CGM产品

Search documents

美好医疗(301363) - 301363美好医疗投资者关系管理信息20260120

2026-01-20 13:16

Group 1: Brain-Computer Interface (BCI) Business - The company is a leading global partner and core supplier in the cochlear implant sector, with nearly 15 years of deep collaboration in technology development and production transformation [2] - The company aims to provide comprehensive technical and product support across invasive, semi-invasive, and non-invasive BCI routes, reinforcing its competitive edge in invasive BCI implants [2] - Current revenue from the BCI business (excluding cochlear implant components) is relatively small, indicating investment risks [2] Group 2: Robotics Business - The company is actively developing humanoid robots and has initiated product technology layouts in collaboration with clients, leveraging its expertise in PEEK materials and small motor components [3] - In the surgical robot sector, the company has begun small-scale deliveries to domestic and international clients [3] Group 3: Shareholding and Financial Management - A total of 14,274,464 shares are proposed to be reduced, accounting for 2.51% of the total share capital, with 2.00% through block trading and 0.51% through competitive bidding [4] - The management emphasizes maintaining shareholder value through transparent and efficient operational strategies [4] Group 4: Injection Pen and Continuous Glucose Monitoring (CGM) Business - The company has successfully delivered adjustable insulin injection pens in bulk and signed orders for weight loss pens, with automated production lines expected to be operational in 2026 [5] - CGM products are set to enter mass delivery in Q2 2025, currently in a stable ramp-up phase, with further capacity expansion planned for 2026 [5] Group 5: Respiratory and Cochlear Implant Components - The company provides comprehensive design, development, manufacturing, and sales services for precision components and products in the medical device sector, aiming to be a global leader in medical technology services [6] - Long-term strategic partnerships with leading global companies in the home ventilator and cochlear implant markets have been established, ensuring continuous innovation and competitive advantages [7]

京东健康发布2026年医疗器械战略全景

Zheng Quan Ri Bao Wang· 2026-01-09 10:16

Core Viewpoint - JD Health aims to become a powerful growth engine and launchpad for global medical device brands by leveraging supply, AI, and medical services as its three core drivers [1] Group 1: Strategic Development - JD Health announced its 2026 medical device development strategy during the annual merchant conference, focusing on high-quality growth and innovation in the medical device sector [1] - The company plans to invest over 100 million yuan in marketing resources for the launch of new products in collaboration with the top 100 global brands [1][2] - The medical device market in China is projected to grow from approximately 300 billion yuan to a target of 500 billion yuan in the coming years, driven by policy and market forces [1] Group 2: Product Innovation and Market Expansion - In 2025, JD Health will deepen global collaborations and introduce overseas supplies through large-scale procurement, aiming for a 100% growth in trending categories [2] - The "Crazy New Product IP" initiative has led to the launch of nearly 30 new products with sales exceeding 10 million yuan and around 500 products exceeding 1 million yuan in sales, setting new industry records [2] - JD Health will focus on four high-potential areas in 2026: chronic disease management, home care, home-use medical products, and consumer health products [2] Group 3: AI Integration and Service Enhancement - JD Health is utilizing its self-developed "Jingyi Qianxun" AI model to transform product categories and define value through service, moving towards a full-cycle health management solution [3] - Collaborations with brands like Yuyue, SanNu, and Weitai have resulted in the launch of customized CGM products, creating an integrated smart blood glucose management system [3] - The company aims to enhance its capabilities in supply, service, and AI to promote sustainable development in the medical device industry and make professional healthcare services more accessible [3]

以AI重塑品类,以服务定义价值,京东健康发布2026年医疗器械战略全景

Xin Lang Cai Jing· 2026-01-09 06:58

Core Insights - JD Health is set to enhance its investment in the medical device sector, focusing on supply, AI, and medical services as core drivers for growth, aiming to become a significant growth engine and launchpad for global medical device brands by 2026 [1][5] Group 1: Strategic Initiatives - JD Health signed agreements with 100 global brands to launch new products in 2026, committing over 100 million in marketing resources to ensure that new products are launched as bestsellers [1][5] - The company aims to create a comprehensive ecosystem that meets user needs across all channels and life cycles, supporting the "Healthy China 2030" strategy [1] Group 2: Market Growth and Product Innovation - The medical device market in China is projected to grow from approximately 300 billion to 500 billion, driven by aging population, health awareness, and consumption upgrades [3] - JD Health plans to deepen global collaborations and enhance domestic supply through initiatives like JDH+N alliance, targeting a 100% growth in trending categories [3] Group 3: Awards and Recognition - JD Health established a rigorous evaluation system for awarding the 2025 Golden Award for new medical devices, recognizing nearly 100 brands for their quality and reputation [5] Group 4: AI and Service Integration - JD Health is leveraging its self-developed AI model "Jingyi Qianxun" to transform product categories and define value through services, moving towards a full-cycle health management solution [7] - The company has launched customized CGM products in collaboration with brands like Yuyue and Sanofi, creating an integrated smart blood glucose management system [9] Group 5: Consumer Engagement and Service Enhancement - JD Health's AI doctor "Xiao Wei" provides comprehensive support throughout the purchasing process, achieving a user satisfaction rate of 98.4% [9] - The company is enhancing its online and offline medical services, integrating them with medical device usage scenarios to create a seamless health management experience [9]

以AI重塑品类 以服务定义价值,京东健康发布2026年医疗器械战略全景

Jin Rong Jie Zi Xun· 2026-01-09 02:31

Core Insights - JD Health is set to enhance its medical device sector by leveraging supply chain, AI, and medical services as core drivers, aiming to become a significant growth engine for global medical device brands by 2026 [1][5] - The company plans to invest over 100 million in marketing resources for the launch of new products in collaboration with top global brands, focusing on high-quality development in the medical device industry [1][5] Group 1: Market Growth and Strategy - The medical device market in China is experiencing rapid growth, projected to reach 500 billion from the current 300 billion, driven by aging population, health awareness, and consumption upgrades [3] - JD Health aims to deepen partnerships with global medical device brands and enhance supply chain capabilities through initiatives like JDH+N alliance, targeting a 100% growth in trending categories by 2025 [3][6] Group 2: Product Innovation and Awards - In 2025, JD Health launched nearly 500 new products, setting industry records, with a focus on innovative product development as a key driver for high-quality growth [3][5] - The company established a rigorous evaluation system for product awards, recognizing nearly 100 brands for their quality and reputation at the annual conference [5] Group 3: AI and Service Integration - JD Health is utilizing its self-developed AI model "Jingyi Qianxun" to transform product categories and define value through service, moving towards comprehensive health management solutions [6][7] - The company has developed a smart blood glucose management system in collaboration with brands, integrating monitoring, analysis, intervention, and tracking for chronic disease management [9] Group 4: Comprehensive Health Management - JD Health is enhancing its online and offline service integration, providing a full-cycle health management experience that includes disease prevention, smart monitoring, chronic disease management, and post-hospital rehabilitation [9] - The company aims to eliminate homogenization in the medical device industry through product innovation and AI technology upgrades, making professional healthcare services more accessible [9]

三诺生物(300298):收入加速增长,专利授权费用影响短期利润:三诺生物(300298):2025年三季报点评

Huachuang Securities· 2025-12-03 08:44

Investment Rating - The report maintains a "Recommendation" rating for the company, with a target price of 24 yuan and a current price of 17.75 yuan [4][9]. Core Insights - The company reported a revenue of 3.453 billion yuan for the first three quarters of 2025, reflecting an increase of 8.52% year-on-year, while the net profit attributable to the parent company was 211 million yuan, down 17.36% [2][9]. - In Q3 2025, the company achieved a revenue of 1.190 billion yuan, up 13.40% year-on-year, but the net profit dropped significantly by 47.55% to 30 million yuan [2][9]. - The decline in profit is primarily attributed to cross-licensing patent fees impacting short-term profitability, specifically a payment of 19 million USD to Roche, which affected the net profit by approximately 136 million yuan [9]. Financial Performance Summary - The total revenue forecast for 2024A, 2025E, 2026E, and 2027E is 4.443 billion, 4.901 billion, 5.474 billion, and 6.250 billion yuan respectively, with year-on-year growth rates of 9.5%, 10.3%, 11.7%, and 14.2% [4][10]. - The net profit attributable to the parent company is projected to be 326 million, 294 million, 485 million, and 581 million yuan for the same years, with growth rates of 14.7%, -10.1%, 65.3%, and 20.0% respectively [4][10]. - The earnings per share (EPS) is expected to be 0.58, 0.52, 0.87, and 1.04 yuan for 2024A, 2025E, 2026E, and 2027E respectively [4][10]. Market Position and Competitive Landscape - The company is experiencing steady growth in both traditional and continuous glucose monitoring (CGM) businesses, with double-digit revenue growth in Q3 2025 [9]. - The company has successfully navigated patent challenges, reaching a settlement with Roche and obtaining necessary patent licenses, which is crucial for its market expansion [9]. - The report highlights the importance of ongoing innovation and intellectual property management to mitigate risks associated with patent litigation from industry giants [9].

鱼跃医疗(002223):海外高增长 费用投入助发展

Xin Lang Cai Jing· 2025-11-08 00:35

Core Insights - The company reported a revenue of 6.545 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 8.58%, while the net profit attributable to shareholders decreased by 4.28% to 1.466 billion yuan due to increased sales investments [1] - The company experienced significant overseas revenue growth, particularly in Southeast Asia, Europe, and North America, with a focus on localizing its market approach and enhancing brand influence [2] - Increased investment in R&D, brand building, and global network expansion is evident, with a strategic focus on digital and wearable products [3] - The overall gross margin remained stable at 50.35%, while the sales expense ratio increased, indicating a rise in operational costs [4] - The company maintains a "buy" rating based on projected revenue and profit growth for 2025-2027 [5] Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 6.545 billion yuan, an increase of 8.58% year-on-year, while the net profit attributable to shareholders was 1.466 billion yuan, down 4.28% [1] - In Q3 2025, the revenue was 1.886 billion yuan, reflecting a growth of 9.63%, but the net profit dropped by 35.99% to 263 million yuan [1] Overseas Growth - The company’s overseas revenue showed strong growth, particularly in Thailand, with plans to replicate this success in Indonesia and Vietnam [2] - Rapid growth was also noted in the European market, especially in respiratory therapy products, supported by the establishment of a scientific advisory committee [2] - Significant revenue growth was recorded in North America, with ongoing strategic collaboration with Inogen [2] Investment and Expenses - Increased expenses were noted in R&D, brand development, and global network expansion, with a focus on digital and wearable products [3] - The company is enhancing its continuous glucose monitoring product market share through comprehensive brand building [3] Profitability Metrics - The gross margin for the first three quarters of 2025 was 50.35%, a slight increase of 0.22 percentage points year-on-year [4] - The sales expense ratio rose to 18.83%, reflecting a 3.39 percentage point increase [4] - The overall net profit margin for Q3 2025 was 13.96%, down 9.22 percentage points from the previous year [4] Future Projections - Revenue projections for 2025-2027 are 8.453 billion, 9.559 billion, and 10.823 billion yuan, with year-on-year growth rates of 11.73%, 13.08%, and 13.22% respectively [4] - Net profit forecasts for the same period are 1.861 billion, 2.259 billion, and 2.680 billion yuan, with growth rates of 3.07%, 21.39%, and 18.63% respectively [4]

【三诺生物(300298.SZ)】一次性费用支出拖累,归母净利润低于预期——2025年三季报点评(王明瑞/吴佳青)

光大证券研究· 2025-10-27 23:04

Core Viewpoint - The company reported a strong revenue growth in Q3 2025, but net profit declined significantly due to a one-time patent payment, indicating underlying business strength when excluding this impact [4][5]. Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 3.453 billion yuan, a year-on-year increase of 8.52%, while net profit attributable to shareholders was 211 million yuan, down 17.36% [4]. - In Q3 2025, the company recorded a revenue of 1.190 billion yuan, reflecting a year-on-year growth of 13.40%, but net profit dropped by 47.55% to 30 million yuan due to a one-time payment of 19 million USD (approximately 136 million yuan) related to a patent settlement [4][5]. Business Segments - The Continuous Glucose Monitoring (CGM) business has become a key driver of growth, with the company on track to meet its annual sales targets. A differentiated strategy is employed, focusing on cost-effective first-generation products and high-end second-generation products [6]. - The domestic BGM business continues to show steady growth, while the overseas market is seeing positive developments, particularly in Europe and the Middle East, where CGM products are gaining insurance coverage [6]. Market Challenges - The company faces short-term uncertainties due to a patent lawsuit initiated by Abbott in Europe, which affects the sales of the first-generation CGM products in certain countries. However, the second-generation products are not impacted, and the company is actively evaluating promotional strategies for these products in Europe [7]. - The overseas subsidiaries, particularly Trividia, are showing continuous revenue growth, and there is a noticeable improvement in the operations of PTS. The company has established a global sales network and brand resources, indicating potential for successful international expansion [8].

九安医疗(002432) - 002432九安医疗投资者关系管理信息20251027

2025-10-27 12:56

Group 1: Business Strategy and Investment - The company has established a dual business model focusing on medical health operations and large asset allocation investments, aiming for stable profits and cash flow [2][3] - The asset allocation strategy is inspired by Yale University's endowment model, targeting a long-term return of 6%-10% per year [3] - As of mid-2025, the company's private equity assets accounted for 12.6% of its total assets, with significant investments in hard technology and healthcare sectors [3][4] Group 2: Product Development and Market Expansion - The company plans to launch a four-in-one respiratory test product, currently in clinical trials, to address seasonal respiratory diseases [5] - The three-in-one test product has achieved stable sales in the consumer market, with a focus on expanding sales channels [8] - The company is actively developing AIoT diabetes management tools, aiming to enhance chronic disease management through technology [12][23] Group 3: Financial Performance and Shareholder Value - The company has conducted five share buyback programs since 2021, totaling approximately ¥2.88 billion, with a sixth program currently underway [7][20] - As of Q3 2025, the company reported a revenue of ¥3.04 billion, a 17.8% increase from the previous quarter, driven by iHealth products and internet medical services [24][25] - The company has committed to distributing at least 30% of its cumulative net profit as dividends over the next three years [20][21] Group 4: Market Challenges and Future Outlook - The company faces challenges in the U.S. market due to tariff issues, but has established overseas production capabilities to mitigate these impacts [29] - The diabetes care service model has expanded to approximately 50 cities and 424 hospitals, managing over 366,000 patients in China [10][22] - The company anticipates significant growth in the diabetes care market, with a target of managing 1 million patients within three years [22]

九安医疗前三季营收“腰斩” 净利却逆势增长16.11%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 12:46

Core Insights - The core observation is that despite a significant decline in revenue, Jiuan Medical has managed to achieve a growth in net profit, indicating a fundamental shift in its profit structure [1][3]. Financial Performance - Jiuan Medical reported a revenue of 1.069 billion yuan for the first three quarters, a year-on-year decrease of 48.89% [2][4]. - The net profit attributable to shareholders was 668.89 million yuan, reflecting a year-on-year increase of 16.11% [2][5]. - The company experienced a negative cash flow of 34.07 million yuan, a decline of 104.90% compared to the previous year [4]. - Investment income reached 937 million yuan, up 84.99% year-on-year, contributing significantly to the net profit growth [5][6]. Business Transformation - Jiuan Medical is transitioning from a reliance on traditional medical device sales to a dual business model that includes both healthcare operations and large asset investment [6][7]. - The company is focusing on expanding its internet healthcare and chronic disease management sectors, particularly through a new diabetes care model [7][8]. - The firm has increased its investment in research and development, with management expenses rising by 26.66% and R&D expenses by 25.91% [5][6]. Investment Strategy - Jiuan Medical has engaged in significant investments in various sectors, including technology and healthcare, and has established partnerships with venture capital firms [8][9]. - The company has launched a new venture capital fund with a total scale of 701 million yuan, aiming to make financial investments [10]. - Jiuan Medical's investment activities are primarily conducted through its wholly-owned subsidiary, Jiuan Hong Kong, focusing on long-term returns in emerging technology fields [8][9].

三诺生物(300298):一次性费用支出拖累,归母净利润低于预期:——三诺生物(300298.SZ)2025年三季报点评

EBSCN· 2025-10-27 06:59

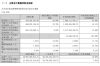

Investment Rating - The report maintains a "Buy" rating for the company, indicating an expected investment return exceeding the market benchmark by more than 15% over the next 6-12 months [5][13]. Core Insights - The company's revenue for the first three quarters of 2025 reached 3.453 billion yuan, a year-on-year increase of 8.52%, while the net profit attributable to shareholders was 211 million yuan, a decline of 17.36% [1]. - In Q3 2025, the company achieved revenue of 1.190 billion yuan, up 13.40% year-on-year, but the net profit attributable to shareholders fell by 47.55% due to a one-time payment of 19 million USD (approximately 136 million yuan) related to a patent settlement with Roche [1][2]. - Excluding the one-time patent fee, the company's underlying profit showed strong growth, with a net profit of 105 million yuan in Q3 2025 [2]. Summary by Sections Revenue and Profitability - The company’s CGM (Continuous Glucose Monitoring) business is a key driver of growth, with strong performance in both domestic and international markets. The company aims to achieve its annual sales target [2]. - The traditional BGM (Blood Glucose Monitoring) business continues to grow steadily in China [2]. Market Position and Strategy - The company has adopted a differentiated competitive strategy, focusing on cost-effective first-generation products and high-end second-generation products. This approach has led to a reduction in losses for domestic operations and gradual improvement in profitability [2]. - The company is making progress in obtaining insurance coverage for its CGM products in Europe and the Middle East, laying the groundwork for future sales growth [2]. Financial Forecasts - The net profit forecast for 2025 has been revised down to 288 million yuan, a 23% decrease from the previous estimate of 374 million yuan. However, the forecasts for 2026 and 2027 remain at 468 million yuan and 564 million yuan, respectively [3][4]. - The report provides a detailed financial summary, including projected revenues and profits for the years 2023 to 2027, indicating a growth trajectory despite short-term challenges [4][9].