XIANMEN BANK(601187)

Search documents

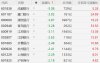

城商行板块10月29日跌2.43%,成都银行领跌,主力资金净流出7.42亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Viewpoint - The city commercial bank sector experienced a decline of 2.43% on October 29, with Chengdu Bank leading the drop, while the overall stock market indices showed an increase [1][2]. Market Performance - The Shanghai Composite Index closed at 4016.33, up 0.7% - The Shenzhen Component Index closed at 13691.38, up 1.95% [1]. Individual Stock Performance - Chengdu Bank saw a significant decline of 5.74%, closing at 17.07 - Other notable declines included Xiamen Bank (-4.90%), Jiangsu Bank (-3.84%), and Qingdao Bank (-3.66%) [2]. - Chongqing Bank was one of the few gainers, with a slight increase of 0.84%, closing at 10.76 [1]. Trading Volume and Turnover - Chengdu Bank had a trading volume of 1.298 million shares, with a turnover of 22.27 million yuan - Jiangsu Bank had a trading volume of 2.039 million shares, with a turnover of 2.164 billion yuan [2]. Capital Flow Analysis - The city commercial bank sector saw a net outflow of 742 million yuan from institutional investors, while retail investors contributed a net inflow of 410 million yuan [2]. - The data indicates that speculative funds had a net inflow of 331 million yuan [2]. Individual Stock Capital Flow - Qingdao Bank had a net inflow of 61.11 million yuan from institutional investors, while it experienced a net outflow of 59.42 million yuan from speculative funds [3]. - Nanjing Bank also saw a net inflow of 43.97 million yuan from institutional investors, but a net outflow of 34.08 million yuan from speculative funds [3].

大爆发!尾盘,多股30%涨停!

证券时报· 2025-10-29 08:30

Market Overview - The A-share market experienced a strong rally on October 29, with the Shanghai Composite Index surpassing 4000 points, reaching a 10-year high. The ChiNext Index rose nearly 3%, and the North Exchange 50 Index surged over 8% [1][2]. Shanghai Composite Index - The Shanghai Composite Index closed at 4016.33 points, up 0.7%. The Shenzhen Component Index increased by 1.95% to 13691.38 points, while the ChiNext Index rose by 2.93% to 3324.27 points. The North Exchange 50 Index saw a significant increase of 8.41% [2][4]. Trading Volume - The total trading volume across the Shanghai, Shenzhen, and North exchanges reached 22909 billion yuan, an increase of approximately 1250 billion yuan compared to the previous day [2]. Sector Performance Photovoltaic Industry - The photovoltaic sector saw explosive growth, with stocks like Sungrow Power Supply rising over 15%, reaching a historical high. Other companies such as Longi Green Energy, Tongwei Co., and JA Solar Technology also hit their daily limit [2][9]. - The market capitalization of Sungrow Power Supply is now nearly 400 billion yuan [9]. Nonferrous Metals Sector - The nonferrous metals sector performed strongly, with companies like China Tungsten High-Tech and Jiangxi Copper nearing their daily limit. The sector was driven by rising prices in tungsten and aluminum [13][15]. - Tungsten prices have increased due to growing demand and supply constraints, with black tungsten concentrate prices rising to 288,000 yuan per ton [15]. Securities Sector - The securities sector also saw gains, with companies like Huashan Securities and Northeast Securities reaching their daily limit during intraday trading [2]. Hainan Free Trade Zone - Stocks related to the Hainan Free Trade Zone, such as Hainan Development and Hainan Airlines, also experienced significant gains, hitting their daily limit [2]. Regulatory Developments - The China Securities Regulatory Commission (CSRC) announced plans to improve the listing mechanism for the North Exchange, aiming to enhance the quality of listed companies and stimulate market activity [7]. Future Outlook - Analysts suggest that the recent adjustments in the North Exchange have created new valuation opportunities, particularly for newly listed companies with strong profit potential and innovative attributes [7]. Conclusion - The A-share market's strong performance on October 29 reflects a shift in investor focus towards sectors like photovoltaic and nonferrous metals, driven by regulatory support and improving market conditions [1][2][7].

“牛市旗手”,突然拉升!这些板块大爆发→

Zheng Quan Shi Bao· 2025-10-29 04:21

Market Overview - The A-share market showed overall strength on October 29, with the Shanghai Composite Index surpassing the 4000-point mark [2][3] - The ChiNext Index experienced a strong performance, with an intraday increase exceeding 2% before narrowing [3] Index Performance - As of the midday close, the Shanghai Composite Index rose by 0.37% to 4002.83 points, the Shenzhen Component Index increased by 0.90% to 13550.65 points, and the ChiNext Index gained 1.35% to 3273.28 points [4][3] Sector Performance - The non-bank financial sector saw a significant rally, particularly in brokerage stocks, which are referred to as the "bull market flag bearers" [6] - The power equipment sector led the gains, with an intraday increase approaching 3% [4] - The non-ferrous metals sector also performed strongly, with gains exceeding 2.5% [6] Notable Stocks - In the power equipment sector, stocks such as Tongguan Copper Foil (301217) hit the daily limit, while Artis (688472) surged over 13% [4][5] - In the non-bank financial sector, Huazhong Securities (600909) and Northeast Securities both reached the daily limit [7] - The non-ferrous metals sector saw notable performances from stocks like Zhongtung High-tech (000657), which hit the daily limit, and Shengxin Lithium Energy (002240) with a 7.35% increase [6] Company-Specific News - Yashi Chuangneng (603378) hit the daily limit for the fourth consecutive trading day, following a significant price increase [9] - Shikong Technology (605178) reached the daily limit for the sixth consecutive trading day, with a cumulative increase of 123.90% since September [12][14] - Both companies issued announcements regarding stock trading anomalies and potential risks associated with their rapid price increases [11][14]

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

银行股下挫,厦门银行跌超6%

Mei Ri Jing Ji Xin Wen· 2025-10-29 02:04

每经AI快讯,10月29日,银行股下挫,厦门银行跌超6%,成都银行、青岛银行、江阴银行跟跌。 (文章来源:每日经济新闻) ...

小红日报|银行板块彰显韧性,标普红利ETF(562060)标的指数收跌0.41%

Xin Lang Ji Jin· 2025-10-29 01:42

Group 1 - The article highlights the top 20 stocks in the S&P China A-Share Dividend Opportunity Index, showcasing their daily and year-to-date performance along with dividend yields [1] - Xiamen Bank (601187.SH) leads with a daily increase of 5.46% and a year-to-date increase of 29.77%, offering a dividend yield of 4.34% [1] - Other notable performers include Jian Sheng Group (603558.SH) with a daily rise of 5.40% and a year-to-date increase of 13.62%, and Jinbei Electric (002533.SZ) with a daily increase of 5.28% and a year-to-date increase of 37.17% [1] Group 2 - The article also mentions that MACD golden cross signals have formed, indicating a positive trend for certain stocks [3]

厦门银行:部分董监高累计增持该行25.44万股,增持计划实施完毕

Bei Jing Shang Bao· 2025-10-28 11:35

北京商报讯(记者孟凡霞周义力)10月28日,厦门银行(601187)发布公告称,该行于2025年4月29日披 露了《厦门银行股份有限公司关于部分董事、监事、高级管理人员自愿增持股份计划的公告》,部分董 事、监事、高级管理人员计划通过上海证券交易所交易系统集中竞价交易方式,以不低于上一年度从该 行取得税后薪酬总额的10%主动增持该行股份,即合计增持金额不低于人民币96.40万元。 截至本公告披露日,有关增持主体以自有资金通过上海证券交易所交易系统以集中竞价交易累计增持股 份25.44万股,占该行总股本的0.00964%,累计增持金额人民币168.57万元,本次增持计划实施完毕。 ...

厦门银行:部分董监高累计增持约25万股,增持计划实施完毕

Mei Ri Jing Ji Xin Wen· 2025-10-28 10:20

每经AI快讯,厦门银行(SH 601187,收盘价:7.15元)10月28日晚间发布公告称,本行于2025年4月29 日披露了《厦门银行股份有限公司关于部分董事、监事、高级管理人员自愿增持股份计划的公告》(公 告编号:2025-020),部分董事、监事、高级管理人员计划通过上海证券交易所交易系统集中竞价交易 方式,以不低于上一年度从本行取得税后薪酬总额的10%主动增持本行股份,即合计增持金额不低于人 民币96.40万元。 截至本公告披露日,有关增持主体以自有资金通过上海证券交易所交易系统以集中竞价交易累计增持股 份约25万股,占公司总股本的0.00964%,累计增持金额人民币168.57万元,相关增持计划实施完毕。 2025年1至6月份,厦门银行的营业收入构成为:利息收入占比88.23%,非利息收入占比4.22%。 截至发稿,厦门银行市值为189亿元。 每经头条(nbdtoutiao)——A股突破4000点!十年沉寂终迎爆发,科技主线重塑市场,"慢牛"新格局开 启! (记者 王晓波) ...

厦门银行(601187) - 厦门银行股份有限公司关于部分董事、监事、高级管理人员增持股份结果的公告

2025-10-28 10:11

证券代码:601187 证券简称:厦门银行 公告编号:2025-043 厦门银行股份有限公司 关于部分董事、监事、高级管理人员 增持股份结果的公告 本公司董事会、全体董事及相关股东保证本公告内容不存在任何虚假记载、 误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: 已披露增持计划情况:厦门银行股份有限公司(以下简称"本行")于 2025 年 4 月 29 日披露了《厦门银行股份有限公司关于部分董事、监事、高级管 理人员自愿增持股份计划的公告》(公告编号:2025-020),部分董事、监事、 高级管理人员计划通过上海证券交易所交易系统集中竞价交易方式,以不低于上 一年度从本行取得税后薪酬总额的 10%主动增持本行股份,即合计增持金额不低 于人民币 96.40 万元。 增持计划的实施结果:截至本公告披露日,有关增持主体以自有资金通 过上海证券交易所交易系统以集中竞价交易累计增持股份 254,400 股,占公司总 股本的 0.00964%,累计增持金额人民币 168.57 万元,本次增持计划实施完毕。 | 增持主体名称 | 董事:洪枇杷、吴昕颢 | | | | --- | - ...

城商行板块10月28日涨0.02%,厦门银行领涨,主力资金净流入2.23亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:40

Market Performance - The city commercial bank sector increased by 0.01% compared to the previous trading day, with Xiamen Bank leading the gains [1] - The Shanghai Composite Index closed at 3988.22, down by 0.22%, while the Shenzhen Component Index closed at 13430.1, down by 0.44% [1] Individual Bank Performance - Xiamen Bank's closing price was 7.15, with a rise of 5.46% and a trading volume of 582,400 shares, amounting to a transaction value of 412 million yuan [1] - Chongqing Bank closed at 10.67, up by 2.11%, with a trading volume of 225,000 shares [1] - Chengdu Bank's closing price was 18.11, increasing by 0.84% with a trading volume of 314,100 shares [1] - Other banks such as Changsha Bank, Lanzhou Bank, and Jiangsu Bank showed minimal changes in their stock prices [1] Capital Flow Analysis - The city commercial bank sector saw a net inflow of 223 million yuan from institutional investors, while retail investors experienced a net outflow of 356 million yuan [2] - The main capital inflow was observed in banks like Nanjing Bank and Chengdu Bank, with significant net inflows from institutional investors [3] - Retail investors showed a negative net flow in several banks, indicating a cautious sentiment among smaller investors [3]