YNYW(600725)

Search documents

A股煤炭股逆势上涨,安泰集团、大有能源涨停

Ge Long Hui A P P· 2025-10-17 02:48

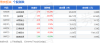

Group 1 - The A-share market saw a rise in coal stocks, with notable increases in companies such as Antai Group and Dayou Energy reaching the daily limit up [1] - Antai Group and Dayou Energy both experienced a 10% increase, while other companies like Baotailong and Yunmei Energy also showed significant gains [1][2] - Year-to-date performance for these coal stocks indicates strong growth, with Dayou Energy up 124.49% and Antai Group up 44.88% [2] Group 2 - The total market capitalization of Antai Group is 2.99 billion, while Dayou Energy has a market cap of 15.8 billion [2] - Other coal companies such as Baotailong and Yunmei Energy have market caps of 8.08 billion and 4.77 billion respectively, reflecting their growing presence in the market [2] - The overall trend in the coal sector suggests a robust performance amidst broader market conditions [1]

煤炭板块延续强势,大有能源6天5板

Mei Ri Jing Ji Xin Wen· 2025-10-17 02:05

Group 1 - The coal sector continues to show strong performance, with companies like Dayou Energy achieving five consecutive trading limits in six days [1] - Antai Group has seen two consecutive trading limits, indicating positive market sentiment [1] - Other companies such as Yunwei Co., Yunmei Energy, and Shaanxi Black Cat are also experiencing upward trends in their stock prices [1]

焦炭板块10月16日涨2.01%,安泰集团领涨,主力资金净流入2.24亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

Core Insights - The coke sector experienced a 2.01% increase on October 16, with Antai Group leading the gains [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Sector Performance - Antai Group's stock price rose by 10.20% to 2.70, with a trading volume of 1.8985 million shares and a transaction value of 500 million yuan [1] - Baotailong's stock price increased by 10.03% to 3.95, with a trading volume of 3.8671 million shares and a transaction value of 1.456 billion yuan [1] - Shanxi Coking Coal's stock price rose by 1.70% to 4.18, with a trading volume of 521,600 shares and a transaction value of 217 million yuan [1] - Shaanxi Black Cat's stock price increased by 1.56% to 3.90, with a trading volume of 789,100 shares and a transaction value of 306 million yuan [1] - Yunnan Coal Energy's stock price rose by 1.23% to 4.12, with a trading volume of 386,400 shares and a transaction value of 159 million yuan [1] - Yunwei Co.'s stock price increased by 0.28% to 3.61, with a trading volume of 215,000 shares and a transaction value of 77.4935 million yuan [1] - Meijin Energy's stock price decreased by 0.60% to 5.00, with a trading volume of 778,800 shares and a transaction value of 389.7 million yuan [1] Capital Flow - The coke sector saw a net inflow of 224 million yuan from main funds, while retail funds experienced a net outflow of 113 million yuan and 111 million yuan respectively [1] - Baotailong had a main fund net inflow of 131 million yuan, while retail funds saw a net outflow of 90.41 million yuan [2] - Antai Group experienced a main fund net inflow of 60.25 million yuan, with retail funds seeing a net outflow of 44.32 million yuan [2] - Shanxi Coking Coal had a main fund net inflow of 29.04 million yuan, with retail funds experiencing a net outflow of 8.61 million yuan [2] - Shaanxi Black Cat saw a main fund net inflow of 12.34 million yuan, while retail funds had a net inflow of 0.33 million yuan [2] - Yunnan Coal Energy had a main fund net inflow of 7.76 million yuan, with retail funds seeing a net inflow of 0.86 million yuan [2] - Yunwei Co. experienced a main fund net outflow of 2.72 million yuan, while retail funds had a net inflow of 0.26 million yuan [2] - Meijin Energy had a main fund net outflow of 13.91 million yuan, with retail funds seeing a net inflow of 1.78 million yuan [2]

焦炭板块10月13日涨1.48%,宝泰隆领涨,主力资金净流出5131.55万元

Zheng Xing Xing Ye Ri Bao· 2025-10-13 12:45

Core Insights - The coke sector experienced a 1.48% increase on October 13, with Baotailong leading the gains [1] - The Shanghai Composite Index closed at 3889.5, down 0.19%, while the Shenzhen Component Index closed at 13231.47, down 0.93% [1] Sector Performance - Baotailong (601011) closed at 3.60, up 10.09% with a trading volume of 449,300 shares and a transaction value of 162 million yuan [1] - Antai Group (600408) closed at 2.42, up 2.11% with a trading volume of 494,300 shares and a transaction value of 117 million yuan [1] - Yunwei Co. (600725) closed at 3.60, up 1.12% with a trading volume of 217,500 shares and a transaction value of 76.66 million yuan [1] - Meijin Energy (000723) closed at 4.99, up 0.60% with a trading volume of 1,890,300 shares and a transaction value of 439 million yuan [1] - Shaanxi Black Cat (601015) closed at 3.74, up 0.54% with a trading volume of 470,700 shares and a transaction value of 174 million yuan [1] - Yunmei Energy (600792) closed at 3.99, up 0.50% with a trading volume of 226,200 shares and a transaction value of 89.03 million yuan [1] - Shanxi Coking Coal (600740) closed at 4.10, down 0.73% with a trading volume of 362,400 shares and a transaction value of 1.47 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 51.32 million yuan from institutional investors and 39.11 million yuan from retail investors, while retail investors had a net inflow of 90.43 million yuan [1] - Baotailong had a net inflow of 8.45 million yuan from institutional investors, but a net outflow of 8.79 million yuan from retail investors [2] - Yunwei Co. experienced a net inflow of 1.48 million yuan from retail investors despite a net outflow from institutional and speculative investors [2] - Shaanxi Black Cat had a net outflow of 5.27 million yuan from institutional investors but a net inflow of 15.40 million yuan from retail investors [2] - Yunmei Energy saw a significant net outflow from institutional and speculative investors, but a net inflow of 13.40 million yuan from retail investors [2] - Antai Group and Shanxi Coking Coal both experienced net outflows from institutional and speculative investors, with retail investors providing some support [2]

焦炭板块10月10日涨2.59%,宝泰隆领涨,主力资金净流入4026.59万元

Zheng Xing Xing Ye Ri Bao· 2025-10-10 08:52

Core Insights - The coke sector experienced a 2.59% increase on October 10, with Baotailong leading the gains, while the Shanghai Composite Index fell by 0.94% [1] Group 1: Market Performance - Baotailong's stock price closed at 3.27, reflecting a 10.10% increase with a trading volume of 835,300 shares and a transaction value of 270 million yuan [1] - Other notable performers included Shanxi Black Cat, which rose by 4.49% to 3.72, and Yunmei Energy, which increased by 3.93% to 3.97 [1] - The overall trading volume for the coke sector was significant, with Baotailong leading in both price increase and transaction value [1] Group 2: Capital Flow - The coke sector saw a net inflow of 40.27 million yuan from main funds, while retail funds experienced a net inflow of 231,000 yuan [1] - Baotailong attracted a net inflow of 80.73 million yuan from main funds, despite a net outflow of 30.20 million yuan from speculative funds [2] - The capital flow data indicates a mixed sentiment among retail investors, with significant outflows from several companies, including Meijin Energy and Antai Group [2]

云维股份(600725) - 云维股份关于重大资产重组进展的公告

2025-10-10 08:30

证券代码:600725 证券简称:云维股份 公告编号:临 2025-048 云南云维股份有限公司 关于重大资产重组进展的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或 者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。 一、本次交易概述 云南云维股份有限公司(以下简称"公司"或"云维股份")拟通过发行股份及 支付现金的方式购买云南省电力投资有限公司(以下简称"云南电投")、云南小 龙潭矿务局有限责任公司(以下简称"小龙潭矿务局")、云南合和(集团)股份 有限公司合计持有的云南能投红河发电有限公司(以下简称"标的公司")100% 股权(以下简称"本次交易")。本次交易的交易对方云南电投、小龙潭矿务局为 公司控股股东控制的其他企业,根据《上市规则》等相关规定,云南电投、小龙 潭矿务局构成上市公司的关联方,因此,本次交易构成关联交易。此外,本次交 易预计构成《上市公司重大资产重组管理办法》规定的重大资产重组,本次交易 不会导致公司实际控制人变更。 二、本次交易进展情况 2024 年 12 月 7 日,公司发布了《关于筹划重大资产重组停牌的公告》,经 公司申请,公司证券(证 ...

云维股份(600725) - 云南云维股份有限公司2025年第四次临时股东大会议案材料

2025-10-10 08:30

云南云维股份有限公司 2025 年第四次临时股东大会议案材料 会议时间:2025 年 10 月 17 日 会议地点:昆明市日新中路 393 号广 福城写字楼 20 楼会议室 请携本会议材料参会! 2025 年第四次临时股东大会会议材料 云南云维股份有限公司 2025 年第四次临时股东大会会议议程 现场会议地点:昆明市日新中路 393 号广福城写字楼 20 楼会议室 现场会议时间:2025 年 10 月 17 日 15:00 现场会议主持人:董事长 刘磊 网络投票时间:采用上海证券交易所网络投票系统,通过交易系 统投票平台的投票时间为股东大会召开当日的交易时间段,即 2025 年 10 月 17 日 9:15-9:25,9:30-11:30,13:00-15:00。 会议议程: 一、主持人宣布现场会议开始,并介绍本次股东大会现场会议出 席情况及代表股份数,宣布现场会议开始; 二、宣读《云南云维股份有限公司股东大会会场纪律》; 三、审议议案: | 序号 | 议案名称 | 投票股东类型 | | | --- | --- | --- | --- | | | | A | 股股东 | | 非累积投票议案 | | | | | ...

焦炭板块10月9日涨3.76%,山西焦化领涨,主力资金净流入2836.05万元

Zheng Xing Xing Ye Ri Bao· 2025-10-09 09:00

Core Insights - The coke sector experienced a significant increase of 3.76% on October 9, with Shanxi Coking leading the gains [1] - The Shanghai Composite Index closed at 3933.97, up 1.32%, while the Shenzhen Component Index closed at 13725.56, up 1.47% [1] Sector Performance - Shanxi Coking (600740) closed at 4.07, with a rise of 4.63% and a trading volume of 338,500 shares, amounting to 1.35 billion yuan [1] - Meijin Energy (000723) closed at 4.93, up 4.45%, with a trading volume of 1,083,800 shares, totaling 526 million yuan [1] - Baotailong (601011) closed at 2.97, increasing by 3.12%, with a trading volume of 514,000 shares, amounting to 150 million yuan [1] - Yunwei Co. (600725) closed at 3.53, up 2.92%, with a trading volume of 210,400 shares, totaling 73.25 million yuan [1] - Shaanxi Black Cat (601015) closed at 3.56, increasing by 2.89%, with a trading volume of 236,900 shares, amounting to 83.36 million yuan [1] - Antai Group (600408) closed at 2.31, up 2.21%, with a trading volume of 302,700 shares, totaling 68.88 million yuan [1] - Yunmei Energy (600792) closed at 3.82, increasing by 2.14%, with a trading volume of 128,500 shares, amounting to 48.63 million yuan [1] Capital Flow - The coke sector saw a net inflow of 28.36 million yuan from main funds, while retail funds experienced a net inflow of 13.28 million yuan [1] - The main funds for Shanxi Coking showed a net inflow of over 8.59 million yuan, while retail funds had a net inflow of 1.00 million yuan [2] - Baotailong had a net inflow of 5.86 million yuan from main funds, but a net outflow of 6.44 million yuan from retail funds [2] - Meijin Energy experienced a net inflow of 4.38 million yuan from main funds, with a significant net outflow of 25.14 million yuan from retail funds [2] - Shaanxi Black Cat had a net inflow of 5.17 million yuan from main funds, while retail funds showed a net outflow of 3.06 million yuan [2]

云维股份(600725) - 云维股份关于召开2025年半年度业绩说明会的公告

2025-10-09 08:15

证券代码:600725 证券简称:云维股份 公告编号:临 2025-047 云南云维股份有限公司 关于召开 2025 年半年度业绩说明会的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: 会议召开时间:2025 年 10 月 16 日 (星期四) 11:00-12:00 会议召开地点:上海证券交易所上证路演中心(网址: https://roadshow.sseinfo.com/) 会议召开方式:上证路演中心网络互动 投资者可于 2025 年 10 月 10 日(星期五) 至 10 月 15 日(星期 三)16:00 前登录上证路演中心网站首页点击"提问预征集"栏目或 通过公司邮箱 174724126@qq.com 进行提问。公司将在说明会上对投 资者普遍关注的问题进行回答。 云南云维股份有限公司(以下简称"公司")已于 2025 年 8 月 29 日发布公司 2025 年半年度报告,为便于广大投资者更全面深入地 了解公司 2025 年半年度经营成果、财务状况,公司计划于 2025 年 10 月 16 日(星 ...

云维股份:聘任吴余生为公司总经理

Mei Ri Jing Ji Xin Wen· 2025-09-30 09:02

Group 1 - Company Yunwei Co., Ltd. announced the appointment of Mr. Wu Yusheng as the new General Manager [1] - The Board of Directors also approved the appointment of Mr. Li Meng as the Chief Financial Officer, who will assume the responsibilities of the financial head [1]