阴极辊

Search documents

洪田股份(603800)2025年三季报点评:锂电主业驱动Q3业绩修复 光学与泛半导体布局前景可期

Xin Lang Cai Jing· 2025-11-03 08:33

Core Viewpoint - The company has shown significant improvement in Q3 performance, driven by growth in lithium battery copper foil business and increased sales gross margin Financial Performance - For Q1-Q3 2025, the company achieved revenue of 881 million yuan, a year-on-year decrease of 17.0% - The net profit attributable to shareholders was 62 million yuan, down 26.7% year-on-year - In Q3 2025, the single-quarter revenue reached 495 million yuan, an increase of 30.6% year-on-year and 96.9% quarter-on-quarter - The net profit attributable to shareholders in Q3 was 98 million yuan, a year-on-year increase of 290.0% and a quarter-on-quarter turnaround from loss to profit [1] - The gross margin for Q1-Q3 2025 was 25.2%, up 2.9 percentage points year-on-year, while the net profit margin was 8.6%, down 1.5 percentage points year-on-year [1] Cash Flow and Inventory - As of the end of Q3 2025, the company's contract liabilities were 252 million yuan, a decrease of 63.9% year-on-year - Inventory stood at 591 million yuan, down 29.8% year-on-year - The net cash flow from operating activities for Q1-Q3 2025 was 67 million yuan, turning positive year-on-year; however, Q3 saw a negative cash flow of 46 million yuan due to increased payments for goods and services [2] Business Development - The company has entered the optical and semiconductor equipment sector through its subsidiary, achieving significant breakthroughs - The first HL-P20 direct-write lithography machine was accepted by a major customer, meeting key parameters for FPC and HDI product needs - Three products have been launched focusing on PCB, semiconductor glass substrates, and advanced packaging mask plates, all receiving orders from leading customers [2] Equipment and Technology - The company continues to lead in electrolytic copper foil equipment, with significant advancements in technology - A new lithium battery copper foil with a roll length of 102,000 meters and a thickness of only 4.5 microns has set an industry record, with a yield rate of 87.6% [3] - The company is expanding its platform in ultra-precision vacuum coating equipment, with continuous growth in orders and aims to become a leading player in the PVD field for kitchen and bathroom appliances by 2025 [3] Profit Forecast and Investment Rating - The company's net profit forecasts for 2025 and 2026 have been adjusted to 190 million yuan and 240 million yuan, respectively, down from previous estimates of 270 million yuan and 330 million yuan - The projected net profit for 2027 is 320 million yuan, with current stock prices corresponding to dynamic PE ratios of 57, 45, and 34 times for 2025, 2026, and 2027 respectively - The company maintains an "overweight" rating due to the high growth potential of its semiconductor business [3]

洪田股份(603800):锂电主业驱动Q3业绩修复,光学与泛半导体布局前景可期

Soochow Securities· 2025-11-03 07:03

Investment Rating - The investment rating for the company is "Accumulate" (maintained) [5] Core Views - The company's main business in lithium batteries has shown significant recovery, with Q3 performance improving both year-on-year and quarter-on-quarter. The Q3 revenue reached 495 million yuan, a year-on-year increase of 30.6% and a quarter-on-quarter increase of 96.9% [2] - The company's profitability has improved significantly in Q3, with a gross profit margin of 32.7%, up 14.2 percentage points year-on-year and 15.2 percentage points quarter-on-quarter [3] - The company is focusing on high-end detection and direct-write lithography, accelerating the industrialization of optical and semiconductor equipment [4] - The electrolytic copper foil equipment continues to lead the market, with significant breakthroughs in technology and production capacity [4] Financial Summary - For the first three quarters of 2025, the company achieved a total revenue of 881 million yuan, a year-on-year decrease of 17.0%, and a net profit attributable to the parent company of 62 million yuan, down 26.7% year-on-year [2] - The company has adjusted its net profit forecasts for 2025 and 2026 to 190 million yuan and 240 million yuan, respectively, while expecting a net profit of 320 million yuan in 2027 [5] - The current stock price corresponds to dynamic P/E ratios of 57, 45, and 34 times for 2025, 2026, and 2027, respectively [5]

泰金新能科创板IPO过会 阴极辊及铜箔钛阳极产品国内市占率第一

Zhi Tong Cai Jing· 2025-10-31 12:04

Core Viewpoint - Xi'an Taijin New Energy Technology Co., Ltd. (Taijin New Energy) has received approval for its IPO on the Shanghai Stock Exchange's Sci-Tech Innovation Board, aiming to raise 990 million yuan [1] Company Overview - Taijin New Energy specializes in the research, design, production, and sales of high-end green electrolysis equipment, titanium electrodes, and metal glass sealing products [1] - The company is a leading provider of high-performance electronic circuit copper foil and ultra-thin lithium battery copper foil production line solutions globally [1] - It is a major R&D and production base for precious metal titanium electrode composite materials and electronic sealing glass materials in China [1] Product and Market Position - Taijin New Energy offers essential equipment and complete production line solutions for high-end copper foil production, including cathode rollers, foil production integrated machines, titanium anodes, surface treatment machines, and efficient copper dissolution tanks [1] - The company also provides high-performance titanium electrodes for industries such as green environmental protection, aluminum foil formation, hydrometallurgy, and hydrogen production [1] - Its glass sealing products are used in aerospace and military electronics, with high market recognition [1] Financial Performance - The company achieved revenues of approximately 1.005 billion yuan, 1.669 billion yuan, 2.194 billion yuan, and 1.164 billion yuan for the years 2022, 2023, 2024, and the first half of 2025, respectively [3] - Net profits for the same periods were approximately 98.2936 million yuan, 155 million yuan, 195 million yuan, and 104 million yuan [3] - As of June 30, 2025, total assets were approximately 3.282 billion yuan, with equity attributable to shareholders at approximately 673.771 million yuan [4] Investment Plans - The company plans to publicly issue no more than 40 million shares, with the raised funds allocated to projects including high-end intelligent complete equipment for green electrolysis, high-performance composite coating titanium electrode materials, and the establishment of a corporate R&D center [2][3]

泰金新能IPO过会 掌握高性能电子电路铜箔整体解决方案

Zheng Quan Shi Bao Wang· 2025-10-31 11:49

Core Viewpoint - The IPO of Taijin New Energy has been approved, marking a significant step for the company as a leading provider of high-performance electronic circuit copper foil solutions in the market [1] Group 1: Company Overview - Taijin New Energy specializes in the research, design, production, and sales of high-end green electrolysis equipment, titanium electrodes, and metal glass sealing products [1] - The company is recognized as a leader in providing overall solutions for high-performance electronic circuit copper foil and ultra-thin lithium battery copper foil production lines [2] - Taijin New Energy's products are applied in various sectors including large computers, 5G high-frequency communications, consumer electronics, new energy vehicles, and aerospace [1][2] Group 2: Clientele and Market Position - The company's main domestic clients include major players such as BYD, Jiyuan Technology, and Jiangxi Copper, among others [2] - Taijin New Energy has achieved significant milestones, including the production of cathode rolls for ultra-thin copper foil, establishing itself as a domestic leader in this technology [2] - The company has successfully developed the world's largest diameter 3.6m cathode roll and integrated foil machine, leading to a market share that ranks first domestically for both cathode rolls and titanium anode products [2] Group 3: Product and Technology - In addition to cathode rolls, Taijin New Energy offers a complete set of copper foil production line solutions, including titanium anodes and surface treatment machines, with technology reaching international advanced levels [3] - The company has been recognized for its high-performance electrolysis copper foil equipment, with specific products like the titanium cathode roll and multi-layered titanium anode being internationally leading [3] Group 4: Financial Performance and IPO Plans - For the first three quarters of 2023 to 2025, Taijin New Energy reported revenues of 1.669 billion, 2.194 billion, and 1.713 billion yuan, with net profits of 155 million, 195 million, and 141 million yuan respectively [3] - The company plans to raise 990 million yuan through its IPO to invest in projects related to high-end intelligent electrolysis equipment, composite coating titanium electrode materials, and the establishment of a research and development center [3]

洪田股份:三季度业绩强劲反弹,高端装备平台驱动高质量增长

Zheng Quan Shi Bao Wang· 2025-10-30 11:13

Core Insights - Hongtian Co., Ltd. reported significant financial improvements in Q3 2025, with revenue reaching 495 million yuan, a year-on-year increase of 30.64% and a quarter-on-quarter increase of 96.90. Net profit surged to 119 million yuan, marking a year-on-year growth of 281.78% and a quarter-on-quarter increase of 1126.89% [2][3] Financial Performance - The company achieved a turnaround in net profit for the first three quarters of 2025 compared to the same period last year, with operating cash flow reaching 67 million yuan, a nearly fourfold increase from the previous year's -23 million yuan [2][3] Strategic Developments - The strong Q3 performance indicates a substantial turnaround in operational status, driven by the successful implementation of the high-end equipment platform strategy [3] - The company has made significant progress in its "high-end equipment and technical services dual platform" strategy, focusing on high-end optical technology and ultra-precision vacuum technology [3][4] Technological Advancements - Hongtian's core subsidiary, Hongtian Technology, achieved breakthroughs in high-end copper foil production equipment, with a new lithium battery copper foil machine setting industry records for length and thickness [3] - The company is the first in China to master and utilize the "one-step dry method" for ultra-precision vacuum coating equipment, enabling advanced manufacturing capabilities [4] Collaborative Efforts - The company has expanded its external partnerships, including investments in Suzhou Daniu New Energy Technology Co., Ltd. and the establishment of a joint venture with Anhui Ruisi Micro Intelligent Technology Co., Ltd. [4] - Collaborations with the Chinese Academy of Sciences have led to significant advancements in optical technology, particularly in the production of direct-write lithography machines [4][5] Market Positioning - The ultra-precision vacuum technology platform shows potential in the solid-state battery equipment sector, with ongoing development aimed at addressing industry challenges [5] - The high-end equipment platform is well-positioned to respond to the growing demand in sectors such as new energy vehicles, advanced packaging, and semiconductors, indicating a promising growth trajectory for the company [6]

泰金新能科创板IPO:“国家队”市占率领先,高预收款印证强议价

Sou Hu Cai Jing· 2025-10-29 16:04

Core Viewpoint - The announcement of Xi'an Taijin New Energy Technology Co., Ltd.'s (Taijin New Energy) IPO application on the Sci-Tech Innovation Board signifies a significant step for the domestic titanium anode sector in the electrolytic copper foil market, enhancing the localization of the new energy industry chain [2] Group 1: Company Background and Ownership Structure - Taijin New Energy is primarily controlled by the Shaanxi Provincial Finance Department, with the Northwest Nonferrous Metal Research Institute holding 22.83% of shares and an additional 20% through a related company, totaling 42.83% voting rights [3] - The Shaanxi Provincial Finance Department views rare metal materials as "strategic livelihood assets," indicating a long-term commitment to the industry beyond mere financial investment [3] - The company is part of a successful model of "research incubation - asset securitization - capital feedback," with previous entities from the same system achieving a combined market value exceeding 45 billion yuan [3] Group 2: Market Position and Competitive Advantage - Taijin New Energy focuses on titanium anodes (DSA electrodes), essential for copper foil production in lithium batteries, breaking the long-standing market monopoly held by Japanese and European companies [4] - The company has been recognized as a national-level specialized and innovative "little giant," securing a leading position in the industry with a compound annual growth rate (CAGR) of 47.78% in revenue from 1.005 billion yuan in 2022 to 2.194 billion yuan in 2024 [4] - The net profit attributable to the parent company increased from approximately 98.29 million yuan to 195 million yuan during the same period, reflecting strong growth potential [4] Group 3: Financial Performance and Cash Flow - The company has maintained a high debt ratio, with figures of 91.35%, 92.04%, 84.86%, and 79.47% from 2022 to mid-2025, yet has low financial costs, indicating strong bargaining power in the industry [6] - Taijin New Energy employs a "sales-based production, step-by-step payment" model, leading to significant contract liabilities, which reflect customer trust rather than traditional interest-bearing debt [6] - The company faced cash flow challenges in 2023 due to industry-wide adjustments, with net cash flows from operating activities showing fluctuations, but it remains committed to technological innovation and maintaining competitive advantages [7] Group 4: Research and Development - The company has invested significantly in R&D, with cumulative expenditures reaching 202 million yuan from 2022 to mid-2025, demonstrating a commitment to technological advancement [7] - Taijin New Energy holds 90 authorized invention patents, including two in the United States, showcasing its strong technological foundation and competitive moat [8] - In the first nine months of 2025, the company reported revenue of approximately 1.713 billion yuan, an 18.61% increase year-on-year, and a net profit of about 140.62 million yuan, reflecting ongoing growth despite industry challenges [9]

泰金新能科创板IPO:“国家队”市占率领先, 高预收款印证强议价

Sou Hu Cai Jing· 2025-10-29 10:37

Core Viewpoint - The announcement of Xi'an Taijin New Energy Technology Co., Ltd.'s IPO application marks a significant step for the domestic titanium anode sector, enhancing the localization of the new energy industry chain in China [1][2]. Group 1: Company Background and Structure - Taijin New Energy is a leading player in the titanium anode market for electrolytic copper foil, with its ultimate control linked to the Shaanxi Provincial Finance Department, indicating its status as a state-owned enterprise [2]. - The company is part of a strategic initiative by the Shaanxi government to develop key industries, including aerospace and new energy, with its IPO seen as a critical step in this strategy [2]. Group 2: Market Position and Financial Performance - Taijin New Energy has established itself as a benchmark for domestic substitution in the titanium anode market, previously dominated by Japanese and European firms, ensuring the stability and cost-effectiveness of copper foil production [3]. - The company has demonstrated strong growth, with revenue projected to increase from 1.005 billion yuan in 2022 to 2.194 billion yuan in 2024, reflecting a compound annual growth rate (CAGR) of 47.78% [4]. - Net profit is expected to rise from approximately 98.29 million yuan to 195 million yuan during the same period, with a CAGR of 40.85% [4]. Group 3: Financial Structure and Competitive Advantage - The company maintains a high debt ratio, with figures of 91.35% in 2022 and 79.47% by mid-2025, yet it has low financial costs, indicating strong market positioning and customer trust [5]. - Taijin New Energy's business model includes significant advance payments from customers, which are recorded as contract liabilities, reflecting its strong bargaining power and industry position [5]. Group 4: Industry Challenges and Resilience - The company faces challenges due to structural overcapacity in the lithium battery industry, leading to a temporary decline in cash flow, with net cash flow projected to be negative in 2023 [6][7]. - Despite these challenges, Taijin New Energy's core competitiveness remains intact, supported by ongoing investments in technology and innovation, with R&D expenditures increasing over the years [7][8]. - The company has secured 90 authorized invention patents and continues to leverage its state-backed resources to maintain a competitive edge [8]. Group 5: Long-term Investment Logic - The investment rationale for Taijin New Energy is based on its combination of technological strength and state-owned enterprise backing, positioning it well for future growth if it navigates the current industry downturn successfully [10].

出货交付量top1!铜箔装备“隐形龙头”是如何炼成的?

起点锂电· 2025-10-29 10:15

Core Viewpoint - The article highlights the rapid development of China's lithium battery industry, emphasizing the successful domestic replacement of foreign monopolies, particularly in the production of key components like cathode rollers, which are crucial for copper foil manufacturing [1]. Group 1: Industry Development - Over the past two decades, China's lithium battery sector has evolved from non-existence to a leading global position, with many high-quality industry leaders emerging [1]. - The domestic production of cathode rollers has surpassed 90% due to technological advancements, breaking the long-standing Japanese monopoly [1][5]. - Xi'an Aerospace New Energy Equipment Technology Co., Ltd. has become a key player in this field, recognized as an "invisible leader" in domestic equipment manufacturing [1]. Group 2: Technological Advancements - The quality of cathode rollers significantly impacts the quality of copper foil, affecting key indicators such as thickness uniformity and mechanical properties [5]. - Xi'an Aerospace New Energy has developed a 2.7-meter cathode roller that has set new domestic standards, with subsequent innovations leading to a 36% increase in production efficiency with a 3.6-meter roller [6][10]. - The company has delivered over 2,100 cathode rollers in the past five years, maintaining the highest domestic market share [10]. Group 3: Addressing Industry Challenges - The production of ultra-thin copper foil requires cathode rollers with extremely low surface roughness and uniform grain size, which has been a challenge for domestic manufacturers [13][14]. - Xi'an Aerospace New Energy has focused on solving these issues through advanced manufacturing techniques and collaborations with research institutions [14][15]. - The company has developed new technologies that enhance the quality and performance of its products, addressing critical pain points in the industry [15]. Group 4: Global Market Expansion - The demand for high-end electrolytic copper foil is expected to grow, driven by emerging industries such as 5G, AI, and new energy vehicles [17]. - Chinese copper foil manufacturers are accelerating overseas expansion and setting international testing standards, necessitating upgrades in equipment technology [19]. - Xi'an Aerospace New Energy has successfully entered international markets, securing orders from countries like South Korea and Hungary, showcasing its technological prowess [20].

泰金新能被质疑业绩成长性,披露同业公司产能或与公开信息不符

Huan Qiu Wang· 2025-10-29 05:09

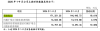

Core Viewpoint - Xi'an Taijin New Energy Technology Co., Ltd. is a leading enterprise in providing high-performance electronic circuit copper foil and ultra-thin lithium battery copper foil production line solutions, currently applying for an IPO [1] Financial Performance - The company reported a compound annual growth rate (CAGR) of 47.78% in operating revenue over the past three years, indicating a strengthening of its ongoing business capabilities [1] - However, the projected revenue growth rates for 2022 to 2024 are 93.41%, 66.18%, and 31.42%, showing a declining trend year-over-year [1] - Revenue growth for the first three quarters of 2025 is expected to further decline to 18.61% [1] Production Capacity and Utilization - The capacity utilization rate for the core product, cathode rolls, was only 50% in 2024 and dropped to 16.41% in the first half of this year, before recovering to around 50% in September [2] - The production capacity and sales rates for cathode rolls and integrated foil machines have shown similar patterns of underutilization [2][4] Contracts and Projects - In November 2024, the company won a contract for a 20,000-ton high-end copper foil project with Zhongcheng Caihong, amounting to approximately 145.37 million yuan [6] - The project is set to begin production debugging in December 2025, with the first batch of equipment already delivered to the site [6] Market Position and Comparison - In 2024, Taijin New Energy's shipment volume exceeded that of its comparable company, Hongtian Co., by more than double, with Taijin reporting 365 units shipped [10] - Despite this, Hongtian's sales volume of electrolysis copper foil equipment reached 482 units, significantly higher than Taijin's reported figures [10] - Taijin's revenue for 2024 is projected at 2.194 billion yuan, nearly double that of Hongtian's 1.374 billion yuan [11]

泰金新能IPO被暂缓审议!先收钱后交货模式受阻 短期借款飙升20倍

Sou Hu Cai Jing· 2025-09-18 14:25

Core Viewpoint - The IPO application of Xi'an Taijin New Energy Technology Co., Ltd. (referred to as "Taijin New Energy") has been temporarily suspended by the Shanghai Stock Exchange, which requires further clarification on future performance and product acceptance delays [2][3][6]. Company Overview - Taijin New Energy is a leading enterprise in Shaanxi Province, focusing on high-end green electrolysis equipment, titanium electrodes, and metal glass sealing products, with applications in various sectors including large computers, 5G communications, consumer electronics, new energy vehicles, and aerospace [10][12]. Financial Performance - From 2022 to 2024, Taijin New Energy's revenue is projected to grow from 1.005 billion yuan to 2.194 billion yuan, with net profits increasing from 98.29 million yuan to 195 million yuan, indicating a consistent upward trend [11]. - In the first half of 2024, the company reported a revenue of 1.167 billion yuan, a year-on-year increase of 17.31%, and a net profit of 105 million yuan, up 8.89% [11]. Sales Model and Financial Structure - The company employs a unique sales settlement model involving "prepayment—delivery—acceptance—warranty," which has resulted in a consistently high debt ratio of around 90%, exceeding the industry average [3][17]. - In 2024, Taijin New Energy's contract liabilities decreased by 900 million yuan, leading to a negative operating cash flow of -470 million yuan, while short-term borrowings surged by 20 times, creating a funding gap of nearly 200 million yuan [3][20]. Production Capacity and Utilization - Despite revenue growth, the production capacity utilization rates for key products have declined significantly from 2022 to 2024, with cathode rollers dropping from 105.41% to 46.05% and the foil-making integrated machine from 96.30% to 18.23% [14][15]. - The company is expanding its production capacity with two fundraising projects aimed at high-end intelligent electrolysis equipment and high-performance composite titanium electrode materials, with planned investments of 439 million yuan and 397 million yuan, respectively [15][16]. Regulatory Scrutiny and Future Outlook - The Shanghai Stock Exchange has raised concerns regarding the potential for significant declines in future performance and the reasons behind the extended acceptance periods for major products, necessitating further explanations from Taijin New Energy [6][8][9]. - The company must address its reliance on prepayments and the cyclical nature of the electrolysis equipment industry to ensure sustainable growth and mitigate financial risks [20].