SOFE(000852)

Search documents

股市必读:石化机械10月21日涨停收盘,收盘价7.72元

Sou Hu Cai Jing· 2025-10-21 16:59

Core Viewpoint - The stock of Sinopec Mechanical (000852) has experienced a significant increase, closing at 7.72 yuan with a 9.97% rise, marking two consecutive days of trading limit up [1]. Trading Information Summary - On October 21, Sinopec Mechanical's stock reached a closing price of 7.72 yuan, hitting the trading limit at 9:25 AM and remaining closed for the day. The total funds locked in the limit order amounted to 251 million yuan, representing 3.44% of its circulating market value [1][3]. Fund Flow Summary - On the same day, the net inflow of main funds was 54.54 million yuan, while speculative funds and retail investors experienced a combined net outflow exceeding 54.54 million yuan [1][3]. Company Announcement Summary - Sinopec Mechanical signed an investment intention letter on October 21 with several subsidiaries of Sinopec Group, including plans for capital increase and share expansion in the hydrogen machinery company. The investment will involve cash contributions from the capital company and hydrogen energy technology contributions from two research institutes. The specific technical details and amounts are pending evaluation and approval. This agreement is a framework arrangement, and the completion of a formal agreement remains uncertain. The transaction is classified as a related party transaction and has not yet made substantial progress, with no significant impact on the company's current financial status and operating performance [1][3].

石化机械(000852)披露与关联方签署全资子公司增资扩股项目投资意向书,10月21日股价上涨9.97%

Sou Hu Cai Jing· 2025-10-21 14:20

截至2025年10月21日收盘,石化机械(000852)报收于7.72元,较前一交易日上涨9.97%,最新总市值 为73.8亿元。该股当日开盘7.72元,最高7.72元,最低7.72元,成交额达2.16亿元,换手率为2.95%。 最新公告列表 公司近日发布公告称,中石化石油机械股份有限公司于2025年10月21日与中石化集团资本有限公司、中 石化石油化工科学研究院有限公司、中石化(大连)石油化工研究院有限公司及中石化氢能机械(武 汉)有限公司签署《投资意向书》。各方拟对氢机公司进行增资扩股,资本公司拟以现金出资,两家研 究院拟以氢能技术出资,具体技术及金额待评估和审批后确定。本次增资不改变公司对氢机公司的控股 地位。该意向书属框架性约定,后续需开展尽职调查、评估并履行审批程序,能否签署正式协议存在不 确定性。本次交易构成关联交易,但目前尚未形成实质。签署意向书不会对公司当前财务状况及经营业 绩产生重大影响。 以上内容为证券之星据公开信息整理,由AI算法生成(网信算备310104345710301240019号),不构成 投资建议。 《关于与关联方签署全资子公司增资扩股项目投资意向书的提示性公告》 ...

石化机械(000852.SZ):氢机公司拟通过增资扩股方式引入战略投资者

Ge Long Hui A P P· 2025-10-21 12:28

Core Viewpoint - The company has signed an investment intention letter with several strategic partners to enhance its capabilities in the hydrogen sector through capital increase and share expansion [1] Group 1: Investment and Strategic Partnerships - The company will collaborate with China Petrochemical Group Capital Co., Ltd., Petrochemical Research Institute, and Dalian Petrochemical Research Institute to invest in Hydrogen Machine Company [1] - The investment aims to leverage the strengths of each party to foster technological and industrial cooperation [1] Group 2: Future Development and Strategic Goals - The capital increase and introduction of strategic investors align with the company's future development strategy, providing solid support for business growth [1] - The collaboration is expected to enhance the research and development capabilities of Hydrogen Machine Company, shorten product development cycles, and improve operational efficiency [1]

石化机械拟为下属氢机公司引入战略投资

Zhi Tong Cai Jing· 2025-10-21 11:10

石化机械(000852)(000852.SZ)公告,公司于2025年10月21日与中国石化集团资本有限公司(简称"资本 公司")、中石化石油化工科学研究院有限公司(简称"石科院")、中石化(大连)石油化工研究院有限公司 (简称"大连院")和公司下属全资子公司中石化氢能机械(武汉)有限公司(简称"氢机公司")签订了《投资意 向书》,资本公司、石科院和大连院拟以增资扩股方式向氢机公司投资。目前本《投资意向书》仅为明 确双方合作意向和基本原则,尚未构成关联交易实质。 ...

石化机械(000852.SZ)拟为下属氢机公司引入战略投资

智通财经网· 2025-10-21 11:07

智通财经APP讯,石化机械(000852.SZ)公告,公司于2025年10月21日与中国石化集团资本有限公司(简 称"资本公司")、中石化石油化工科学研究院有限公司(简称"石科院")、中石化(大连)石油化工研究院有 限公司(简称"大连院")和公司下属全资子公司中石化氢能机械(武汉)有限公司(简称"氢机公司")签订了 《投资意向书》,资本公司、石科院和大连院拟以增资扩股方式向氢机公司投资。目前本《投资意向 书》仅为明确双方合作意向和基本原则,尚未构成关联交易实质。 ...

石化机械:签署子公司增资扩股项目投资意向书

Zheng Quan Shi Bao Wang· 2025-10-21 11:05

Core Viewpoint - The announcement indicates that Shihua Machinery (000852) has signed an investment intention agreement with several subsidiaries of Sinopec Group, aiming for capital increase and expansion in the hydrogen energy sector through equity investment and collaboration in technology and industry [1] Group 1 - Shihua Machinery has entered into an investment intention agreement with Sinopec Group Capital Co., Ltd., Sinopec Petroleum and Chemical Research Institute Co., Ltd., Sinopec (Dalian) Petroleum and Chemical Research Institute Co., Ltd., and Sinopec Hydrogen Machinery (Wuhan) Co., Ltd. [1] - The investment will be conducted through capital increase and share expansion in the hydrogen machinery company, which is a wholly-owned subsidiary of Shihua Machinery [1] - The collaboration will focus on joint efforts in technology and industry, indicating a strategic move towards enhancing capabilities in the hydrogen energy sector [1]

石化机械最新公告:拟引入战略投资者增资全资子公司氢机公司

Sou Hu Cai Jing· 2025-10-21 10:57

Core Viewpoint - The company, Shihua Machinery (000852.SZ), has signed a Letter of Intent for Investment with China Petroleum & Chemical Corporation Capital Co., Ltd., Sinopec Petroleum and Chemical Research Institute Co., Ltd., and Sinopec (Dalian) Petroleum and Chemical Research Institute Co., Ltd. to invest in its wholly-owned subsidiary, Hydrogen Machine Company, through capital increase and share expansion [1] Group 1 - The investment aims to promote the transformation of scientific and technological achievements and enhance the leadership in the hydrogen energy industry chain [1] - The capital increase will strengthen the core competitiveness of Hydrogen Machine Company while ensuring that Shihua Machinery maintains its controlling position in the subsidiary post-investment [1] - The Letter of Intent serves as a framework agreement for cooperation intentions and basic principles, with further due diligence and assessment to follow, which may involve related party transactions [1]

揭秘涨停 | 芯片概念多股涨停

Zheng Quan Shi Bao Wang· 2025-10-21 10:52

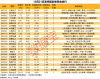

Market Overview - On October 21, the A-share market closed with a total of 93 stocks hitting the daily limit, with 79 stocks after excluding 14 ST stocks, resulting in a limit-up rate of 80.87% [1] Top Gainers - The stock with the highest limit-up order volume was Shihua Oil Service, with 465,700 hands, followed by ShenKai Co., Zhonghua Rock Soil, and Shihua Machinery with 348,300 hands, 344,900 hands, and 325,400 hands respectively [2] - In terms of consecutive limit-up days, Pioneer Electronics and ST Zhongdi achieved three consecutive limit-ups, while ShenKai Co., Shihua Machinery, and CITIC Heavy Industries had two consecutive limit-ups [2] Significant Stocks - Pioneer Electronics achieved a limit-up with a closing price of 25.03 yuan and a limit-up order amount of 4.61 billion yuan, focusing on smart gas metering and safety monitoring [3][4] - ShenKai Co. closed at 11.21 yuan with a limit-up order amount of 3.90 billion yuan, driven by deep-sea equipment and robot concepts [3][4] - Shihua Machinery closed at 7.72 yuan with a limit-up order amount of 2.51 billion yuan, benefiting from oil and gas equipment and state-owned enterprise status [3][4] Sector Highlights Chip Sector - Multiple stocks in the chip sector, including Dawi Co., Taiji Industry, and Wentai Technology, achieved limit-ups, with Dawi Co. focusing on high-performance storage chip products [4][5][6] Real Estate Sector - Stocks such as Shangshi Development and Hefei Urban Construction saw limit-ups, with Shangshi Development reporting a signed sales amount of approximately 290 million yuan [7] Energy Equipment Sector - Stocks like Shihua Oil Service and ShenKai Co. also achieved limit-ups, with Shihua Oil Service accelerating its overseas business development [8] Investment Trends - The net buying amount for stocks on the Dragon and Tiger list included significant purchases in Shanhe Intelligent and Hefei Urban Construction, with net buying amounts of 1.88 billion yuan and 1.18 billion yuan respectively [9][10]

石化机械(000852) - 关于与关联方签署全资子公司增资扩股项目投资意向书的提示性公告

2025-10-21 10:45

证券代码:000852 证券简称:石化机械 公告编号:2025-060 本公司及除独立董事周京平先生外的董事会成员保证信息披露的内容真实、 准确和完整,没有虚假记载、误导性陈述或重大遗漏。 特别提示: 1、本《投资意向书》属于各方合作意愿和基本原则的框架性、 意向性的约定,后续本《投资意向书》签署主体将就本次对中石化石 油机械股份有限公司(以下简称"公司"或"本公司")下属全资子 公司中石化氢能机械(武汉)有限公司(以下简称"氢机公司")增 资扩股项目的投资展开尽职调查和评估,各方将就核心的交易条件、 交易金额等进行商讨,并履行各自审批程序,决定是否签署正式投资 协议等文件。各方能否就本《投资意向书》所涉及的合作事项后续签 署实质性协议并实施尚存在不确定性,请广大投资者谨慎投资,注意 投资风险。 2、本《投资意向书》签订不会对公司当前财务数据及经营业绩 产生重大影响。对公司未来经营业绩的影响需视具体合作情况的推进 和实施情况而定。 3、由于本《投资意向书》的签署方为本公司控股股东中国石油 化工集团有限公司(以下简称"中石化集团")下属主体,本次合作 意向如实际实施将构成关联交易。目前本《投资意向书》仅为明确双 ...

石化机械:拟引入战略投资者增资全资子公司氢机公司

Mei Ri Jing Ji Xin Wen· 2025-10-21 10:44

Core Viewpoint - The company, Shihua Machinery, has signed a letter of intent for investment with three subsidiaries of Sinopec, aiming to enhance its competitiveness in the hydrogen energy sector through capital increase and expansion [1] Group 1: Investment Details - Shihua Machinery will receive investments from Sinopec Capital, Sinopec Petroleum and Chemical Research Institute, and Sinopec (Dalian) Petroleum and Chemical Research Institute, along with Hydrogen Machine Company [1] - The investment will be conducted through capital increase and expansion, focusing on the transformation of technological achievements [1] - After the investment, Shihua Machinery will maintain its controlling stake in Hydrogen Machine Company [1] Group 2: Strategic Goals - The primary goal of this investment is to enhance the leadership in the hydrogen energy industry chain [1] - The investment is expected to strengthen the core competitiveness of Hydrogen Machine Company [1] Group 3: Future Steps - The letter of intent serves as a framework for cooperation and basic principles, with further due diligence and assessment to follow [1] - The process may involve related party transactions as part of the investment evaluation [1]