电池氢氧化锂

Search documents

连亏股芳源股份实控人方拟套现0.5亿 上市5年共募10亿

Zhong Guo Jing Ji Wang· 2025-12-01 07:39

Core Viewpoint - Fangyuan Co., Ltd. (688148.SH) has announced a share reduction plan by its shareholder, Jiangmen Square Yili Investment Consulting Partnership, intending to sell up to 5,100,000 shares, representing no more than 1% of the company's total share capital, within three months after the announcement [1][2]. Group 1: Share Reduction Plan - The shareholder Square Yili plans to reduce its holdings through centralized bidding based on market prices [1]. - The total cash expected from the share reduction is approximately 51,459,000 yuan, calculated at the previous trading day's closing price of 10.09 yuan per share [2]. - As of the announcement date, Square Yili holds 9,502,700 shares, accounting for 1.86% of the total share capital, and is considered a concerted actor with the company's actual controllers [2]. Group 2: Company Background and Financials - Fangyuan Co., Ltd. was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on August 6, 2021, with an initial public offering of 80 million shares at a price of 4.58 yuan per share, raising a total of 366 million yuan [3]. - The company has raised a total of 1.008 billion yuan through two fundraising events since its listing [5]. - In 2024, the company reported a revenue of 2.161 billion yuan, a year-on-year increase of 2.81%, but a net loss of 427 million yuan, slightly improved from a loss of 455 million yuan in the previous year [5].

芳源股份前三季度亏1.2亿元 2021年上市两募资共10亿

Zhong Guo Jing Ji Wang· 2025-10-21 06:59

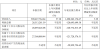

Core Insights - Fangyuan Co., Ltd. (688148.SH) reported its Q3 2025 financial results, showing a revenue of 1.49 billion RMB, a year-on-year increase of 5.29% [1] - The company recorded a net loss attributable to shareholders of 121 million RMB, slightly worsening from a loss of 119 million RMB in the same period last year [1][3] - The net cash flow from operating activities was -59.83 million RMB, compared to -27.99 million RMB in the previous year [1] Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 1.49 billion RMB, reflecting a growth of 5.29% year-on-year [1][3] - The total profit for the period was -120.70 million RMB, with a net profit attributable to shareholders also at -120.77 million RMB [3] - The net profit excluding non-recurring gains and losses was -121.73 million RMB, an improvement from -141 million RMB in the previous year [1][3] Cash Flow Analysis - The net cash flow from operating activities for the first three quarters was -59.83 million RMB, compared to -27.99 million RMB in the same period last year [1][3] - In 2024, the company reported a net cash flow from operating activities of 73.91 million RMB, a significant recovery from -326.17 million RMB in 2023 [4] Capital Raising and Financial Strategy - Fangyuan Co., Ltd. raised a total of 366 million RMB through its initial public offering, with a net amount of 301 million RMB after deducting issuance costs [5] - The company initially planned to raise 1.05 billion RMB for projects related to high-end lithium battery precursors and lithium hydroxide production [5] - The company has conducted two fundraising rounds since its listing, totaling 1.008 billion RMB [7]

芳源股份连亏2年半 2021年上市两募资共10亿元

Zhong Guo Jing Ji Wang· 2025-09-29 08:29

Financial Performance - In the first half of 2025, the company reported total revenue of 900 million yuan, a year-on-year decrease of 13.48% [1] - The net profit attributable to shareholders was -149 million yuan, with the same figure for net profit excluding non-recurring gains and losses [1] - The net cash flow from operating activities was -55.95 million yuan [1] - In 2024, the company achieved total revenue of 2.161 billion yuan, a year-on-year increase of 2.81% [2] - The net profit attributable to shareholders was -427 million yuan, an improvement from -455 million yuan in the previous year [2] - The net cash flow from operating activities was 739.14 million yuan, compared to -326 million yuan in the previous year [2] Capital Raising Activities - The company was listed on the Sci-Tech Innovation Board on August 6, 2021, issuing 80 million shares at a price of 4.58 yuan per share, raising a total of 366 million yuan [3] - The net amount raised after deducting issuance costs was 301 million yuan, which was 749 million yuan less than the planned amount of 1.05 billion yuan [3] - The funds raised were intended for the production of high-end ternary lithium battery precursors and lithium hydroxide [3] - The company issued convertible bonds totaling 642 million yuan, with a net amount raised of 638.37 million yuan after deducting related fees [4][5] - The total amount raised by the company since its listing is 1.008 billion yuan [5]

破发股芳源股份续亏 2021年上市两募资共10亿元

Zhong Guo Jing Ji Wang· 2025-04-18 03:13

Financial Performance - In 2024, the company achieved operating revenue of 2.16 billion yuan, representing a year-on-year increase of 2.81% compared to 2023 [1][2] - The net profit attributable to shareholders was -427.77 million yuan, an improvement from -455.38 million yuan in the previous year [1][2] - The net profit attributable to shareholders after deducting non-recurring gains and losses was -442.75 million yuan, slightly worse than -438.82 million yuan in 2023 [1][2] - The net cash flow from operating activities was 73.91 million yuan, a significant improvement from -326.17 million yuan in the previous year [1][2] Dividend Policy - The company announced that it will not distribute cash dividends, issue bonus shares, or increase capital through reserves for the year 2024 [2] Project Developments - The company decided to terminate the "battery-grade lithium carbonate production and comprehensive utilization of waste lithium iron phosphate batteries project" due to current market conditions and strategic adjustments [3] - Since its IPO on August 6, 2021, the company's stock has been trading below its initial offering price, indicating a state of underperformance [3] Fundraising Activities - The company raised a total of 366 million yuan from its initial public offering, which was 749 million yuan less than the planned amount of 1.05 billion yuan [3] - The total fundraising from two rounds since listing amounts to 1.008 billion yuan [5]