高性能蓝绿颜料

Search documents

双乐股份不超8亿可转债获深交所通过 浙商证券建功

Zhong Guo Jing Ji Wang· 2025-10-31 03:05

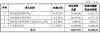

Core Viewpoint - The Shenzhen Stock Exchange's listing review committee approved Shuangle Pigment Co., Ltd.'s issuance of convertible bonds, indicating compliance with issuance, listing, and information disclosure requirements [1] Group 1: Issuance Details - Shuangle Pigment plans to raise up to RMB 80 million through the issuance of convertible bonds, which will be allocated to various projects and working capital [2] - The projects funded by the issuance include high-performance blue-green pigments, high-performance yellow-red pigments, a research center for high-performance functional pigments, and working capital [3] Group 2: Project Investment Breakdown - The total investment for the high-performance blue-green pigment project is RMB 18.5 million, with RMB 16.62 million from the raised funds [3] - The high-performance yellow-red pigment project has a total investment of RMB 46.35 million, with RMB 41.58 million allocated from the raised funds [3] - The research center for high-performance functional pigments requires a total investment of RMB 6 million, with RMB 3.80 million from the raised funds [3] - The working capital will utilize the full RMB 18 million from the raised funds [3] Group 3: Convertible Bond Terms - The convertible bonds will have a duration of six years, with the conversion period starting six months after issuance [3] - The initial conversion price will be determined based on the average stock price over the twenty trading days prior to the announcement of the fundraising plan [4] - The controlling shareholder, Yang Hanzhou, holds 35.23% of the company's shares directly and controls an additional 15.10% indirectly [4]

双乐股份拟发行8亿元可转债 聚焦高性能颜料扩产及研发中心建设

Xin Lang Cai Jing· 2025-10-22 13:51

Core Viewpoint - Shuangle Co., Ltd. plans to raise up to 800 million yuan through the issuance of convertible bonds to fund the construction of high-performance blue-green pigments, yellow-red pigments, and a research and development center [1] Group 1: Investment Project Overview - The fundraising project includes the addition of 3,000 tons of high-performance blue-green pigment capacity (1,800 tons from existing product expansion and 1,200 tons of new specialized products), 4,000 tons of high-performance yellow-red pigment capacity, and 1,000 tons of pre-dispersed pigments [2] - The company has maintained a capacity utilization rate of over 100% for phthalocyanine green products, reaching 111.86% in 2024 and 118.81% in the first nine months of 2025, indicating strong market demand [2] - As a leading domestic phthalocyanine pigment manufacturer, the company held over 30% market share from 2021 to 2023, and the expansion will help solidify its industry position [2] Group 2: Financial Projections - The blue-green pigment project is expected to generate sales revenue of 207 million yuan and a net profit of 19.76 million yuan in its first year of production, while the yellow-red pigment project is projected to achieve sales revenue of 433 million yuan and a net profit of 52.38 million yuan [3] - The gross profit margins for the two projects are estimated at 15.24% and 18.24%, respectively, which are in line with the company's 2024 phthalocyanine pigment margin of 17.08% but lower than competitors like Shenlanhua (20.55%) and Baihehua (20.31%), reflecting a cautious forecast [3] Group 3: Financing Necessity - The company estimates a funding gap of 886 million yuan over the next three years, with available cash of 55.01 million yuan and projected net cash flow from operating activities of 439 million yuan [3] - The company needs to cover a minimum cash reserve of 522 million yuan, cash dividends of 150 million yuan, and an investment of 708 million yuan for the fundraising projects [3] - Existing bank credit of 970 million yuan is primarily short-term loans, which are insufficient for long-term project funding needs; issuing convertible bonds will optimize the capital structure with a significantly lower financing cost compared to bank loans [3]

双乐股份回应可转债审核问询:募投项目具备合理性与必要性

Xin Lang Cai Jing· 2025-10-17 11:56

Core Viewpoint - Shuangle Co., Ltd. plans to issue convertible bonds to raise up to 800 million yuan for the development of high-performance pigments and to supplement working capital [1] Fundraising Project Overview - The high-performance blue-green pigment project consists of three sub-projects: 1,000 tons of phthalocyanine blue, 2,000 tons of phthalocyanine green, and wastewater resource utilization and environmental treatment facility upgrades. The project is expected to generate sales revenue of 207 million yuan and a net profit of 19.76 million yuan in its first year of operation [2] - The high-performance yellow-red pigment project aims to produce 4,000 tons of high-performance organic yellow-red pigments and related pre-dispersed pigments, with expected first-year sales revenue of 433 million yuan and a net profit of 52.38 million yuan [2] - The high-performance functional pigment R&D center will include a comprehensive research building and laboratory to meet the company's R&D needs [2] Project Analysis - The yellow-red pigment project has significant differences in raw materials compared to the company's main products, but there are no major uncertainties in technology or customer aspects. The company has personnel and technical reserves in this field, and the project aligns with the main business direction [3] - The blue-green pigment project upgrades existing products in terms of technology and performance, with a verified technical route and no major uncertainties. The existing phthalocyanine green products are in high demand, making the investment reasonable and necessary [3] Investment Composition and Implementation Progress - The total investment for the blue-green pigment project is 185 million yuan, with 100 million yuan for phthalocyanine blue, 50 million yuan for phthalocyanine green, and 35 million yuan for environmental projects. Combining these projects improves management efficiency [4] - The construction of the yellow-red pigment project has been slow due to pressures from IPO fundraising and company operations, but there are no substantial obstacles to the initial construction [4] Implementation Entity Qualifications and Capacity Scale - The qualifications of Shuangle Taixing, including hazardous chemical registration and pollutant discharge permits, are up to date and will not adversely affect the fundraising project [5] - The company has maintained a capacity utilization rate of over 100% for phthalocyanine green, indicating that the new capacity is reasonable. The existing customer resources and market position will help absorb the new production capacity [5] Expected Benefits and Financing Necessity - The projected benefits of the fundraising projects are based on average market prices and cost structures, with a reasonable and cautious forecast for product prices and profit margins. The company anticipates a funding gap of 898 million yuan over the next three years, making the planned fundraising of 800 million yuan essential for project development and business stability [7]

双乐股份: 立信会计师事务所(特殊普通合伙)关于《关于双乐颜料股份有限公司申请向不特定对象发行可转换公司债券的审核问询函》的回复

Zheng Quan Zhi Xing· 2025-08-17 08:15

Core Viewpoint - The company plans to issue convertible bonds to raise up to 800 million yuan for various projects, including high-performance blue-green pigments, high-performance yellow-red pigments, and a research and development center, along with supplementing working capital [3][4][5]. Group 1: Project Details - The blue-green pigment project includes the functional upgrade and capacity expansion of existing phthalocyanine pigments, with expected first-year sales revenue of 206.55 million yuan and net profit of 19.76 million yuan [3]. - The yellow-red pigment project aims to produce 4,000 tons of high-performance organic yellow-red pigments, with anticipated first-year sales revenue of 432.52 million yuan and net profit of 52.38 million yuan [3]. - The R&D center project will support the company's research needs, enhancing its innovation capabilities [3]. Group 2: Financial Projections - The company expects the blue-green pigment project to generate sales revenue of 206.55 million yuan and net profit of 19.76 million yuan in its first year of operation [3]. - The yellow-red pigment project is projected to achieve sales revenue of 432.52 million yuan and net profit of 52.38 million yuan upon reaching full production [3]. - The total expected revenue from the projects is estimated at 800 million yuan, with a focus on enhancing product offerings and market competitiveness [3][4]. Group 3: Market Position and Competition - The company holds a leading position in the domestic market for phthalocyanine pigments, with a market share exceeding 30% from 2021 to 2023 [8]. - The company is also the top player in the inorganic yellow-red pigment market, with a market share of 31.67% in 2024 [8]. - The competitive landscape includes companies like Shilanhua, which has a production capacity of 10,000 tons for phthalocyanine blue, indicating a strong competitive environment [9][10]. Group 4: Funding Necessity - The company has identified a funding gap of 897.73 million yuan over the next three years, necessitating the issuance of convertible bonds to support its growth and project funding [26][27]. - The total amount to be raised through the bond issuance aligns with the projected funding needs, ensuring that the financing is reasonable and necessary for the company's development [26][27].

双乐股份: 双乐颜料股份有限公司关于公司向不特定对象发行可转换公司债券摊薄即期回报、采取填补措施及相关主体承诺的公告

Zheng Quan Zhi Xing· 2025-03-25 14:17

Core Viewpoint - The company plans to issue convertible bonds to unspecified investors, which may dilute immediate returns but includes measures to compensate for this dilution [1][5][11] Financial Impact of Convertible Bond Issuance - The issuance of convertible bonds is expected to impact key financial metrics, with scenarios analyzed for net profit growth of 0%, 10%, and 20% for 2025 [2][3][4] - Under the assumption of no growth, the diluted earnings per share (EPS) and return on equity (ROE) will decrease, with basic EPS dropping from 0.47 to 1.29 under full conversion [3][4] - If net profit grows by 10%, the diluted EPS could increase to 1.40, while a 20% growth could raise it to 1.53 [4][5] Necessity and Rationality of the Bond Issuance - The funds raised will be allocated to high-performance pigment projects and working capital, aimed at enhancing profitability and market competitiveness [5][6][9] - The projects align with the company's existing business in pigment production and R&D, focusing on expanding product lines and improving production capabilities [6][8] Company’s Preparedness for Investment Projects - The company has a robust human resources management system and a skilled workforce to support the implementation of the investment projects [7][8] - The R&D team has significant experience in the pigment sector, with several products recognized as high-tech by local authorities [7][8] Measures to Mitigate Dilution of Immediate Returns - The company will accelerate the construction of investment projects to ensure timely returns and minimize the dilution of immediate returns [9][10] - Emphasis will be placed on technological innovation and operational management to enhance product quality and operational efficiency [9][10] Commitments from Company Stakeholders - The controlling shareholders and management have made commitments to ensure the effective execution of measures to mitigate the dilution of immediate returns [11][12]