Banking as a Service (BaaS)

Search documents

Coastal Financial Corporation Announces Fourth Quarter 2025 Results

Globenewswire· 2026-01-29 12:00

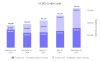

Core Insights - Coastal Financial Corporation reported a net income of $12.6 million for Q4 2025, a decrease from $13.6 million in Q3 2025 and $13.4 million in Q4 2024, with a full-year net income of $47.0 million compared to $45.2 million in 2024 [1][2]. Financial Performance - Loans receivable increased by $45.7 million, or 1.2%, and deposits grew by $171.6 million, or 4.3% in Q4 2025 [2]. - Net interest income for Q4 2025 was $79.4 million, up 1.9% from Q3 2025 and 9.5% from Q4 2024 [40]. - The net interest margin was 7.03% for Q4 2025, slightly up from 7.00% in Q3 2025 but down from 7.23% in Q4 2024 [41]. CCBX Segment Performance - The CCBX segment generated $8.4 million in program fee income for Q4 2025, a 10.7% increase from Q3 2025 [7]. - CCBX loans increased by $3.4 million to $1.81 billion despite selling $2.98 billion in loans during the quarter [25]. - The CCBX segment has 28 relationships at various stages, with two partners in testing and five in implementation/onboarding as of December 31, 2025 [19]. Community Bank Performance - The community bank saw net loans increase by $42.3 million, or 2.2%, to $1.94 billion in Q4 2025 [36]. - Community bank deposits decreased by $11.2 million, or 0.7%, to $1.59 billion during the same period [39]. Strategic Initiatives - The company is deploying artificial intelligence to enhance efficiency and customer experience, while also exploring opportunities in digital assets [3]. - The acquisition of the GreenFi brand reflects the company's strategy to optimize its portfolio and align resources with long-term priorities [7]. - The company plans to continue expanding its product offerings with existing partners while onboarding new relationships aligned with long-term objectives [2][20].

stal Financial (CCB) - 2025 Q4 - Earnings Call Presentation

2026-01-29 12:00

COASTAL FINANCIAL CORPORATION INVESTOR PRESENTATION Fourth Quarter 2025 LEGAL INFORMATION AND DISCLAIMER Important note regarding forward-looking statements: Statements made in this presentation (or conveyed orally) which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding Coastal Financial Corporation's ("Coastal") plans, objectives, or goals for future operations, products or services, and fore ...

Blue Ridge, which erred with fintechs, exits consent order

Yahoo Finance· 2025-11-14 21:10

Key insight: A community bank in Virginia has been freed from a consent order related to its previous fintech partnerships. Expert quote: "We just threw BaaS out the door," said CEO Billy Beale. Forward look: The bank is now focused on a traditional community bank strategy, Beale said. Blue Ridge Bankshares in Richmond, Virginia, which became a poster child for what can go wrong when banks partner with fintechs, has been released from a 2024 consent order related to its failed foray into banking as a s ...

Helix Partners with Bangor Savings Bank to Expand its Banking as a Service Capabilities

Businesswire· 2025-11-12 15:00

Core Insights - Helix has partnered with Bangor Savings Bank to enhance its Banking as a Service (BaaS) capabilities, aiming to improve operational efficiencies and expand access to innovative fintech collaborations [1][2][3] Company Overview - Bangor Savings Bank, founded in 1852, has over $7 billion in assets and has been developing its BaaS program to provide tailored solutions for fintech companies [2] - Helix by Q2 is recognized for its cloud-native core designed for embedded finance, which will support Bangor Savings Bank in delivering innovative financial solutions [1][4] Partnership Details - The partnership allows Bangor Savings Bank to leverage Helix's proven success in powering fintech programs, enhancing operational efficiency, and driving automation [3] - Bangor Savings Bank selected Helix due to its experience, reliability, and tools necessary for expanding BaaS offerings [3][4] Strategic Goals - The collaboration aims to create cutting-edge financial experiences for customers and businesses across the U.S. by combining Helix's technology with Bangor Savings Bank's community-first values [3][4] - Helix's platform provides essential banking components such as accounts, cards, payments, and data controls, facilitating the integration of personalized financial experiences [8]

stal Financial (CCB) - 2025 Q3 - Earnings Call Presentation

2025-11-07 12:00

Financial Performance - Diluted EPS 为 $088,高于上一季度的 $071[19] - 净收入为 $136 million,比上一季度增长 232%,比去年同期增长 10%[19] - 核心税前拨备前净收入 (PPNR) 为 $191 million,比上一季度增长 246%,比去年同期增长 155%[19] - 总收入增长 211%,达到 $1447 million[12,19] - 核心净收入增长 13%,达到 $529 million[12,19] Balance Sheet - 贷款总额(扣除递延费用)增加 $1635 million,即 46%,达到 $370 billion[12,19] - 存款增加 $590 million,即 15%,达到 $397 billion[12,19] - 有形账面价值增长 28%,达到每股 $3145[19] - 将 $6723 million 的存款转移到表外,用于 FDIC 保险和流动性目的,产生 $311000 的非利息收入[12,19] CCBX (Banking as a Service) - CCBX 贷款销售额为 $162 billion,高于上一季度的 $130 billion[19] - CCBX 贷款总额增长 $1239 million,即 74%[61] - CCBX 存款增长 $148 million,即 06%[61] - BaaS 项目费用收入同比增长 465%[37,52] Capital and Liquidity - 现金和即时借款能力合计 $135 billion[27] - 相当于 2025 年 9 月 30 日存款总额的 340%[27] - 一级杠杆资本为 105%[27] - 普通股一级风险资本为 123%[19,27]

Coastal Financial Corporation Announces Third Quarter 2025 Results

Globenewswire· 2025-10-29 11:00

Core Insights - Coastal Financial Corporation reported a net income of $13.6 million for Q3 2025, an increase from $11.0 million in Q2 2025 and $13.5 million in Q3 2024, translating to earnings per diluted share of $0.88 [1][4] - The company experienced a 4.6% increase in loans receivable, amounting to $163.5 million, and a 1.5% growth in deposits totaling $59.0 million during the same quarter [2][4] Financial Performance - Interest and dividend income reached $109.0 million, up from $107.8 million in Q2 2025 and $105.2 million in Q3 2024 [5] - Net interest income was $77.9 million, reflecting a 1.5% increase from $76.7 million in Q2 2025 and a 7.8% increase from $72.3 million in Q3 2024 [38] - Noninterest income totaled $66.8 million, compared to $42.7 million in Q2 2025 and $78.8 million in Q3 2024 [5] Loan and Deposit Growth - Average deposits were $3.97 billion, an increase of $40.7 million or 1.0% from Q2 2025, primarily driven by CCBX partner programs [6] - The community bank segment saw net loans increase by $39.6 million, or 2.1%, to $1.90 billion [34] CCBX Segment Performance - The CCBX segment reported a total of 29 relationships, with 2 partners in testing, 4 in implementation, and 2 signed letters of intent as of September 30, 2025 [20][24] - CCBX loans increased by $123.9 million, or 7.4%, to $1.80 billion despite selling $1.62 billion in loans during the quarter [24][27] Cost Management and Efficiency - Total noninterest expense decreased by $2.7 million, or 3.7%, to $70.2 million compared to Q2 2025, mainly due to lower legal and professional expenses [6] - The efficiency ratio improved to 48.50% from 60.98% in Q2 2025, indicating better operational efficiency [17] Credit Quality - Nonperforming assets to total assets ratio improved to 1.31% from 1.36% in Q2 2025, while the allowance for credit losses to nonperforming loans ratio was 290.8% [8][12] - The company reported gross charge-offs of $54.5 million for the quarter, slightly up from $53.8 million in Q2 2025 [8] Management Outlook - The company anticipates further growth in the BaaS space with new partner engagements and continued investment in technology and risk management infrastructure [18] - Credit quality remains a central focus, with a strategy to manage the balance sheet effectively in response to interest rate changes [18]

Coastal Financial Corporation Announces Second Quarter 2025 Results

Globenewswire· 2025-07-29 10:00

Core Insights - Coastal Financial Corporation reported a net income of $11.0 million for Q2 2025, an increase from $9.7 million in Q1 2025 but a decrease from $11.6 million in Q2 2024 [1] - The company experienced a quality deposit growth of $122.3 million during Q2 2025, with CCBX program fee income increasing by 8.2% compared to the previous quarter [2][18] Financial Performance - Interest and dividend income for Q2 2025 was $107.8 million, up from $104.9 million in Q1 2025 and $97.4 million in Q2 2024 [5] - Net interest income increased to $76.7 million in Q2 2025 from $76.1 million in Q1 2025 and $66.2 million in Q2 2024 [38] - Noninterest income was $42.7 million in Q2 2025, down from $63.5 million in Q1 2025 [5] - Total assets reached $4.48 billion as of June 30, 2025, compared to $4.34 billion at the end of Q1 2025 [5] Credit Quality and Loss Provisions - Provision for credit losses decreased to $32.2 million in Q2 2025 from $55.8 million in Q1 2025, reflecting improved performance in the CCBX portfolio [5][12] - Nonperforming loans to total loans receivable ratio was 1.72% as of June 30, 2025, compared to 1.60% in Q1 2025 [7] CCBX Segment Performance - CCBX loans increased by $29.5 million, or 1.8%, to $1.68 billion despite selling $1.30 billion in loans during Q2 2025 [24] - The CCBX segment had 29 relationships as of June 30, 2025, with two partners in testing and five signed letters of intent [20] - Total BaaS program fee income was $6.8 million in Q2 2025, an increase of $512,000 from Q1 2025 [6] Community Bank Performance - The community bank segment saw net loans decrease by $6.5 million, or 0.3%, to $1.86 billion in Q2 2025 [35] - Community bank deposits increased by $29.2 million, or 1.9%, to $1.55 billion during the same period [37] Management Outlook - The company anticipates additional new partner engagements in the latter half of 2025, supported by a strong CCBX pipeline [18] - Continued investments in technology and risk management infrastructure are expected to yield future efficiencies and cost reductions [18]

Coastal Financial Corporation Announces First Quarter 2025 Results

Globenewswire· 2025-04-29 13:25

Core Insights - Coastal Financial Corporation reported a net income of $9.7 million for Q1 2025, a decrease from $13.4 million in Q4 2024 and an increase from $6.8 million in Q1 2024 [1] - The company experienced a significant deposit growth of $205.9 million, or 5.7%, during the first quarter, driven by its CCBX partner programs [2][6] - CCBX program fee income increased by 55.2% compared to the same period in 2024, reaching $6.3 million [2][6] Financial Performance - Interest and dividend income for Q1 2025 was $104.9 million, up from $97.4 million in Q1 2024 [5] - Net interest income increased to $76.1 million, a rise of 5.1% from Q4 2024 and 22.3% from Q1 2024 [33] - Noninterest expenses rose to $72.0 million, primarily due to higher salaries and employee benefits, legal and professional expenses, and BaaS loan expenses [6][11] CCBX Segment Update - As of March 31, 2025, the CCBX segment had 25 relationships, with two partners in testing and three in implementation/onboarding [17][21] - CCBX loans increased by $47.2 million, or 2.9%, to $1.65 billion despite selling $744.6 million in loans during the quarter [21][24] - The loan yield for CCBX was 16.88%, reflecting a slight increase from the previous quarter [22] Deposit and Loan Portfolio - Total deposits reached $3.79 billion, with CCBX deposits increasing by $202.9 million, or 9.8% [29][32] - Community bank loans decreased by $16.5 million, or 0.9%, to $1.87 billion due to normal balance fluctuations [30][31] - The cost of deposits for the community bank segment was 1.76%, down from 1.86% in the previous quarter [32] Management Outlook - The company anticipates continued elevated onboarding activity into Q2 2025, with a focus on technology and risk management infrastructure [15] - Future revenue sources are expected to grow as new partnerships and products are launched [15][18] - The company remains focused on managing credit quality and optimizing its loan portfolio earnings [24][18]