轮胎原材料价格波动风险

Search documents

A股申购 | 泰凯英(920020.BJ)开启申购 专业从事矿山及建筑轮胎的设计、研发、销售与服务

智通财经网· 2025-10-14 22:46

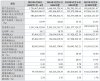

Core Viewpoint - Taike Ying (920020.BJ) has initiated its subscription on October 15, with an issue price of 7.50 CNY per share and a subscription limit of 199.12 million shares, reflecting a price-to-earnings ratio of 11.02 times, indicating its focus on the global mining and construction tire market driven by technological innovation [1] Company Overview - Taike Ying specializes in the design, research and development, sales, and service of tires for mining and construction, particularly in engineering radial tires and all-steel truck tires [1] - The company ranks third among Chinese brands and eighth globally in engineering radial tires as of 2023, with a market share of third place in the domestic engineering radial tire matching market, and first in the domestic market for large-tonnage crane tires [1] Clientele - The company collaborates with leading domestic engineering machinery firms such as SANY Group and XCMG, as well as global giants like Liebherr, JCB, Zijin Mining, Rio Tinto, Glencore, Vale, and BHP [2] Financial Performance - For the fiscal years 2022, 2023, and 2024, Taike Ying reported revenues of approximately 1.803 billion CNY, 2.031 billion CNY, and 2.295 billion CNY respectively, with net profits of about 108 million CNY, 138 million CNY, and 157 million CNY respectively [2] - As of June 30, 2025, total assets are projected to be approximately 1.726 billion CNY, with total equity of about 780 million CNY, and a debt-to-asset ratio of 65.99% [3] - The company’s gross profit margin has shown slight fluctuations, recorded at 18.12% for the first half of 2025, compared to 19.20% in 2023 [3] - Research and development expenses accounted for 2.24% of revenue in the first half of 2025, up from 1.78% in 2022 [3]