全钢卡车轮胎

Search documents

泰凯英上市募3.3亿首日涨189% 去年净利升现金净额降

Zhong Guo Jing Ji Wang· 2025-10-28 07:51

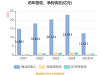

Core Points - The company TaiKaiYing has been listed on the Beijing Stock Exchange, with a closing price of 21.64 yuan, representing a 188.53% increase from the opening price of 19.05 yuan, and a total market capitalization of 4.788 billion yuan [1] - TaiKaiYing focuses on the global mining and construction tire market, specializing in the design, research and development, sales, and service of mining and construction tires [1] - The company raised a net amount of approximately 290.44 million yuan from its IPO, which will be used for product upgrades, technology research and development, and management system enhancements [4] Financial Performance - In recent years, TaiKaiYing's revenue has shown a steady increase, with reported revenues of 1.803 billion yuan in 2022, 2.031 billion yuan in 2023, and 2.295 billion yuan in 2024, with a projected revenue of 1.242 billion yuan for the first half of 2025 [5][6] - The net profit attributable to the parent company was 108 million yuan in 2022, 138 million yuan in 2023, and 157 million yuan in 2024, with a projected net profit of approximately 87.4 million yuan for the first half of 2025 [5][6] - The company expects to achieve a revenue of 1.9 billion to 1.965 billion yuan for the first nine months of 2025, representing a year-on-year growth of 12.08% to 15.92% [9][10] Shareholding Structure - Before the IPO, TaiKaiYing Holdings directly held 129,106,698 shares, accounting for 72.94% of the total share capital, and after the IPO, this percentage decreased to 58.35% [2] - The actual controllers of the company, Wang Chuan Zhu and his spouse Guo Yong Fang, held a combined total of 63.77% of the shares after the IPO [2]

北交所轮胎第一股、汽车电子PCB企业申购

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 23:57

Group 1: Company Overview - Taika Ying is the first company in the tire segment of the mining and construction industry to be listed on the Beijing Stock Exchange, recognized as the "first tire stock of the Beijing Stock Exchange" [2] - The company specializes in engineering radial tires and all-steel truck tires, holding a leading position in the engineering radial tire sector, ranking 3rd among Chinese brands and 8th globally in 2023 [3] - Taika Ying has established partnerships with major global and domestic construction machinery manufacturers, including SANY Group, XCMG, Liebherr, and JCB, among others [3] Group 2: Financial Performance - In 2024, Chaoying Electronics reported a main business revenue of 3.945 billion yuan, ranking 41st among global PCB manufacturers with a market share of 0.75% [5] - The company ranks 23rd among comprehensive PCB companies in China, with a market share of 1.41% in mainland China [5] - Chaoying Electronics is recognized as one of the top ten automotive electronic PCB suppliers globally and among the top five in China [5] Group 3: Market Position and Risks - Taika Ying's market share in the domestic engineering radial tire supporting market ranks 3rd among all tire brands, with the highest market share in the domestic market for large-tonnage crane tires [3] - Chaoying Electronics has a stable collaboration with Tier 1 automotive suppliers and well-known electric vehicle manufacturers like Tesla [4] - Both companies face risks related to their operational models, with Taika Ying relying on an outsourcing production model and Chaoying Electronics being sensitive to macroeconomic fluctuations and downstream market demand [4][5]

轮胎企业泰凯英登陆北交所

Zhong Guo Hua Gong Bao· 2025-10-22 02:25

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. has officially launched its issuance subscription on the Beijing Stock Exchange, aiming to raise a total of 332 million yuan through the issuance of shares priced at 7.50 yuan each, with a price-to-earnings ratio of 11.02 times [1] Group 1: Fundraising Purpose - The raised funds will be allocated to projects including the upgrade of the full range of specialized tire products, the establishment of an innovative technology research and development center for specialized tires, and the enhancement of an intelligent management system for tires [1] - Successful implementation of these projects is expected to optimize the company's product line, enhance its research and development capabilities, and expand its market reach, thereby increasing the scale of the company's main business revenue [1] Group 2: Company Profile - Taike Ying focuses on the global mining and construction tire market, specializing in the design, research and development, sales, and service of mining and construction tires, including engineering radial tires and all-steel truck tires [1] - The company's core competitive advantage lies in its ability to develop products based on user scenario demands [1]

泰凯英:拟首发募资3.32亿元升级产品与研发 15日申购

Sou Hu Cai Jing· 2025-10-15 07:09

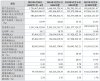

Core Viewpoint - The company aims to enhance its financial strength and market competitiveness through a fundraising initiative, focusing on product innovation, research capabilities, and intelligent tire management systems [1][2]. Group 1: Fundraising and Investment Projects - The fundraising will significantly improve the company's financial strength, allowing for concentrated investment in product competitiveness, research capabilities, and intelligent tire management systems [1]. - Key projects include upgrading the entire series of scene-specific tire products, establishing a specialized tire innovation technology research center, and enhancing the intelligent tire management system [1]. - Successful implementation of these projects is expected to optimize the product line, enhance research capabilities, and expand market reach, ultimately increasing the company's main business revenue [1]. Group 2: Company Overview - The company, Taikaiying, is driven by technological innovation and focuses on the global mining and construction tire market, specializing in the design, research, sales, and service of mining and construction tires [2]. - The product range includes engineering radial tires and all-steel truck tires, developed through a scenario-based technology development system aimed at reducing tire consumption and improving equipment operational efficiency [2]. Group 3: Financial Overview - The company plans to issue 44.25 million shares at a price of 7.5 yuan per share, with an expected total fundraising amount of 332 million yuan [3]. - The company's revenue composition for 2024 indicates that engineering radial tires contribute 1.7177 billion yuan, while all-steel truck tires contribute 501.2 million yuan [5]. - Historical revenue growth rates show fluctuations, with total revenue growth rates and net profit growth rates varying over the years [5][6]. Group 4: Financial Ratios and Performance Metrics - The company's weighted average return on equity for 2024 is projected at 25.56%, a decrease of 2.84 percentage points from the previous year [18]. - The operating cash flow net amount for 2024 is reported at 145 million yuan, a decline of 10.13% year-on-year [21]. - The company's liquidity ratios indicate a current ratio of 1.76 and a quick ratio of 1.65 for 2024, improving to 1.87 and 1.72 respectively in the first half of 2025 [50].

A股申购 | 泰凯英(920020.BJ)开启申购 专业从事矿山及建筑轮胎的设计、研发、销售与服务

智通财经网· 2025-10-14 22:46

Core Viewpoint - Taike Ying (920020.BJ) has initiated its subscription on October 15, with an issue price of 7.50 CNY per share and a subscription limit of 199.12 million shares, reflecting a price-to-earnings ratio of 11.02 times, indicating its focus on the global mining and construction tire market driven by technological innovation [1] Company Overview - Taike Ying specializes in the design, research and development, sales, and service of tires for mining and construction, particularly in engineering radial tires and all-steel truck tires [1] - The company ranks third among Chinese brands and eighth globally in engineering radial tires as of 2023, with a market share of third place in the domestic engineering radial tire matching market, and first in the domestic market for large-tonnage crane tires [1] Clientele - The company collaborates with leading domestic engineering machinery firms such as SANY Group and XCMG, as well as global giants like Liebherr, JCB, Zijin Mining, Rio Tinto, Glencore, Vale, and BHP [2] Financial Performance - For the fiscal years 2022, 2023, and 2024, Taike Ying reported revenues of approximately 1.803 billion CNY, 2.031 billion CNY, and 2.295 billion CNY respectively, with net profits of about 108 million CNY, 138 million CNY, and 157 million CNY respectively [2] - As of June 30, 2025, total assets are projected to be approximately 1.726 billion CNY, with total equity of about 780 million CNY, and a debt-to-asset ratio of 65.99% [3] - The company’s gross profit margin has shown slight fluctuations, recorded at 18.12% for the first half of 2025, compared to 19.20% in 2023 [3] - Research and development expenses accounted for 2.24% of revenue in the first half of 2025, up from 1.78% in 2022 [3]

泰凯英(920020):工程子午线轮胎“小巨人”,轻资产运营下智能化赋能高价值易耗轮胎需求

Hua Yuan Zheng Quan· 2025-10-14 14:29

Investment Rating - The report suggests a focus on the company, with a price of 7.50 CNY per share and a P/E ratio of 10.59X for the upcoming issuance [2][5]. Core Insights - The company, Taikaiying, is recognized as a "little giant" in the engineering radial tire sector, with a projected CAGR of 37.81% for net profit from 2021 to 2024 [10][47]. - The company has developed over 600 tire products suitable for various operational scenarios and holds 166 patents [13][16]. - The engineering radial tire market is expected to grow significantly, with a projected market size of 16 billion USD by 2029 [56][60]. Summary by Sections 1. Initial Issuance - The company plans to issue 44,250,000 shares at a price of 7.50 CNY per share, representing 20% of the total post-issuance share capital [2][5]. - The net proceeds from the issuance will be invested in projects aimed at upgrading specialized tire products and enhancing technological capabilities [8][9]. 2. Company Overview - Taikaiying specializes in the design, research, and sales of tires for mining and construction, focusing on reducing tire consumption and improving operational efficiency [10][22]. - The company has a diverse product range, including engineering radial tires and all-steel truck tires, with projected revenues of 1.718 billion CNY from engineering radial tires in 2024 [20][36]. 3. Industry Insights - The global market for engineering radial tires is estimated at 8 billion USD in 2023, with a significant growth trajectory expected [56][60]. - The trend towards radialization in the tire industry is evident, with China's overall radialization rate reaching 95.20% in 2022, although the engineering tire radialization rate was only 43.2% in 2023 [58][61].

泰凯英(920020):北交所新股申购策略报告之一百四十五:轮胎小巨人,聚焦矿山及建筑轮胎市场-20251014

Shenwan Hongyuan Securities· 2025-10-14 13:33

Investment Rating - The investment rating for the company is not explicitly stated in the provided content, but the report suggests a positive outlook for participation in the upcoming IPO, indicating a favorable investment sentiment [20]. Core Viewpoints - The company, Taikaiying, is recognized as a "small giant" in the tire industry, specializing in engineering radial tires and all-steel truck tires, with a strong focus on the mining and construction tire market [4][20]. - The company has achieved significant market recognition, ranking third among Chinese brands and eighth globally in engineering radial tires as of 2023 [7]. - The revenue performance is stable, with projected revenue of 2.295 billion yuan for 2024, reflecting a compound annual growth rate (CAGR) of 12.82% over the past three years [8]. - The company plans to utilize the funds raised from the IPO for product upgrades, the establishment of a research and development center, and the enhancement of a specialized tire intelligent management system [10]. Summary by Sections 1. Company Overview - Taikaiying was established in 2007 and is headquartered in Qingdao, Shandong, focusing on the design, research and development, sales, and service of mining and construction tires [4][7]. - The company has established a strong brand presence and has been recognized by international clients, including major industry players [7]. 2. Financial Performance - The projected revenue for 2024 is 2.295 billion yuan, with a net profit of approximately 156.65 million yuan, indicating a CAGR of 20.25% over the past three years [8]. - The gross margin for 2024 is expected to be 18.79%, while the net margin is projected at 6.82% [8]. 3. IPO Details - The IPO will involve a direct pricing method with an issue price of 7.50 yuan per share, raising approximately 3.32 billion yuan [11]. - The initial issuance will consist of 44.25 million shares, representing 20% of the total post-issue share capital, with a low expected free float of 18% [12]. 4. Industry Context - The Chinese tire industry is experiencing growth, with a decline in global market concentration, and is a major production hub for tires [13][14]. - The demand for tires is expected to increase due to rising vehicle ownership and the expansion of the replacement market, particularly in the context of new infrastructure and energy initiatives [14]. 5. Competitive Advantages - The company has a strong technical innovation advantage, having developed over 700 types of tires suitable for various operational environments [15]. - It employs a localized service model to meet customer needs effectively, covering the entire sales process from market research to product claims [15]. 6. Purchase Analysis - The report recommends active participation in the IPO, highlighting the company's low initial valuation and limited historical trading records, which may present a favorable investment opportunity [20].

泰凯英(920020):北交所新股申购策略报告之一百四十五:轮胎“小巨人”,聚焦矿山及建筑轮胎市场-20251014

Shenwan Hongyuan Securities· 2025-10-14 11:58

Investment Rating - The investment rating for the company is suggested to be "actively participate" in the new share subscription [23]. Core Viewpoints - The company is recognized as a "small giant" in the domestic tire sector, specializing in engineering radial tires and all-steel truck tires, focusing on the mining and construction tire market. It has a strong market position and plans to use the raised funds for product upgrades, R&D center construction, and enhancing a specialized tire intelligent management system [23][11]. Summary by Sections 1. Company Overview - The company, established in 2007 and headquartered in Qingdao, Shandong, specializes in the design, R&D, sales, and service of mining and construction tires. It ranks 3rd among Chinese brands and 8th globally in engineering radial tires as of 2023 [8][9]. 2. Financial Performance - The company is projected to achieve a revenue of 2.295 billion yuan in 2024, with a 3-year CAGR of +12.82%. The net profit attributable to the parent company is expected to be 156.65 million yuan, with a 3-year CAGR of +20.25%. The gross margin is forecasted at 18.79%, and the net margin at 6.82% for 2024 [9][14]. 3. Issuance Plan - The new share issuance will adopt a direct pricing method with an issue price of 7.50 yuan per share. The initial issuance scale is 44.25 million shares, accounting for 20% of the total share capital post-issuance. The expected market capitalization after issuance is 1.659 billion yuan [13][14]. 4. Industry Situation - The Chinese tire industry is on the rise, with a decreasing concentration in the global tire market. The demand for tires is expected to grow due to the increasing ownership of automobiles and engineering machinery, alongside the promotion of new infrastructure and new energy initiatives [15][16]. 5. Competitive Advantages - The company has several competitive advantages, including a strong focus on technological innovation, a localized service model, and effective supply resource integration. It has developed over 700 types of tires suitable for various operational environments [17]. 6. Comparable Companies - The company is relatively small in scale compared to its peers, with a gross margin that is in the mid-range of the industry. The financial comparison with similar companies shows that it has a lower PE ratio compared to the median of comparable firms [22][24]. 7. Subscription Analysis - The report suggests that the company's initial valuation is low, with a low proportion of shares available for circulation. It is recommended to actively participate in the subscription due to these favorable conditions [23].

泰凯英北交所IPO成功过会 拟募资3.9亿元加码产品、技术、管理全方位升级

Quan Jing Wang· 2025-08-13 05:51

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. has successfully passed the IPO review on the Beijing Stock Exchange and is set to enter the registration and issuance process [1] Company Overview - Taike Ying focuses on the global mining and construction tire market, specializing in the design, research and development, sales, and service of mining and construction tires [3] - The company has developed over 600 types of tires suitable for various working environments, meeting user needs in mining and construction scenarios [6] - Taike Ying's brand "TECHKING" is recognized in the engineering radial tire market and ranks 3rd among Chinese brands and 8th globally in 2023 [6] Market Position and Clientele - The company has established a leading position in both the mining and construction segments, particularly in overseas markets, serving major industry players such as SANY Group, XCMG Group, and others [3][4] - Taike Ying has signed long-term procurement framework agreements with companies like Liebherr and Rio Tinto, and is recognized as an A-class supplier by Liebherr [3][6] Product Development and Innovation - The company employs a scenario-based technical development system to enhance tire consumption reduction and equipment operational efficiency [3] - Taike Ying's products are designed to address user pain points by incorporating various scenario elements into the product development process [4] Fundraising and Future Plans - The company aims to raise 390 million yuan for projects including the upgrade of specialized tire products, the establishment of an innovative technology research center, and the enhancement of intelligent management systems [7] - Successful implementation of these projects is expected to optimize the product line, enhance R&D capabilities, and expand market reach, ultimately increasing the company's revenue [8]

泰凯英过会背后:代工依赖存隐忧,8.6亿采购款流向“爆雷供应商”

Xin Lang Cai Jing· 2025-08-05 12:44

Core Viewpoint - Qingdao Taikaiying Special Tire Co., Ltd. (hereinafter referred to as "Taikaiying") has successfully passed the IPO review on the Beijing Stock Exchange, despite relying entirely on external OEM factories for tire production, raising concerns about its dependency on a key supplier facing financial difficulties [1][26][31]. Group 1: Company Overview - Taikaiying, established in 2007, specializes in the design, research and development, sales, and service of tires for mining and construction, with main products including engineering radial tires and all-steel truck tires [2][4]. - The company is controlled by a couple, Wang Chuan Zhu and Guo Yong Fang, who hold a combined 79.71% of the shares [7][8]. Group 2: Financial Performance - In the reporting period, Taikaiying's revenue was 18.03 billion, 20.31 billion, and 22.95 billion yuan, with year-on-year growth rates of 21.18%, 12.64%, and 12.99% respectively [18][20]. - The net profit attributable to the parent company was 1.08 billion, 1.38 billion, and 1.57 billion yuan, with growth rates of 81%, 22.84%, and 13.58% respectively [18][20]. - The company's gross profit margins were 18.08%, 19.20%, and 18.79% during the same period, fluctuating and generally lower than the average of comparable companies [21][20]. Group 3: Supply Chain and Dependency Risks - Taikaiying's procurement from its top five suppliers accounted for 75.48%, 78.73%, and 79.85% of total procurement in the reporting years, indicating a high concentration of suppliers [24][22]. - A significant portion of Taikaiying's procurement, amounting to 8.6 billion yuan over three years, was from Xingda Tire, which is currently facing severe debt issues and has been restricted from high consumption [28][26][31]. Group 4: Research and Development - Taikaiying's R&D expenses were 320.17 million, 418.78 million, and 481.24 million yuan, representing 1.78%, 2.06%, and 2.10% of revenue, which is lower than the average R&D expense ratio of comparable companies [35][36]. - The company focuses on scenario-based product development, but a portion of its products are essentially "private label" items, relying heavily on the capabilities of its OEM partners [34][32].