古驰美妆产品

Search documents

欧莱雅豪赌高端化:向“全奢美妆”巨头迈进

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 12:27

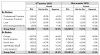

Core Insights - L'Oréal has made significant moves in the beauty industry, including a €4 billion acquisition of Kering's beauty business, which includes long-term beauty licenses for Gucci and Balenciaga, indicating a strategy to enhance its high-end beauty portfolio and secure luxury brand resources for the next 50 years [1][3] - The company aims to transition from a brand manager to an "ecosystem builder," exploring new growth opportunities through partnerships, particularly with Kering [2] - L'Oréal's Q3 2025 financial results show a total sales of €32.81 billion, with a like-for-like growth of 3.4%, driven by recovery in North America and mainland China [2][6] Acquisition Strategy - The acquisition of Kering's beauty business includes the buyout of the high-end niche fragrance brand Creed and long-term beauty licenses for Gucci, Bottega Veneta, and Balenciaga, which are expected to enhance L'Oréal's position in the luxury beauty market [3][4] - L'Oréal has also acquired professional hair care brand ColorWow and skincare brand Medik8, filling gaps in its high-end salon hair care and professional skincare segments [3] Market Performance - L'Oréal's sales growth in the North Asia region has turned positive for the first time in two years, with a 0.5% increase, attributed to the recovery of high-end cosmetics and innovative products from brands like Lancôme and Helena Rubinstein [6] - The professional products division led growth with a 7.4% increase, while the fragrance category continues to show strong performance [6] Competitive Landscape - The beauty industry is witnessing a shift towards brand matrix, channel innovation, and digital transformation, with L'Oréal's aggressive expansion in luxury beauty positioning it well against competitors like Estée Lauder [7][8] - Estée Lauder's recent acquisition of Tom Ford for $2.8 billion highlights a similar strategy in the luxury segment, despite facing challenges in organic sales growth [6][9] Future Outlook - L'Oréal's future collaboration with Kering is anticipated to unlock new growth avenues, particularly in the luxury beauty sector, as the company seeks to leverage its expertise in customer engagement and brand management [5][9]

开云40亿欧元将美妆卖给欧莱雅,还有古驰的50年授权

第一财经· 2025-10-20 14:03

Core Viewpoint - The new CEO of Kering Group has initiated a significant strategic shift by selling Kering Beauté to L'Oréal for €4 billion, marking a move towards focusing on core luxury goods while alleviating financial pressures [1][9]. Group 1: Transaction Details - Kering Group announced the sale of Kering Beauté to L'Oréal for €4 billion, with the transaction expected to complete in the first half of 2026 [1][3]. - The deal includes the acquisition of the high-end perfume brand Creed and a 50-year exclusive licensing agreement for producing beauty products for Kering's brands like Gucci and Balenciaga [3][10]. - Kering Beauté accounted for only 2% of Kering's total revenue, highlighting its limited impact on the overall business [4][9]. Group 2: Strategic Implications - The sale reflects a broader trend in the luxury sector, where brands are shifting from a "brand-led" model to a "platform-led" approach, focusing on creativity and brand value while outsourcing operations to specialized groups [3][9]. - Kering's decision to divest non-core businesses is seen as a rational adjustment to enhance financial stability and focus on its primary luxury goods segment [9][10]. - The cash influx from the sale will help Kering address its growing debt, which reached €9.5 billion by mid-2023 [8][9]. Group 3: Market Context - The luxury goods sector has faced challenges, with Kering experiencing a 16% revenue decline to €7.587 billion and a 46% drop in net profit to €474 million in the first half of 2025 [8][9]. - L'Oréal's acquisition aligns with its strategy to strengthen its position in the high-end beauty market, where it has been expanding its portfolio of luxury brands [10][13]. - The global perfume market is projected to grow, with estimates suggesting it will exceed $400 billion by 2025, indicating potential for future growth in this segment [13].