场景化技术开发

Search documents

泰凯英:拟首发募资3.32亿元升级产品与研发 15日申购

Sou Hu Cai Jing· 2025-10-15 07:09

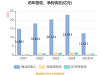

Core Viewpoint - The company aims to enhance its financial strength and market competitiveness through a fundraising initiative, focusing on product innovation, research capabilities, and intelligent tire management systems [1][2]. Group 1: Fundraising and Investment Projects - The fundraising will significantly improve the company's financial strength, allowing for concentrated investment in product competitiveness, research capabilities, and intelligent tire management systems [1]. - Key projects include upgrading the entire series of scene-specific tire products, establishing a specialized tire innovation technology research center, and enhancing the intelligent tire management system [1]. - Successful implementation of these projects is expected to optimize the product line, enhance research capabilities, and expand market reach, ultimately increasing the company's main business revenue [1]. Group 2: Company Overview - The company, Taikaiying, is driven by technological innovation and focuses on the global mining and construction tire market, specializing in the design, research, sales, and service of mining and construction tires [2]. - The product range includes engineering radial tires and all-steel truck tires, developed through a scenario-based technology development system aimed at reducing tire consumption and improving equipment operational efficiency [2]. Group 3: Financial Overview - The company plans to issue 44.25 million shares at a price of 7.5 yuan per share, with an expected total fundraising amount of 332 million yuan [3]. - The company's revenue composition for 2024 indicates that engineering radial tires contribute 1.7177 billion yuan, while all-steel truck tires contribute 501.2 million yuan [5]. - Historical revenue growth rates show fluctuations, with total revenue growth rates and net profit growth rates varying over the years [5][6]. Group 4: Financial Ratios and Performance Metrics - The company's weighted average return on equity for 2024 is projected at 25.56%, a decrease of 2.84 percentage points from the previous year [18]. - The operating cash flow net amount for 2024 is reported at 145 million yuan, a decline of 10.13% year-on-year [21]. - The company's liquidity ratios indicate a current ratio of 1.76 and a quick ratio of 1.65 for 2024, improving to 1.87 and 1.72 respectively in the first half of 2025 [50].