募集资金

Search documents

捷邦科技连亏2年半 2022年上市募9.4亿中信建投保荐

Zhong Guo Jing Ji Wang· 2025-10-17 07:56

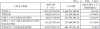

Core Viewpoint - Jebang Technology (301326.SZ) reported a revenue of 438 million yuan for the first half of 2023, marking a year-on-year increase of 27.51%, but faced significant net losses [1][2]. Financial Performance - The company's revenue for the first half of 2023 was 437,563,581.36 yuan, up 27.51% from 343,161,782.76 yuan in the same period last year [2]. - The net profit attributable to shareholders was -38,023,569.68 yuan, a decline of 572.70% compared to -5,652,381.96 yuan in the previous year [2]. - The net profit after deducting non-recurring gains and losses was -42,653,207.11 yuan, representing a decrease of 195.19% from -14,449,608.02 yuan [2]. - The net cash flow from operating activities was -65,423,440.64 yuan, a drop of 537.21% from -10,267,235.33 yuan [2]. Future Projections - For 2024, the company is projected to achieve a revenue of 792,805,238.89 yuan, a 16.90% increase from 678,193,574.22 yuan in 2023 [3]. - The net profit attributable to shareholders is expected to improve to -19,348,460.60 yuan, a 65.33% reduction from -55,803,415.39 yuan in 2023 [3]. - The net profit after deducting non-recurring gains and losses is projected to be -33,129,566.38 yuan, a 53.10% improvement from -70,641,707.56 yuan [3]. - The net cash flow from operating activities is anticipated to be 20,799,161.98 yuan, a significant decrease of 85.85% from 146,987,913.70 yuan in 2023 [3]. IPO and Fundraising - Jebang Technology raised a total of 936.132 million yuan from its initial public offering, with a net amount of 836.9503 million yuan after deducting issuance costs [4]. - The final net fundraising amount exceeded the original plan by 28.69503 million yuan [4]. - The funds are intended for the construction of a high-precision electronic functional structural component production base, a research and development center, and to supplement working capital [4].

汇创达实控人方拟套现约1.7亿 正拟募资总股本2成质押

Zhong Guo Jing Ji Wang· 2025-10-16 07:21

Core Viewpoint - The company Huichuangda (300909.SZ) announced a share reduction plan by its shareholder Ningbo Tongmu, which intends to reduce up to 5,189,100 shares, accounting for 2.9999% of the total share capital, from November 6, 2025, to February 5, 2026 [1] Group 1: Share Reduction Plan - Ningbo Tongmu plans to reduce its holdings through centralized bidding or block trading, with a maximum of 1,729,700 shares (1% of total shares) via centralized bidding and 3,459,400 shares (2% of total shares) via block trading [1] - The estimated amount from this share reduction is approximately 172 million yuan based on the closing price of 33.08 yuan per share on October 15, 2025 [2] Group 2: Company Background and Financials - Huichuangda was listed on the Shenzhen Stock Exchange's Growth Enterprise Market on November 18, 2020, with an initial issuance of 25,226,666 shares at a price of 29.57 yuan per share [2] - The highest price recorded since its listing was 94.89 yuan [2] - The total funds raised from the initial public offering amounted to 74.59525 million yuan, with a net amount of 68.65536 million yuan after deducting issuance costs [2] Group 3: Recent Financial Activities - In 2023, Huichuangda reported a special report on the use of raised funds, confirming the completion of fundraising of 149,999,996.86 yuan from a specific issuance of 6,581,834 shares at 22.79 yuan each [4] - The company plans to issue convertible bonds to raise up to 65.04142 million yuan for projects related to power batteries and working capital [4] - As of the 2025 semi-annual report, major shareholders have pledged a total of 36,140,000 shares, representing 20.89% of the company's total share capital [5]

高测股份连亏一年半 2020年上市3募资合计19.82亿

Zhong Guo Jing Ji Wang· 2025-10-15 06:43

Core Viewpoint - The financial performance of Gaoce Co., Ltd. (688556.SH) in the first half of 2025 shows significant declines in revenue and net profit compared to the same period last year, indicating ongoing challenges for the company in the current economic environment [1][2]. Financial Performance Summary - The company reported a revenue of 1.45 billion yuan in the first half of 2025, a decrease of 45.16% year-on-year [2]. - The net profit attributable to shareholders was -88.55 million yuan, representing a decline of 132.47% compared to the previous year [2]. - The net profit attributable to shareholders after deducting non-recurring gains and losses was -121.83 million yuan, down 151.26% year-on-year [2]. - The net cash flow from operating activities was -329.73 million yuan, an improvement from -485.13 million yuan in the same period last year [2]. Historical Financial Data - In 2024, the company achieved a revenue of 4.47 billion yuan, a decrease of 27.65% year-on-year [2]. - The net profit attributable to shareholders in 2024 was -44.43 million yuan, down 103.03% year-on-year [2]. - The net profit after deducting non-recurring gains and losses in 2024 was -109 million yuan, a decrease of 107.61% compared to the previous year [2]. - The net cash flow from operating activities in 2024 was -1.26 billion yuan, a decline of 205.64% year-on-year [2]. Company Background - Gaoce Co., Ltd. was listed on the Sci-Tech Innovation Board on August 7, 2020, with an issuance of 40.46 million shares at a price of 14.41 yuan per share [3]. - The total amount raised during the IPO was 583 million yuan, with a net amount of 531 million yuan after deducting issuance costs [3]. - The company planned to use the raised funds for high-precision CNC equipment industrialization, diamond wire industrialization, R&D center expansion, and working capital [3]. Fundraising Activities - Since its listing, Gaoce Co., Ltd. has raised a total of 1.98 billion yuan through three fundraising activities [4]. - In 2022, the company issued convertible bonds to unspecified objects, raising 483.3 million yuan, with a net amount of 474.25 million yuan after costs [5]. - In 2023, the company issued A-shares to specific objects, raising approximately 915.55 million yuan, with a net amount of 910.05 million yuan after deducting issuance costs [6].

航天宏图连亏2年半 国信证券保荐上市6年3募资共24亿

Zhong Guo Jing Ji Wang· 2025-10-14 07:04

Core Viewpoint - The company, Aerospace Hongtu, reported a significant decline in revenue and increased net losses for the first half of 2025 compared to the previous year [1] Financial Performance - For the first half of 2025, the company achieved operating revenue of 290 million yuan, a year-on-year decrease of 65.63% [1] - The net profit attributable to shareholders was -248 million yuan, compared to -185 million yuan in the same period last year [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was -252 million yuan, compared to -197 million yuan in the previous year [1] - The net cash flow from operating activities was -89.79 million yuan, compared to -461 million yuan in the same period last year [1] Fundraising Activities - The company was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on July 22, 2019, with an initial public offering of 41.5 million shares at a price of 17.25 yuan per share, raising a total of 715.875 million yuan [1] - In 2021, the company issued 17,648,348 shares to specific investors at a price of 39.67 yuan per share, raising a total of 700.11 million yuan, with a net amount of 689.3626 million yuan after deducting issuance costs [2] - In 2022, the company issued 10.088 million convertible bonds at a face value of 100 yuan each, raising a total of 1,008.8 million yuan, with a net amount of 991.3742 million yuan after deducting issuance costs [3] - The total funds raised from the initial public offering, the 2020 specific issuance, and the 2022 convertible bond issuance amounted to 2.425 billion yuan [3] Dividend Distribution - On May 23, 2023, the company announced a profit distribution plan, distributing a cash dividend of 0.13 yuan per share and increasing capital by 0.4 shares per share, resulting in a total share capital of 259,946,793 shares after the distribution [4] - The projected operating revenues for 2023 and 2024 are 1.819 billion yuan and 1.575 billion yuan, respectively, with net losses expected to be -374 million yuan and -1.393 billion yuan [4]

华兴源创实控人方拟套现1.3亿 A股共募17.7亿去年转亏

Zhong Guo Jing Ji Wang· 2025-10-09 06:49

Core Viewpoint - Huaxing Yuanchuang (688001.SH) announced a share reduction plan by its shareholders, Suzhou Yuanke and Suzhou Yuanfen, due to their funding needs, intending to sell up to 4,000,000 shares, representing no more than 0.90% of the total share capital [1][2] Group 1: Shareholder Reduction Plan - Suzhou Yuanke plans to reduce its holdings by up to 2,000,000 shares, accounting for no more than 0.45% of the total share capital, while Suzhou Yuanfen also plans to reduce by the same amount [1] - The total cash amount from the planned share reduction is estimated to be no more than 126 million yuan based on the closing price of 31.59 yuan on September 30 [2] Group 2: Company Background and Financials - Huaxing Yuanchuang was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on July 22, 2019, with an initial public offering (IPO) of 40.1 million shares at a price of 24.26 yuan per share [2] - The total funds raised from the IPO amounted to 972.826 million yuan, with a net amount of 880.893 million yuan after deducting issuance costs [2] - The company reported a revenue of 1.823 billion yuan in 2024, a decrease of 2.07% year-on-year, and a net profit attributable to shareholders of -497 million yuan, a decline of 307.39% [4][5]

精测电子实控人拟套现8.46亿 扣非亏1年半A股共募35亿

Zhong Guo Jing Ji Wang· 2025-09-24 03:29

Core Viewpoint - The announcement details the transfer of shares from the controlling shareholder, Peng Qian, to a private equity fund, aiming to optimize the company's equity structure and attract strategic investors while addressing personal funding needs [1][2]. Share Transfer Details - Peng Qian plans to transfer a total of 14,044,100 shares, representing 5.02% of the company's total equity, to Wenfa Changjiang No. 2 Private Securities Investment Fund at a price of 60.24 yuan per share [2]. - After the transfer, Peng Qian will hold 58,500,000 shares, or 20.91% of the total equity, while Wenfa Changjiang No. 2 will become a significant shareholder with 5.02% [2]. Financial Performance - In the first half of 2025, the company reported revenue of 1.381 billion yuan, a year-on-year increase of 23.20%, but a net profit attributable to shareholders of 27.67 million yuan, down 44.48% [3][4]. - The company's cash flow from operating activities was negative 460 million yuan, compared to negative 198 million yuan in the same period last year [3][4]. Future Projections - For 2024, the company expects revenue of 2.565 billion yuan, a growth of 5.59%, but anticipates a net loss of 97.60 million yuan, contrasting with a profit of 150.10 million yuan in 2023 [5]. - The projected net profit excluding non-recurring items is expected to be negative 158.56 million yuan, a significant decline from the previous year's profit of 32.88 million yuan [5]. Historical Context - The company was listed on the Shenzhen Stock Exchange in November 2016, raising approximately 398.40 million yuan through an initial public offering [6]. - The total amount raised from four fundraising activities since its listing is approximately 3.543 billion yuan [10].

臻镭科技实控人被留置 2022年IPO超募8亿中信证券保荐

Zhong Guo Jing Ji Wang· 2025-09-22 09:16

Core Viewpoint - Zhenlei Technology (688270.SH) announced that its chairman, Yu Faxin, is currently under investigation by the Huangshi Municipal Supervisory Committee, but the company's control has not changed and normal operations will continue [1] Group 1: Company Governance and Management - The company has a robust governance structure and internal control mechanisms in place, ensuring that daily operations are managed by senior management during the chairman's absence [1] - Zhang Bing, a board member, will temporarily assume the chairman's responsibilities while Yu Faxin is unable to perform his duties [1] Group 2: Financial Performance - In the first half of 2025, Zhenlei Technology achieved a revenue of 205 million yuan, representing a year-on-year increase of 73.64% [2][3] - The net profit attributable to shareholders reached approximately 62.32 million yuan, marking a significant year-on-year growth of 1006.99% [2][3] - The net profit after deducting non-recurring gains and losses was approximately 52.89 million yuan, a recovery from a loss of 605,600 yuan in the same period last year [2][3] - The net cash flow from operating activities was approximately 10.21 million yuan, compared to a negative cash flow of 4.31 million yuan in the previous year [3] Group 3: Historical Financial Data - Over the past five years, Zhenlei Technology's revenue has shown consistent growth, with figures of 152.1 million yuan, 190.6 million yuan, 242.6 million yuan, 280.8 million yuan, and 303.4 million yuan respectively [3] - The net profit attributable to shareholders over the same period has varied, with figures of 76.94 million yuan, 98.84 million yuan, 107.7 million yuan, 72.48 million yuan, and 17.85 million yuan [3] Group 4: Initial Public Offering (IPO) Details - Zhenlei Technology was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on January 27, 2022, with an issue price of 61.88 yuan per share and a total issuance of 27.31 million shares [4] - The total funds raised from the IPO amounted to 1.69 billion yuan, with a net amount of 1.54 billion yuan after deducting issuance costs [4] Group 5: Stock Dividend and Bonus Issues - On May 26, 2023, the company announced a stock bonus plan of 4 additional shares for every 10 shares held, along with a pre-tax dividend of 3 yuan [5] - A similar plan was announced on May 9, 2024, proposing 4 additional shares for every 10 shares held and a pre-tax dividend of 1.7 yuan [6]

经纬恒润2年1期均亏 2022年上市募36亿中信证券保荐

Zhong Guo Jing Ji Wang· 2025-09-22 07:16

Core Viewpoint - The company achieved significant revenue growth in the first half of 2025, but continued to report net losses, indicating ongoing financial challenges despite operational improvements [1][2]. Financial Performance - In the first half of 2025, the company reported operating revenue of 2.908 billion yuan, a year-on-year increase of 43.48% compared to 2.027 billion yuan in the same period last year [2]. - The net profit attributable to shareholders was a loss of 86.96 million yuan, improving from a loss of 333.76 million yuan in the previous year [2]. - The net profit attributable to shareholders after deducting non-recurring gains and losses was a loss of 115.22 million yuan, compared to a loss of 387.21 million yuan in the same period last year [2]. - The net cash flow from operating activities was -299.22 million yuan, an improvement from -726.51 million yuan in the previous year [2]. Previous Year Comparison - In 2024, the company achieved total operating revenue of 5.541 billion yuan, representing an 18.46% increase from 4.678 billion yuan in 2023 [3]. - The net profit attributable to shareholders for 2024 was a loss of 550.32 million yuan, worsening from a loss of 217.26 million yuan in 2023 [3]. - The net cash flow from operating activities in 2024 was -537.53 million yuan, slightly better than -559.29 million yuan in 2023 [3]. Fundraising and Use of Proceeds - The company raised a total of 363 million yuan from its IPO, with a net amount of 348.80 million yuan after deducting issuance costs, which was 151.20 million yuan less than the planned amount of 500 million yuan [4]. - The raised funds were intended for projects including the automotive electronics production base in Nantong, the R&D center in Tianjin, digital capability enhancement, and working capital [4].

倍轻松1高管拟减持 扣非连亏3年半上市即巅峰募4.2亿

Zhong Guo Jing Ji Wang· 2025-09-15 08:12

Summary of Key Points Core Viewpoint - The announcement from Beilingsong (688793.SH) regarding shareholder Wang Qiaoqing's plan to reduce shareholding due to personal financial needs highlights potential liquidity concerns for the company, as well as the ongoing challenges reflected in its financial performance [1][2]. Group 1: Shareholder Reduction Plan - Wang Qiaoqing holds a total of 4,811,500 shares, representing 5.6% of the company's total equity [1]. - The planned reduction involves selling up to 859,454 shares, which is no more than 1% of the total equity, through centralized bidding within three months after the announcement [2]. - The shares to be sold include 3,436,786 shares that were released from restrictions on July 15, 2022, and 1,374,714 shares obtained from capital reserve conversion [1][2]. Group 2: Financial Performance - Beilingsong reported a net profit attributable to shareholders of -1.30 billion yuan in 2022, -559.93 million yuan in 2023, -327.69 thousand yuan in 2024, and -37.01 million yuan in the first half of 2025 [2]. - The company's revenue for 2024 was approximately 1.085 billion yuan, a decrease of 14.88% compared to the previous year [3]. - In the first half of 2025, the company reported a revenue of approximately 384.94 million yuan, down 36.22% year-on-year, with a net profit attributable to shareholders of -36.11 million yuan [4]. Group 3: Initial Public Offering (IPO) and Fundraising - Beilingsong raised a total of 422 million yuan during its IPO, with a net amount of 359 million yuan after deducting issuance costs [5]. - The company initially planned to raise 497 million yuan for various projects, including marketing network construction and R&D upgrades [5]. - The underwriting fees for the IPO amounted to 63.32 million yuan, with the lead underwriter being Anxin Securities [5].

奥锐特实控人方拟减持 2020年上市2募资共11.55亿元

Zhong Guo Jing Ji Wang· 2025-09-01 03:37

Core Viewpoint - The company Aorite (605116.SH) announced a share reduction plan due to the funding needs of some partners, with a maximum reduction of 2,176,600 shares, accounting for 0.54% of the total share capital [1] Group 1: Shareholding Structure - As of the announcement date, the total number of shares of the company is 406,195,234, with Tian Tai Bo Rong and its concerted parties holding a total of 170,096,400 shares, representing 41.88% of the total share capital [1] - Tian Tai Bo Rong holds 9,907,200 shares, accounting for 2.44% of the total share capital, while Zhejiang Tong Ben holds 153,583,200 shares, representing 37.81% [1] Group 2: Fundraising and Projects - Aorite was listed on the Shanghai Stock Exchange on September 21, 2020, with a total fundraising amount of 34,317.00 million yuan, and a net amount of 28,404.13 million yuan after deducting issuance costs [2] - The funds raised are intended for projects including the technical transformation of production lines for various pharmaceutical products and the construction of a pilot experimental center [2][3] - The total investment for the projects is 46,110.00 million yuan, with specific allocations for each project detailed in the report [3] Group 3: Convertible Bonds - Aorite plans to issue convertible bonds with a total face value of 81,212.00 million yuan, raising approximately 800,471,428.30 yuan after deducting issuance costs [4] - The issuance is conducted by the lead underwriter Guotai Junan Securities Co., Ltd., and the funds have been verified and deposited into the company's fundraising supervision account [4]