天然气概念

Search documents

2月10日安彩高科(600207)涨停分析:治理优化、产能升级、资产处置驱动

Sou Hu Cai Jing· 2026-02-10 07:43

Core Viewpoint - An analysis of the recent stock performance of AnCai High-Tech (安彩高科) indicates a significant increase in share price, attributed to various strategic and operational improvements within the company [1] Group 1: Company Developments - The board of directors completed a restructuring on February 3, with the new chairman Xu Dongwei and the management team having over ten years of experience in the photovoltaic and glass industries, leading to optimized governance [1] - The upgrade of the photovoltaic glass production line has been completed, increasing annual production capacity to 10.057 million square meters [1] - The sale of rhodium powder generated a pre-tax profit of 114 million yuan, representing a 366.67% asset appreciation, which aids in capital recovery and focuses on the core business [1] - The company has canceled the supervisory board and strengthened the functions of the audit committee, enhancing governance efficiency [1] Group 2: Market Performance - On February 10, the stock reached a closing price of 5.61 yuan, with a trading halt at 10:51 AM and a closing order volume of 135 million yuan, accounting for 2.22% of its circulating market value [1] - The net inflow of main funds was 119 million yuan, representing 26.81% of the total transaction volume, while retail investors experienced a net outflow of 65.39 million yuan, accounting for 14.76% of the total transaction volume [1] - The stock is recognized as a hot stock in the context of Henan state-owned enterprise reform and natural gas concepts, with related concepts showing slight increases of 0.09% and 0.06% respectively on the same day [1]

19.05亿主力资金净流入,天然气概念涨2.76%

Zheng Quan Shi Bao Wang· 2026-01-22 09:24

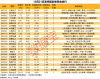

截至1月22日收盘,天然气概念上涨2.76%,位居概念板块涨幅第9,板块内,141股上涨,特瑞斯30%涨 停,洲际油气、蓝焰控股、雪人集团等涨停,中泰股份、石化油服、潜能恒信等涨幅居前,分别上涨 15.07%、8.79%、8.64%。跌幅居前的有洪田股份、乐山电力、积成电子等,分别下跌3.62%、3.49%、 3.42%。 | 代码 | 简称 | 今日涨跌幅 | 今日换手率 | 主力资金流量(万 | 主力资金净流入比率 | | --- | --- | --- | --- | --- | --- | | | | (%) | (%) | 元) | (%) | | 002639 | 雪人集 团 | 9.99 | 22.33 | 68563.73 | 21.54 | | 600028 | 中国石 化 | 4.19 | 0.47 | 31213.97 | 11.30 | | 000407 | 胜利股 份 | 9.92 | 14.65 | 21251.31 | 31.94 | | 600871 | 石化油 服 | 8.79 | 3.95 | 20190.45 | 14.64 | | 600759 | 洲际油 气 | 10 ...

天然气概念走强 蓝焰控股、石化油服涨停

Xin Lang Cai Jing· 2026-01-22 01:54

天然气概念走强,蓝焰控股、石化油服涨停,潜能恒信、中泰股份、胜利股份、新天然气等涨幅居前。 ...

控股股东或变更,最牛股胜通能源收获六连板丨透视一周牛熊股

2 1 Shi Ji Jing Ji Bao Dao· 2025-12-21 10:12

Market Overview - A-shares showed mixed performance in the past week (December 15-19), with the Shanghai Composite Index closing at 3890.45 points, up 0.03%, while the Shenzhen Component Index fell 0.89% to 13140.21 points, and the ChiNext Index dropped 2.26% to 3122.24 points [2] - Over 54% of stocks gained during the week, with 107 stocks rising over 15% and 31 stocks declining over 15%. Retail, dairy, and pharmaceutical sectors led the gains, while sectors like sci-tech new shares, film and television, and Hainan Free Trade Zone saw significant declines [2] Top Gainers - The top-performing stock, Victory Energy (001331.SZ), surged 61.06% in the week, followed by Huaren Health (301408.SZ) with a 55.91% increase. Other notable gainers included Baida Group (600865.SH) and Xice Testing (301306.SZ), both exceeding 50% growth [4] - Victory Energy specializes in liquefied natural gas (LNG) procurement, transportation, and sales, serving various sectors including industrial, urban gas, and transportation [5] Financial Performance - For the first three quarters of 2025, Victory Energy reported revenue of 4.513 billion yuan, a year-on-year increase of 21.34%, and a net profit attributable to shareholders of 44.39 million yuan, up 83.58% [6] Stock Market Activity - On December 19, Victory Energy's stock hit a new high, closing at 26.14 yuan per share, marking its sixth consecutive trading day of gains. The company announced that a special robotics firm, Qiteng Robotics, plans to acquire up to 44.99% of its shares for over 1.6 billion yuan, which will change the controlling shareholder to Qiteng's founder, Zhu Dong [7] - Victory Energy reassured investors that its recent stock price fluctuations were due to the acquisition announcement and that there were no undisclosed significant matters affecting the company [8] Top Losers - The worst-performing stock, Guandao Tui (920680.BJ), plummeted 41.47%, while Zhongyuan Home (603709.SH) and ST Lifang (300344.SZ) both saw declines exceeding 25%. The top ten losers all experienced drops over 22% [10] - Zhongyuan Home, which focuses on furniture products, faced a nearly 26% drop over the week, with consecutive trading days of price declines [14][16] - The company reported a slight revenue decrease of 0.05% year-on-year, with a net loss of 17.44 million yuan, a significant decline of 802.46% compared to the previous year [17]

12月3日午间涨停分析

Xin Lang Cai Jing· 2025-12-03 04:00

Group 1: Investment and Equity Holdings - Company holds a 0.89% equity stake in Blue Arrow Aerospace Technology Co., Ltd. through three investment entities, including Chengdu Luxin Jingrong Phase II Venture Capital Center [2] - Company plans to invest up to 540 million in acquiring Kuixin Technology, expanding into the semiconductor sector [3] Group 2: Pharmaceutical and Healthcare Sector - Multiple provinces in China are experiencing high levels of flu activity, indicating a potential increase in demand for healthcare products [3] - Haiwang Bio has achieved six consecutive trading limit-ups, indicating strong market performance [3] - Yisheng Pharmaceutical is the first in the industry to fully develop ginseng products, with key products including Zhenyuan capsules and XinYue capsules [3] Group 3: Energy and Utilities - Company signed a sales contract for generator sets for North American data centers, with a contract value exceeding 100 million USD, marking entry into the high-end power market [4] - Company is the largest power enterprise in Fujian Province, focusing on hydropower, wind power, and photovoltaic energy [3] Group 4: Technology and Innovation - Company collaborates with Sodium One New Energy to develop semi-solid sodium battery products, focusing on various electrode materials and cell systems [5] - Company is actively participating in the testing of PCB products for NVIDIA, indicating a strong position in the GPU-related product market [4] Group 5: Consumer Goods and Retail - Company is a leading domestic fish ball producer, specializing in frozen fish paste and meat products, with six consecutive trading limit-ups [3] - New macroeconomic policies aim to enhance the adaptability of consumer goods supply and demand, potentially boosting consumption [4]

收评:沪指跌0.97%失守4000点 海南、福建板块逆市走强

Zheng Quan Shi Bao Wang· 2025-11-14 07:08

Core Viewpoint - The three major indices opened lower and maintained a fluctuating adjustment trend, with significant declines in the Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index [1] Market Performance - As of the market close, the Shanghai Composite Index fell by 0.97%, the Shenzhen Component Index decreased by 1.93%, and the ChiNext Index dropped by 2.82% [1] - The Hainan sector continued its strong performance, with stocks like Hainan Mining and Hainan Haiyao hitting the daily limit [1] - The natural gas concept saw a surge, with stocks such as Shouhua Gas, Changchun Gas, and Guo Xin Energy also reaching the daily limit [1] - The banking sector showed strength, with the Industrial and Commercial Bank of China reaching a historical high in stock price during the session [1] - The Fujian sector was actively traded, with stocks like Pingtan Development and Dongbai Group hitting the daily limit [1] - The aquatic products concept experienced a notable rise, with Zhongshui Fishery reaching the daily limit [1] Sector Performance - The supply and heating, commercial retail, pharmaceutical, and real estate sectors saw significant gains [1] - Conversely, the semiconductor, mineral products, storage chips, and internet sectors experienced notable declines [1]

揭秘涨停 | 芯片概念多股涨停

Zheng Quan Shi Bao Wang· 2025-10-21 10:52

Market Overview - On October 21, the A-share market closed with a total of 93 stocks hitting the daily limit, with 79 stocks after excluding 14 ST stocks, resulting in a limit-up rate of 80.87% [1] Top Gainers - The stock with the highest limit-up order volume was Shihua Oil Service, with 465,700 hands, followed by ShenKai Co., Zhonghua Rock Soil, and Shihua Machinery with 348,300 hands, 344,900 hands, and 325,400 hands respectively [2] - In terms of consecutive limit-up days, Pioneer Electronics and ST Zhongdi achieved three consecutive limit-ups, while ShenKai Co., Shihua Machinery, and CITIC Heavy Industries had two consecutive limit-ups [2] Significant Stocks - Pioneer Electronics achieved a limit-up with a closing price of 25.03 yuan and a limit-up order amount of 4.61 billion yuan, focusing on smart gas metering and safety monitoring [3][4] - ShenKai Co. closed at 11.21 yuan with a limit-up order amount of 3.90 billion yuan, driven by deep-sea equipment and robot concepts [3][4] - Shihua Machinery closed at 7.72 yuan with a limit-up order amount of 2.51 billion yuan, benefiting from oil and gas equipment and state-owned enterprise status [3][4] Sector Highlights Chip Sector - Multiple stocks in the chip sector, including Dawi Co., Taiji Industry, and Wentai Technology, achieved limit-ups, with Dawi Co. focusing on high-performance storage chip products [4][5][6] Real Estate Sector - Stocks such as Shangshi Development and Hefei Urban Construction saw limit-ups, with Shangshi Development reporting a signed sales amount of approximately 290 million yuan [7] Energy Equipment Sector - Stocks like Shihua Oil Service and ShenKai Co. also achieved limit-ups, with Shihua Oil Service accelerating its overseas business development [8] Investment Trends - The net buying amount for stocks on the Dragon and Tiger list included significant purchases in Shanhe Intelligent and Hefei Urban Construction, with net buying amounts of 1.88 billion yuan and 1.18 billion yuan respectively [9][10]

天然气概念股快速拉升 长春燃气涨停

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-17 03:27

Core Viewpoint - Natural gas concept stocks experienced a rapid increase, driven by the early initiation of winter heating in several regions, including Gansu, in response to continuous temperature drops [1] Group 1: Stock Performance - Shouhua Gas surged over 12% [1] - Changchun Gas hit the daily limit [1] - Hongtong Gas, Chengdu Gas, and Tianhao Energy also saw significant gains [1] Group 2: Market Drivers - The onset of winter heating mode has led to a peak in natural gas demand [1] - The early start of heating in multiple areas indicates a proactive approach to managing energy needs during colder months [1]

天然气概念持续走强,成都燃气等多股涨停

Xin Lang Cai Jing· 2025-08-21 05:13

Group 1 - The natural gas sector continues to strengthen, with companies such as Chengdu Gas, Huai Oil, and Shenkai Co. hitting the daily limit up [1] - Other companies that experienced gains include Shandong Molong, Xinjin Power, Beiken Energy, Qianeng Hengxin, Zhongman Petroleum, and Shouhua Gas [1]

九丰能源涨0.57%,成交额3.13亿元,今日主力净流入-2499.64万

Xin Lang Cai Jing· 2025-08-15 08:28

Core Viewpoint - The company, Jiufeng Energy, is a major player in the clean energy sector, focusing on natural gas and related products, with a strategic emphasis on expanding its hydrogen energy initiatives and logistics capabilities [2][3]. Company Overview - Jiufeng Energy, established on February 27, 2008, and listed on May 25, 2021, is headquartered in Guangzhou, Guangdong Province. The company specializes in liquefied natural gas (LNG), liquefied petroleum gas (LPG), methanol, and dimethyl ether (DME) [8]. - The revenue composition of Jiufeng Energy includes: 51.19% from natural gas and operations, 39.99% from liquefied petroleum gas, 4.77% from other chemical products, 2.97% from energy logistics and technical services, and 1.07% from specialty gases [8]. Business Operations - The company operates as a large-scale clean energy service provider, focusing on the midstream and terminal sectors of the gas industry. Its main products include LNG, LPG, and chemical products like methanol and DME, which are used in power generation, industrial fuel, town gas, automotive fuel, and chemical raw materials [2][3]. - Jiufeng Energy's core business also includes energy service operations, particularly in gas recovery and processing services around "three types of gas wells," with ongoing projects in the southwestern region of China [2][3]. Logistics and Transportation - The company's logistics capabilities are crucial for securing supply for downstream customers. Jiufeng Energy owns three LNG transport vessels, leases two, and has one under construction, along with one leased LPG transport vessel and one under construction, totaling eight vessels [3]. - The ownership of transport vessels provides cost advantages, enhancing the company's competitive edge by reducing transportation costs and improving safety and reliability [3]. Hydrogen Energy Initiatives - Jiufeng Energy's subsidiary plans to collaborate with Ju Zhengyuan Co., Ltd. to develop hydrogen energy, leveraging by-products from polypropylene projects to advance hydrogen-related technology and market operations [3]. - The initial focus areas include hydrogen production and purification technology, low-carbon environmental technology research, and the development of safety measures for hydrogen transportation and storage [3].