双主业发展模式

Search documents

硅宝科技(300019) - 300019硅宝科技投资者关系管理信息20251210

2025-12-10 09:28

Group 1: Company Overview and Production Capacity - The company, Silicon Treasure Technology, has a production capacity of 370,000 tons/year for high-end adhesives, ranking first in the industry [2] - It has established nine production bases across regions including Sichuan, Jiangsu, Anhui, and Shanghai, with a focus on high-end silicone sealants and adhesives [2] - Future plans include expanding production centers in Southwest, East, and South China to enhance market proximity and service [2] Group 2: New Projects and Investments - The company is investing CNY 150 million in a new subsidiary in Shanghai for advanced silicone materials, including a 5,000 tons/year electronic and optical packaging materials production line [3] - This project aims to leverage Shanghai's international advantages and enhance R&D capabilities to serve the Yangtze River Delta economic circle [3] Group 3: Product Applications and Market Position - The company offers a range of UV adhesive products, including UV-curable adhesives and coatings, primarily used in electronics and optical devices [4] - Its UV-curable optical adhesives have been successfully applied in military, automotive, and commercial display sectors, showcasing strong market advantages [4] Group 4: Strategic Acquisitions - The acquisition of Jiangsu Jiahau, a leading hot melt adhesive company, aims to enhance the company's product range and core competitiveness in the hot melt adhesive sector [5] - In 2024, Jiangsu Jiahau achieved a revenue of CNY 1.027 billion, a year-on-year increase of 24.66%, and a net profit of CNY 49.33 million, up 8.34% [6] Group 5: International Sales and Growth Strategy - The company has expanded its overseas market presence, exporting products to over 60 countries, with a significant increase in export sales revenue of CNY 223.46 million, a year-on-year growth of 288.01% [6] - Key growth drivers include strong market demand and the establishment of localized sales networks in countries like Brazil, India, and the USA [6] - Future strategies will focus on further expanding overseas markets and increasing market share in hot melt and silicone adhesive products [6]

九安医疗(002432) - 002432九安医疗投资者关系管理信息20251027

2025-10-27 12:56

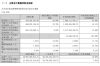

Group 1: Business Strategy and Investment - The company has established a dual business model focusing on medical health operations and large asset allocation investments, aiming for stable profits and cash flow [2][3] - The asset allocation strategy is inspired by Yale University's endowment model, targeting a long-term return of 6%-10% per year [3] - As of mid-2025, the company's private equity assets accounted for 12.6% of its total assets, with significant investments in hard technology and healthcare sectors [3][4] Group 2: Product Development and Market Expansion - The company plans to launch a four-in-one respiratory test product, currently in clinical trials, to address seasonal respiratory diseases [5] - The three-in-one test product has achieved stable sales in the consumer market, with a focus on expanding sales channels [8] - The company is actively developing AIoT diabetes management tools, aiming to enhance chronic disease management through technology [12][23] Group 3: Financial Performance and Shareholder Value - The company has conducted five share buyback programs since 2021, totaling approximately ¥2.88 billion, with a sixth program currently underway [7][20] - As of Q3 2025, the company reported a revenue of ¥3.04 billion, a 17.8% increase from the previous quarter, driven by iHealth products and internet medical services [24][25] - The company has committed to distributing at least 30% of its cumulative net profit as dividends over the next three years [20][21] Group 4: Market Challenges and Future Outlook - The company faces challenges in the U.S. market due to tariff issues, but has established overseas production capabilities to mitigate these impacts [29] - The diabetes care service model has expanded to approximately 50 cities and 424 hospitals, managing over 366,000 patients in China [10][22] - The company anticipates significant growth in the diabetes care market, with a target of managing 1 million patients within three years [22]

九安医疗前三季营收“腰斩” 净利却逆势增长16.11%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 12:46

Core Insights - The core observation is that despite a significant decline in revenue, Jiuan Medical has managed to achieve a growth in net profit, indicating a fundamental shift in its profit structure [1][3]. Financial Performance - Jiuan Medical reported a revenue of 1.069 billion yuan for the first three quarters, a year-on-year decrease of 48.89% [2][4]. - The net profit attributable to shareholders was 668.89 million yuan, reflecting a year-on-year increase of 16.11% [2][5]. - The company experienced a negative cash flow of 34.07 million yuan, a decline of 104.90% compared to the previous year [4]. - Investment income reached 937 million yuan, up 84.99% year-on-year, contributing significantly to the net profit growth [5][6]. Business Transformation - Jiuan Medical is transitioning from a reliance on traditional medical device sales to a dual business model that includes both healthcare operations and large asset investment [6][7]. - The company is focusing on expanding its internet healthcare and chronic disease management sectors, particularly through a new diabetes care model [7][8]. - The firm has increased its investment in research and development, with management expenses rising by 26.66% and R&D expenses by 25.91% [5][6]. Investment Strategy - Jiuan Medical has engaged in significant investments in various sectors, including technology and healthcare, and has established partnerships with venture capital firms [8][9]. - The company has launched a new venture capital fund with a total scale of 701 million yuan, aiming to make financial investments [10]. - Jiuan Medical's investment activities are primarily conducted through its wholly-owned subsidiary, Jiuan Hong Kong, focusing on long-term returns in emerging technology fields [8][9].

主营业务多点开花 硅宝科技前三季度营收、净利润均创同期新高

Zheng Quan Ri Bao Wang· 2025-10-22 12:16

Core Viewpoint - Chengdu Silica Technology Co., Ltd. (Silica Technology) has demonstrated strong operational performance in the first three quarters of 2025, achieving record highs in revenue and net profit, driven by growth in its main business segments [1][2]. Group 1: Financial Performance - In the first three quarters of 2025, Silica Technology reported revenue of 2.651 billion yuan and a net profit attributable to shareholders of 229 million yuan, representing year-on-year increases of 24.3% and 44.63%, respectively [1]. - The company's overall performance has reached new highs for the same period, reflecting a positive trend in its business operations [1]. Group 2: Business Segments - Silica Technology maintains its leading position in the construction adhesive sector, while its industrial adhesive business is experiencing rapid growth, and the hot melt adhesive business is steadily improving [1]. - The company has been actively developing new products and expanding applications in the industrial adhesive sector, enhancing its market share with major clients such as BYD, CATL, ZTE, and others [1]. Group 3: Strategic Acquisitions - In 2024, Silica Technology successfully acquired Jiangsu Jiahua Hot Melt Adhesive Co., Ltd., a leading player in the hot melt adhesive industry, which has positively impacted its business performance [2]. - The acquisition is expected to contribute to Silica Technology's revenue growth and help it move closer to its goal of achieving a "100 billion yuan" production value [2]. Group 4: Future Outlook - The company is focusing on expanding production capacity and establishing three major production centers in Southwest, East China, and South China to better serve the market [3]. - Silica Technology aims to strengthen its position in the construction adhesive market, increase its market share in industrial adhesives, and actively develop its silicon-carbon negative material business, transitioning towards a "dual main business" development model [3].