高效浮选药剂

Search documents

赛恩斯拟发不超5.7亿可转债 前3季净利降半IPO募4.5亿

Zhong Guo Jing Ji Wang· 2025-10-30 06:29

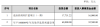

Core Viewpoint - The company Sains (688480.SH) has announced a plan to issue convertible bonds to raise a total of up to 565 million yuan, which will be used for various projects and to supplement working capital [1][2]. Group 1: Convertible Bond Issuance - The total amount to be raised from the issuance of convertible bonds is capped at 565 million yuan, which includes the principal amount [1]. - The net proceeds after deducting issuance costs will be allocated to three main projects: the expansion of the flotation reagent project, the construction of a high-efficiency flotation reagent project with an annual production capacity of 100,000 tons, and to supplement working capital [1][2]. - The bonds will be issued at par value, with a face value of 100 yuan each, and the total number of bonds to be issued will not exceed 5,650,000 [2][3]. Group 2: Financial Performance - For the first three quarters of 2025, the company reported a revenue of 677 million yuan, representing a year-on-year increase of 15.81% [3]. - The net profit attributable to shareholders decreased by 48.32% to 74 million yuan, while the net profit excluding non-recurring gains and losses fell by 10.78% to 72 million yuan [3]. - The net cash flow from operating activities was reported at 37 million yuan [3]. Group 3: Previous Fundraising and Stock Performance - The company was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on November 25, 2022, raising a total of 454.69 million yuan, with a net amount of 399.24 million yuan after costs [4]. - The stock price reached a new high of 64.99 yuan on October 14, 2025, marking the highest price since its listing [5].

格隆汇公告精选︱金帝股份:拟投资2.88亿元建设高端精密轴承保持器数字化转型升级项目

Ge Long Hui A P P· 2025-10-29 16:19

Group 1 - Linyi Intelligent Manufacturing plans to issue H-shares and list on the Hong Kong Stock Exchange [1] - Jindi Co., Ltd. intends to invest 288 million yuan in a digital transformation project for high-end precision bearing retainers [1] - Tengda Construction has won contracts totaling 1.231 billion yuan in the first three quarters [1] Group 2 - Huali Co., Ltd. plans to acquire 51% of Zhongke Huilian's shares to accelerate its digital transformation [1] - Hemai Co., Ltd. intends to repurchase shares worth 100 million to 200 million yuan [1] - Zhongwei Company reported a net profit of 1.211 billion yuan in the first three quarters, a year-on-year increase of 32.66% [1] Group 3 - Greenfield Machinery's shareholder plans to reduce holdings by no more than 3% [1] - Longyuan Power plans to raise no more than 5 billion yuan through a private placement for wind power projects [1][2] - Sains plans to issue convertible bonds to raise no more than 565 million yuan for a project to produce 100,000 tons per year of efficient flotation agents [2]

赛恩斯(688480.SH):拟发行可转债募资不超5.65亿元 投于年产100000吨/年高效浮选药剂建设项目等

Ge Long Hui A P P· 2025-10-29 13:33

Core Viewpoint - Sains (688480.SH) announced a plan to issue convertible bonds to unspecified investors, with a total fundraising amount not exceeding 565 million yuan, which will be used for various projects and working capital [1] Group 1: Fundraising Details - The total amount of funds raised from the issuance of convertible bonds is capped at 565 million yuan, including the principal [1] - The net proceeds from the fundraising, after deducting issuance costs, will be allocated to specific projects [1] Group 2: Project Allocation - The funds will be used for the expansion of the selection and flotation reagent project (Phase I) [1] - A construction project for an annual production capacity of 100,000 tons of high-efficiency flotation reagents will also be funded [1] - Additional funds will be allocated to supplement working capital [1]

赛恩斯:拟募资不超5.65亿元 用于选冶药剂再扩建项目(一期)等

Ge Long Hui A P P· 2025-10-29 11:33

Group 1 - The company, Sains (688480.SH), announced plans to issue convertible bonds to raise no more than 565 million yuan [1] - The funds will be used for the expansion of the selection and flotation reagent project (Phase I) and the construction of a 100,000 tons per year high-efficiency flotation reagent production project [1] - Additionally, the raised capital will be allocated to supplement working capital [1]

赛恩斯:拟募资不超过5.65亿元 用于选冶药剂再扩建项目(一期)等

Mei Ri Jing Ji Xin Wen· 2025-10-29 11:24

Core Viewpoint - Company Sains (688480.SH) plans to issue convertible bonds to raise no more than 565 million yuan for the expansion of its flotation reagent project and to supplement working capital [1] Group 1 - The company intends to use the funds for the first phase of the flotation reagent expansion project [1] - The company aims to construct a project with an annual production capacity of 100,000 tons of high-efficiency flotation reagents [1] - The total amount to be raised through the issuance of convertible bonds is capped at 565 million yuan [1]

赛恩斯(688480):运营服务和产品销售增速亮眼 看好公司品类扩张潜力

Xin Lang Cai Jing· 2025-08-26 00:33

Core Viewpoint - The company reported its 2025 H1 financial results, showing a revenue increase but a significant decline in net profit, primarily due to the impact of its comprehensive solution business and one-time investment gains from the previous year [1][2]. Financial Performance - In 2025 H1, the company achieved a revenue of 423 million yuan, a year-on-year increase of 18.8%, while the net profit attributable to shareholders was 49.03 million yuan, a decrease of 57.5% [1]. - The Q2 revenue was 253 million yuan, reflecting a slight growth of 0.34% year-on-year, with a net profit of 31.3 million yuan, down 12.9% [1]. - The adjusted net profit, excluding one-time gains, showed an 8.75% decline year-on-year [2]. Business Segment Analysis - Revenue from the comprehensive solution business, operational services, and product sales in 2025 H1 was 53 million yuan, 201 million yuan, and 166 million yuan, respectively, with year-on-year changes of -49.8%, +53.0%, and +41.8% [2]. - The gross margin for 2025 H1 decreased by 2.08 percentage points to 35.0%, with product sales, operational services, and comprehensive solutions having gross margins of 45.1%, 29.8%, and 21.0%, respectively [2]. Cost Structure - The company's expense ratio increased slightly to 20.0% in 2025 H1, up 0.52 percentage points year-on-year, driven by higher R&D and sales expenses [2]. Future Outlook - The company has set ambitious targets in its stock incentive plan, aiming for a revenue CAGR of 24.9% and a non-GAAP profit CAGR of 17.0% from 2025 to 2027 [4]. - Profit forecasts for 2025-2027 are 153 million yuan, 236 million yuan, and 299 million yuan, with expected growth rates of 28.6% for 2025 and 54.1% and 26.5% for 2026 and 2027, respectively [4].

赛恩斯(688480):运营服务和产品销售增速亮眼,看好公司品类扩张潜力

Changjiang Securities· 2025-08-25 23:30

Investment Rating - The investment rating for the company is "Buy" and is maintained [9] Core Views - The company achieved a revenue of 423 million yuan in H1 2025, representing a year-on-year growth of 18.8%. However, the net profit attributable to shareholders decreased by 57.5% to 49.03 million yuan, while the net profit excluding non-recurring items fell by 12.7% to 47.22 million yuan [2][6] - Excluding the one-time investment income impact from H1 2024, the net profit attributable to shareholders in H1 2025 decreased by 8.75%, primarily due to the drag from the comprehensive solution business. In contrast, the operational services and product sales showed impressive growth, with revenues increasing by 53.0% and 41.8% respectively [2][12] - The company is expanding its copper extraction agent production capacity, achieving a doubling of capacity. The resource recycling and new materials projects are gradually being implemented, indicating potential for category expansion and new growth opportunities [2][12] Summary by Sections Financial Performance - In H1 2025, the company reported revenues of 423 million yuan, a year-on-year increase of 18.8%. The net profit attributable to shareholders was 49.03 million yuan, down 57.5%, while the net profit excluding non-recurring items was 47.22 million yuan, down 12.7% [6][12] - For Q2 2025, the company achieved revenues of 253 million yuan, a slight increase of 0.34% year-on-year, with a net profit of 31.30 million yuan, down 12.9% [6][12] - The comprehensive solution business saw a revenue decline of 49.8%, while operational services and product sales grew significantly [12] Business Segments - Revenue breakdown for H1 2025: heavy metal pollution prevention solutions generated 53 million yuan, operational services 201 million yuan, and product sales 166 million yuan [12] - The gross margin for H1 2025 decreased by 2.08 percentage points to 35.0%, with product sales, operational services, and comprehensive solutions having gross margins of 45.1%, 29.8%, and 21.0% respectively [12] Growth Potential - The core subsidiary, Longli Chemical, reported a net profit of 26.63 million yuan in H1 2025, a year-on-year increase of 76.5%. The total production capacity for copper extraction agents increased from 3,400 tons/year to 7,000 tons/year, a 106% increase [12] - The company is actively pursuing multiple research projects, including lithium slag recycling and high-value recovery of rare metals, with promising results in new lithium extraction agents [12] - A stock incentive plan was announced in July 2025, targeting a revenue CAGR of 24.9% and a net profit CAGR of 17.0% from 2025 to 2027 [12]

赛恩斯(688480):2025H1业绩预告点评:费用、减值拖累业绩,开展药剂投资,股权激励锁定增长

Soochow Securities· 2025-08-01 07:37

Investment Rating - The investment rating for the company is "Buy" (maintained) [1] Core Views - The company reported a decline in net profit for the first half of 2025, primarily due to increased expenses and impairment losses, despite revenue growth driven by operational services and product sales [7] - The company has initiated a stock incentive plan aimed at achieving significant growth in net profit from 2025 to 2027, reflecting confidence in future performance [7] - The company plans to expand its product offerings in the chemical sector, particularly in flotation agents and sodium sulfide, to capitalize on market demand [7] Financial Summary - The company expects total revenue to grow from 808.41 million RMB in 2023 to 1,724.02 million RMB by 2027, with a compound annual growth rate (CAGR) of approximately 16.86% [1] - The forecasted net profit for 2025 is adjusted to 163.15 million RMB, a decrease of 9.74% compared to the previous year, with a projected P/E ratio of 25.36 [1][7] - The company anticipates a significant increase in revenue and net profit over the next few years, with a target of 30% revenue growth in 2025 [7]

赛恩斯20250728

2025-07-29 02:10

Summary of Conference Call Notes Company Overview - **Company Name**: 长江环保 (Changjiang Environmental Protection) - **Industry**: Environmental Protection and Resource Recovery - **Founded**: 2009 by a team from Central South University - **Key Milestones**: Listed at the end of 2022, expanded into overseas markets post heavy metal pollution incident in Jiangxi Core Business and Market Performance - **Business Segments**: - Comprehensive Solutions (EPC) - Operational Services - Product Sales - **Revenue Composition**: - Product sales are becoming the core focus, with a projected increase in revenue share - EPC revenue share decreased from 70% in 2019 to 33% in 2024, while operational services increased from 8.9% to 35% in the same period [5][6] - **Market Potential**: - In the copper, lead, and zinc industry, the annual EPC market space is approximately 1.4 billion CNY, and operational space is 7.1 billion CNY [9] - The company aims to increase market share in the acid-free and wastewater treatment sectors, with potential revenue reaching 1.03 billion CNY if market shares reach 30% and 10% respectively [9] Financial Goals and Incentives - **Equity Incentive Plan**: - Revenue growth targets set at 30%, 15%, and 30% for 2025, 2026, and 2027 respectively, with a compound annual growth rate (CAGR) of 25% [6] - Profit growth targets are 20%, 20%, and 10% for the same years, with a CAGR of 17% [6] Strategic Partnerships - **Key Client**: 紫金矿业 (Zijin Mining) - Transaction amounts with Zijin increased from 140 million CNY in 2022 to approximately 300 million CNY in 2024 [10][11] - The partnership is expected to deepen, with Zijin's overseas projects being managed by the company [11] Recent Developments and Projects - **Acquisition**: - Acquired 龙利化学 (Longli Chemical) to enter the chemical agent sector, focusing on copper extraction agents [13] - Sales dependency on Zijin reduced to about 20%, enhancing sustainability [14] - **New Projects**: - Announced a high-efficiency flotation agent project with a total capacity of 100,000 tons and an investment of 600 million CNY [16] - Initiated a high-purity sodium sulfide project with a capacity of 60,000 tons and an investment of 210 million CNY [21] Market Expansion and Future Outlook - **Overseas Market**: - Benefiting from Chinese enterprises acquiring mining projects in Africa and Central Asia, with significant revenue from Congo and Chile [15] - **Resource Recovery Strategy**: - Focus on expanding resource recovery projects, including rhenium recovery, with a potential revenue of 19 million CNY if fully operational [19][20] - **Overall Development Outlook**: - Strong sustainability in core business, with a shift towards chemical agents and resource recovery expected to drive future growth [23]

赛恩斯: 申万宏源证券承销保荐有限责任公司关于赛恩斯环保股份有限公司2025年度公司及子公司增加申请综合授信额度以及提供担保额度的核查意见

Zheng Quan Zhi Xing· 2025-07-21 12:08

Core Viewpoint - The company, Sains Environmental Co., Ltd., is seeking to increase its comprehensive credit limit and guarantee amount to support new project investments in Anhui and Shandong provinces, with a total credit limit proposed to reach up to RMB 1.7 billion [1][2]. Summary by Sections Previous Approval Overview - The company previously approved a comprehensive credit limit of up to RMB 1.5 billion and a mutual guarantee amount not exceeding RMB 300 million during a board meeting on April 23, 2025 [1]. New Credit Application Overview - The company plans to apply for an additional comprehensive credit limit of up to RMB 200 million, raising the total limit to RMB 1.7 billion. This credit will support various financing needs, including medium to long-term project loans and trade financing [2]. New Guarantee Application Overview - The company intends to increase the mutual guarantee amount between itself and its subsidiaries by up to RMB 100 million, bringing the total guarantee amount to RMB 400 million. This is aimed at enhancing flexibility for business development while maintaining risk control [2]. New Guarantee/Guaranteed Entities - Shandong Longli Chemical Co., Ltd. is a proposed wholly-owned subsidiary responsible for a project with an estimated investment of RMB 600 million [3]. - Tongling Longrui Chemical Co., Ltd. is a proposed holding subsidiary with an estimated investment of RMB 210 million for a project [4]. Reasons and Necessity for Guarantees - The guarantees are necessary to support the company's strategic development and ensure controlled risks, which will not adversely affect the interests of the company and its shareholders [5]. Review Procedures and Opinions - The board of directors approved the increase in credit and guarantee limits on July 19, 2025, and the proposal will be submitted for shareholder approval [5]. - The supervisory board supports the proposal, stating it will not negatively impact the company's financial status or independence [5]. Cumulative External Guarantee Amount - As of the disclosure date, the company has a balance of zero for mutual guarantees provided to subsidiaries [6]. Sponsor's Review Opinion - The sponsor believes the decision-making process for increasing the credit and guarantee limits complies with relevant laws and regulations, and it aligns with the company's operational and growth needs [6].