轮胎数字化管理系统

Search documents

青岛专精特新“小巨人”泰凯英登陆北交所

Zhong Zheng Wang· 2025-10-28 02:45

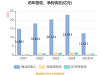

Group 1 - Qingdao Taike Ying Special Tire Co., Ltd. successfully listed on the Beijing Stock Exchange on October 28, 2023, with an opening price of 19.05 CNY per share, a 154% increase from the issue price of 7.50 CNY per share [1] - The company issued 44.25 million new shares, raising funds for various projects including the upgrade of specialized tire products, the establishment of an innovation technology research center, and the enhancement of an intelligent management system [1] - Taike Ying is recognized as a national-level "specialized, refined, distinctive, and innovative" small giant enterprise, with a leading position in the domestic engineering radial tire market, ranking third overall and first in the large-tonnage crane tire segment [2][3] Group 2 - The company's net profit for 2022 to 2024 is projected to be 110 million CNY, 140 million CNY, and 160 million CNY respectively, indicating a steady growth trend [3] - Qingdao has a total of 65 listed companies, with a strong performance in the first half of 2025, achieving a combined revenue of 332.3 billion CNY, which is 39% of the city's GDP, and a year-on-year growth of 6.48% [4] - The net profit of Qingdao's listed companies reached 30.9 billion CNY in the same period, with a year-on-year increase of 5.42%, outperforming the national average [4] Group 3 - Qingdao's listed companies are increasingly expanding their international business, with 38 companies reporting overseas revenue totaling 106.5 billion CNY, accounting for 32% of total revenue [5] - The city has established a supportive ecosystem for nurturing listed companies, optimizing the policy environment, and enhancing the awareness and capability of enterprises to utilize capital markets [6][7] - As of October 28, 2023, Qingdao has 25 companies undergoing regulatory guidance for listing, marking a historical high, with 10 more companies planning to list overseas [7]

泰凯英:拟首发募资3.32亿元升级产品与研发 15日申购

Sou Hu Cai Jing· 2025-10-15 07:09

Core Viewpoint - The company aims to enhance its financial strength and market competitiveness through a fundraising initiative, focusing on product innovation, research capabilities, and intelligent tire management systems [1][2]. Group 1: Fundraising and Investment Projects - The fundraising will significantly improve the company's financial strength, allowing for concentrated investment in product competitiveness, research capabilities, and intelligent tire management systems [1]. - Key projects include upgrading the entire series of scene-specific tire products, establishing a specialized tire innovation technology research center, and enhancing the intelligent tire management system [1]. - Successful implementation of these projects is expected to optimize the product line, enhance research capabilities, and expand market reach, ultimately increasing the company's main business revenue [1]. Group 2: Company Overview - The company, Taikaiying, is driven by technological innovation and focuses on the global mining and construction tire market, specializing in the design, research, sales, and service of mining and construction tires [2]. - The product range includes engineering radial tires and all-steel truck tires, developed through a scenario-based technology development system aimed at reducing tire consumption and improving equipment operational efficiency [2]. Group 3: Financial Overview - The company plans to issue 44.25 million shares at a price of 7.5 yuan per share, with an expected total fundraising amount of 332 million yuan [3]. - The company's revenue composition for 2024 indicates that engineering radial tires contribute 1.7177 billion yuan, while all-steel truck tires contribute 501.2 million yuan [5]. - Historical revenue growth rates show fluctuations, with total revenue growth rates and net profit growth rates varying over the years [5][6]. Group 4: Financial Ratios and Performance Metrics - The company's weighted average return on equity for 2024 is projected at 25.56%, a decrease of 2.84 percentage points from the previous year [18]. - The operating cash flow net amount for 2024 is reported at 145 million yuan, a decline of 10.13% year-on-year [21]. - The company's liquidity ratios indicate a current ratio of 1.76 and a quick ratio of 1.65 for 2024, improving to 1.87 and 1.72 respectively in the first half of 2025 [50].

中证路演回放丨泰凯英:坚定向成为“全球矿山建筑轮胎领先品牌”迈进

Zhong Guo Zheng Quan Bao· 2025-10-14 14:46

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. is entering a new development stage following its public stock issuance and listing on the Beijing Stock Exchange, aiming to become a leading global brand in mining and construction tires [1][2]. Company Overview - Established in 2007, the company focuses on the design, research and development, sales, and service of tires for the mining and construction industries, driven by technological innovation [2]. - The company specializes in engineering radial tires and all-steel truck tires, developing a scenario-based technology development system to address the complex and harsh working conditions of tire users [5]. Business Model and Strategy - The company will maintain its current business model without establishing its own production line, focusing on scenario-based technological innovation and utilizing an OEM/ODM production approach [6]. - The internal control system is robust, ensuring the preparation of accurate financial statements and compliance with laws and regulations [6]. Financial Performance - The company's gross margin for 2022, 2023, 2024, and the first half of 2025 is reported as 18.08%, 19.2%, 18.79%, and 18.12% respectively, with the main business gross margin at 18%, 18.98%, 18.66%, and 17.97% [7]. Fundraising and Investment Projects - The funds raised will be allocated to upgrading the full range of scenario-specific tire products, establishing an innovative technology research center, and enhancing the intelligent management system for specialized tires [8]. - Successful implementation of these projects is expected to optimize the product line, enhance R&D capabilities, and increase market expansion, thereby boosting the company's revenue [8].

生产全靠外包,这家轮胎企业要来IPO了……

IPO日报· 2025-07-24 12:15

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. (hereinafter referred to as "Taike Ying") is preparing for its IPO on the Beijing Stock Exchange, having pursued this goal since 2019. The company focuses on the design and research of mining and construction tires, operating without its own production facilities, which is a unique business model in the industry [1][3][5]. Business Model and Market Position - Taike Ying specializes in the design, research, sales, and service of engineering radial tires and all-steel truck tires. In 2023, it ranked 3rd among Chinese brands and 8th globally in the engineering radial tire market. It also holds the 1st position in the domestic market for large-tonnage crane tires [3][4]. - The company has established partnerships with several leading domestic and international construction machinery manufacturers, including SANY Group and XCMG, as well as global giants like Liebherr and JCB [4]. Production and Supply Chain Issues - The company does not manufacture tires but relies on a contract manufacturing model, focusing on research and development to enhance tire efficiency and reduce consumption [5][6]. - However, Taike Ying's main contract manufacturer, Xingda Tire, is currently facing debt default issues, which could impact the stability of product supply. The procurement amounts from Xingda Tire during the reporting period were significant, accounting for over 20% of total procurement in 2022 [7]. Financial Performance - Taike Ying has shown stable growth in its financial performance, with operating profits of 140.98 million, 178.63 million, and 199.87 million CNY over the past three years, and net profits of 108.34 million, 137.93 million, and 156.65 million CNY, reflecting a net profit margin around 6.01% to 6.82% [8]. - The company has also distributed cash dividends totaling 51.63 million CNY over the past two years, indicating a commitment to returning value to shareholders [9]. IPO and Fundraising Plans - Initially, the company planned to raise 770 million CNY, exceeding its net asset size, but this amount has been significantly reduced to 390.10 million CNY after scrutiny from the market and the review committee. The revised fundraising plan focuses on upgrading tire products, establishing a research center, and enhancing digital management systems [10][18]. - The adjusted fundraising amount represents 23.69% of the latest total assets and 17.00% of the most recent annual revenue, making it a more reasonable target compared to the original plan [18]. Future Outlook and Risks - Despite the promising market outlook, the company faces potential risks associated with its unique business model and the ongoing issues with its main supplier. The construction period for new projects may lead to short-term profit declines due to high depreciation and amortization costs [18][20].

生产全靠外包,这家轮胎企业要来IPO了……

Guo Ji Jin Rong Bao· 2025-07-24 12:09

Core Viewpoint - Qingdao Taike Ying Special Tire Co., Ltd. (referred to as "Taike Ying") is set to undergo a review by the North Exchange's IPO committee, marking a long-awaited step towards its public listing after starting its red-chip structure in 2019 [1][11]. Company Overview - Taike Ying specializes in the design, research, sales, and service of tires for mining and construction, focusing on engineering radial tires and all-steel truck tires [3][4]. - The company ranks third among Chinese brands and eighth globally in engineering radial tires as of 2023, with a leading market share in large-tonnage crane tires domestically [3][4]. Business Model - The company operates a unique business model that emphasizes research and development without any in-house production, relying on contract manufacturing for its products [4][5]. - Taike Ying has established a "main and auxiliary backup" supplier system to ensure product delivery despite the current debt issues faced by its main contract manufacturer, Xingda Tire [5][6]. Financial Performance - The company has shown stable growth in its financial performance, with operating profits of 140.98 million, 178.63 million, and 199.87 million yuan over the past three years, and net profits of 108.34 million, 137.93 million, and 156.65 million yuan respectively [8]. - The net profit margins have remained relatively stable, with net profit rates of 6.01%, 6.79%, and 6.82% during the same period [8]. IPO and Fundraising - Initially, the company planned to raise over its net asset value but has since reduced its fundraising target significantly to 390.10 million yuan, focusing on three key projects aimed at enhancing product competitiveness and research capabilities [12][13]. - The revised fundraising plan now represents 23.69% of the latest total assets and 17.00% of the most recent annual revenue, making it appear more reasonable compared to the original target [12]. Risks and Challenges - The main contract manufacturer, Xingda Tire, is currently undergoing a debt resolution process, which poses a risk to Taike Ying's supply stability if the situation worsens [6][7]. - The company anticipates that the initial phase of its fundraising projects may negatively impact its profits due to high depreciation and amortization costs, projecting a profit reduction of approximately 2.51 million yuan in the first year of project implementation [14].