电解铜箔用钛阳极(DSA电极)

Search documents

泰金新能科创板IPO:“国家队”市占率领先, 高预收款印证强议价

Sou Hu Cai Jing· 2025-10-29 10:37

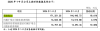

Core Viewpoint - The announcement of Xi'an Taijin New Energy Technology Co., Ltd.'s IPO application marks a significant step for the domestic titanium anode sector, enhancing the localization of the new energy industry chain in China [1][2]. Group 1: Company Background and Structure - Taijin New Energy is a leading player in the titanium anode market for electrolytic copper foil, with its ultimate control linked to the Shaanxi Provincial Finance Department, indicating its status as a state-owned enterprise [2]. - The company is part of a strategic initiative by the Shaanxi government to develop key industries, including aerospace and new energy, with its IPO seen as a critical step in this strategy [2]. Group 2: Market Position and Financial Performance - Taijin New Energy has established itself as a benchmark for domestic substitution in the titanium anode market, previously dominated by Japanese and European firms, ensuring the stability and cost-effectiveness of copper foil production [3]. - The company has demonstrated strong growth, with revenue projected to increase from 1.005 billion yuan in 2022 to 2.194 billion yuan in 2024, reflecting a compound annual growth rate (CAGR) of 47.78% [4]. - Net profit is expected to rise from approximately 98.29 million yuan to 195 million yuan during the same period, with a CAGR of 40.85% [4]. Group 3: Financial Structure and Competitive Advantage - The company maintains a high debt ratio, with figures of 91.35% in 2022 and 79.47% by mid-2025, yet it has low financial costs, indicating strong market positioning and customer trust [5]. - Taijin New Energy's business model includes significant advance payments from customers, which are recorded as contract liabilities, reflecting its strong bargaining power and industry position [5]. Group 4: Industry Challenges and Resilience - The company faces challenges due to structural overcapacity in the lithium battery industry, leading to a temporary decline in cash flow, with net cash flow projected to be negative in 2023 [6][7]. - Despite these challenges, Taijin New Energy's core competitiveness remains intact, supported by ongoing investments in technology and innovation, with R&D expenditures increasing over the years [7][8]. - The company has secured 90 authorized invention patents and continues to leverage its state-backed resources to maintain a competitive edge [8]. Group 5: Long-term Investment Logic - The investment rationale for Taijin New Energy is based on its combination of technological strength and state-owned enterprise backing, positioning it well for future growth if it navigates the current industry downturn successfully [10].