高性能功能性颜料

Search documents

双乐股份不超8亿可转债获深交所通过 浙商证券建功

Zhong Guo Jing Ji Wang· 2025-10-31 03:05

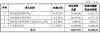

Core Viewpoint - The Shenzhen Stock Exchange's listing review committee approved Shuangle Pigment Co., Ltd.'s issuance of convertible bonds, indicating compliance with issuance, listing, and information disclosure requirements [1] Group 1: Issuance Details - Shuangle Pigment plans to raise up to RMB 80 million through the issuance of convertible bonds, which will be allocated to various projects and working capital [2] - The projects funded by the issuance include high-performance blue-green pigments, high-performance yellow-red pigments, a research center for high-performance functional pigments, and working capital [3] Group 2: Project Investment Breakdown - The total investment for the high-performance blue-green pigment project is RMB 18.5 million, with RMB 16.62 million from the raised funds [3] - The high-performance yellow-red pigment project has a total investment of RMB 46.35 million, with RMB 41.58 million allocated from the raised funds [3] - The research center for high-performance functional pigments requires a total investment of RMB 6 million, with RMB 3.80 million from the raised funds [3] - The working capital will utilize the full RMB 18 million from the raised funds [3] Group 3: Convertible Bond Terms - The convertible bonds will have a duration of six years, with the conversion period starting six months after issuance [3] - The initial conversion price will be determined based on the average stock price over the twenty trading days prior to the announcement of the fundraising plan [4] - The controlling shareholder, Yang Hanzhou, holds 35.23% of the company's shares directly and controls an additional 15.10% indirectly [4]

双乐股份回应可转债审核问询:募投项目具备合理性与必要性

Xin Lang Cai Jing· 2025-10-17 11:56

Core Viewpoint - Shuangle Co., Ltd. plans to issue convertible bonds to raise up to 800 million yuan for the development of high-performance pigments and to supplement working capital [1] Fundraising Project Overview - The high-performance blue-green pigment project consists of three sub-projects: 1,000 tons of phthalocyanine blue, 2,000 tons of phthalocyanine green, and wastewater resource utilization and environmental treatment facility upgrades. The project is expected to generate sales revenue of 207 million yuan and a net profit of 19.76 million yuan in its first year of operation [2] - The high-performance yellow-red pigment project aims to produce 4,000 tons of high-performance organic yellow-red pigments and related pre-dispersed pigments, with expected first-year sales revenue of 433 million yuan and a net profit of 52.38 million yuan [2] - The high-performance functional pigment R&D center will include a comprehensive research building and laboratory to meet the company's R&D needs [2] Project Analysis - The yellow-red pigment project has significant differences in raw materials compared to the company's main products, but there are no major uncertainties in technology or customer aspects. The company has personnel and technical reserves in this field, and the project aligns with the main business direction [3] - The blue-green pigment project upgrades existing products in terms of technology and performance, with a verified technical route and no major uncertainties. The existing phthalocyanine green products are in high demand, making the investment reasonable and necessary [3] Investment Composition and Implementation Progress - The total investment for the blue-green pigment project is 185 million yuan, with 100 million yuan for phthalocyanine blue, 50 million yuan for phthalocyanine green, and 35 million yuan for environmental projects. Combining these projects improves management efficiency [4] - The construction of the yellow-red pigment project has been slow due to pressures from IPO fundraising and company operations, but there are no substantial obstacles to the initial construction [4] Implementation Entity Qualifications and Capacity Scale - The qualifications of Shuangle Taixing, including hazardous chemical registration and pollutant discharge permits, are up to date and will not adversely affect the fundraising project [5] - The company has maintained a capacity utilization rate of over 100% for phthalocyanine green, indicating that the new capacity is reasonable. The existing customer resources and market position will help absorb the new production capacity [5] Expected Benefits and Financing Necessity - The projected benefits of the fundraising projects are based on average market prices and cost structures, with a reasonable and cautious forecast for product prices and profit margins. The company anticipates a funding gap of 898 million yuan over the next three years, making the planned fundraising of 800 million yuan essential for project development and business stability [7]