自由现金流收益率

Search documents

大摩:金沙中国(01928)末季EBITDA逊预期 受累利润率收窄

智通财经网· 2026-01-29 06:54

Core Viewpoint - Morgan Stanley reported that Sands China (01928) had an EBITDA of $607 million for the last quarter of the year, adjusted to $582 million, which was below the market expectation of $617 million due to stagnant mass market base, deteriorating product mix, and rising costs [1] Group 1: Financial Performance - The fourth quarter EBITDA margin decreased by 200 basis points quarter-on-quarter to 29.5% [1] - Operating expenses increased by 12% quarter-on-quarter [1] Group 2: Market Position and Strategy - Morgan Stanley noted that competition intensity has stabilized, and the company's strategy is beginning to show results, although no signs of this have been observed yet [1] Group 3: Valuation Metrics - Based on projected performance for 2026, the trading price corresponds to an enterprise value multiple of 10.7 times and a free cash flow yield of 8.2%, which is attractive compared to historical averages [1]

大行评级|大摩:金沙中国末季EBITDA逊预期,仍予“增持”评级

Ge Long Hui· 2026-01-29 03:57

Core Viewpoint - Morgan Stanley's report indicates that Sands China’s EBITDA for the last quarter was $607 million, adjusted for winning rates to $582 million, which fell short of market expectations of $617 million due to stagnant mass market growth, deteriorating product mix, and rising costs [1] Financial Performance - EBITDA profit margin decreased by 200 basis points quarter-on-quarter to 29.5% [1] - The estimated enterprise value multiple based on projected performance for 2026 is 10.7 times, with a free cash flow yield of 8.2%, which is attractive compared to historical averages [1] Market Strategy - Morgan Stanley cites that the intensity of competition has stabilized, and the company's strategies are beginning to show effectiveness, although no clear signs of this have been observed yet [1] Investment Rating - The stock is rated "Overweight" with a target price of HKD 23 [1]

富国银行调整能源股评级:康菲石油(COP.US)股息增长前景获看好 山脉资源(RRC.US)因估值溢价遭下调

智通财经网· 2026-01-13 06:31

Group 1 - Wells Fargo upgraded ConocoPhillips (COP.US) from "Neutral" to "Outperform," raising the target price from $100 to $132 per share, indicating potential for leading industry dividend compound annual growth rate in the coming years [1] - The Willow oil field project is expected to start production in 2029, which will be a key turning point for the company's free cash flow, projected to generate approximately $4 billion in net cash flow in its first year at a Brent crude price of $65 per barrel [1] - Several factors will drive the company's organic free cash flow growth and enhance dividend payment capacity before the project starts, including the winding down of Qatar LNG project expenditures and the launch of multiple growth projects [1] Group 2 - The analyst estimates that ConocoPhillips' cumulative dividend payment capacity will increase by over $6 per share from 2026 to 2029, with an 8% dividend increase following the Q3 2025 earnings report, reaching $3.36 per share in 2026, demonstrating strong defensiveness in a declining oil price environment [2] - The rating for Range Resources (RRC.US) was downgraded from "Outperform" to "Neutral," with the target price reduced from $46 to $43 due to its free cash flow yield being at a premium compared to peers, particularly against Antero Resources (AR.US) [2] - Despite Range Resources' strong balance sheet and cost control, the current valuation premium is considered high, limiting further upside potential for the stock amid rising natural gas market risks [2]

英伟达(NVDA.US)回调现入场机会?模型测算股价被低估22%,目标价230美元

智通财经网· 2025-11-10 01:13

Core Viewpoint - Nvidia's stock price has decreased from a recent high of $206.88 to $188.15, but its strong free cash flow suggests a potential per-share value of $230, indicating it may be undervalued by approximately 22% [1][4]. Free Cash Flow Analysis - Nvidia reported a free cash flow of $13.45 billion for the quarter ending July 27, 2025, with a revenue of $46.743 billion, resulting in a free cash flow ratio of about 28.8% for that quarter [3]. - Over the past three quarters, Nvidia's free cash flow ratios were 59.43%, 39.54%, and 47.93%, leading to a trailing twelve months (TTM) average of 43.9% [3]. - If Nvidia maintains a free cash flow ratio of 29% in the upcoming third quarter, the TTM average would adjust to 39.15% [3]. Revenue and Cash Flow Projections - Analysts project Nvidia's annual revenue to reach $287.24 billion by January 2027, estimating a future free cash flow of $112.02 billion based on a 39% free cash flow ratio [4]. - Using a conservative free cash flow yield of 2.0%, if Nvidia distributes its projected free cash flow as dividends, the market capitalization could increase to $5.6 trillion, representing a 22% growth from its current market cap of $4.58 trillion [5]. Stock Valuation Insights - The theoretical target price for Nvidia's stock, based on free cash flow yield, is estimated at $230 per share, reflecting a potential upside of 22.24% from the current price [5][6]. Options Strategy - Selling out-of-the-money put options has become attractive due to elevated premiums, allowing investors to set a lower entry point [8]. - For instance, a put option with a strike price of $170 offers a premium of $4.60, resulting in a breakeven point of $165.40, which is 12% lower than the recent closing price [8]. - For more risk-averse investors, selling a $175 put option with a premium of $6.05 yields a breakeven point of $168.95, providing a favorable risk-reward scenario [9].

Interparfums Stock Looks Too Cheap For Its Cash Power

Forbes· 2025-11-07 17:55

Core Insights - Interparfums (IPAR) has established itself as a consistent performer in the luxury fragrance industry, focusing on brand management, free cash flow, and profitability [2] - The company has adjusted its 2025 sales forecast to $1.47 billion, reflecting a 1% year-over-year increase, influenced by economic challenges and retailer inventory reductions [3] - Interparfums has reported a 6% increase in diluted EPS to $2.05 for Q3 2025, marking 20 consecutive quarters of profitability [3] Financial Performance - The company has a free cash flow yield of 5.0%, indicating strong cash generation capabilities [7] - Interparfums has achieved a 3-year average revenue growth of 14.7% and an operating margin of 19.2%, showcasing solid fundamentals [7] - The stock is currently trading at a 41% discount to its 2-year high and 12% below its 1-month high, with a price-to-sales ratio lower than its 3-year average [7] Market Position and Strategy - The growth in sales is attributed to new licensing agreements with brands like Lacoste and Coach, along with a planned launch for Longchamp in 2027 [3] - The luxury fragrance sector is expected to grow at a compound annual growth rate (CAGR) of 8.86% through 2030, providing a favorable market backdrop for Interparfums [3]

Acacia(ACTG) - 2025 Q3 - Earnings Call Transcript

2025-11-05 14:00

Financial Data and Key Metrics Changes - Acacia reported total revenue of $59.4 million, up 16% sequentially and up 155% year-over-year, primarily driven by the third full quarter of Deflecto [5][17] - Adjusted EBITDA for the company was $8 million, with segment-adjusted EBITDA at $12.6 million [5][17] - Free cash flow for the quarter was $7.7 million, with a GAAP loss of $0.03 per share [5][22] - Book value per share at the end of Q3 was $5.98, essentially flat from the last quarter [5] Business Line Data and Key Metrics Changes - Energy operations generated $14.2 million in revenue, down from $15.8 million year-over-year due to a softer oil price environment [17] - Manufacturing operations, including Deflecto, generated $30.8 million, marking a third consecutive sequential increase [17] - Industrial operations reported $6.7 million in revenue, down from $7 million in the same quarter last year [17] - Intellectual property operations generated $7.8 million in revenue, a significant increase from $0.5 million in the prior year [17] Market Data and Key Metrics Changes - The Class 8 truck market faced demand headwinds, with September net orders being the weakest since 2019 [13] - Despite tariff pressures, Deflecto's essential non-discretionary products position the business well for future growth [14] - Benchmark's hedging strategy protects a significant amount of cash flow from downside price risk, with over 70% of operated oil and gas production hedged [11] Company Strategy and Development Direction - Acacia is focused on identifying and acquiring under-loved, under-managed, and under-valued businesses to drive long-term growth [6] - The company is implementing pricing strategies, cost savings initiatives, and operational efficiencies to mitigate tariff pressures [4] - There is a strong emphasis on pursuing accretive, organic, and inorganic growth opportunities, with a cash position of approximately $332 million [8] Management's Comments on Operating Environment and Future Outlook - Management acknowledged persistent macroeconomic and geopolitical headwinds but emphasized strong execution against their operationally focused strategy [4] - The company remains focused on driving revenue, EBITDA, and free cash flow growth while expanding its M&A pipeline [8] - Management expressed confidence in the inherent value of their assets and the ability to build momentum through year-end and into next year [25] Other Important Information - Total consolidated G&A expenses were $16 million, up from $11.2 million year-over-year, primarily due to the addition of Deflecto [18] - The company recorded a GAAP operating loss of $6.4 million, an improvement from a loss of $10.3 million in the prior year [19] - Acacia's total indebtedness was $94 million as of September 30, 2025, with zero debt at the parent company level [23][24] Q&A Session Summary Question: Focus on Deflecto's performance - Management noted that Deflecto performed better than expected in a challenging environment and discussed future free cash flow allocation towards debt repayment [26][27] Question: Update on Benchmark and Cherokee properties - Management confirmed that Benchmark's production is performing well and discussed ongoing strategic acquisitions in the Cherokee area [30] Question: Interest in AMO Pharma - Management stated that while AMO Pharma has made positive advancements, they have not changed their estimated valuation [44] Question: Impact of geopolitical tensions on patent portfolio - Management indicated that the U.S. appears to be more IP-friendly under the new administration, which is a positive for their patent portfolio [32] Question: Outreach to investors and analysts - Management acknowledged the need for increased investor outreach and discussed ongoing efforts to raise Acacia's profile among potential investors [39][41]

如何抓住美股“十倍股”,必读

3 6 Ke· 2025-10-22 03:18

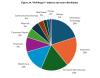

Core Insights - The article discusses the characteristics of "tenbagger" stocks, which have increased in value by ten times or more over a period from 2000 to 2024, highlighting the importance of identifying these stocks before they soar [1][2]. Group 1: Characteristics of Tenbagger Stocks - Market capitalization is a decisive factor for tenbagger potential, with most tenbagger stocks starting as small-cap stocks, benefiting from a "low base effect" [3][6]. - Many tenbagger stocks exhibit undervaluation at their inception, where the book value significantly mismatches the stock price, leading to price appreciation as earnings grow and market sentiment improves [3][6]. - A combination of value and profitability is crucial, with companies showing high book-to-market ratios and stable profitability metrics (ROE, net profit margin) outperforming the market [6][8]. Group 2: Investment Signals and Patterns - High free cash flow yield is a hidden signal for potential tenbagger stocks, indicating the ability to reinvest or return capital to shareholders without relying on financing [8]. - Tenbagger stocks often exhibit rapid price increases followed by sharp declines, indicating a "complex momentum effect" that requires careful timing for entry and exit [8][10]. - The macroeconomic environment, particularly the Federal Reserve's interest rate policies, significantly influences the emergence of tenbagger stocks, with low rates favoring growth stock valuations [10][12]. Group 3: Investment Strategy - Investors should focus on small-cap companies with value advantages and profitability, while also considering high free cash flow and reasonable capital expenditure patterns [14]. - Patience is essential, as short-term volatility can lead to premature exits from promising investments [14]. - The research challenges the notion that high EPS growth is a necessary condition for tenbagger status, suggesting a multi-dimensional approach to investment analysis [13][14].

Could Gartner Stock's Cash Flow Spark The Next Rally?

Forbes· 2025-10-14 13:42

Core Viewpoint - Gartner (IT) stock is considered a valuable investment opportunity due to its growth, strong cash generation, and significant valuation discount [2][7]. Financial Performance - Gartner has an impressive cash flow yield of 8.0%, indicating strong cash generation capabilities [7]. - The company reported a revenue growth of 5.9% over the last 12 months, suggesting that its cash reserves are likely to increase [7]. Valuation Metrics - The stock is currently trading at a valuation discount of 34% below its 3-month high, 52% below its 1-year high, and 52% below its 2-year high [7]. Investment Strategy - A selection strategy focusing on high free cash flow yield combined with growth and valuation discount has shown average forward returns of 25.7% over 6 months and 57.9% over 12 months [8]. - The win rate for this strategy, defined as the percentage of picks returning positive, exceeds 70% for both 6-month and 12-month periods [8].

Why Is Booking Stock With Its High Flow Yield Not On Your Watchlist?

Forbes· 2025-10-09 14:45

Core Insights - Booking.com has reached a mutual agreement with French tax authorities to pay 153 million euros for a tax reassessment covering the period from 2006 to 2018 [2] Financial Performance - Booking.com exhibits a free cash flow yield of 5.5%, which is considered high compared to other stocks [7] - The company has a 3-year average revenue growth of 19.9% and an operating margin of 30.8%, indicating strong fundamentals [7] - Currently, Booking.com stock is trading 12% below its 2-year high and 8.0% below its 1-month high, with a price-to-sales ratio lower than its 3-year average [7] Investment Strategy - Investing in a diversified portfolio, such as the High Quality Portfolio (HQ), has shown to outperform benchmarks like the S&P 500, achieving returns over 91% since its launch [4][10] - The HQ Portfolio has a win rate of approximately 74% for the 12-month horizon, producing an average return of nearly 18% even during stable periods [11] Market Volatility - Booking.com has experienced significant stock declines in the past, including nearly 100% during the Dot-Com Bubble and around 66% during the Global Financial Crisis [8] - The stock has also faced drops of approximately 27% and 40% due to corrections and inflation shocks in 2018, and a 45% decline during the Covid selloff [8]

Energy Transfer(ET.US)获丰业银行“跑赢大盘”评级!资本支出支撑盈利增长 股价潜在涨幅达30%

智通财经网· 2025-09-03 06:43

Group 1 - The core viewpoint is that Energy Transfer has been rated "Outperform" by Canadian Imperial Bank of Commerce (CIBC) with a target price of $23, indicating nearly 30% upside potential from the current closing price of $17.7 [1] - Energy Transfer possesses a large and integrated asset base covering all segments of the midstream value chain, creating a comprehensive investment portfolio from wellhead to water [1] - The company is expected to benefit from sustained earnings growth driven by both short-term and future thematic demand, with projected average capital expenditures of approximately $4.9 billion from fiscal years 2026 to 2028 [1] Group 2 - Energy Transfer is highly active in mergers and acquisitions, maintaining a strong willingness to spend, which keeps its stock price relatively undervalued in the long term [2] - The company's complex corporate structure and somewhat complicated capital structure further contribute to its valuation challenges [2] - Although the current discount in valuation is not expected to disappear completely, it is anticipated to narrow to a more reasonable range compared to current levels [2]