allegedly inflated its 2024 revenue by 25.1874 million yuan, accounting for 11.36% of its total revenue and 0.64% of Fuhuang's revenue for the same year. The inflated profit amounted to 8.9803 million yuan, representing 62.82% of Zhongke's total profit and 13.99% of Fuhuang's profit [3]. Omitted Related Party Transactions - The draft report failed to disclose related party transactions totaling 12.2984 million yuan in 2023 and 7.0477 million yuan in 2024, which were conducted with six companies led by Zhongke Vision [4]. False Equity Ownership Records - The draft report inaccurately stated that Miao Xiaodong held 2% of Zhongke Vision's shares, while he actually held 207,321 shares, with the remaining shares held on behalf of other key personnel [5]. Penalties Imposed - The Anhui Securities Regulatory Bureau proposed penalties totaling 31.8 million yuan against Fuhuang Steel Structure, Zhongke Vision, and related individuals, including fines of 6 million yuan for Fuhuang and 3.5 million yuan for its former chairman [6]. Company Performance - Fuhuang Steel Structure has experienced a decline in revenue and net profit for three consecutive years from 2022 to 2024, with a 19.6% year-on-year decrease in total revenue to 2.348 billion yuan and a 39.16% drop in net profit to 41.3 million yuan in the first three quarters of 2025 [7]. - As of November 7, the company's stock price increased by 0.71% to 5.64 yuan per share, with a total market capitalization of approximately 2.455 billion yuan, reflecting a cumulative decline of about 14% for the year [8].

头部家居厂商罕见收缩产能 江山欧派关闭两大生产基地

Xin Lang Cai Jing· 2025-10-27 14:18

Core Viewpoint - Jiangshan Oupai (603208.SH), a leading wooden door manufacturer, is undergoing significant capacity adjustments due to continuous declines in performance and increased market competition, resulting in the closure of production facilities in Henan and Chongqing, with operations shifting to Zhejiang [1][2]. Company Summary - Jiangshan Oupai has experienced a substantial decline in performance since 2024, with net profit attributable to shareholders shrinking over 70% last year and a reported loss of 41.49 million yuan in the first three quarters of this year [2]. - The company's wholly-owned subsidiaries in Henan and Chongqing have also reported losses of 14.08 million yuan and 13.52 million yuan, respectively, in the first three quarters of this year [2]. - Following its IPO in 2017, Jiangshan Oupai expanded its production capacity nationwide, establishing three major production bases in Zhejiang, Henan, and Chongqing, and diversifying its product offerings [2]. Industry Summary - The trend of national capacity expansion is common among leading home furnishing companies, with competitors like Sophia (002572.SZ) and Oupai Home (603833.SZ) also establishing multiple production bases across the country [3]. - The capacity reduction by Jiangshan Oupai sends a negative signal to the industry, indicating increased downward pressure on the home furnishing market, prompting manufacturers to reconsider the balance of their production capacities [3].

江山欧派前三季度营业收入12.84亿元 净亏损4149.2万元

Huan Qiu Wang· 2025-10-24 02:58

Core Insights - Jiangshan Oupai reported a significant decline in revenue and net profit for Q3 2025, with a revenue of 416 million yuan, down 48.92% year-on-year, and a net loss of approximately 51.58 million yuan [1] - For the first three quarters of 2025, the total revenue was 1.28 billion yuan, a decrease of 43.11% compared to the same period last year, with a net loss of about 41.49 million yuan [1] Revenue Breakdown - The revenue from laminated doors was 615 million yuan, down 51.47% year-on-year [1] - The revenue from solid wood composite doors was 184 million yuan, down 50.77% year-on-year [1] - Cabinet products generated 93 million yuan, down 37.98% year-on-year [1] - Other products accounted for 241 million yuan, down 12.14% year-on-year [1] - Franchise service fees increased to 107 million yuan, up 21.02% year-on-year [1] Reasons for Decline - The decline in net profit is attributed to an overall downturn in the industry, shrinking market demand, and intense competition [1] - Price adjustments on some products led to a decrease in gross margin [1] - Fixed costs such as depreciation and personnel expenses did not decrease in line with the revenue drop [1] - The company also made provisions for asset impairment [1]

江山欧派(603208) - 江山欧派关于2025年前三季度主要经营情况的公告

2025-10-23 10:00

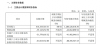

根据上海证券交易所《上市公司行业信息披露指引第十五号——家具制造 (2022 年修订)》的有关规定,江山欧派门业股份有限公司(以下简称"公司) 现将 2025 年前三季度主要经营情况报告如下: | | | 江山欧派门业股份有限公司 关于 2025 年前三季度主要经营情况的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 注:上述表中数据尾差系四舍五入所致。 二、报告期代理经销商变动情况 2025 年前三季度代理经销商变动情况 | 类型 | 2025 | 年年初数量 | 2025 1-9 | 年 | 月新 | 2025 年 1-9 | | 月取 | 2025 年 | 9 月 30 日数 | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | | | (家) | 开拓(家) | | | 消(家) | | | 量(家) | | | 代理经销商 | | 63,170 | | 10,631 | | | 118 | | 73,683 | | | 合 ...

江山欧派跌2.06%,成交额3443.99万元,主力资金净流出513.94万元

Xin Lang Cai Jing· 2025-10-16 05:52

Core Viewpoint - Jiangshan Oupai's stock price has experienced a significant decline this year, with a year-to-date drop of 19.00% and a recent 5-day decline of 5.33% [1][2] Company Overview - Jiangshan Oupai, established on July 31, 2006, and listed on February 10, 2017, is primarily engaged in the research, production, sales, and service of wooden doors [1] - The company's revenue composition includes: 45.39% from laminated molded doors, 20.73% from other products, 15.64% from solid wood composite doors, 7.43% from franchise service fees, 7.32% from cabinet products, and 3.49% from other sources [1] Financial Performance - For the first half of 2025, Jiangshan Oupai reported revenue of 868 million yuan, a year-on-year decrease of 39.82%, and a net profit attributable to shareholders of 10.08 million yuan, down 90.39% year-on-year [2] - The company has distributed a total of 1.034 billion yuan in dividends since its A-share listing, with 617 million yuan distributed over the past three years [3] Shareholder Information - As of June 30, 2025, Jiangshan Oupai had 11,100 shareholders, a decrease of 3.12% from the previous period, with an average of 16,006 circulating shares per shareholder, an increase of 3.22% [2] - Among the top ten circulating shareholders, the fifth largest is招商行业精选股票 (000746) with 2.8688 million shares, unchanged from the previous period, while招商瑞智优选混合 (LOF) (161728) is a new entrant holding 892,400 shares [3]

江山欧派涨2.03%,成交额5769.00万元,主力资金净流入343.58万元

Xin Lang Cai Jing· 2025-10-09 05:43

Core Insights - Jiangshan Oupai's stock price increased by 2.03% on October 9, reaching 15.60 CNY per share, with a total market capitalization of 2.764 billion CNY [1] - The company has experienced a year-to-date stock price decline of 14.33%, but has seen a recent uptick of 2.03% over the last five trading days [1] Financial Performance - For the first half of 2025, Jiangshan Oupai reported a revenue of 868 million CNY, a year-on-year decrease of 39.82%, and a net profit attributable to shareholders of 10.08 million CNY, down 90.39% year-on-year [2] - Cumulative cash dividends since the company's A-share listing amount to 1.034 billion CNY, with 617 million CNY distributed over the past three years [3] Shareholder Information - As of June 30, 2025, the number of shareholders decreased by 3.12% to 11,100, while the average circulating shares per person increased by 3.22% to 16,006 shares [2] - Notable institutional shareholders include招商行业精选股票 (000746) and招商瑞智优选混合 (LOF) (161728), with the latter being a new entrant among the top ten circulating shareholders [3] Business Overview - Jiangshan Oupai, established on July 31, 2006, specializes in the research, production, sales, and service of wooden doors, with its main revenue sources being laminated doors (45.39%) and other products [2] - The company operates within the light industry manufacturing sector, specifically in customized home furnishings, and is associated with concepts such as new urbanization and small-cap stocks [2]

证监会:立案!A股公司,公告!

券商中国· 2025-09-27 07:52

Core Viewpoint - The article highlights the recent regulatory scrutiny faced by several A-share companies, particularly focusing on 富煌钢构 (Fuhuang Steel Structure) which has been investigated for information disclosure violations by the China Securities Regulatory Commission (CSRC) [1][2]. Summary by Sections 富煌钢构 Investigation - 富煌钢构 announced on September 26 that it received a notice from the CSRC regarding an investigation for suspected violations of information disclosure laws [2]. - The company stated that its business operations remain normal and it will cooperate with the investigation while adhering to legal disclosure obligations [2]. - For the first half of 2025, 富煌钢构 reported a revenue of 1.92 billion yuan, a year-on-year decrease of 8.01%, and a net profit attributable to shareholders of 30.63 million yuan, down 19.03% year-on-year [2]. Market Monitoring - The Shanghai Stock Exchange reported that from September 22 to September 26, it monitored stocks with significant price fluctuations, including 天普股份 (Tiangpu Co.) and 上纬新材 (Shangwei New Materials) [5]. - The Shenzhen Stock Exchange also reported monitoring of "*ST宇顺" for abnormal trading activities during the same period [5]. - The Beijing Stock Exchange continued to monitor the delisting risk warning stock "*ST云创" and took self-regulatory measures against 10 instances of abnormal trading [5]. 天普股份 Trading Activity - 天普股份 experienced a significant price increase, with its stock price rising 317.72% over 15 consecutive trading days from August 22 to September 23 [6]. - The company announced a trading suspension for further investigation due to the substantial trading risks associated with its stock price [6]. - The acquisition of control over 天普股份 by 中昊芯英 (Zhonghao Xinying) is noted, with no plans for asset injection or major business changes in the next 12 months [7].

江山欧派: 江山欧派关于2025年半年度主要经营情况的公告

Zheng Quan Zhi Xing· 2025-08-29 16:52

Core Viewpoint - Jiangshan Oupai Door Industry Co., Ltd. reported a significant decline in revenue and gross profit margins for the first half of 2025, indicating challenges in the furniture manufacturing sector [2][3]. Group 1: Main Business Performance by Product - The total revenue for the first half of 2025 was RMB 836.66 million, a decrease of 39.36% year-on-year [2]. - The gross profit margin for the overall business was 17.51%, down from the previous year [2]. - The revenue from plywood doors was RMB 405.42 million, down 49.84% year-on-year, with a gross profit margin of 12.31% [2]. - The revenue from solid wood composite doors was RMB 139.67 million, down 44.69% year-on-year, with a gross profit margin of 9.22% [2]. - The revenue from cabinet products was RMB 65.41 million, down 29.69% year-on-year, with a gross profit margin of 8.52% [2]. - Other products generated revenue of RMB 159.76 million, down 6.90% year-on-year, with a gross profit margin of 9.54% [2]. - Franchise service fees contributed RMB 66.40 million, an increase of 22.32% year-on-year, with a gross profit margin of 94.69% [2]. Group 2: Main Business Performance by Channel - Revenue from the agency distribution channel was RMB 493.86 million, down 44.42% year-on-year, with a gross profit margin of 8.52% [3]. - Revenue from the direct engineering channel was RMB 192.73 million, down 51.46% year-on-year, with a gross profit margin of 14.28% [3]. - Revenue from foreign trade exports was RMB 83.66 million, an increase of 109.82% year-on-year, with a gross profit margin of 121.90% [3]. - Franchise service channel revenue was RMB 66.40 million, with a gross profit margin of 94.69% [3]. Group 3: Changes in Agency Distributors - The total number of agency distributors was 72,092, with 9,010 new openings and 88 closures during the reporting period [4].