无人机动力

Search documents

好盈科技IPO:无人机业务快速增长但毛利率偏低 关税对海外业务拓展影响大

Sou Hu Cai Jing· 2025-10-28 02:10

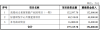

Core Viewpoint - The low-altitude economy is emerging, and Shenzhen Haoying Technology Co., Ltd. is preparing to list on the Sci-Tech Innovation Board, focusing on the research, production, and sales of drone power systems [1] Group 1: Business Performance - Haoying Technology has shown strong growth in operating performance, with projected revenues of approximately 468 million yuan, 546 million yuan, 738 million yuan, and 580 million yuan for the years 2022, 2023, 2024, and the first half of 2025, respectively [2] - Net profits for the same periods are expected to be 81.89 million yuan, 94.18 million yuan, 152 million yuan, and 139 million yuan [2] - The company holds a leading position in the drone power system industry, with a global market share of 4.12% projected for 2024, and a remarkable 23.09% share in the competitive model power system market, ranking first worldwide [2] Group 2: Business Structure and Risks - The company's reliance on the drone power system business is increasing, with its revenue share rising from 39.94% in 2022 to 75.57% in the first half of 2025, indicating a potential imbalance in business structure [3] - The traditional competitive model power system's revenue share has decreased from 43.19% in 2022 to below 20% in the first half of 2025, highlighting the risk of over-dependence on the drone sector [3] Group 3: Profitability and Competition - Haoying Technology faces volatility in gross margins, which fluctuated between 44.85% and 47.41% during the reporting period, influenced by sales prices, production costs, and product mix [4] - The gross margin for the drone power system in the first half of 2025 is significantly lower at 43.31% compared to a comparable company, indicating competitive disadvantages [4] - The company primarily serves domestic clients, with 85.59% of its revenue coming from domestic sales, making it sensitive to price fluctuations [4] Group 4: International Market Challenges - The company is exposed to uncertainties in expanding overseas markets due to international trade policy changes, with recent tariff uncertainties impacting sales [5] - The competitive model power system sales saw a slight decline in the first half of 2025, attributed to decreased export revenue from tariff impacts [5] - Haoying Technology's late entry into the overseas drone power market has resulted in a low revenue share from international operations, posing a competitive disadvantage [5]

好盈科技科创板IPO已受理 为行业内领先的无人机动力系统专业制造商

Zhi Tong Cai Jing· 2025-10-23 23:24

Core Viewpoint - Shenzhen Haoying Technology Co., Ltd. has submitted its IPO application to the Shanghai Stock Exchange's Sci-Tech Innovation Board, aiming to raise 1.96 billion yuan [1] Company Overview - Haoying Technology is a leading manufacturer of drone power systems, focusing on the R&D, production, and sales of integrated power systems, electronic controls, motors, and propellers [1] - The company emphasizes self-research across the entire technology stack and is advancing high-end power technologies for heavy-lift drones and large eVTOLs [1] - The company has a strong market position, ranking in the first tier among third-party suppliers, with a projected global market share of 4.12% for its drone power products in 2024 [1] Competitive Landscape - The low-altitude economy is thriving, with a competitive landscape characterized by low market concentration and numerous participants in the drone power market [1] - The drone power sector is talent and technology-intensive, integrating multiple disciplines such as electronic science, computer science, software engineering, electrical engineering, electromagnetics, solid mechanics, and fluid mechanics [1] Performance in Model Racing - In the model racing sector, Haoying Technology is a leading enterprise, with its power products helping racers win 64 championships in top global model car competitions since 2022 [2] - The company holds a global market share of 23.09% in the model racing power system sector for 2024, ranking first worldwide [2] Fund Utilization - The funds raised will be allocated to the following projects: - High-end power system smart industrial park project (Phase I): 1.33 billion yuan - Haoying R&D center upgrade project: 485 million yuan - Working capital supplement: 160 million yuan - Total investment for these projects is approximately 1.97 billion yuan [2] Financial Performance - Revenue and net profit figures for Haoying Technology are as follows: - 2022: Revenue of 468 million yuan, net profit of 81.89 million yuan - 2023: Revenue of 546 million yuan, net profit of 94.18 million yuan - 2024: Revenue of 738 million yuan, net profit of 152 million yuan - 2025 (Jan-Jun): Revenue of 580 million yuan, net profit of 139 million yuan [2][3] - The company's total assets and equity have shown significant growth from 2022 to 2025, with total assets reaching approximately 953 million yuan by mid-2025 [3] - The company maintains a healthy financial position with a debt-to-asset ratio of 22.88% as of mid-2025 [3]