稀土

Search documents

1027A股日评:量能重返2万亿,沪指逼近4000点-20251027

Changjiang Securities· 2025-10-27 13:13

Core Insights - The A-share market experienced a significant upward trend, with the Shanghai Composite Index approaching the 4000-point mark and a total trading volume exceeding 2 trillion yuan [2][10][7] - Key sectors leading the market include telecommunications, electronics, metal materials, mining, and agricultural products, with notable gains in the storage, cross-strait integration, rare earths, and consumer electronics outsourcing concepts [10][10][10] Market Performance - The Shanghai Composite Index rose by 1.18%, the Shenzhen Component Index increased by 1.51%, and the ChiNext Index surged by 1.98%. The total market turnover reached 2.36 trillion yuan, with 3360 stocks rising [2][10][10] - Specific sector performance on October 27, 2025, showed telecommunications (+3.28%), electronics (+2.95%), metal materials and mining (+2.45%), and agricultural products (+1.65%) leading the gains, while sectors like media, food and beverage, real estate, and banking saw declines [10][10][10] Market Drivers - The increase in trading volume to over 2 trillion yuan was driven by global storage giants announcing price hikes, boosting technology hardware stocks, particularly in the semiconductor sector [10][10] - Legislative actions, such as the establishment of October 25 as Taiwan Recovery Day, have led to increased activity in the cross-strait integration sector, while the Ministry of Industry and Information Technology's draft on steel industry capacity replacement has positively impacted steel stocks [10][10] Future Outlook - The report maintains a bullish outlook on the Chinese stock market, particularly favoring technology as a key investment theme. It suggests that macroeconomic factors will support a bullish trend similar to past bull markets in 1999, 2014, and 2019 [10][10] - Investment focus areas include technology sectors such as AI, robotics, military industry, and new consumption, as well as scarce resources like metals and sectors with improving supply dynamics such as steel, chemicals, transportation, and pig farming [10][10]

沪指逼近4000点!

Sou Hu Cai Jing· 2025-10-27 08:57

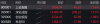

Core Viewpoint - A-shares experienced a strong performance on Monday, reaching a ten-year high with the Shanghai Composite Index peaking at 3999.07 points, closing at 3996.94, up 1.18% [1][2]. Market Performance - The Shanghai Composite Index closed at 3996.94, increasing by 46.63 points or 1.18% - The Shenzhen Component Index rose by 200.22 points, or 1.51%, closing at 13489.40 - The ChiNext Index increased by 62.89 points, or 1.98%, closing at 3234.45 - The CSI 300 Index closed at 4716.02, up 55.34 points or 1.19% - The CSI 500 Index rose by 120.86 points, or 1.67%, closing at 7379.39 - The total number of stocks that rose in the two markets and the Beijing Stock Exchange was 3360, while 1859 stocks fell, and 217 stocks remained flat [2][4]. Sector Performance - The storage chip concept saw a surge in stock prices, with strong performances in consumer electronics, CPO, and circuit board sectors - Active movements were noted in rare earth, nuclear fusion, and coal stocks - Conversely, gaming, Hainan, and oil and gas sectors experienced declines [4].

粤开市场日报-20251027

Yuekai Securities· 2025-10-27 08:57

Market Overview - The main indices showed positive performance today, with the Shanghai Composite Index increasing by 1.18%, the Shenzhen Component Index rising by 1.51%, and the ChiNext Index up by 1.98% [1] - Among the Shenwan first-level industry sectors, the top performers were Communication, Electronics, and Comprehensive, while Banking, Retail, and Textile & Apparel lagged behind [1] Concept Sector Performance - Overall, the Memory, Rare Earth, and Consumer Electronics Manufacturing concepts performed relatively well [1] - In contrast, the Hainan Free Trade Port, Blood Products, and Online Gaming concepts showed weaker performance [1]

收盘丨沪指放量涨超1%逼近4000点 存储芯片概念持续爆发

Di Yi Cai Jing· 2025-10-27 07:30

Market Performance - The three major A-share indices experienced a rebound, with the Shanghai Composite Index rising by 1.18% to close at 3996.94 points, reaching a peak of 3999.07 points during the session [1][2] - The Shenzhen Component Index increased by 1.51% to 13489.40 points, while the ChiNext Index rose by 1.98% to 3234.45 points [2] Sector Performance - The storage chip sector saw a significant surge, with stocks like Zhaoyi Innovation hitting the daily limit, alongside strong performances from companies such as Daway Technology and China Electronics Port [2] - Other active sectors included consumer electronics, CPO, circuit boards, rare earths, nuclear fusion, and coal stocks, while gaming, Hainan, and oil and gas sectors faced declines [2] Capital Flow - Main capital inflows were observed in the communication, non-ferrous metals, and public utilities sectors, while there were outflows from battery, banking, and gaming sectors [4] - Notable net inflows were recorded for Industrial Fulian, Shenghong Technology, and Hengbao Co., with net inflows of 1.768 billion, 1.016 billion, and 867 million respectively [5] Institutional Insights - According to Caitong Securities, the Shanghai Composite Index's approach to the 4000-point mark signifies a new, more dynamic phase for the market, driven by policy and restored confidence, although sustained upward momentum requires solid economic fundamentals and improved corporate earnings [6] - Qianhai Rongyue Asset Management suggests that the next resistance level for the Shanghai Composite Index may be around 4100 points [7] - Guocheng Investment indicates that the market's upward trend should be monitored for resistance near 4200 points on the Shanghai Composite Index [8]

图南股份:公司部分牌号合金材料含有微量稀土元素,其微量添加主要用于提升合金材料的综合性能

Mei Ri Jing Ji Xin Wen· 2025-10-24 01:50

Core Viewpoint - The company, Tunan Co., confirmed that some of its alloy materials contain trace amounts of rare earth elements, which are used to enhance the overall performance of the alloys [2]. Group 1 - Investors inquired whether the company's products contain rare earth materials [2]. - The company stated that rare earth elements are referred to as "industrial monosodium glutamate" [2]. - The trace addition of rare earth elements is primarily aimed at improving the comprehensive performance of the alloy materials [2].

X @外汇交易员

外汇交易员· 2025-10-23 10:42

Strategic Outlook - The company's strategy involves utilizing all available measures, including those related to rare earth elements and supply chains, to delay challenges for a decade [1] - The company aims to achieve stability, maintain openness, and strive for breakthroughs to overcome current issues [1]

X @外汇交易员

外汇交易员· 2025-10-22 12:38

Trade Negotiations - The U S expects the meeting between President Trump and President Xi to proceed as scheduled [1] - Negotiations are meaningful, but require further observation [1] - The U S Treasury Secretary and Trade Representative will meet with Chinese officials in Malaysia to explore opportunities for advancement [1] Agricultural Products - The U S frequently discusses soybeans with China, and President Trump will raise the issue of agricultural products with the Chinese side [1] Rare Earth Elements - The U S is diversifying its rare earth procurement channels and focusing on activating rare earth production capacity within the U S [1]

早盘拉升49倍后紧急停牌 ASF Group (ASX:AFA)宣布注册为数字货币交易所提供商

Sou Hu Cai Jing· 2025-10-22 11:52

Group 1 - ASF Group (ASX:AFA) experienced a dramatic stock price surge of 4900% before being suspended for inquiries by the Australian Stock Exchange due to unusual trading activity [3] - The registration with AUSTRAC marks a significant milestone for ASF Capital in integrating traditional financial markets with regulated digital asset services [3] - ASF Capital plans to develop secure, transparent, and compliant trading solutions for wholesale and institutional clients [3] Group 2 - Astron Ltd (ASX:ATR) received a conditional support letter from Export Finance Australia for up to AUD 80 million in financing for its Donald rare earths project [6][8] - The Donald project is set to produce rare earth elements for processing in the U.S. by Energy Fuels, with production expected to commence in the second half of 2027 [8] - ATR's stock price surged by 22.86%, nearly tripling since the end of June [8] Group 3 - Genetic Signatures Ltd (ASX:GSS) reported a 58.33% increase in stock price following a strong quarterly report, with sales revenue reaching AUD 5.4 million, a 20% quarter-on-quarter increase and a 15% year-on-year increase [10][12] - The company has successfully expanded its market presence in the U.S., including securing contracts with major healthcare institutions [12] Group 4 - Power Minerals Ltd (ASX:PNN) is gaining attention due to its Gamma rare earth project, which has seen a stock price increase of nearly 240% since June [16][18] - The company is pursuing a dual listing on the OTCQB market in the U.S. to attract North American investors [16][18] - PNN plans to accelerate exploration and permitting for the Gamma project after the acquisition is completed [18] Group 5 - Resolution Minerals Ltd (ASX:RML) saw a 34% increase in stock price after securing AUD 2 million in funding from Tribeca Investment Partners [19][21] - The funds will be used to advance the Horse Heaven antimony-silver project [21] Group 6 - Mesoblast Limited (ASX:MSB) reported a 69% quarter-on-quarter increase in net revenue for its Ryoncil® product, reaching USD 19.1 million [25][26] - The product's growth is attributed to increased clinical demand and support from U.S. insurance [26] Group 7 - Larvotto Resources Limited (ASX:LRV) received a non-binding acquisition proposal from United States Antimony Corporation, which currently holds about 10% of LRV's shares [27][29] - The proposal aims to create a vertically integrated antimony group across the U.S. and Australia [29] Group 8 - Great Northern Minerals Ltd (ASX:GNM) has seen its stock price increase over sixfold in two months following the acquisition of the Catalyst Ridge rare earth project [31][33] - The project is strategically located near the only large-scale rare earth producer in the U.S., MP Materials [33] - GNM plans to initiate drilling in 2026 and is in discussions with potential strategic partners [37]

持仓观望

第一财经· 2025-10-22 10:37

Core Viewpoint - The market is experiencing a weak profit effect with a significant decline in trading volume, indicating a cautious sentiment among institutional investors and a complex behavior among retail investors [6][7][8]. Market Performance - The market saw a total of 2,278 stocks rising, but the overall trend was characterized by more declines than gains, reflecting a weak profit effect [5][6]. - The Shanghai Composite Index closed at 3,913.76, with a notable decrease in trading volume, dropping over 2,000 billion, marking a recent low in trading activity [10][7]. Sector Analysis - The deep economic concept continues to gain traction, with Agricultural Bank achieving a historical high after 14 consecutive days of gains [6]. - The lithium battery industry chain experienced a widespread decline, while gold and rare earth metals also saw collective downturns [6]. Capital Flow - There was a net outflow of funds from institutional investors, who are shifting from high-valuation tech sectors like electronics and semiconductors to lower-valuation, high-dividend assets such as building materials and petrochemicals for defensive strategies [8]. - Retail investors displayed a more complex behavior, showing signs of reverse support in a broadly declining market, but their actions are heavily influenced by short-term market fluctuations and emotions [8]. Investor Sentiment - Retail investor sentiment is at 75.85%, indicating a significant level of caution and uncertainty in the market [9]. - The current positions of investors show that 25.21% are increasing their holdings, while 18.18% are reducing them, with a majority (56.61%) choosing to hold their positions [12].