账面价值比

Search documents

如何抓住美股“十倍股”,必读

3 6 Ke· 2025-10-22 03:18

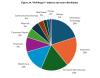

Core Insights - The article discusses the characteristics of "tenbagger" stocks, which have increased in value by ten times or more over a period from 2000 to 2024, highlighting the importance of identifying these stocks before they soar [1][2]. Group 1: Characteristics of Tenbagger Stocks - Market capitalization is a decisive factor for tenbagger potential, with most tenbagger stocks starting as small-cap stocks, benefiting from a "low base effect" [3][6]. - Many tenbagger stocks exhibit undervaluation at their inception, where the book value significantly mismatches the stock price, leading to price appreciation as earnings grow and market sentiment improves [3][6]. - A combination of value and profitability is crucial, with companies showing high book-to-market ratios and stable profitability metrics (ROE, net profit margin) outperforming the market [6][8]. Group 2: Investment Signals and Patterns - High free cash flow yield is a hidden signal for potential tenbagger stocks, indicating the ability to reinvest or return capital to shareholders without relying on financing [8]. - Tenbagger stocks often exhibit rapid price increases followed by sharp declines, indicating a "complex momentum effect" that requires careful timing for entry and exit [8][10]. - The macroeconomic environment, particularly the Federal Reserve's interest rate policies, significantly influences the emergence of tenbagger stocks, with low rates favoring growth stock valuations [10][12]. Group 3: Investment Strategy - Investors should focus on small-cap companies with value advantages and profitability, while also considering high free cash flow and reasonable capital expenditure patterns [14]. - Patience is essential, as short-term volatility can lead to premature exits from promising investments [14]. - The research challenges the notion that high EPS growth is a necessary condition for tenbagger status, suggesting a multi-dimensional approach to investment analysis [13][14].