Creed香水

Search documents

欧洲股市企稳:开云39亿欧元季营收超预期获2020年来最大单日涨幅 BP股价下探

Sou Hu Cai Jing· 2026-02-10 21:45

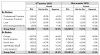

Group 1: Kering Group Performance - Kering Group reported Q4 2025 sales of €3.9 billion, a year-on-year decline of 3% after currency adjustment, which was better than the market expectation of a 5% drop [1] - The core brand Gucci experienced a 10% decline in sales, marking the tenth consecutive quarter of decline, but this was an improvement over the expected 12% drop, boosting market confidence [1] - CEO Luca de Meo indicated that sales trends are gradually improving, although still in early and fragile stages, and emphasized the company's focus on ongoing development [1] Group 2: Strategic Moves and Financial Position - Kering Group faces significant debt pressure, with net debt reaching €9.5 billion and an additional €6 billion in long-term lease liabilities as of June 2025 [2] - To alleviate financial pressure and focus on its core fashion business, Kering sold its beauty division to L'Oréal in October 2025, which includes exclusive rights for three major brands and a joint venture for cross-industry collaboration [2] - The company is implementing cost-cutting measures, with a 10% reduction in total employees and a 22% decrease in Gucci's workforce since its peak in 2022, alongside plans to close 75 underperforming boutiques [2] Group 3: BP's Market Performance - BP's stock price declined due to weakening crude oil futures and slower-than-expected progress in its energy transition efforts, with Brent crude oil prices falling 2.1% to $78 per barrel [3] - BP reported a Q4 2025 loss of $320 million in its energy transition business, failing to meet market expectations for breakeven, which led to increased investor sell-off [3]

Gucci销售超预期 开云集团“止血”

Bei Jing Shang Bao· 2026-02-10 15:33

2111 更新 20 % 0 111153555 r and the program and 1188 8.87 - II 业绩下滑但好于预期 开云集团当地时间周二公布,2025年第四季度销售额为39亿欧元,经汇率调整后同比下降3%,好于分析师预期的5%跌幅。旗舰品牌Gucci销售下降10%,为 连续第10个季度下滑,但表现好于市场预期的12%跌幅。这一业绩提振了市场信心,开云集团欧股当天上涨14%,为2020年以来最大涨幅。 "销售趋势逐季改善,这种势头是真实的——虽然还处于早期且脆弱,但确实存在。我可以向你们保证,我们将在此基础上继续发展,"雷诺前CEO、去年执 掌开云的卢卡·德·梅奥(Luca de Meo)在分析师电话会议上表示。 这也卢卡·德·梅奥执掌开云后的首份季度业绩。他同时坦言:"我们离目标还很远,还没有把所有事情都安排妥当,但我们每天都在专注推进。"德意志银行 分析师表示,开云刚刚开启一场为期多年的转型,2025财年业绩足以提醒投资者转型方向。 自去年9月更换CEO后,开云集团出现了回暖的迹象。最新财报显示,公司整体及主要品牌Gucci第四季度销售虽然还在下滑,但幅度好于市场预期。然而, 业 ...

330亿,今年最大美妆收购诞生了

投中网· 2025-10-26 07:04

Core Viewpoint - The acquisition of Kering's beauty division by L'Oréal for €4 billion (approximately ¥33 billion) is a significant strategic move in the luxury beauty market, reflecting both companies' long-term goals and the current challenges faced by Kering [3][12][17]. Group 1: Transaction Details - Kering Group announced the sale of its beauty division to L'Oréal for €4 billion, with the transaction expected to be completed in the first half of 2026 [3]. - The deal includes the acquisition of the high-end perfume brand Creed and a 50-year exclusive licensing agreement for Kering's beauty products [3][4]. - A joint venture will be established to explore opportunities in the luxury and health sectors, indicating a strategic alliance beyond mere acquisition [3][17]. Group 2: Kering's Financial Performance - Kering's beauty division generated €323 million in revenue in 2024, with a 9% growth rate in the first half of 2025, primarily driven by Creed [6]. - In contrast, Kering's overall revenue fell by 16% to €7.587 billion in the first half of 2025, with net profit plummeting by 46% to €474 million [6][7]. - The decline in Kering's performance is largely attributed to the underperformance of its flagship brand, Gucci, which saw a 26% drop in revenue [7]. Group 3: Strategic Shifts and Leadership Changes - Kering's new CEO, Luca de Meo, initiated significant reforms shortly after his appointment, including the decision to sell the beauty division [4][10]. - De Meo's leadership is characterized by a focus on core luxury goods, aiming to streamline operations and reduce costs amid financial challenges [10][11]. - The decision to divest the beauty division, despite its growth potential, reflects a strategic pivot to address Kering's broader financial issues [7][9]. Group 4: L'Oréal's Strategic Intent - L'Oréal's acquisition aligns with its strategy to penetrate the high-end beauty market, enhancing its portfolio with luxury brands [12][16]. - The company has been actively acquiring and licensing high-end fragrance brands, indicating a clear focus on expanding its presence in the luxury segment [15][16]. - L'Oréal's recent financial performance shows a 3% increase in sales, with the fragrance segment growing by 11%, underscoring the potential value of the acquisition [17]. Group 5: Market Impact - The transaction has implications for Coty Group, which has relied on Gucci's beauty products; losing this partnership could significantly impact Coty's business [18]. - The competitive landscape in the luxury beauty market is shifting, with L'Oréal positioning itself as a leader in the niche fragrance market through strategic acquisitions and partnerships [16][17].

欧莱雅豪赌高端化:向“全奢美妆”巨头迈进

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 12:27

Core Insights - L'Oréal has made significant moves in the beauty industry, including a €4 billion acquisition of Kering's beauty business, which includes long-term beauty licenses for Gucci and Balenciaga, indicating a strategy to enhance its high-end beauty portfolio and secure luxury brand resources for the next 50 years [1][3] - The company aims to transition from a brand manager to an "ecosystem builder," exploring new growth opportunities through partnerships, particularly with Kering [2] - L'Oréal's Q3 2025 financial results show a total sales of €32.81 billion, with a like-for-like growth of 3.4%, driven by recovery in North America and mainland China [2][6] Acquisition Strategy - The acquisition of Kering's beauty business includes the buyout of the high-end niche fragrance brand Creed and long-term beauty licenses for Gucci, Bottega Veneta, and Balenciaga, which are expected to enhance L'Oréal's position in the luxury beauty market [3][4] - L'Oréal has also acquired professional hair care brand ColorWow and skincare brand Medik8, filling gaps in its high-end salon hair care and professional skincare segments [3] Market Performance - L'Oréal's sales growth in the North Asia region has turned positive for the first time in two years, with a 0.5% increase, attributed to the recovery of high-end cosmetics and innovative products from brands like Lancôme and Helena Rubinstein [6] - The professional products division led growth with a 7.4% increase, while the fragrance category continues to show strong performance [6] Competitive Landscape - The beauty industry is witnessing a shift towards brand matrix, channel innovation, and digital transformation, with L'Oréal's aggressive expansion in luxury beauty positioning it well against competitors like Estée Lauder [7][8] - Estée Lauder's recent acquisition of Tom Ford for $2.8 billion highlights a similar strategy in the luxury segment, despite facing challenges in organic sales growth [6][9] Future Outlook - L'Oréal's future collaboration with Kering is anticipated to unlock new growth avenues, particularly in the luxury beauty sector, as the company seeks to leverage its expertise in customer engagement and brand management [5][9]

欧莱雅(OR):欧莱雅25Q3业绩加速增长,战略收购开云美妆夯实奢华美妆版图

Haitong Securities International· 2025-10-23 12:15

Investment Rating - The report maintains a positive outlook on L'Oréal, indicating an "Outperform" rating for the stock over the next 12-18 months [19]. Core Insights - L'Oréal's sales growth momentum significantly strengthened in Q3 2025, driven by the "Beauty Stimulus Plan" and successful new product launches, achieving sales of €32.80 billion for the first nine months, with a like-for-like growth of 3.4% [2][8]. - The company announced a strategic acquisition of Kering Beauté for €4.0 billion, which includes the niche fragrance brand Creed and licenses for Balenciaga and Bottega Veneta, enhancing its luxury portfolio [5][11]. Summary by Sections Financial Performance - In Q3 2025, L'Oréal's sales reached approximately €8.05 billion, with a like-for-like growth accelerating to 4.2%, up from 3.5% in Q1 and 2.4% in Q2 [2][8]. - The "Beauty Stimulus Plan" contributed approximately 170 basis points to growth in Q3, an increase from 150 basis points in the first half of the year [2][8]. Divisional Performance - The Professional Products Division saw a 9.3% growth, driven by the strong performance of Kérastase and the acquisition of Color Wow [3][9]. - The Consumer Products Division experienced a notable rebound, particularly in North America, with growth exceeding 20% for Mixa in Europe and successful expansion of 3CE in Southeast Asia [3][9]. - The L'Oréal Luxe Division continued to outperform the market, especially in North Asia, while the Dermatological Beauty Division showed balanced growth across its major brands [3][9]. Regional Growth - Sales in Europe grew by 4.1%, with strong performances in Spain, Portugal, Germany, Austria, Switzerland, and Italy [4][10]. - North America experienced a 1.4% growth, with a cumulative growth of 3.1% for the first nine months after IT system adjustments [4][10]. - The SAPMENA–SSA region led with a 12.2% growth, with online channels acting as a key growth driver [4][10]. Strategic Developments - The acquisition of Kering Beauté is seen as a strategic highlight, expected to enhance L'Oréal's position in the luxury beauty market and potentially double Creed's sales [5][11]. - Key executive changes were announced to facilitate the integration of the acquired brands, including the establishment of a 50/50 joint venture focused on health and longevity services [5][11].

25省已实现生育津贴直接发放至个人|首席资讯日报

首席商业评论· 2025-10-21 04:31

Group 1 - The direct issuance of maternity allowances to individuals has been implemented in 25 provinces in China, enhancing women's rights and social security [2] - China Galaxy Securities indicates a short-term market style shift due to external trade uncertainties and previous sector gains, suggesting a cautious investment sentiment [3] - L'Oréal is reportedly planning to acquire Kering's beauty division for approximately 40 billion USD, indicating a trend of mergers and acquisitions in the beauty sector [4] Group 2 - Carlyle Group's CEO expresses concerns about recent fluctuations in the credit market but notes that the overall economic situation remains resilient [5] - The Louvre Museum in Paris has experienced a robbery, highlighting security vulnerabilities in museums and the increasing targeting by professional smuggling groups [6] - In September, China's retail sales growth slowed to 3.0% year-on-year, influenced by the timing of the Mid-Autumn Festival [7] Group 3 - Lyon has raised TSMC's target price to 2000 NTD, maintaining a strong buy rating based on improved profit margins and sustained demand for AI computing [8] - The value added of the lithium-ion battery manufacturing industry in China increased by 29.8% year-on-year in the first three quarters, driven by policies promoting domestic demand [9] - Ant Group's subsidiary in Hainan has increased its registered capital from 10 million to 3.5 billion RMB, indicating significant growth and investment in technology services [10] Group 4 - The People's Bank of China reported an increase of 601.3 billion RMB in loans in the first three quarters, with a notable decrease compared to the previous year [11] - China's GDP grew by 5.2% year-on-year in the first three quarters, with the service sector showing the highest growth rate [12] - CITIC Securities highlights a three-year plan to double electric vehicle charging facilities by 2027, emphasizing the importance of infrastructure development in the EV sector [13]

开云美妆战略大转向,欧莱雅成“接盘侠”

Guan Cha Zhe Wang· 2025-10-21 02:07

Core Viewpoint - L'Oréal Group and Kering Group announced a strategic partnership valued at €4 billion, where L'Oréal will acquire Kering's beauty business, including the Creed perfume brand and exclusive licenses for Gucci, Balenciaga, and Bottega Veneta for 50 years [1][3]. Group 1: Transaction Details - The transaction is expected to be completed in the first half of 2026, pending regulatory approval [2]. - L'Oréal will acquire Kering's beauty business, which includes the Creed brand that Kering purchased for €3.5 billion in 2023 [3]. - L'Oréal will receive exclusive licenses for Gucci, Balenciaga, and Bottega Veneta's beauty and fragrance products for 50 years, with Gucci's current license held by Coty Group set to transfer to L'Oréal in 2028 [3]. Group 2: Financial Context - Kering faces significant financial pressure, with net debt reaching €9.5 billion and long-term lease liabilities of €6 billion as of June 2025 [4]. - Gucci's operating profit fell by 52% year-on-year to €486 million, with revenue down 16% to €7.587 billion in the first half of 2025 [4]. Group 3: Strategic Implications - Kering's CEO, Luca de Meo, emphasized that this strategic alliance is crucial for accelerating the development of major brands in the fragrance and cosmetics sectors, similar to the success of YSL beauty under L'Oréal [4]. - The decision to sell the beauty business marks a significant shift from Kering's previous strategy of expanding its beauty division, which included the acquisition of Creed and the hiring of a former Estée Lauder executive [5]. - The beauty business is seen as a key area for luxury brands to attract a broader consumer base, especially in a slowing luxury goods market [5][6]. Group 4: L'Oréal's Position - This acquisition represents L'Oréal's largest transaction in its history, surpassing the $2.5 billion acquisition of Estée Lauder in 2023 [6]. - L'Oréal has been expanding in the fragrance sector, acquiring several brands, including the high-end Middle Eastern brand Amouage in 2025 [7]. - The partnership with Kering may set a new trend in the industry, focusing on equity cooperation and joint ventures to align interests while maintaining brand prestige [8].

40亿欧元售出!开云集团宣布,欧莱雅接盘

Zhong Guo Ji Jin Bao· 2025-10-20 09:32

Core Insights - Kering Group has announced the sale of its beauty business to L'Oréal for €4 billion, marking a significant strategic shift after a two-year investment in the beauty sector [2][4] - The transaction includes the acquisition of the Creed perfume brand and beauty licenses for Gucci, Bottega Veneta, and Balenciaga, with completion expected in the first half of 2026 [2][4] Strategic Shift - The decision to sell was driven by new CEO Luca de Meo, who has implemented major reforms within a short period, including leadership changes and restructuring [4] - The agreement outlines three key areas: acquisition of Creed, management of beauty licenses for luxury brands, and a joint venture to explore opportunities in health and longevity [5] Financial Context - Kering faces significant financial pressure, with net debt reaching €9.5 billion and long-term lease liabilities of €6 billion as of June 2025 [6] - Gucci's performance has been declining, with operating profit dropping 52% to €486 million and revenue falling 16% to €7.587 billion in the first half of 2025 [6] Market Dynamics - Despite Kering's beauty segment achieving a 9% growth rate in the first half of 2025, this was insufficient to alleviate the overall financial challenges faced by the group [6] - The sale is seen as a strategic move to reduce debt and streamline operations, as luxury beauty businesses typically require significant investment and time to develop [6][8] Industry Implications - The sale signals a potential shift in luxury brand strategies, with Kering's partnership with L'Oréal indicating a trend towards equity collaborations rather than traditional licensing or self-managed beauty divisions [8] - The luxury beauty market has been one of the fastest-growing segments, and the collaboration aims to leverage L'Oréal's expertise while maintaining the luxury brand's identity [7][8]

40亿欧元售出!开云集团宣布,欧莱雅接盘

中国基金报· 2025-10-20 09:11

Core Viewpoint - Kering Group has dramatically shifted its beauty strategy by selling its beauty business to L'Oréal for €4 billion, including the Creed perfume brand and beauty licenses for Gucci, Bottega Veneta, and Balenciaga, signaling a strategic retreat from the beauty sector [2][4][5]. Group 1: Strategic Shift - The decision to sell was driven by new CEO Luca de Meo, who has implemented significant reforms within a short time, contrasting with the previous aggressive expansion into the beauty sector [4][5]. - The agreement includes three key components: L'Oréal acquiring Creed, taking over beauty licenses for Gucci, Bottega Veneta, and Balenciaga, and exploring opportunities in health and longevity together [5][6]. Group 2: Financial Context - Kering faces severe financial pressure, with net debt reaching €9.5 billion and long-term lease liabilities of €6 billion as of June 2025, raising concerns among investors [9]. - Gucci's performance has been declining, with operating profit dropping 52% to €486 million and revenue falling 16% to €7.587 billion in the first half of 2025 [9]. - Despite Kering's beauty segment showing a 9% growth in the same period, it is insufficient to alleviate the overall financial challenges faced by the group [9]. Group 3: Market Implications - The sale reflects a broader trend in the luxury sector, where beauty products are seen as a key growth area, yet Kering's decision indicates a shift towards more strategic and refined decision-making in brand management [11][12]. - The collaboration model between Kering and L'Oréal may set a new trend in the industry, focusing on equity partnerships and joint ventures to maintain brand integrity while leveraging operational expertise from beauty companies [12].

今年美妆最大并购诞生

投资界· 2025-10-20 08:01

Core Viewpoint - Kering Group and L'Oréal Group have announced a long-term strategic partnership in the luxury beauty and health sector, with a total deal value of €4 billion (approximately ¥332 billion), marking the largest acquisition in the beauty sector this year [4][11]. Group 1: Details of the Agreement - The agreement consists of three main parts: Kering will sell its beauty business, including the Creed brand, to L'Oréal, along with a 50-year licensing agreement for Kering's iconic perfume brands [9][10]. - Creed, a historic perfume brand founded in 1760, was acquired by Kering for €3.5 billion just four months prior to this deal, indicating a rapid change in ownership [9][12]. - L'Oréal will also receive exclusive rights for the development, production, and distribution of Gucci's beauty products, as well as a 50-year exclusive license for the creation and distribution of Bottega Veneta and Balenciaga's beauty products [10][11]. Group 2: Strategic Implications - This partnership reflects Kering's need to alleviate financial pressure and focus on its core business, as the company faces declining revenue and a significant net profit drop of 62% [11][12]. - L'Oréal's aggressive expansion strategy is highlighted by this acquisition, positioning the company as a major player in the rapidly growing high-end perfume market [13][14]. - The collaboration will also explore business opportunities at the intersection of luxury goods, health, and longevity, with plans to establish a 50-50 joint venture [11][12]. Group 3: Market Context - L'Oréal has been actively acquiring brands to strengthen its position in the beauty market, including recent acquisitions of luxury brands and investments in emerging markets [13][14]. - The company has a history of building its empire through strategic acquisitions, with a diverse portfolio of over 50 brands across various beauty segments [15].