数传模块

Search documents

美格智能通过港交所聆讯 占全球无线通信模块市场份额6.4%

Zhi Tong Cai Jing· 2026-02-11 23:00

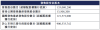

Core Viewpoint - Meig Smart Technology Co., Ltd. (002881.SZ) is undergoing a listing hearing on the Hong Kong Stock Exchange, with China International Capital Corporation (CICC) as the sole sponsor [1] Company Overview - Meig Smart is a leading provider of wireless communication modules and solutions, focusing on smart modules, particularly high-performance intelligent modules [3] - The company's products are widely used in the Internet of Things (IoT), intelligent connected vehicles (ICV), and wireless broadband sectors [3] Market Position - According to Frost & Sullivan, Meig Smart ranks fourth in the global wireless communication module industry by revenue, holding a market share of 6.4% in 2024 [3] - The global wireless communication module market is highly concentrated, with the top three players accounting for 65.7% of the market revenue in 2024, and the largest player holding 42.7% [3] Product Offerings - The company's wireless communication module product portfolio includes: - Smart modules with system-on-chip (SoC) processors and intelligent operating systems, divided into: - High-performance smart modules for complex algorithms and edge AI applications - Conventional smart modules for intelligent applications, such as customized software and multimedia functions - Data transmission modules focusing on secure and high-throughput data exchange [3][4] Custom Solutions - Meig Smart offers customized solutions that integrate hardware, software, and specific application development services, addressing complex integration challenges for clients [4] - The company aims to shorten R&D cycles and reduce technical risks for clients, thereby accelerating time-to-market for their products [4] Financial Performance - The company's revenue for the fiscal years ending December 31 for 2022, 2023, 2024, and the nine months ending September 30, 2025, are approximately: - 2022: 2.306 billion RMB - 2023: 2.147 billion RMB - 2024: 2.941 billion RMB - 2025 (nine months): 2.821 billion RMB [5][6] - The net profit for the same periods is approximately: - 2022: 126.6 million RMB - 2023: 62.6 million RMB - 2024: 134.4 million RMB - 2025 (nine months): 113.2 million RMB [5][6]

美格智能,递交IPO招股书,拟赴香港上市,中金公司独家保荐 | A股公司香港上市

Sou Hu Cai Jing· 2025-12-21 14:13

Core Viewpoint - MeiG Smart Technology Co., Ltd. is seeking to go public on the Hong Kong Stock Exchange after a previous application was invalidated, indicating a renewed effort to raise capital for its operations in the wireless communication module sector [2][3]. Company Overview - Established in 2007, MeiG Smart is a leading provider of wireless communication modules and solutions, focusing on high-performance smart modules to promote the application of AI and 5G technology [3][4]. - The company ranked fourth globally in the wireless communication module industry with a market share of 6.4% as of 2024, according to Frost & Sullivan [3]. Product Portfolio - MeiG Smart's product offerings include high-performance smart modules, conventional smart modules, and data transmission modules, catering to various applications in the Internet of Things (IoT), smart connected vehicles, and wireless broadband sectors [4][5][6]. - The company was the first to launch smart modules in 2014 and has achieved significant milestones, including the deployment of 5G smart modules in electric vehicles [4]. Financial Performance - The company's revenue for the years 2022, 2023, and projected for 2024 and the first half of 2025 are as follows: RMB 2.30 billion, RMB 2.15 billion, RMB 2.94 billion, and RMB 1.89 billion respectively [12][13]. - Net profits for the same periods were RMB 126.6 million, RMB 62.6 million, RMB 134.4 million, and RMB 84.2 million [12][13]. Shareholding Structure - Prior to the IPO, the major shareholder, Mr. Wang Ping, holds approximately 49.16% of the company, with 39.13% directly and an additional 10.03% through Zhaoge Investment [8][9]. Management Team - The board of directors consists of seven members, including four executive directors and three independent non-executive directors, highlighting a diverse leadership structure [11][12]. Underwriting and Advisory Team - The IPO is being managed by a team that includes CICC as the sole sponsor, Ernst & Young as the auditor, and various law firms for legal counsel in China, Hong Kong, and the United States [14][15].

新股消息 | 美格智能二次递表港交所 2024年在全球无线通信模块行业中排名第四

智通财经网· 2025-12-20 09:52

Company Overview - Meige Intelligent Technology Co., Ltd. (referred to as Meige Intelligent) has submitted a listing application to the Hong Kong Stock Exchange, with China International Capital Corporation as its sole sponsor. This marks the company's second application this year, having previously submitted one on June 18 [1] - Meige Intelligent is a leading global provider of wireless communication modules and solutions, focusing on smart modules, particularly high-performance intelligent modules, to drive the widespread application of AI and 5G communication [2][3] Market Position - According to Frost & Sullivan, Meige Intelligent ranks fourth in the global wireless communication module industry by revenue in 2024, holding a market share of 6.4% [1] - The company is the largest supplier of high-performance intelligent modules, with a projected market share of 29.0% in 2024 [4] Product Development - Meige Intelligent has established a competitive advantage by focusing on high-performance intelligent modules and customized solutions, leading the technological development in the industry [3] - The company was the first globally to launch intelligent module products in 2014 and achieved large-scale deployment of 5G intelligent modules in new energy vehicles in 2021 [3][4] Financial Performance - The company reported revenues of RMB 2.305 billion in 2022, RMB 2.147 billion in 2023, and projected revenues of RMB 2.941 billion in 2024 [7] - Gross profit for the same periods was RMB 405.375 million, RMB 396.138 million, and projected RMB 484.662 million, with corresponding gross profit margins of 17.6%, 18.4%, and 16.5% [8] - Net profit for 2022 was RMB 126.615 million, decreasing to RMB 62.609 million in 2023, with a projected increase to RMB 134.375 million in 2024 [9] Industry Overview - The global wireless communication module market is expected to grow from RMB 32.3 billion in 2020 to RMB 43.6 billion in 2024, with a compound annual growth rate (CAGR) of 7.7% [10] - The Chinese market is projected to expand from RMB 17.4 billion in 2020 to RMB 24.7 billion in 2024, achieving a CAGR of 9.1% [10] - The demand for high-performance intelligent modules is expected to increase significantly, with the market size projected to grow from RMB 1.4 billion in 2020 to RMB 3.5 billion in 2024, reflecting a CAGR of 29.2% [13] Application Scenarios - The market for wireless communication modules in the Internet of Things (IoT) is expected to grow from RMB 16.8 billion in 2020 to RMB 22.0 billion in 2024, with a CAGR of 6.9% [17] - The smart connected vehicle market is projected to grow from RMB 2.3 billion in 2020 to RMB 5.0 billion in 2024, with a CAGR of 21.3% [20]

新股消息 | 美格智能(002881.SZ)二次递表港交所 2024年在全球无线通信模块行业中排名第四

智通财经网· 2025-12-20 09:48

Group 1: Company Overview - Meige Intelligent Technology Co., Ltd. (referred to as Meige Intelligent) has submitted a listing application to the Hong Kong Stock Exchange, with China International Capital Corporation as its sole sponsor [1] - This is the second application submitted by the company in 2023, following an earlier submission on June 18 [1] - According to Frost & Sullivan, Meige Intelligent ranks fourth in the global wireless communication module industry by revenue, holding a market share of 6.4% in 2024 [1] Group 2: Business Focus and Product Offerings - Meige Intelligent is a leading provider of wireless communication modules and solutions, focusing on smart modules, particularly high-performance smart modules, to drive the application of AI and 5G communication [3] - The company emphasizes three core application areas: the Internet of Things (IoT), intelligent connected vehicles, and wireless broadband [3] - Meige Intelligent was the first company globally to launch smart module products in 2014 and achieved large-scale deployment of 5G smart modules in new energy vehicles in 2021 [3] Group 3: Market Position and Competitive Advantage - In the high-performance smart module sector, Meige Intelligent is the largest supplier globally, with a market share of 29.0% in 2024 [4] - The company has developed a product matrix of high-performance smart modules with computing power ranging from 8 TOPS to 64 TOPS, supporting various mainstream AI models [4] - Meige Intelligent is recognized as a pioneer in the transition from 4G to 5G in the wireless communication module industry, being among the first to launch 5G data transmission modules [5] Group 4: Financial Performance - The company reported revenues of RMB 2.30 billion in 2022, RMB 2.15 billion in 2023, and projected revenues of RMB 2.94 billion in 2024 [7] - Gross profit for the same periods was RMB 405.38 million, RMB 396.14 million, and projected RMB 484.66 million, with corresponding gross profit margins of 17.6%, 18.4%, and 16.5% [8] - Net profit for 2022 was RMB 126.62 million, decreasing to RMB 62.61 million in 2023, with a projected increase to RMB 134.38 million in 2024 [9] Group 5: Industry Overview - The global wireless communication module market is expected to grow from RMB 32.3 billion in 2020 to RMB 43.6 billion in 2024, with a compound annual growth rate (CAGR) of 7.7% [10] - The Chinese market for wireless communication modules is projected to expand from RMB 17.4 billion in 2020 to RMB 24.7 billion in 2024, achieving a CAGR of 9.1% [10] - The demand for high-performance smart modules is anticipated to increase significantly, with the market size expected to grow from RMB 1.4 billion in 2020 to RMB 3.5 billion in 2024, reflecting a CAGR of 29.2% [13]

首家“A+H”无线通信模组企业来了!广和通今天登陆港交所

Zheng Quan Shi Bao Wang· 2025-10-22 13:12

Core Viewpoint - Guanghetong officially listed on the Hong Kong Stock Exchange on October 22, becoming the first wireless communication module company in China to achieve "A+H" listing and the 12th "A+H" enterprise listed this year [1] Group 1: Company Overview - Guanghetong was established in 1999 and is a leading global provider of wireless communication modules, offering products such as data transmission modules, intelligent modules, and AI modules, along with customized solutions for downstream application scenarios [2] - According to Frost & Sullivan, Guanghetong ranks as the second-largest wireless communication module provider globally, holding a market share of 15.4% [2] Group 2: Financial Performance - On its first day of trading, Guanghetong's H-shares opened at HKD 21.5, closing down 11.72% at HKD 18.98, while its A-shares fell 7.89% to CNY 27.57, indicating a premium of approximately 59.09% for A-shares compared to H-shares [1] - The company raised approximately HKD 29.03 billion through the global offering of about 135 million H-shares, with a net amount of HKD 28.11 billion after deducting issuance costs [1] Group 3: Use of Proceeds - Approximately 55% of the net proceeds from the IPO is expected to be allocated for R&D, focusing on AI and robotics technology innovation and product development [3] - About 15% of the net proceeds is planned for the construction of manufacturing facilities in Shenzhen, China, aimed at producing module products and terminal products as part of the company's solutions [3] - Around 10% of the net proceeds is intended for strategic investments and/or acquisitions, targeting companies in wireless communication, AI, robotics, and other complementary fields to enhance technological capabilities and expand market share [3] Group 4: Market Context - In 2023, 12 A-share companies have listed in Hong Kong, with four companies raising over HKD 10 billion, including CATL and Hengrui Medicine [4] - Among the 12 listed companies, 9 have seen their stock prices rise above the issue price, with some companies like Chifeng Jilong Gold and CATL doubling their stock prices [4]

广和通上市预冷:首日下跌12%,公司市值171亿港元,上半年利润降31%,勤道赣通浮亏5860万

3 6 Ke· 2025-10-22 09:37

Core Viewpoint - Guanghetong Wireless Co., Ltd. has successfully listed on the Hong Kong Stock Exchange, raising approximately HKD 2.911 billion, but its stock performance has been disappointing, closing down 11.72% from the issue price on the first day of trading [1][2]. Fundraising and Investor Participation - Guanghetong issued about 135 million H-shares at an offer price of HKD 21.5, with net proceeds of approximately HKD 2.811 billion after deducting issuance costs of HKD 93.6 million [1]. - Key cornerstone investors include Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), and others, collectively subscribing for HKD 1.26 billion [2]. Stock Performance - The stock opened at HKD 21.5 but closed at HKD 18.98, resulting in a market capitalization of HKD 17.092 billion, which is significantly lower than its A-share market cap of RMB 21 billion [2]. Financial Performance - For the first half of the year, Guanghetong reported revenue of RMB 2.48 billion, with a profit decline of 31% year-on-year [3][8]. - Revenue projections for 2022, 2023, and 2024 are RMB 5.2 billion, RMB 5.65 billion, and RMB 6.97 billion, respectively, with corresponding gross profits of RMB 1.066 billion, RMB 1.187 billion, and RMB 1.267 billion [6][7]. Business Overview - Guanghetong specializes in wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules, with applications in automotive electronics, smart homes, consumer electronics, and smart retail [5]. - The company has acquired 100% of Shenzhen Ruiling to expand its presence in the overseas automotive market, but plans to divest this business by July 2024 due to challenging international market conditions [5]. Shareholding Structure - As of June 30, 2025, Zhang Tianyu holds a 36.78% stake in the company, while other significant shareholders include Ying Lingpeng and New Yu Guanghe Chuanghong Investment Partnership [12][18].

广和通募29亿港元首日破发跌12% 广发基金管理等浮亏

Zhong Guo Jing Ji Wang· 2025-10-22 08:57

Core Viewpoint - Guanghetong Wireless Co., Ltd. (stock codes: 300638.SZ, 00638.HK) was listed on the Hong Kong Stock Exchange, closing at HKD 18.98, down 11.72% from its issue price, with an intraday low of HKD 18.89 [1] Summary by Sections Share Issuance and Capital Structure - The total number of shares issued under the global offering was 135,080,200 H-shares, with 13,508,200 shares for the Hong Kong public offering and 121,572,000 shares for international offering [2] - The number of shares issued at listing (before the exercise of the over-allotment option) was 900,533,742 [2] Key Investors - The cornerstone investors included Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), GF Fund Management, GF International, Ruihua Investment, Zhidu Investment, Zhang Xiaolei, Guotai Junan Securities Investment, and Junyi Hong Kong Fund [5] Pricing and Proceeds - The final offer price was HKD 21.50, with total proceeds amounting to HKD 2,904.2 million, and net proceeds after estimated listing expenses of HKD 93.6 million were HKD 2,810.6 million [7] - Approximately 55% of the net proceeds are expected to be allocated for R&D, particularly in AI and robotics technology innovation and product development [7] Use of Proceeds - About 15% of the net proceeds is planned for building manufacturing facilities in Shenzhen, China, primarily for module products [7] - 10% of the net proceeds is expected to be used for repaying certain interest-bearing bank loans [7] - Another 10% is anticipated for strategic investments and/or acquisitions, focusing on companies in wireless communication, AI, robotics, and other complementary fields [7] - The remaining 10% is expected to be used for working capital and other general corporate purposes [7] Company Overview - Guanghetong is a provider of wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules [8] - The company provides customized solutions based on its module products, including edge AI solutions, robotic solutions, and other applications [8]

广和通赴港二次上市,折价35%,给二级市场预留了一点水位

Sou Hu Cai Jing· 2025-10-14 14:31

Core Viewpoint - The China Securities Regulatory Commission (CSRC) is launching five new measures in 2024 to support mainland companies in listing in Hong Kong, including a 30-day fast-track approval process for A-share companies with a market capitalization exceeding 10 billion [1] Company Overview - Guanghetong, established in 1999 in Shenzhen, is a leading global provider of wireless communication modules and solutions, with a market share of 15.4% in 2024, making it the second-largest in the world [2][5] - The company offers a range of products including data transmission modules, smart modules, and AI modules, catering to various applications such as automotive electronics, smart homes, consumer electronics, and smart retail [2][3] Market Position - Guanghetong holds the largest market share in the smart home sector at 36.6% and in consumer electronics at 75.9%, while it ranks second in automotive electronics with a market share of 14.4% [3] Financial Performance - From 2022 to 2024, Guanghetong's revenue is projected to grow from 5.203 billion RMB to 6.971 billion RMB, reflecting a compound annual growth rate (CAGR) of over 14%. Net profit is expected to increase from 365 million RMB to 677 million RMB during the same period [5][6] - In the first half of 2025, the company reported a revenue of 3.707 billion RMB, a year-on-year decline of 9.02%, primarily due to the sale of its wireless vehicle-mounted business. Excluding this factor, the core business revenue grew by 23.49% [6] Revenue Breakdown - Guanghetong's overseas revenue accounts for approximately 60%, with Taiwan contributing 35.7% and the U.S. 10.9%. The company faces significant uncertainty due to potential geopolitical risks [8] Industry Outlook - The global IoT industry is experiencing rapid growth, with the number of IoT devices expected to reach 21.5 billion by 2025, a year-on-year increase of 14.4%. The integration of AI and IoT is anticipated to create new opportunities in the smart era [9] IPO Details - Guanghetong's IPO will issue 15% of its total shares, raising approximately 2.9 billion HKD at the upper end of the price range of 21.5 HKD per share. The company has secured cornerstone investments from 10 investors, accounting for 44.8% of the offering [12][10]

广和通(00638)招股

Xin Lang Cai Jing· 2025-10-14 05:30

Core Viewpoint - Guanghetong, a wireless communication module provider based in Nanshan District, Shenzhen, Guangdong, is launching its IPO from October 9 to October 14, 2025, with plans to list on the Hong Kong Stock Exchange on October 22, 2025, under the sponsorship of CITIC Securities [2][6]. Summary by Sections IPO Details - The company plans to issue 135.08 million H-shares, representing 15% of the total shares post-IPO, with 90% allocated for international offering and 10% for public offering [3][4]. - The expected share price range is between HKD 19.88 and HKD 21.50, aiming to raise approximately HKD 26.85 billion to HKD 29.04 billion [3][4]. - The entry fee for investors is HKD 4,343.37 for 200 shares [3]. Financial Projections - Assuming the midpoint of the share price at HKD 20.69 and no exercise of the over-allotment option, the total estimated expenses for the IPO are around HKD 105.4 million, which includes a 2% underwriting commission [4]. - The net proceeds from the IPO are projected to be approximately HKD 26.89 billion, with allocations of 55% for R&D, 15% for manufacturing facilities in Shenzhen, 10% for repaying bank loans, 10% for strategic investments or acquisitions, and 10% for working capital and other general corporate purposes [5]. Shareholder Structure - Post-IPO, the controlling shareholder, Mr. Zhang Tianyu, will hold 31.26% of the shares [7][8]. - Other shareholders include Mr. Ying Lingpeng with 2.83%, and various other shareholders holding a combined 68.74% [8]. Company Overview - Established in 1999, Guanghetong is a leading global provider of wireless communication modules, with products including data transmission modules, smart modules, and AI modules [8]. - According to Frost & Sullivan, Guanghetong ranks as the second-largest wireless communication module provider globally, with a market share of 15.4% in 2024 [8]. - The company leads in several downstream application markets, ranking second in automotive electronics with a market share of 26.8%, and first in smart home and consumer electronics with market shares of 15.1% and 5%, respectively [8].

优秀!从会计到年薪236万CFO,如今又助公司赴港IPO!

Sou Hu Cai Jing· 2025-09-19 10:31

Core Viewpoint - Guanghetong Wireless Co., Ltd. plans to issue up to approximately 155 million shares for overseas listing on the Hong Kong Stock Exchange, with a current market capitalization of about 23.5 billion RMB as of September 18 [3][4]. Company Overview - Guanghetong, established in 1999, is a leading global provider of wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules, along with customized solutions for various applications [4]. - The company holds a 15.4% market share in the global wireless communication module market, ranking as the second-largest provider globally [4]. Market Position - Guanghetong ranks first in several downstream application markets, including automotive electronics (24.6% market share), smart home (36.6%), and consumer electronics (75.9%) [4]. Financial Performance - Revenue for Guanghetong is projected to be 5.2 billion RMB in 2022, 5.65 billion RMB in 2023, and 6.97 billion RMB in 2024, with corresponding gross profits of 1.066 billion RMB, 1.187 billion RMB, and 1.267 billion RMB [5]. - The gross profit margins are 20.5% for 2022, 21% for 2023, and 18.2% for 2024 [5]. - Operating profits are expected to be 335 million RMB in 2022, 400 million RMB in 2023, and 387 million RMB in 2024, with operating profit margins of 6.4%, 7.1%, and 5.6% respectively [5]. - Net profits are projected at 365 million RMB for 2022, 565 million RMB for 2023, and 677 million RMB for 2024, with net profit margins of 7%, 10%, and 9.7% [5]. Strategic Decisions - In response to complex international market conditions, Guanghetong has decided to sell its overseas automotive communication business operated by its subsidiaries in Hong Kong and Luxembourg by July 2024 [5].