加速器

Search documents

英伟达:长期增长能见度增强,期待 GTC 产品路线图,上调目标价

BOCOM International· 2026-02-28 00:20

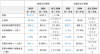

Investment Rating - The investment rating for the company is "Buy" with a target price raised to $260, indicating a potential upside of 40.6% from the current price of $184.89 [5][16]. Core Insights - The report highlights enhanced visibility for long-term growth, particularly with the upcoming GTC product roadmap, which has led to an upward revision of the target price [2][12]. - The company is expected to achieve significant revenue growth, with projected revenues of $215.94 billion in 2026, reflecting a year-on-year increase of 65.5% [3][18]. - The management has indicated strong demand visibility for several quarters ahead, particularly in the AI sector, which is expected to drive further revenue growth [9][10]. Financial Overview - Revenue projections for the fiscal years are as follows: - 2025: $130.50 billion - 2026: $215.94 billion - 2027E: $354.50 billion - 2028E: $455.76 billion - 2029E: $500.56 billion - Year-on-year revenue growth rates are projected at 114.2% for 2025, 65.5% for 2026, and 64.2% for 2027 [3][18]. - Net profit is expected to grow from $74.27 billion in 2025 to $116.99 billion in 2026, with a projected EPS of $4.77 for 2026, reflecting a 59.4% increase [3][18]. - The company maintains a strong gross margin, with a Non-GAAP gross margin forecasted at 75.2% for FY1Q27 [8][12]. Market Position and Competitive Landscape - The report notes that the top five cloud service providers (CSPs) are expected to exceed $700 billion in capital expenditures for CY26, which is significantly higher than market expectations [9]. - The company is positioned to benefit from a diversified customer base, with non-CSP clients growing faster than cloud vendor revenues, enhancing long-term growth confidence [10][12]. - The upcoming GTC event is anticipated to showcase new products, including CPUs, GPUs, and DPUs, which will help maintain a competitive edge in the market [11][12].

中国半导体巨头海光信息2025年净利同比增逾31%

Zhong Guo Xin Wen Wang· 2026-02-25 12:42

此外,当天海光信息还发布公告称,预计2026年第一季度实现营业收入39.1亿元至42.2亿元,同比增长 62.91%至75.82%;实现归属于母公司所有者的净利润6.2亿元至7.2亿元,同比增长22.56%至42.32%。 中新社北京2月25日电 (记者 陈康亮)中国上市公司海光信息技术股份有限公司(下称海光信息)25日发布 业绩快报称,2025年公司实现归属于母公司所有者的净利润约25.42亿元(人民币,下同),比上年同期增 加31.66%。 公开资料显示,海光信息是中国半导体产业的头部公司,主要从事高端处理器、加速器等计算芯片产品 和系统的研究、开发。截至25日收盘,海光信息A股总市值逾5700亿元,在A股半导体板块市值仅次于 中芯国际。(完)【编辑:惠小东】 业绩快报还显示,2025年,海光信息实现营业收入约143.76亿元,比上年同期增加56.91%;实现归属于 母公司所有者的扣除非经常性损益的净利润约23.03亿元,比上年同期增加26.82%。 针对业绩改善的原因,海光信息方面表示,主要是因为在报告期内,中国国产高端芯片市场需求持续攀 升,公司通过深化与整机厂商、生态伙伴在重点行业和重点领域的合作, ...

AMD 与英伟达的竞争,正在进入一个更残酷、也更真实的阶段

美股研究社· 2026-02-17 04:25

Core Viewpoint - The AI computing market is transitioning from a "technical monopoly" dominated by NVIDIA to a "rational competition" phase, as indicated by Arista Networks' CEO's statement about AMD's increasing presence in project selections [1][3][30]. Group 1: Market Dynamics - A year ago, nearly 99% of AI clusters were built around NVIDIA, but now AMD is becoming the preferred accelerator in 20%-25% of projects, signaling a significant shift [1][6]. - The AI computing market is moving from a focus on "availability" to "value," as companies begin to consider cost-effectiveness in their decisions [7][12]. - The entry of AMD into the market is not a failure for NVIDIA but rather a re-evaluation of market dynamics, where NVIDIA's pricing power may be challenged as AMD proves to be a viable alternative [19][20]. Group 2: Competitive Landscape - AMD's advantage lies not in outperforming NVIDIA in all metrics but in becoming a rational choice in specific applications, particularly in large-scale inference and cost-sensitive tasks [13][16]. - The introduction of AMD as a second option allows companies to optimize costs and mitigate risks associated with relying solely on one supplier [17][18]. - The competition is evolving into a slower, more patient process, where maintaining market share without sacrificing profit margins becomes crucial [21][22]. Group 3: Structural Changes - The capital market's reaction to NVIDIA's stock drop and AMD's rise reflects a long-term structural change rather than a short-term performance assessment [24][26]. - NVIDIA's current valuation assumes a prolonged monopoly, but emerging data suggests that this assumption may need to be reassessed as AMD gains traction [25][26]. - The AI computing development can be divided into two phases: the first being a "technical race" and the second an "economic competition," where the focus shifts to profitability as computing power becomes less scarce [27][28].

比特币跌超3% 加密币全网超15万人爆仓 32亿元灰飞烟灭

Mei Ri Jing Ji Xin Wen· 2025-11-11 23:34

Market Overview - On November 11, U.S. stock indices closed mixed, with the Dow Jones up 1.18%, S&P 500 up 0.21%, and Nasdaq down 0.25% [1] - Chip stocks experienced a broad decline, with Micron Technology down over 4%, ARM down over 3%, and Nvidia, AMD, and Applied Materials down over 2% [1] - Nvidia's market value dropped by $143.127 billion (approximately ¥1,018.678 billion) in one night [1] AMD's Financial Outlook - AMD's CEO, Lisa Su, provided an optimistic outlook for the AI market during the company's first Financial Analyst Day, predicting accelerated sales growth over the next five years [2] - AMD anticipates that the total addressable market (TAM) for AI data centers will exceed $1 trillion by 2030, up from approximately $200 billion this year, with a compound annual growth rate (CAGR) exceeding 40% [2] - The company expects an average revenue CAGR of over 35% in the next three to five years, with AI data center revenue projected to grow by an average of 80% [3] Analyst Expectations - Current analyst estimates suggest AMD's sales will grow by 32% this year, followed by 31% and 39% growth in 2026 and 2027, respectively [3] - AMD's stock price fluctuated during the day, initially dropping over 3.8% before recovering to gain over 3% in after-hours trading [3] Other Market Movements - CoreWeave, an AI tech stock, saw its share price plummet over 16% after lowering its full-year revenue forecast, leading Morgan Stanley to downgrade its rating from "overweight" to "neutral" [3] - Chinese concept stocks showed mixed performance, with the Nasdaq Golden Dragon China Index down 0.06%, while stocks like Xpeng Motors rose over 7% and Alibaba fell over 3% [3] Commodity Prices - International oil prices rose on November 11, with light crude oil futures for December delivery increasing by $0.91 to $61.04 per barrel (up 1.51%), and Brent crude oil futures for January delivery rising by $1.10 to $65.16 per barrel (up 1.72%) [5] - Gold prices briefly fell below $4,100, and Bitcoin dropped over 3%, with a total of $511 million (approximately ¥3.6 billion) in liquidations reported across the crypto market [5]

AMD CEO苏姿丰:公司预计,AI芯片总市场规模(TAM)到2030年将增长至1万亿美元。最新TAM目标包括CPU、加速器、网络

Hua Er Jie Jian Wen· 2025-11-11 18:32

Group 1 - The core viewpoint is that AMD's CEO, Lisa Su, anticipates the total addressable market (TAM) for AI chips will grow to $1 trillion by 2030, which includes CPUs, accelerators, and networking [1] Group 2 - The latest TAM target encompasses various segments such as CPU, accelerators, and networking [1]

英特尔2025年第三季度营收137亿美元

Cai Jing Wang· 2025-10-24 08:42

Core Insights - Intel reported Q3 2025 revenue of $13.7 billion, a 3% year-over-year increase, with earnings per share (EPS) of $0.90 and non-GAAP EPS of $0.23 [1] Financial Performance - Q3 2025 revenue: $13.7 billion, up 3% year-over-year [1] - EPS: $0.90; Non-GAAP EPS: $0.23 [1] - Q4 2025 revenue guidance: $12.8 billion to $13.8 billion; EPS guidance: $(0.14); Non-GAAP EPS guidance: $0.08 [1] Strategic Focus - CEO Pat Gelsinger highlighted improved execution and steady progress on strategic priorities [1] - Artificial intelligence is accelerating computing demand, creating attractive opportunities in Intel's product portfolio, including core x86 platforms, dedicated ASICs, accelerators, and foundry services [1] - Intel's advanced CPU and cutting-edge logic manufacturing and R&D capabilities position the company to capitalize on long-term opportunities presented by these trends [1]

英特尔:2025年Q3营收137亿美元,同比增长3%

Xin Lang Ke Ji· 2025-10-24 03:23

Core Insights - Intel reported Q3 2025 revenue of $13.7 billion, a 3% increase year-over-year, with earnings per share (EPS) of $0.90 and non-GAAP EPS of $0.23 [1] Financial Performance - Revenue: $13.7 billion in Q3 2025, up 3% from $13.3 billion in Q3 2024 [1] - Gross Margin: 38.2%, an increase of 23.2 percentage points compared to 15.0% in Q3 2024 [1] - R&D and Marketing Expenses: $4.4 billion to $5.4 billion, a decrease of 20% from $3.9 billion to $4.8 billion in Q3 2024 [1] - Operating Profit Margin: 5.0%, up 73.2 percentage points from (68.2)% in Q3 2024 [1] - Net Income: $4.1 billion, a 124% increase from a net loss of $16.6 billion in Q3 2024 [1] - Diluted EPS: $0.90, up 123% from a loss of $3.88 in Q3 2024 [1] Future Outlook - Intel expects Q4 2025 revenue to be between $12.8 billion and $13.8 billion, with an anticipated EPS loss of ($0.14) and non-GAAP EPS of $0.08 [1]

英特尔Q3财报超预期,盘后股价涨超8% AI与代工业务成增长引擎

Feng Huang Wang· 2025-10-24 01:12

Core Insights - Intel's Q3 2025 financial results exceeded expectations in revenue, gross margin, and earnings per share, leading to an over 8% increase in stock price post-announcement [1] - The growth is attributed to sustained performance in core markets, marking the fourth consecutive quarter of improved execution and operational efficiency [1] - The company has strengthened its balance sheet through significant funding from the U.S. government, NVIDIA, and SoftBank, along with partial divestitures of Altera and Mobileye [1] AI Strategy - Artificial intelligence is becoming a focal point in Intel's strategic layout, with AI technology accelerating demand for computing and creating new opportunities across its product portfolio, including core x86 platforms, dedicated ASICs, accelerators, and foundry services [1] - Intel emphasizes its collaboration with NVIDIA as a model for revitalizing the x86 ecosystem in the AI era, with both companies working on next-generation x86 products tailored for AI [1] Foundry Business Progress - Intel is making steady progress in its foundry business, with the advanced process node 18A on track and the next-generation client processor Panther Lake expected to launch within the year [2] - The Arizona Fab 52 wafer fabrication plant is now fully operational, and initial feedback from external clients on the 14A process is encouraging, indicating long-term growth opportunities driven by AI-related capacity demands [2] - Intel's management expresses confidence in the company's transformation efforts aimed at creating long-term shareholder value, aligning with its proactive strategies in AI and foundry sectors [2]

OpenAI和博通宣布战略合作

财联社· 2025-10-13 13:17

Core Insights - OpenAI and Broadcom plan to launch custom data center chips by 2026, deploying 10 gigawatts of AI accelerators designed by OpenAI [1] - The collaboration will involve Broadcom's accelerators and Ethernet solutions for both vertical and horizontal scaling [1] - The deployment of AI accelerators and network systems is scheduled to begin in the second half of 2026 and is expected to be completed by the end of 2029 [1] - OpenAI will design the accelerators and systems, allowing the integration of knowledge gained from developing cutting-edge models and products directly into hardware [1] - The racks will utilize Broadcom's Ethernet and other connectivity solutions to meet the global demand surge for AI, with deployment in OpenAI's facilities and partner data centers [1]

英特尔,浴血重生?

半导体芯闻· 2025-09-22 10:36

Core Viewpoint - Nvidia's $5 billion investment in Intel revitalizes a decades-old "rescue strategy" initiated by former CEO Craig Barrett, shifting the financial burden from Intel's customers to the AI leader in Silicon Valley [2] Group 1: Strategic Changes at Intel - Lip-Bu Tan's leadership at Intel since March 2025 involves aggressive restructuring, including layoffs and breaking down departmental barriers, with a focus on AI [2] - Tan's approach contrasts with former CEO Pat Gelsinger's emphasis on manufacturing subsidies and wafer fabrication, highlighting a shift towards a clear AI strategy as essential for the future of "American manufacturing" [2] - Gelsinger's tenure saw the revival of Intel's foundry business and accelerated production of the 18A node, but it could not counter the market's shift towards GPUs [3] Group 2: Financial Challenges - Since the rise of generative AI in 2022, Intel has struggled with a "CPU-first" mindset, missing out on the GPU boom, leading to a significant financial downturn with nearly $20 billion in losses [3] - Tan's challenge is to reverse this trend, focusing on disruptive breakthroughs in AI rather than merely expanding manufacturing capabilities [3] Group 3: Leadership and Organizational Changes - Prior to Nvidia's investment announcement, Tan executed a significant leadership overhaul, bringing in key figures like Kevork Kechichian to lead the data center division and Srinivasan Iyengar to head the newly formed Central Engineering Group [4] - The appointment of Kechichian is seen as a gamble, as he is tasked with reviving Intel's data center business amidst fierce competition [4] - Tan has separated the AI accelerator business from the server division, assigning it directly to CTO Sachin Katti, signaling a strategic shift to prioritize both CPU and accelerator development [5] Group 4: Future Outlook - The restructuring and strategic focus on products rather than wafer fabrication indicate that Intel's path to recovery lies in innovation and collaboration, particularly with Nvidia [5] - The new leadership and organizational changes reflect a recognition that the future of Intel depends on its ability to adapt to the evolving semiconductor landscape, particularly in AI and custom chip design [5]