Adobe(ADBE)

Search documents

Adobe (ADBE) Positions Itself as an AI “One-Stop Shop” — Analysts Remain Bullish

Yahoo Finance· 2025-10-31 23:38

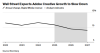

Core Insights - Adobe Inc. is experiencing significant AI momentum and annual recurring revenue (ARR) growth, which are seen as key value drivers despite concerns regarding accounting shifts [1][2][3] Group 1: AI Strategy and Market Position - Adobe aims to be a "one-stop shop" for creative design by integrating third-party models, which is leading to growth in user engagement and content creation [2][4] - The company is witnessing "unambiguous" growth in seats and content creation, countering fears related to generative AI impacts [4] Group 2: Financial Reporting and Growth Projections - Adobe is transitioning to a Total ARR reporting and guidance framework, which may face skepticism but is expected to support continued double-digit growth in customer groupings, a critical value driver [3][4] - Analysts believe that despite initial cost increases from conversational experiences, operational expenditures related to training will likely decrease over time [3][4]

Adobe Aims to Reassure Investors as AI Transforms Markets for Creative Software

PYMNTS.com· 2025-10-31 16:38

Core Insights - Adobe's annual conference aimed to retain the business of marketers, filmmakers, and content creators while reassuring investors about its future prospects [1] - The company is facing increased competition in the AI space from firms like Google, OpenAI, and Canva, leading to a significant drop in its stock price by approximately 25% this year [2][3] - Despite the stock decline, Adobe's AI features in products like Photoshop have been utilized tens of billions of times, indicating strong user engagement [3] AI Strategy and Product Integration - Adobe's CEO stated that the company's stock is undervalued as the market is currently focused on semiconductors and AI model training [4] - The latest annual conference was seen as a step towards addressing concerns regarding the competitive landscape of generative AI tools [4] - Adobe announced the integration of an AI assistant in its Creative Cloud apps, including Photoshop and Lightroom, to handle repetitive tasks and provide personalized recommendations [4][5] Collaborative Intelligence and Updates - Adobe introduced over 100 updates under the concept of "collaborative intelligence," where human input and AI capabilities work together [5] - Features such as image upscaling, generative editing, and batch-image processing are part of the Firefly suite, enhancing the creative process for users [5] - The company's AI strategy encompasses its entire product portfolio, with Firefly models being integrated into flagship applications like Photoshop and Premiere Pro [6]

Adobe (ADBE) CEO Says Stock Undervalued; William Blair Reaffirms Buy

Yahoo Finance· 2025-10-31 14:50

Core Insights - Adobe Inc. is considered undervalued despite strong growth and AI adoption, according to its CEO Shantanu Narayen [1][2] - The market's current focus on semiconductors and AI infrastructure is overshadowing the importance of software solutions, which Adobe is well-positioned to benefit from [2] - The company is increasing share buybacks due to its undervaluation [2] Analyst Perspectives - Jake Roberge from William Blair reaffirmed a Buy rating for Adobe, encouraged by product launches and AI integration plans [3] - Roberge highlighted the visibility into long-term growth catalysts and reaffirmed FY 2025 guidance, indicating a positive outlook for FY 2026 [4] - Adobe is recognized as a leader in creative, document, and digital experience software, providing essential tools for various business functions [4]

投资者拷问Adobe(ADBE.US):AI时代,何以生存?

智通财经网· 2025-10-31 13:15

Core Insights - Adobe is actively embracing AI technology to maintain its position as a leading creative software provider, despite investor concerns about potential structural competition and pricing pressures driven by AI advancements [1][4] - The company's stock has declined approximately 25% this year, reflecting broader investor worries about the slower-than-expected adoption of AI tools across various industries [1][2] Group 1: AI Integration and Strategy - Adobe's media creation market is rapidly being reshaped by AI technology, with its applications like Photoshop seeing AI functionality usage surpassing hundreds of billions, yet many popular AI tools are emerging from competitors [2][4] - To retain creators adopting AI, Adobe announced several strategic initiatives at its recent conference, including integrating AI models from competitors like Google and OpenAI into its core tools, effectively positioning itself as a distributor of third-party AI models [4][6] - This marks a significant shift in Adobe's AI strategy, moving away from solely promoting its proprietary Firefly AI model to acknowledging the necessity of using third-party models for creative ideation [4][6] Group 2: Financial Impact and Market Response - AI-driven products currently generate over $250 million in annual revenue for Adobe, but the company emphasizes that this figure does not fully capture the technology's impact, introducing a broader "AI-driven revenue" metric estimated to contribute around $5 billion annually through pricing enhancements and reduced customer churn [6] - Analyst feedback from the conference was positive regarding the integration of third-party AI models into Adobe products, indicating a potential competitive advantage in the AI image and video generation space [6]

Which Stock Will Rally: Adobe Or Oracle?

Forbes· 2025-10-31 12:20

Core Insights - Oracle's stock has declined by -6.7% recently, raising concerns about its growth and rising costs, alongside insider selling, while Adobe is presented as a more favorable investment option due to its superior revenue growth and lower valuation compared to Oracle [1][3] Company Performance Comparison - Adobe's revenue growth over the last 12 months was 10.7%, surpassing Oracle's 9.7%, and its three-year average revenue growth was 10.5% compared to Oracle's 10.2% [6] - Adobe's profitability is also higher, with a last twelve months margin of 36.2% and a three-year average margin of 35.4%, indicating stronger financial health than Oracle [6] Investment Strategy - A diversified investment approach is recommended, as investing in a single stock can be risky; the Trefis High Quality Portfolio, which includes various asset classes, has historically outperformed benchmarks like the S&P 500 [4][8]

Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

Yahoo Finance· 2025-10-30 13:15

Core Viewpoint - Adobe's market value dropped by 6.13% following the announcement of an expanded partnership with Google Cloud, raising skepticism among investors despite the potential for innovative AI-powered creative technologies [1][2]. Group 1: Partnership Announcement - Adobe and Google Cloud announced a partnership at Adobe Max, aiming to combine Adobe's creative expertise with Google's AI models to enhance creative expression [2]. - The announcement did not resonate positively with investors, leading to a significant decline in Adobe's stock price [2]. Group 2: Stock Performance - Adobe's stock has experienced a 24% decline since the beginning of the year and is down nearly 31% over the past 52 weeks [3]. - Over the last five years, Adobe's stock has underperformed by more than 24% [3]. Group 3: Analyst Ratings - Wall Street analysts maintain a consensus rating of Moderate Buy for Adobe's stock, although this assessment has become less stable with recent changes in ratings [4]. - The consensus has seen one Strong Sell rating added and one Strong Buy rating removed in the past three months [4]. Group 4: Market Sentiment - The Barchart Technical Opinion indicator rates Adobe's stock as an 88% Strong Sell, indicating a bearish short-term outlook [5]. - In the derivatives market, net trade sentiment shows a negative bias, with options flow indicating a sentiment of $897,800 below parity, favoring bearish positions [5]. Group 5: Investment Strategy - Trading in Adobe's stock, particularly in the options market, is likened to search-and-rescue tactics, emphasizing the need for strategic decision-making in a challenging environment [6].

Adobe Stock Dropped Yesterday, Should You Buy It Now?

Forbes· 2025-10-30 13:05

Core Insights - Adobe's stock (NASDAQ: ADBE) saw a significant decline of 6.1% on October 29, 2025, despite multiple AI-focused product announcements at its annual MAX conference, indicating investor concerns about the long-term competitive impact of AI on the business [2][3] - The stock has experienced a substantial decline of 60.0% from its peak of $688.37 on November 19, 2021, to $275.20 on September 30, 2022, underperforming the S&P 500, which had a peak-to-trough drop of 25.4% during the same period [7] - Adobe's stock has not yet returned to its pre-crisis peak, with the highest value since then being $634.76 on February 4, 2024, and it currently trades at $337.86 [7] Stock Performance Analysis - During the 2020 COVID-19 pandemic, ADBE stock declined by 25.6% from a peak of $383.28 on February 19, 2020, to $285.00 on March 12, 2020, while the S&P 500 experienced a peak-to-trough decline of 33.9% [9] - ADBE stock fully recovered to its pre-crisis peak by May 20, 2020, demonstrating resilience during that downturn [9] - In the 2018 correction, ADBE stock dropped 25.5% from a peak of $275.49 on October 1, 2018, to $205.16 on December 24, 2018, compared to a 19.8% decline for the S&P 500, and it also fully recovered by April 23, 2019 [9] Investment Strategy Considerations - Investing in a single stock like ADBE can be risky, and a diversified strategy, such as the Trefis High Quality Portfolio, is recommended to mitigate stock-specific risk while providing upside potential [4] - The Trefis High Quality Portfolio has consistently outperformed its benchmark, which includes the S&P 500, S&P mid-cap, and Russell 2000 indices, indicating a strategy that provides superior returns with reduced risk [8]

What Makes Adobe (ADBE) an Investment Bet?

Yahoo Finance· 2025-10-30 12:29

Core Insights - Diamond Hill Capital's "Select Fund" underperformed the Russell 3000 Index in Q3 2025, returning 4.98% compared to the index's 8% gain [1] - The fund initiated four new positions in Q3, including Adobe Inc. (NASDAQ:ADBE), indicating a belief in the long-term growth potential of selected companies despite market trends [3] Company Performance - Adobe Inc. reported record revenue of $5.99 billion in Q3 2025, reflecting a 10% year-over-year growth [4] - The stock of Adobe Inc. closed at $337.86 on October 29, 2025, with a market capitalization of $141.428 billion [2] Stock Analysis - Adobe Inc. experienced a one-month return of -2.56% and a significant decline of 30.02% over the past 52 weeks [2] - The company is ranked 13th among the 30 Most Popular Stocks Among Hedge Funds, with 104 hedge fund portfolios holding its stock at the end of Q2 2025, down from 111 in the previous quarter [4]

Adobe Systems Bear Put Spread Could Return 233% in this Down Move

Yahoo Finance· 2025-10-30 11:00

Group 1 - Adobe Systems (ADBE) stock has been identified as a bearish candidate after breaking below the 50-day moving average [1] - The Barchart Technical Opinion rating for Adobe is 88% Sell, indicating a strengthening short-term outlook for maintaining the current bearish trend [13] - Adobe operates through three segments, with the Digital Media solutions segment enabling businesses to create and deliver content across various media [14][15] Group 2 - A Bear Put spread trade is being considered, which assumes that Adobe's stock will continue to decline [4] - The proposed Bear Put spread involves buying a December 19 put with a strike price of $285 and selling a $280 put, trading for around $1.50 [8] - The maximum profit for this trade is $350, representing a 233.33% return on risk if Adobe's stock falls below $280 [9]

OpenAI与Adobe达成合作:ChatGPT将整合Photoshop实现自然语言互动修图

Huan Qiu Wang Zi Xun· 2025-10-30 03:17

Core Insights - Adobe has announced a new collaboration with OpenAI to deeply integrate their core products, allowing users to edit images using natural language on the ChatGPT platform, marking an expansion of AI-driven creative tools [1][3] Group 1: Collaboration Details - The integration will connect Adobe's popular creative software, Photoshop and Adobe Express, to the ChatGPT ecosystem, enabling users to issue editing commands in natural language without switching platforms, significantly simplifying the creative workflow [1][3] - Users can find the Adobe applications in the "More" menu on ChatGPT and interact with GPT to execute image editing tasks [1] Group 2: Functional Enhancements - The demonstration showcased practical features of the integration, where Adobe Express can generate complete flyers from vague text prompts, and new UI elements allow users to quickly adjust image parameters without repeatedly inputting commands [3] - Generated content can be exported directly to Adobe Express for further detailed modifications, balancing efficiency and creative flexibility [3] Group 3: Adobe's AI Strategy - Adobe's Vice President, Alexandru Costin, emphasized that the collaboration aims to integrate technological strengths rather than replace Adobe's own AI models, highlighting the unique advantages of Adobe's Firefly model, which is trained on authorized content to ensure copyright compliance [3][4] - The Firefly model allows users to generate content that can be used commercially, providing reliable protection for professional creators and businesses [3][4] Group 4: Recent Developments in AI Tools - Adobe has been active in the AI creative tools space, recently launching a new AI assistant for Photoshop that automates repetitive editing tasks based on minimal text input, reducing the burden of basic operations [4] - The newly released Firefly Image 5 model can generate high-definition images at 4 million pixels and supports layer editing, further enhancing the efficiency and quality of professional image creation [4]