Home Appliances

Search documents

Electrolux Q3 profit jumps as North America business picks up

Yahoo Finance· 2025-10-30 07:03

Core Insights - Electrolux reported a more than doubling of profit in Q3, driven by recovery in its North America business, which compensated for higher U.S. trade tariff costs [1][2] - The operating profit increased to 890 million crowns ($94.5 million) from 349 million crowns a year earlier, with organic sales growth of 5% primarily from double-digit growth in North America [1][2] Financial Performance - Operating profit rose to 890 million crowns ($94.5 million) compared to 349 million crowns in the same quarter last year [1] - Analysts had forecasted an operating profit of 875 million crowns, indicating that the actual performance exceeded expectations [2] Market Dynamics - The North America business gained market share despite previous struggles with high costs and competition [2] - Demand in the U.S. remained largely unchanged, with inflation concerns related to tariffs impacting consumer confidence [3] - Electrolux's main brands managed to gain market share despite ongoing price competition across all regions [3] Management Changes - Electrolux appointed Patrick Minogue as the head of its North America division [3]

美的集团_2025 年三季度初步点评_营收与利润率表现稳健,To C 业务增长超预期且 To B 业务持续强劲

2025-10-30 02:01

Summary of Midea Group 3Q25 Conference Call Company Overview - **Company**: Midea Group (000333.SZ) - **Industry**: Home Appliances and HVAC Key Financial Performance - **3Q25 Results**: - Total revenue: Rmb112 billion, up +10% YoY - Net profit: Rmb12 billion, up +9% YoY - Revenue and net profit exceeded expectations by +2% and +6% respectively [1][7] - **Gross Profit Margin (GPM)**: Increased by 0.3 percentage points YoY to 26.7% - **Operating Profit Margin (OPM)**: Increased by 1.4 percentage points YoY to 10.6% [1][3] Business Segments Performance - **2C (Consumer) Business**: - Implied growth of ~10% in 3Q25, driven by resilience in overseas markets [2] - Domestic split AC, washing machines, and refrigerator shipments showed mixed results: -9%, +2%, and +5% YoY respectively [2] - **2B (Business Solutions)**: - Continued robust growth with double-digit percentage increases, particularly in intelligent building solutions [2] - Sales in energy solutions, industrial technology, and robotics grew by +21%, +25%, and +9% YoY respectively in 9M25 [2] Margin and Efficiency Insights - **Margin Improvement**: - GPM expansion primarily from the AC business due to pricing and product mix improvements [3] - OPM increase supported by efficiency gains, with a reduction in sales/admin expense ratio by 0.8 percentage points YoY [3] Cash Flow and Financial Health - **Operating Cash Flow**: - Generated Rmb20 billion in 3Q25, down from Rmb27 billion in 3Q24, attributed to support for distributors during DTC transformation [4] - **Balance Sheet**: - Maintains a healthy balance sheet with a high net cash position and strong cash flow generation to support CAPEX and shareholder returns [6] Investment Thesis - **Market Position**: - Midea is a leading player in China's HVAC and major appliances market, with rapid expansion into overseas markets and business solutions [8] - **Growth Drivers**: - Focus on intelligent building solutions as a significant long-term growth driver due to revenue opportunities and market consolidation potential [8] Valuation and Risks - **Price Target**: - 12-month target price of Rmb94 for A-shares and HK$101 for H-shares, based on a 16x exit multiple applied to 2027E EPS [9] - **Key Risks**: - Potential demand disruption in white goods due to weaker global macro conditions - Rising material costs impacting product margins - Execution risks related to premiumization strategy - Increased competition in the low-to-mid-end segment [10] Conclusion - Midea Group's strong performance in 3Q25, driven by both consumer and business segments, along with effective margin management and a solid balance sheet, positions the company favorably for future growth in the competitive home appliances and HVAC market.

Aterian Announces Availability of hOmeLabs Dehumidifiers on HomeDepot.com

Globenewswire· 2025-10-29 12:30

Core Points - Aterian, Inc. announced the availability of its hOmeLabs brand line of dehumidifiers on Home Depot's website, enhancing its digital presence and sales strategy [1][3] - The hOmeLabs dehumidifiers are designed for improved health and efficiency, featuring user-friendly controls, Energy Star ratings, portability, and Wi-Fi capabilities [2] - Aterian aims to strengthen its brand presence and omni-channel sales approach through this partnership with Home Depot, a leading retail brand in the U.S. [3] Company Overview - Aterian, Inc. is a consumer products company that develops and acquires e-commerce brands across various categories, including home appliances and air quality devices [5] - The company sells products on major online marketplaces such as Amazon, Walmart, and Target, as well as through its own direct-to-consumer channels [5] - Aterian's brand portfolio includes well-known names like Mueller Living, PurSteam, hOmeLabs, and Squatty Potty [5] Home Depot Overview - Home Depot is the largest home improvement specialty retailer globally, operating over 2,353 retail stores and more than 325 distribution centers [4] - The company employs over 470,000 associates and is included in the Dow Jones Industrial Average and S&P 500 index [4]

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

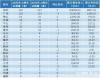

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].

India’s $200 million-an-hour IPO boom shows rise of local investors

The Economic Times· 2025-10-29 03:52

Core Insights - India has emerged as one of the world's hottest IPO venues, with total proceeds approaching last year's record of $21 billion, driven by significant local investor participation [1][28] - The current IPO wave is characterized by a shift towards domestic investors, including mutual funds and retail investors, reducing reliance on foreign funds and fostering a self-sustaining IPO market [2][28] - Despite the euphoria, there are concerns regarding excessive valuations and high over-subscription rates, which could lead to potential corrections affecting retail investors [3][28] Investment Trends - Local investors have invested 979 billion rupees in IPOs since the start of 2024, compared to 790 billion rupees from foreign funds, with domestic investments accounting for nearly 75% of total IPO proceeds for 2025 [6][28] - The participation of domestic institutional investors has increased, with their ownership in over 2,000 companies rising to 19.2%, the highest in 25 years, while foreign portfolio investor holdings have decreased to 17.3% [12][28] - Indian IPOs have generated a weighted average return of 18% this year, outperforming the NSE Nifty 50 Index's 9.7% gain, despite foreign outflows of approximately $16 billion [13][28] Market Dynamics - The IPO market is experiencing a diverse range of issuers, moving beyond tech startups to include companies in sectors like fintech and renewables, reflecting a broader market landscape [19][27] - The rapid growth of retail investing, facilitated by mobile trading apps and social media, has created millions of first-time equity investors, contributing to the robust demand for IPOs [10][11] - The median return for stocks one month after listing has decreased to 2.9% this year, down from 22% last year, indicating a potential fading ability to generate quick returns [23][29] Future Outlook - Analysts expect 2026 to be another strong year for IPOs, with proceeds potentially setting new records, drawing parallels to the early years of China's IPO boom [24][25] - India is home to over 90 private firms valued at over $1 billion, positioning it as the third-largest market for unicorns globally, supported by favorable regulatory changes [26][27] - The increasing breadth of the IPO market is attributed to the emergence of new themes and sectors, enhancing liquidity and investment opportunities [27]

海信家电_2025 年三季度初步点评_因中央空调和出口业务不及预期,但国内白色家电增长仍健康

2025-10-29 02:52

Summary of Hisense Home Appliances Group (000921.SZ) 3Q25 Earnings Call Company Overview - **Company**: Hisense Home Appliances Group - **Ticker**: 000921.SZ - **Reporting Period**: 3Q25 Key Financial Results - **Total Revenue**: Rmb 22,192 million, up by +1% year-over-year (yoy) - **Net Profit**: Rmb 735 million, down by -5% yoy - **Comparison to Estimates**: Revenue and net profit were -4% and -16% below Goldman Sachs estimates respectively [1][4][5] Core Insights and Arguments - **Central AC and Exports**: The central air conditioning (AC) business continues to face pressure, contributing to lower revenue growth. Exports of AC units have also moderated, impacting overall performance [4][6] - **Domestic Market Performance**: Despite challenges in the central AC segment, domestic white goods showed healthy growth, particularly in washing machines and refrigerators, which demonstrated resilience in both domestic and overseas markets [4][6] - **Margin Decline**: Gross Profit Margin (GPM) and Operating Profit Margin (OPM) declined by 0.6 percentage points and 0.1 percentage points yoy to 20.2% and 3.9% respectively. This decline is attributed to lower contributions from the higher-margin central AC segment and increased domestic competition [4][5] Management Focus Areas for Future - **Earnings Call Topics**: Management will address several key areas during the earnings call, including: 1. Breakdown of sales channels in 3Q25 and outlook for the central AC business 2. Impact of trade-in stimulus on the legacy white goods business 3. Changes in competitive intensity, particularly in split ACs 4. Updates on export orders and tariff impacts 5. Measures to enhance operating efficiency and margins [2][4] Investment Thesis - **Buy Rating Justification**: The investment thesis supports a Buy rating based on: 1. High earnings growth visibility, particularly with the 2024 Employee Stock Ownership Plan (ESOP) target 2. Attractive dividend yield 3. Valuation metrics indicating the stock is trading at an undemanding forward Price-to-Earnings (P/E) ratio against high single-digit profit growth expectations [6][7] Risks to Consider - **Key Risks**: 1. Potential disruption in white goods demand due to weaker global macroeconomic conditions 2. Further slowdown in the property market affecting demand for Variable Refrigerant Flow (VRF) systems 3. Increased competition from domestic players threatening the Hisense-Hitachi joint venture's leading position 4. Margin dilution from greater penetration in the developer channel 5. Below-expected integration performance of the Hisense-Hitachi joint venture 6. Underperformance of the legacy white goods business [8][6] Conclusion Hisense Home Appliances Group's 3Q25 results reflect a mixed performance with challenges in the central AC segment and exports, while domestic white goods show resilience. The company is focusing on improving margins and operational efficiency, with a positive long-term outlook supported by strategic initiatives and a favorable investment thesis. However, several risks could impact future performance.

India’s red-hot IPO market, minting $200 million an hour, mirrors China’s rise

BusinessLine· 2025-10-29 00:32

Core Insights - LG Electronics India Ltd.'s $1.3 billion IPO was fully sold in just six-and-a-half hours, marking the fastest take-up in 17 years among major Indian IPOs, contributing to India's status as a leading IPO market globally [1][9][17] - The current IPO wave is characterized by a significant shift towards domestic investors, with local mutual funds, insurers, and retail investors dominating the market, reducing reliance on foreign funds [3][6][14] Investment Trends - Domestic investors have invested ₹97,900 crore in IPOs since the start of 2024, compared to ₹79,000 crore from foreign funds, with domestic investments accounting for nearly 75% of total IPO proceeds in 2025 [6][14] - The participation of domestic institutional investors in over 2,000 companies has increased to 19.2%, the highest in 25 years, while foreign portfolio investors' holdings have decreased to 17.3% [13] Market Dynamics - The Indian IPO market is experiencing a structural shift, with a growing number of first-time equity investors driven by mobile trading apps and social media content [10][11] - New IPOs have generated a weighted average return of 18% this year, outperforming the NSE Nifty 50 Index's 9.7% gain, despite significant foreign outflows [14][19] Future Outlook - The robust demand from local investors has made the equity market a preferred venue for issuers, with 80 firms approved for IPOs and another 121 applications filed [15][20] - Upcoming large IPOs from companies like Reliance Jio Infocomm Ltd. and Flipkart India Pvt. are anticipated to further boost the market [16][20] Valuation Concerns - Despite the current euphoria, there are concerns regarding excessive valuations and over-subscription rates, which could lead to potential corrections in the market [4][22] - Nearly half of the IPOs listed this year are underperforming, with the median return one month post-listing dropping to 2.9% from 22% last year [23][24] Regulatory Environment - A favorable regulatory backdrop is aiding the IPO market, with recent changes making it easier for large private firms to go public and relaxed loan rules for investors [28]

A. O. Smith Q3 Earnings Surpass Estimates, Sales Increase Y/Y

ZACKS· 2025-10-28 18:10

Core Insights - A. O. Smith Corporation (AOS) reported third-quarter 2025 adjusted earnings of 94 cents per share, exceeding the Zacks Consensus Estimate of 89 cents, marking a 15% year-over-year increase [1][8] - Net sales reached $942.5 million, surpassing the consensus estimate of $936 million, with a 4% year-over-year growth driven by higher water heater and boiler sales in North America [1][8] Segmental Performance - North America sales increased by 6% year-over-year to $742.8 million, outperforming the estimated $722.2 million, attributed to higher commercial water heater and boiler volumes [2] - Earnings from North America were $179.7 million, reflecting an 11% year-over-year increase [2] - Sales in the Rest of the World segment totaled $207.9 million, down 1% year-over-year, with China sales decreasing by 12%, while organic sales in India grew by 13% [3] - The Rest of the World segment's earnings rose by 13.2% year-over-year to $15.4 million due to cost reduction measures [3] Financial Metrics - A. O. Smith's cost of sales was $578.0 million, up 2.2% year-over-year, while selling, general, and administrative expenses increased by 7% to $188.9 million [4] - Gross profit increased by 8.1% year-over-year to $364.5 million, resulting in a gross margin of 38.7%, up from 37.4% in the previous year [4] - Interest expenses rose to $3.6 million from $1.5 million in the year-ago quarter [4] Liquidity and Cash Flow - As of September 30, 2025, cash and cash equivalents totaled $152.7 million, down from $239.6 million at the end of December 2024 [5] - Long-term debt decreased to $166.8 million from $183.2 million at the end of December 2024 [5] - Cash provided by operating activities for the first nine months of 2025 was $433.7 million, compared to $359.9 million in the same period last year [5] Share Repurchase Activity - In the first nine months of 2025, A. O. Smith repurchased 5 million shares for $335.4 million, with approximately 1.8 million shares remaining under the current repurchase authorization as of September 2025 [6] 2025 Outlook - A. O. Smith updated its 2025 sales outlook, now expecting net sales in the range of $3.50-$3.80 billion, down from the previous estimate of $3.85-$3.93 billion [9] - The company projects adjusted earnings per share (EPS) to be between $3.70-$3.85, slightly revised from the earlier expectation of $3.70-$3.90 [9]

A. O. Smith(AOS) - 2025 Q3 - Earnings Call Presentation

2025-10-28 14:00

Financial Performance - Sales increased by 4% year-over-year, reaching $943 million in Q3 2025, compared to $903 million in Q3 2024[11] - Earnings Per Share (EPS) increased by 15% year-over-year, reaching $0.94 in Q3 2025, compared to $0.82 in Q3 2024[11] - North America segment sales increased by 6% year-over-year[22] - China third-party sales declined 12% in local currency[28] - Legacy India business grew 13% and Pureit added $17 million to the quarter[28] - Free cash flow year-to-date September 2025 was $381 million, compared to $283 million for the same period in 2024[30] Segment Performance - North America segment earnings were $180 million in Q3 2025, compared to $163 million in Q3 2024[23] - Rest of World segment sales decreased by 1% year-over-year to $208 million in Q3 2025, from $210 million in Q3 2024[25] - Rest of World segment operating margin expanded 90 basis points[28] - North America segment margin increased 110 bps to 242 percent[15] Sustainability - Achieved a 30% reduction in greenhouse gas intensity by 2024, exceeding the 2025 goal of 10% reduction[16] - Achieved annual water savings of 36 million gallons, progressing towards the 2030 goal of 40 million gallons[18]

Earnings live: PayPal stock soars on OpenAI partnership, UPS surges, UnitedHealth pops

Yahoo Finance· 2025-10-28 12:04

Core Insights - Whirlpool reported better-than-expected financial results, with revenue of $4.03 billion surpassing Wall Street's forecast of $3.93 billion and adjusted earnings per share at $2.09 compared to estimates of $1.40 [1] Financial Performance - Revenue for the quarter was $4.03 billion, exceeding expectations [1] - Adjusted earnings per share were $2.09, significantly higher than the anticipated $1.40 [1] - For the full year, Whirlpool reiterated net sales of approximately $15.8 billion, with adjusted earnings per share now expected to be around $7.00, up from a previous range of $6 to $8 [4] Product Performance - Major domestic appliances in North America saw a 2.8% increase, driven by a refresh of 30% of the product portfolio [2] - Small domestic appliances globally experienced a 10.5% growth, largely due to the KitchenAid business, which reported double-digit revenue growth [2] Market Outlook - The company anticipates that new products will gain traction in the fourth quarter and into the next year as they increase their presence in retail [3] - Whirlpool is positioned well to capture growth as consumers return to the housing market [3] Regional Performance - A decline of 7.2% in major domestic appliances was noted in Asia, attributed to cooler weather and currency volatility in Argentina, which also affected Latin America with a 5.2% decline [4] External Factors - Tariffs impacted margins by 250 basis points in the third quarter, despite over 80% of US sales being produced domestically [5] - The company is seeking clarity on trade issues, particularly in light of an upcoming summit between US and Chinese leaders [6] - The fourth quarter is expected to be highly promotional as Whirlpool competes with companies facing excess inventory ahead of tariffs [6]