灵骏AI集群

Search documents

AI落地加速中,底层架构却成最大绊脚石?丨ToB产业观察

Tai Mei Ti A P P· 2025-11-17 03:09

Group 1 - The core viewpoint of the articles highlights the rapid growth of China's AI infrastructure service market, which reached 19.87 billion yuan in the first half of 2025, a year-on-year increase of 122.4%, with projections nearing 150 billion yuan by 2029 [2] - Despite 83% of enterprises prioritizing AI as a strategic focus, the actual success rate of implementation is only 29%, indicating significant challenges in AI project execution [3] - The systemic architectural imbalance, characterized by issues in computing power supply, data governance, system collaboration, and security compliance, is identified as a root cause of AI implementation failures [3] Group 2 - The CEO of Qingyun Technology outlines three phases of digital transformation since the emergence of ChatGPT, with the first phase focusing on the scarcity of computing power as a major obstacle for AI applications [4] - The second phase sees an increase in customer willingness to experiment with AI, but diverse industry needs remain inadequately addressed [4] - The third phase marks a shift in enterprises' attitudes towards serious consideration of AI integration, facing historical IT architecture issues that lead to fragmented computing resources [5] Group 3 - A significant 53% of enterprises adopt tightly coupled AI architectures, which bind model training and inference directly to business systems, leading to challenges during the iteration phase [6] - Enterprises face a triad of core challenges: maintaining legacy IT investments while embracing AI innovation, balancing diverse business demands with simplified IT architecture, and ensuring business stability during technological iterations [6] - AI Infra is proposed as a critical engine to resolve these implementation challenges, emphasizing the need for a bridge that connects historical IT assets with future requirements [7][8] Group 4 - AI Infra is defined as a platform that can achieve cost reduction, efficiency improvement, safety, and controllability through capabilities like computing power coordination, storage innovation, architecture integration, and ecological openness [9] - The deployment of AI Infra has shown to increase AI project success rates from 29% to 78%, with a 120% improvement in return on investment [11] - The global AI Infra market is projected to exceed $80 billion by 2025, with a compound annual growth rate of 58%, indicating intense competition among domestic and international players [12] Group 5 - Domestic players focus on local pain points, while international firms emphasize technological barriers, leading to a competitive landscape characterized by full-stack, vertical technology, and ecological integration players [12][13] - Companies like Qingyun Technology and Huawei are addressing historical compatibility issues and enhancing training efficiency through their AI Infra solutions [12] - The competition has evolved from product-based to a comprehensive contest involving technology, ecology, and application scenarios, with a need for domestic firms to overcome core technology bottlenecks [15]

IDC:中国AI基础设施市场爆发式增长,阿里云第一

Cai Jing Wang· 2025-10-22 08:20

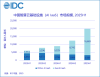

Core Insights - The Chinese AI Infrastructure as a Service (IaaS) market is projected to grow by 122.4% year-on-year, reaching 19.87 billion by the first half of 2025, driven by the demand for AI capabilities across various industries [1][2] - Alibaba Cloud leads the market with a 24.7% share, excelling in both Generative AI IaaS and Other AI IaaS segments [1] - The Generative AI IaaS segment is expected to account for over 80% of the AI IaaS market, with a staggering growth of 219.3% year-on-year [1] Market Dynamics - The demand for AI services is robust across multiple sectors, including internet, automotive, mobile manufacturing, finance, and government, with automotive companies intensifying competition for smart driving solutions [2] - Alibaba Cloud has established partnerships with major Chinese automotive manufacturers, such as FAW, BYD, Geely, NIO, and Xpeng, to enhance their smart capabilities [2] Future Projections - The importance of inference infrastructure, necessary for running AI agents, is expected to significantly increase, becoming a core component of AI cloud services [2] - The overall AI infrastructure market is anticipated to approach 150 billion by 2029 [2]

IDC:上半年中国AI IaaS市场规模达198.7亿元 整体市场同比增长122.4%

智通财经网· 2025-10-21 03:56

Core Insights - The overall AI IaaS market in China is expected to grow by 122.4% year-on-year, reaching a market size of 19.87 billion RMB by the first half of 2025 [1] - The GenAI IaaS market is projected to grow by 219.3%, with a market size of 16.68 billion RMB, while the Other AI IaaS market is expected to decline by 14.1%, reaching 3.19 billion RMB [1] Market Overview - The AI IaaS market is experiencing explosive growth, driven by strong demand across various sectors including internet, automotive, mobile manufacturing, finance, and government [5] - Cloud service providers have significantly increased capital investment in AI infrastructure, leading to stable resource supply and pricing in the computing market [5] - The demand for intelligent computing and AI applications is rising, particularly in the automotive sector, where competition for autonomous driving solutions is intensifying [5] GenAI IaaS Market Dynamics - The focus in the GenAI IaaS market is shifting from large-scale model training to inference, with inference scenarios accounting for 42% of the market share in the first half of the year [6] - The DeepSeek event has positively impacted the market, with significant deployments in state-owned enterprises and government sectors nearing completion [6] - Major enterprises are beginning to test generative AI applications within their business systems, indicating a shift towards more diverse AI applications [6] Supply Landscape - The supply landscape is evolving towards a diversified ecosystem, with cloud vendors and leading computing clients focusing on optimizing inference service cost structures [7] - Domestic and international cloud computing companies are increasingly investing in self-developed chips, signaling a new growth phase for domestic computing resources [7] Competitive Landscape - The GenAI IaaS market share has risen to 84%, while the Other AI IaaS market share has dropped to 16%, indicating a concentration of market power [9] - Alibaba Cloud maintains the largest market share by increasing capital expenditure on AI infrastructure and offering diverse AI IaaS services [9] - Other players like ByteDance's Volcano Engine and Baidu are also expanding their market presence through competitive pricing and technological advantages [9] Operator Developments - Major telecom operators are rapidly deploying intelligent computing resources, with significant growth in AI-related business [10] - China Telecom is building a distributed intelligent computing network, while China Mobile and China Unicom are enhancing their AI capabilities and service offerings [10] Future Projections - The AI IaaS market in China is expected to continue its rapid growth, potentially reaching nearly 150 billion RMB by 2029, with inference computing accounting for nearly 80% of the market [12] - Technological advancements in multi-modal models and video generation models are anticipated to drive new AI applications and further increase demand for AI computing resources [12]