AI模块

Search documents

把普通毛绒玩具改造成AI玩具,需要多少时间?深圳华强北有答案→

Xin Lang Cai Jing· 2026-01-31 05:01

Group 1 - The core idea of the article highlights the rapid innovation in AI technology at Huaqiangbei, where traditional electronic component vendors are transforming into AI product developers and manufacturers [1][8]. - Huaqiangbei has evolved from a market known for electronic components to a hub for AI hardware, enabling quick prototyping and production, with a significant number of design and manufacturing companies operating within a small area [10][12]. - The transformation allows for the rapid development of AI products, with the ability to design in the morning, prototype in the afternoon, and mass-produce by the next day, showcasing the efficiency of the local ecosystem [10][12]. Group 2 - The article mentions that Huaqiangbei has around 1,350 design companies, 3,200 R&D enterprises, and 3,480 mass production suppliers, contributing to an annual transaction volume exceeding 480 billion yuan [10]. - The cost of modifying a plush toy into an AI toy is approximately 90 yuan, with potential discounts for bulk modifications, indicating a low entry cost for innovation [6]. - The local market's feedback mechanism allows for real-time adjustments and improvements in product offerings, making it a dynamic environment for tech innovation [8][12].

首家“A+H”无线通信模组企业来了!广和通今天登陆港交所

Zheng Quan Shi Bao Wang· 2025-10-22 13:12

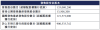

Core Viewpoint - Guanghetong officially listed on the Hong Kong Stock Exchange on October 22, becoming the first wireless communication module company in China to achieve "A+H" listing and the 12th "A+H" enterprise listed this year [1] Group 1: Company Overview - Guanghetong was established in 1999 and is a leading global provider of wireless communication modules, offering products such as data transmission modules, intelligent modules, and AI modules, along with customized solutions for downstream application scenarios [2] - According to Frost & Sullivan, Guanghetong ranks as the second-largest wireless communication module provider globally, holding a market share of 15.4% [2] Group 2: Financial Performance - On its first day of trading, Guanghetong's H-shares opened at HKD 21.5, closing down 11.72% at HKD 18.98, while its A-shares fell 7.89% to CNY 27.57, indicating a premium of approximately 59.09% for A-shares compared to H-shares [1] - The company raised approximately HKD 29.03 billion through the global offering of about 135 million H-shares, with a net amount of HKD 28.11 billion after deducting issuance costs [1] Group 3: Use of Proceeds - Approximately 55% of the net proceeds from the IPO is expected to be allocated for R&D, focusing on AI and robotics technology innovation and product development [3] - About 15% of the net proceeds is planned for the construction of manufacturing facilities in Shenzhen, China, aimed at producing module products and terminal products as part of the company's solutions [3] - Around 10% of the net proceeds is intended for strategic investments and/or acquisitions, targeting companies in wireless communication, AI, robotics, and other complementary fields to enhance technological capabilities and expand market share [3] Group 4: Market Context - In 2023, 12 A-share companies have listed in Hong Kong, with four companies raising over HKD 10 billion, including CATL and Hengrui Medicine [4] - Among the 12 listed companies, 9 have seen their stock prices rise above the issue price, with some companies like Chifeng Jilong Gold and CATL doubling their stock prices [4]

广和通上市预冷:首日下跌12%,公司市值171亿港元,上半年利润降31%,勤道赣通浮亏5860万

3 6 Ke· 2025-10-22 09:37

Core Viewpoint - Guanghetong Wireless Co., Ltd. has successfully listed on the Hong Kong Stock Exchange, raising approximately HKD 2.911 billion, but its stock performance has been disappointing, closing down 11.72% from the issue price on the first day of trading [1][2]. Fundraising and Investor Participation - Guanghetong issued about 135 million H-shares at an offer price of HKD 21.5, with net proceeds of approximately HKD 2.811 billion after deducting issuance costs of HKD 93.6 million [1]. - Key cornerstone investors include Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), and others, collectively subscribing for HKD 1.26 billion [2]. Stock Performance - The stock opened at HKD 21.5 but closed at HKD 18.98, resulting in a market capitalization of HKD 17.092 billion, which is significantly lower than its A-share market cap of RMB 21 billion [2]. Financial Performance - For the first half of the year, Guanghetong reported revenue of RMB 2.48 billion, with a profit decline of 31% year-on-year [3][8]. - Revenue projections for 2022, 2023, and 2024 are RMB 5.2 billion, RMB 5.65 billion, and RMB 6.97 billion, respectively, with corresponding gross profits of RMB 1.066 billion, RMB 1.187 billion, and RMB 1.267 billion [6][7]. Business Overview - Guanghetong specializes in wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules, with applications in automotive electronics, smart homes, consumer electronics, and smart retail [5]. - The company has acquired 100% of Shenzhen Ruiling to expand its presence in the overseas automotive market, but plans to divest this business by July 2024 due to challenging international market conditions [5]. Shareholding Structure - As of June 30, 2025, Zhang Tianyu holds a 36.78% stake in the company, while other significant shareholders include Ying Lingpeng and New Yu Guanghe Chuanghong Investment Partnership [12][18].

广和通募29亿港元首日破发跌12% 广发基金管理等浮亏

Zhong Guo Jing Ji Wang· 2025-10-22 08:57

Core Viewpoint - Guanghetong Wireless Co., Ltd. (stock codes: 300638.SZ, 00638.HK) was listed on the Hong Kong Stock Exchange, closing at HKD 18.98, down 11.72% from its issue price, with an intraday low of HKD 18.89 [1] Summary by Sections Share Issuance and Capital Structure - The total number of shares issued under the global offering was 135,080,200 H-shares, with 13,508,200 shares for the Hong Kong public offering and 121,572,000 shares for international offering [2] - The number of shares issued at listing (before the exercise of the over-allotment option) was 900,533,742 [2] Key Investors - The cornerstone investors included Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), GF Fund Management, GF International, Ruihua Investment, Zhidu Investment, Zhang Xiaolei, Guotai Junan Securities Investment, and Junyi Hong Kong Fund [5] Pricing and Proceeds - The final offer price was HKD 21.50, with total proceeds amounting to HKD 2,904.2 million, and net proceeds after estimated listing expenses of HKD 93.6 million were HKD 2,810.6 million [7] - Approximately 55% of the net proceeds are expected to be allocated for R&D, particularly in AI and robotics technology innovation and product development [7] Use of Proceeds - About 15% of the net proceeds is planned for building manufacturing facilities in Shenzhen, China, primarily for module products [7] - 10% of the net proceeds is expected to be used for repaying certain interest-bearing bank loans [7] - Another 10% is anticipated for strategic investments and/or acquisitions, focusing on companies in wireless communication, AI, robotics, and other complementary fields [7] - The remaining 10% is expected to be used for working capital and other general corporate purposes [7] Company Overview - Guanghetong is a provider of wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules [8] - The company provides customized solutions based on its module products, including edge AI solutions, robotic solutions, and other applications [8]

广和通赴港二次上市,折价35%,给二级市场预留了一点水位

Sou Hu Cai Jing· 2025-10-14 14:31

Core Viewpoint - The China Securities Regulatory Commission (CSRC) is launching five new measures in 2024 to support mainland companies in listing in Hong Kong, including a 30-day fast-track approval process for A-share companies with a market capitalization exceeding 10 billion [1] Company Overview - Guanghetong, established in 1999 in Shenzhen, is a leading global provider of wireless communication modules and solutions, with a market share of 15.4% in 2024, making it the second-largest in the world [2][5] - The company offers a range of products including data transmission modules, smart modules, and AI modules, catering to various applications such as automotive electronics, smart homes, consumer electronics, and smart retail [2][3] Market Position - Guanghetong holds the largest market share in the smart home sector at 36.6% and in consumer electronics at 75.9%, while it ranks second in automotive electronics with a market share of 14.4% [3] Financial Performance - From 2022 to 2024, Guanghetong's revenue is projected to grow from 5.203 billion RMB to 6.971 billion RMB, reflecting a compound annual growth rate (CAGR) of over 14%. Net profit is expected to increase from 365 million RMB to 677 million RMB during the same period [5][6] - In the first half of 2025, the company reported a revenue of 3.707 billion RMB, a year-on-year decline of 9.02%, primarily due to the sale of its wireless vehicle-mounted business. Excluding this factor, the core business revenue grew by 23.49% [6] Revenue Breakdown - Guanghetong's overseas revenue accounts for approximately 60%, with Taiwan contributing 35.7% and the U.S. 10.9%. The company faces significant uncertainty due to potential geopolitical risks [8] Industry Outlook - The global IoT industry is experiencing rapid growth, with the number of IoT devices expected to reach 21.5 billion by 2025, a year-on-year increase of 14.4%. The integration of AI and IoT is anticipated to create new opportunities in the smart era [9] IPO Details - Guanghetong's IPO will issue 15% of its total shares, raising approximately 2.9 billion HKD at the upper end of the price range of 21.5 HKD per share. The company has secured cornerstone investments from 10 investors, accounting for 44.8% of the offering [12][10]

广和通(00638)招股

Xin Lang Cai Jing· 2025-10-14 05:30

Core Viewpoint - Guanghetong, a wireless communication module provider based in Nanshan District, Shenzhen, Guangdong, is launching its IPO from October 9 to October 14, 2025, with plans to list on the Hong Kong Stock Exchange on October 22, 2025, under the sponsorship of CITIC Securities [2][6]. Summary by Sections IPO Details - The company plans to issue 135.08 million H-shares, representing 15% of the total shares post-IPO, with 90% allocated for international offering and 10% for public offering [3][4]. - The expected share price range is between HKD 19.88 and HKD 21.50, aiming to raise approximately HKD 26.85 billion to HKD 29.04 billion [3][4]. - The entry fee for investors is HKD 4,343.37 for 200 shares [3]. Financial Projections - Assuming the midpoint of the share price at HKD 20.69 and no exercise of the over-allotment option, the total estimated expenses for the IPO are around HKD 105.4 million, which includes a 2% underwriting commission [4]. - The net proceeds from the IPO are projected to be approximately HKD 26.89 billion, with allocations of 55% for R&D, 15% for manufacturing facilities in Shenzhen, 10% for repaying bank loans, 10% for strategic investments or acquisitions, and 10% for working capital and other general corporate purposes [5]. Shareholder Structure - Post-IPO, the controlling shareholder, Mr. Zhang Tianyu, will hold 31.26% of the shares [7][8]. - Other shareholders include Mr. Ying Lingpeng with 2.83%, and various other shareholders holding a combined 68.74% [8]. Company Overview - Established in 1999, Guanghetong is a leading global provider of wireless communication modules, with products including data transmission modules, smart modules, and AI modules [8]. - According to Frost & Sullivan, Guanghetong ranks as the second-largest wireless communication module provider globally, with a market share of 15.4% in 2024 [8]. - The company leads in several downstream application markets, ranking second in automotive electronics with a market share of 26.8%, and first in smart home and consumer electronics with market shares of 15.1% and 5%, respectively [8].

优秀!从会计到年薪236万CFO,如今又助公司赴港IPO!

Sou Hu Cai Jing· 2025-09-19 10:31

Core Viewpoint - Guanghetong Wireless Co., Ltd. plans to issue up to approximately 155 million shares for overseas listing on the Hong Kong Stock Exchange, with a current market capitalization of about 23.5 billion RMB as of September 18 [3][4]. Company Overview - Guanghetong, established in 1999, is a leading global provider of wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules, along with customized solutions for various applications [4]. - The company holds a 15.4% market share in the global wireless communication module market, ranking as the second-largest provider globally [4]. Market Position - Guanghetong ranks first in several downstream application markets, including automotive electronics (24.6% market share), smart home (36.6%), and consumer electronics (75.9%) [4]. Financial Performance - Revenue for Guanghetong is projected to be 5.2 billion RMB in 2022, 5.65 billion RMB in 2023, and 6.97 billion RMB in 2024, with corresponding gross profits of 1.066 billion RMB, 1.187 billion RMB, and 1.267 billion RMB [5]. - The gross profit margins are 20.5% for 2022, 21% for 2023, and 18.2% for 2024 [5]. - Operating profits are expected to be 335 million RMB in 2022, 400 million RMB in 2023, and 387 million RMB in 2024, with operating profit margins of 6.4%, 7.1%, and 5.6% respectively [5]. - Net profits are projected at 365 million RMB for 2022, 565 million RMB for 2023, and 677 million RMB for 2024, with net profit margins of 7%, 10%, and 9.7% [5]. Strategic Decisions - In response to complex international market conditions, Guanghetong has decided to sell its overseas automotive communication business operated by its subsidiaries in Hong Kong and Luxembourg by July 2024 [5].

广和通港股IPO背后:募投必要性存疑?市场格局好但产业链话语权是否强

Xin Lang Zheng Quan· 2025-04-30 08:16

Group 1 - Since 2025, there has been a surge in A-share listed companies planning to list on the Hong Kong stock market, with over 30 companies having submitted applications or announced plans for such listings [1][2] - Companies are motivated by the desire to enhance their global business presence and competitiveness, as indicated by their announcements regarding the benefits of global development [3] - Supportive policies from the Chinese government, including measures to facilitate the listing of leading domestic companies in Hong Kong, have contributed to this trend [3] Group 2 - Guanghetong has submitted an application for H-share listing in Hong Kong, with the primary use of raised funds focused on AI and robotics technology innovation and product development [5] - The company plans to invest in R&D, build a new manufacturing facility in Shenzhen, pursue strategic investments and acquisitions, repay bank loans, and supplement working capital [5] - Despite the planned fundraising, the company's R&D expenditure as a percentage of revenue has been declining, from 11% in 2021 to 8.78% in 2024 [6] Group 3 - As of 2024, Guanghetong has over 1.4 billion yuan in cash, which is sufficient to cover its approximately 1.2 billion yuan in interest-bearing debt [8] - The company's financial expenses have decreased over the past three years, indicating improved financial management [8] - Previous fundraising efforts through convertible bonds were questioned regarding their necessity and ultimately terminated [10][13] Group 4 - Guanghetong is a leading global provider of wireless communication modules, with significant revenue growth in its core product lines, particularly driven by the adoption of 5G technology [11][12] - The company holds a substantial market share in various application scenarios, including automotive electronics and smart home solutions, ranking first in several categories [14] - However, the company's profitability and growth quality have been called into question, with a notable divergence between revenue growth and net cash flow from operating activities [16] Group 5 - The company has a high dependency on a few major clients, with revenue from the top five clients accounting for over 58% of total revenue in recent years [18] - This concentration poses risks, as any financial difficulties faced by these clients could significantly impact the company's financial health [18] - The company has implemented a comprehensive accounts receivable management system to mitigate risks associated with high accounts receivable levels [18]