工程子午线轮胎

Search documents

工程机械复苏动能稳步释放,建议关注北交所工程机械相关标的

Soochow Securities· 2026-02-26 04:00

证券研究报告·北交所报告·北交所专题报告 北交所专题报告 20260226 工程机械复苏动能稳步释放,建议关注北交 所工程机械相关标的 [Table_Tag] [Table_Summary] 观点 2026 年 02 月 26 日 证券分析师 朱洁羽 执业证书:S0600520090004 zhujieyu@dwzq.com.cn 证券分析师 易申申 执业证书:S0600522100003 yishsh@dwzq.com.cn 证券分析师 余慧勇 执业证书:S0600524080003 yuhy@dwzq.com.cn 研究助理 武阿兰 执业证书:S0600124070018 wual@dwzq.com.cn 研究助理 陈哲晓 执业证书:S0600124080015 sh_chenzhx@dwzq.com.cn 相关研究 《年度业绩快报密集发布,北证 50 上 涨 0.77%》 2026-02-25 《人民银行开展 5260 亿元 7 天期逆 回购操作,北证 50 上涨 0.37%》 2026-02-24 东吴证券研究所 1 / 21 请务必阅读正文之后的免责声明部分 ◼ 工程机械行业自 2025 年下半年进 ...

青岛全周期培育冠军企业

Jing Ji Ri Bao· 2026-01-26 22:03

Core Insights - The Ministry of Industry and Information Technology has announced the ninth batch of manufacturing single champion enterprises, with seven companies from Qingdao included, bringing the total to 45, ranking eighth nationally and fifth among sub-provincial cities [1] - Qingdao has established a systematic cultivation framework for champion enterprises, integrating policies into the "Industrial Empowerment Qingdao, Strong Manufacturing City" strategy, fostering cross-departmental collaboration [1][2] - The city has provided significant financial support, including a one-time reward of 2 million yuan for newly recognized champion enterprises, totaling 61 million yuan disbursed, and 358 million yuan for technological upgrades over the past three years [2] Group 1 - Qingdao's champion enterprises have made significant advancements in their respective fields, with companies like Sailun Group achieving breakthroughs in manufacturing large engineering tires, enhancing safety and load-bearing capabilities [2] - China Shipbuilding Group's engine division has focused on low-carbon and zero-carbon fuel engines, successfully delivering dual-fuel engines that reduce carbon emissions by approximately 24% [1][2] - Hisense Visual has established the world's first "lighthouse factory" in the television industry, integrating AI throughout the production process, achieving a remarkable output of one 85-inch television every 20 seconds [3] Group 2 - The cultivation of champion enterprises is seen as a key strategy for advancing the industry towards mid-to-high-end manufacturing and ensuring the stability of supply chains [2] - Qingdao has built a robust support system consisting of 3,315 specialized small and medium-sized enterprises, 256 "little giant" enterprises, and 128 provincial-level champion enterprises, providing a continuous source of growth for the champion enterprise group [2] - The achievements of these champion enterprises not only enhance Qingdao's manufacturing reputation but also position them competitively on a global scale, marking a new coordinate for Chinese manufacturing [3]

上市不到两个月:青岛上市新军董事长换人

Sou Hu Cai Jing· 2025-12-26 00:07

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. has made significant management changes shortly after its IPO, indicating a strategic shift as the company aims to enhance its market position and execute its development plans effectively [2][7]. Management Changes - Wang Chuan Zhu has been appointed as both Chairman and General Manager, leveraging his extensive background in rubber and international market experience to align with the company's "technology-driven + globalization" strategy [8][9]. - Other key appointments include Song Xing as Deputy General Manager and Board Secretary, and Ju Peng as Financial Officer, aimed at strengthening the company's governance and financial management [12]. Strategic Focus - The company plans to invest 390 million yuan in upgrading its full range of specialized tires, establishing an innovation technology research center, and enhancing its intelligent management systems [4]. - Taike Ying aims to expand its overseas market presence while maintaining a competitive edge through differentiated strategies [5]. Industry Context - The engineering tire industry is undergoing a transformation, and Taike Ying's management changes are a proactive response to these evolving market dynamics [13]. - In 2023, Taike Ying ranked third among Chinese brands and eighth globally in engineering radial tire sales, with a significant overseas revenue share of 70% [15].

登陆北交所!青岛迎今年首家A股上市企业

Sou Hu Cai Jing· 2025-10-29 01:29

Core Insights - Qingdao Taike Ying Special Tires Co., Ltd. successfully listed on the Beijing Stock Exchange, becoming one of the most anticipated manufacturing IPOs of the year [1] - The company has been recognized with multiple honors, including being named a "Little Giant" enterprise and a top brand in China, reflecting its strong market position and innovation capabilities [3] Company Overview - Taike Ying specializes in the global mining and construction tire market, with a focus on "scenario-based technological innovation" as its core development driver [3][5] - The company has developed over 700 types of scenario-specific tires, addressing complex operational conditions and creating a significant technological barrier in the engineering radial tire sector [5] Technological Innovation - Taike Ying's R&D system transforms extreme operational environment parameters into specific technical indicators, supported by 188 patents and four internationally leading key technologies [5] - The proprietary TIKS tire intelligent management system utilizes IoT devices and AI algorithms to extend tire lifespan by over 20% [5] Market Position - In 2023, Taike Ying ranked third among Chinese brands and eighth globally in engineering radial tire sales, with a leading market share in large-tonnage crane tires domestically [7] - The company has a global presence, with products sold in over 100 countries and 70% of its revenue coming from international markets [7] Strategic Partnerships - Taike Ying has established long-term agreements with major mining companies like Rio Tinto and has entered the A-class supplier system of Liebherr, enhancing its position in the global supply chain [9] - The company maintains a gross margin of over 35%, which is approximately 10 percentage points higher than the industry average, due to its technological premium [9] Future Plans - Post-IPO, Taike Ying plans to invest in three key areas: upgrading its full range of scenario-specific tire products, establishing an innovation technology R&D center, and enhancing its intelligent management system [10] - The company aims to transition from a "product supplier" to a "global mining tire solution provider," capitalizing on the ongoing global mining electrification and intelligent transformation [12] Regional Impact - Taike Ying's listing reflects the collaborative development of Qingdao's manufacturing sector and capital markets, contributing to the city's economic growth [13] - In the first half of 2025, Qingdao's 64 listed companies achieved a revenue of 332.3 billion yuan, accounting for 39% of the city's GDP, indicating a robust industrial strategy [13][15]

泰凯英上市募3.3亿首日涨189% 去年净利升现金净额降

Zhong Guo Jing Ji Wang· 2025-10-28 07:51

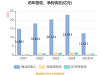

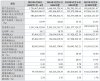

Core Points - The company TaiKaiYing has been listed on the Beijing Stock Exchange, with a closing price of 21.64 yuan, representing a 188.53% increase from the opening price of 19.05 yuan, and a total market capitalization of 4.788 billion yuan [1] - TaiKaiYing focuses on the global mining and construction tire market, specializing in the design, research and development, sales, and service of mining and construction tires [1] - The company raised a net amount of approximately 290.44 million yuan from its IPO, which will be used for product upgrades, technology research and development, and management system enhancements [4] Financial Performance - In recent years, TaiKaiYing's revenue has shown a steady increase, with reported revenues of 1.803 billion yuan in 2022, 2.031 billion yuan in 2023, and 2.295 billion yuan in 2024, with a projected revenue of 1.242 billion yuan for the first half of 2025 [5][6] - The net profit attributable to the parent company was 108 million yuan in 2022, 138 million yuan in 2023, and 157 million yuan in 2024, with a projected net profit of approximately 87.4 million yuan for the first half of 2025 [5][6] - The company expects to achieve a revenue of 1.9 billion to 1.965 billion yuan for the first nine months of 2025, representing a year-on-year growth of 12.08% to 15.92% [9][10] Shareholding Structure - Before the IPO, TaiKaiYing Holdings directly held 129,106,698 shares, accounting for 72.94% of the total share capital, and after the IPO, this percentage decreased to 58.35% [2] - The actual controllers of the company, Wang Chuan Zhu and his spouse Guo Yong Fang, held a combined total of 63.77% of the shares after the IPO [2]

风电齿轮箱领军企业、苏州造价龙头申购,4只新股上市

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 23:17

New IPOs and Listings - Two new stocks are available for subscription: Delijia (603092.SH) on the Shanghai Stock Exchange and Zhongcheng Consulting (920003.BJ) on the Beijing Stock Exchange [1] - Four stocks are listed today: Bibete (688759.SH), Xi'an Yicai (688783.SH), Heyuan Bio (688765.SH), and Taikaiying (920020.BJ) [1] Delijia (603092.SH) - Delijia specializes in the R&D, production, and sales of high-speed heavy-load precision gear transmission products, primarily for wind power generation [2][7] - The IPO price is 46.68 CNY per share, with an institutional offering price of 47.68 CNY, and a market capitalization of 16.8 billion CNY [5] - The company has a projected market share of 10.36% globally and 16.22% in China for wind power transmission equipment by 2024, ranking third globally and second in China [7] - Delijia's revenue from onshore wind power is expected to be 36.25 billion CNY in 2024, accounting for 98.57% of its total revenue [7] Zhongcheng Consulting (920003.BJ) - Zhongcheng Consulting focuses on engineering consulting services and has ranked among the top five in Jiangsu Province for engineering cost consulting revenue from 2021 to 2024 [8][11] - The IPO price is 14.27 CNY per share, with a market capitalization of 1.4 billion CNY [11] - The company plans to invest 1.23 billion CNY in building an engineering consulting service network and 0.77 billion CNY in R&D and information technology [11] Taikaiying (920020.BJ) - Taikaiying is the first company in the mining and construction tire segment to be listed on the Beijing Stock Exchange, recognized as the "first tire stock" on the exchange [15][19] - The IPO price is 7.50 CNY per share, with a market capitalization of 750 million CNY [18] - The company holds the number one market share in the domestic market for large-tonnage crane tires [19] Xi'an Yicai (688783.SH) - Xi'an Yicai is a leading manufacturer of 12-inch silicon wafers, ranking first in China and sixth globally in terms of production capacity [21][22] - The IPO price is 8.62 CNY per share, with a market capitalization of 34.81 billion CNY [21] - The company has a projected capacity of 120,000 wafers per month by 2026, which will meet 40% of the demand in mainland China [22] Heyuan Bio (688765.SH) - Heyuan Bio focuses on the research and development of plant-derived recombinant protein expression technology and has developed several pharmaceutical products [33][38] - The IPO price is 29.06 CNY per share, with a market capitalization of 10.39 billion CNY [35] - The company plans to invest 19.09 billion CNY in the construction of a plant for recombinant human serum albumin and 7.94 billion CNY in new drug development [37]

北交所轮胎第一股、汽车电子PCB企业申购

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 23:57

Group 1: Company Overview - Taika Ying is the first company in the tire segment of the mining and construction industry to be listed on the Beijing Stock Exchange, recognized as the "first tire stock of the Beijing Stock Exchange" [2] - The company specializes in engineering radial tires and all-steel truck tires, holding a leading position in the engineering radial tire sector, ranking 3rd among Chinese brands and 8th globally in 2023 [3] - Taika Ying has established partnerships with major global and domestic construction machinery manufacturers, including SANY Group, XCMG, Liebherr, and JCB, among others [3] Group 2: Financial Performance - In 2024, Chaoying Electronics reported a main business revenue of 3.945 billion yuan, ranking 41st among global PCB manufacturers with a market share of 0.75% [5] - The company ranks 23rd among comprehensive PCB companies in China, with a market share of 1.41% in mainland China [5] - Chaoying Electronics is recognized as one of the top ten automotive electronic PCB suppliers globally and among the top five in China [5] Group 3: Market Position and Risks - Taika Ying's market share in the domestic engineering radial tire supporting market ranks 3rd among all tire brands, with the highest market share in the domestic market for large-tonnage crane tires [3] - Chaoying Electronics has a stable collaboration with Tier 1 automotive suppliers and well-known electric vehicle manufacturers like Tesla [4] - Both companies face risks related to their operational models, with Taika Ying relying on an outsourcing production model and Chaoying Electronics being sensitive to macroeconomic fluctuations and downstream market demand [4][5]

轮胎企业泰凯英登陆北交所

Zhong Guo Hua Gong Bao· 2025-10-22 02:25

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. has officially launched its issuance subscription on the Beijing Stock Exchange, aiming to raise a total of 332 million yuan through the issuance of shares priced at 7.50 yuan each, with a price-to-earnings ratio of 11.02 times [1] Group 1: Fundraising Purpose - The raised funds will be allocated to projects including the upgrade of the full range of specialized tire products, the establishment of an innovative technology research and development center for specialized tires, and the enhancement of an intelligent management system for tires [1] - Successful implementation of these projects is expected to optimize the company's product line, enhance its research and development capabilities, and expand its market reach, thereby increasing the scale of the company's main business revenue [1] Group 2: Company Profile - Taike Ying focuses on the global mining and construction tire market, specializing in the design, research and development, sales, and service of mining and construction tires, including engineering radial tires and all-steel truck tires [1] - The company's core competitive advantage lies in its ability to develop products based on user scenario demands [1]

泰凯英:拟首发募资3.32亿元升级产品与研发 15日申购

Sou Hu Cai Jing· 2025-10-15 07:09

Core Viewpoint - The company aims to enhance its financial strength and market competitiveness through a fundraising initiative, focusing on product innovation, research capabilities, and intelligent tire management systems [1][2]. Group 1: Fundraising and Investment Projects - The fundraising will significantly improve the company's financial strength, allowing for concentrated investment in product competitiveness, research capabilities, and intelligent tire management systems [1]. - Key projects include upgrading the entire series of scene-specific tire products, establishing a specialized tire innovation technology research center, and enhancing the intelligent tire management system [1]. - Successful implementation of these projects is expected to optimize the product line, enhance research capabilities, and expand market reach, ultimately increasing the company's main business revenue [1]. Group 2: Company Overview - The company, Taikaiying, is driven by technological innovation and focuses on the global mining and construction tire market, specializing in the design, research, sales, and service of mining and construction tires [2]. - The product range includes engineering radial tires and all-steel truck tires, developed through a scenario-based technology development system aimed at reducing tire consumption and improving equipment operational efficiency [2]. Group 3: Financial Overview - The company plans to issue 44.25 million shares at a price of 7.5 yuan per share, with an expected total fundraising amount of 332 million yuan [3]. - The company's revenue composition for 2024 indicates that engineering radial tires contribute 1.7177 billion yuan, while all-steel truck tires contribute 501.2 million yuan [5]. - Historical revenue growth rates show fluctuations, with total revenue growth rates and net profit growth rates varying over the years [5][6]. Group 4: Financial Ratios and Performance Metrics - The company's weighted average return on equity for 2024 is projected at 25.56%, a decrease of 2.84 percentage points from the previous year [18]. - The operating cash flow net amount for 2024 is reported at 145 million yuan, a decline of 10.13% year-on-year [21]. - The company's liquidity ratios indicate a current ratio of 1.76 and a quick ratio of 1.65 for 2024, improving to 1.87 and 1.72 respectively in the first half of 2025 [50].

A股申购 | 泰凯英(920020.BJ)开启申购 专业从事矿山及建筑轮胎的设计、研发、销售与服务

智通财经网· 2025-10-14 22:46

Core Viewpoint - Taike Ying (920020.BJ) has initiated its subscription on October 15, with an issue price of 7.50 CNY per share and a subscription limit of 199.12 million shares, reflecting a price-to-earnings ratio of 11.02 times, indicating its focus on the global mining and construction tire market driven by technological innovation [1] Company Overview - Taike Ying specializes in the design, research and development, sales, and service of tires for mining and construction, particularly in engineering radial tires and all-steel truck tires [1] - The company ranks third among Chinese brands and eighth globally in engineering radial tires as of 2023, with a market share of third place in the domestic engineering radial tire matching market, and first in the domestic market for large-tonnage crane tires [1] Clientele - The company collaborates with leading domestic engineering machinery firms such as SANY Group and XCMG, as well as global giants like Liebherr, JCB, Zijin Mining, Rio Tinto, Glencore, Vale, and BHP [2] Financial Performance - For the fiscal years 2022, 2023, and 2024, Taike Ying reported revenues of approximately 1.803 billion CNY, 2.031 billion CNY, and 2.295 billion CNY respectively, with net profits of about 108 million CNY, 138 million CNY, and 157 million CNY respectively [2] - As of June 30, 2025, total assets are projected to be approximately 1.726 billion CNY, with total equity of about 780 million CNY, and a debt-to-asset ratio of 65.99% [3] - The company’s gross profit margin has shown slight fluctuations, recorded at 18.12% for the first half of 2025, compared to 19.20% in 2023 [3] - Research and development expenses accounted for 2.24% of revenue in the first half of 2025, up from 1.78% in 2022 [3]