x86平台

Search documents

英特尔2025年第三季度营收137亿美元

Cai Jing Wang· 2025-10-24 08:42

Core Insights - Intel reported Q3 2025 revenue of $13.7 billion, a 3% year-over-year increase, with earnings per share (EPS) of $0.90 and non-GAAP EPS of $0.23 [1] Financial Performance - Q3 2025 revenue: $13.7 billion, up 3% year-over-year [1] - EPS: $0.90; Non-GAAP EPS: $0.23 [1] - Q4 2025 revenue guidance: $12.8 billion to $13.8 billion; EPS guidance: $(0.14); Non-GAAP EPS guidance: $0.08 [1] Strategic Focus - CEO Pat Gelsinger highlighted improved execution and steady progress on strategic priorities [1] - Artificial intelligence is accelerating computing demand, creating attractive opportunities in Intel's product portfolio, including core x86 platforms, dedicated ASICs, accelerators, and foundry services [1] - Intel's advanced CPU and cutting-edge logic manufacturing and R&D capabilities position the company to capitalize on long-term opportunities presented by these trends [1]

英特尔:2025年Q3营收137亿美元,同比增长3%

Xin Lang Ke Ji· 2025-10-24 03:23

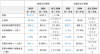

Core Insights - Intel reported Q3 2025 revenue of $13.7 billion, a 3% increase year-over-year, with earnings per share (EPS) of $0.90 and non-GAAP EPS of $0.23 [1] Financial Performance - Revenue: $13.7 billion in Q3 2025, up 3% from $13.3 billion in Q3 2024 [1] - Gross Margin: 38.2%, an increase of 23.2 percentage points compared to 15.0% in Q3 2024 [1] - R&D and Marketing Expenses: $4.4 billion to $5.4 billion, a decrease of 20% from $3.9 billion to $4.8 billion in Q3 2024 [1] - Operating Profit Margin: 5.0%, up 73.2 percentage points from (68.2)% in Q3 2024 [1] - Net Income: $4.1 billion, a 124% increase from a net loss of $16.6 billion in Q3 2024 [1] - Diluted EPS: $0.90, up 123% from a loss of $3.88 in Q3 2024 [1] Future Outlook - Intel expects Q4 2025 revenue to be between $12.8 billion and $13.8 billion, with an anticipated EPS loss of ($0.14) and non-GAAP EPS of $0.08 [1]

英特尔Q3财报超预期,盘后股价涨超8% AI与代工业务成增长引擎

Feng Huang Wang· 2025-10-24 01:12

Core Insights - Intel's Q3 2025 financial results exceeded expectations in revenue, gross margin, and earnings per share, leading to an over 8% increase in stock price post-announcement [1] - The growth is attributed to sustained performance in core markets, marking the fourth consecutive quarter of improved execution and operational efficiency [1] - The company has strengthened its balance sheet through significant funding from the U.S. government, NVIDIA, and SoftBank, along with partial divestitures of Altera and Mobileye [1] AI Strategy - Artificial intelligence is becoming a focal point in Intel's strategic layout, with AI technology accelerating demand for computing and creating new opportunities across its product portfolio, including core x86 platforms, dedicated ASICs, accelerators, and foundry services [1] - Intel emphasizes its collaboration with NVIDIA as a model for revitalizing the x86 ecosystem in the AI era, with both companies working on next-generation x86 products tailored for AI [1] Foundry Business Progress - Intel is making steady progress in its foundry business, with the advanced process node 18A on track and the next-generation client processor Panther Lake expected to launch within the year [2] - The Arizona Fab 52 wafer fabrication plant is now fully operational, and initial feedback from external clients on the 14A process is encouraging, indicating long-term growth opportunities driven by AI-related capacity demands [2] - Intel's management expresses confidence in the company's transformation efforts aimed at creating long-term shareholder value, aligning with its proactive strategies in AI and foundry sectors [2]