新冠检测试剂盒

Search documents

盛典刚落幕,惊雷已炸响!亚辉龙90后少帅的阴影和烦恼

Quan Jing Wang· 2026-02-25 10:06

Core Viewpoint - The company Aihuilong is under investigation by the China Securities Regulatory Commission (CSRC) for allegedly misleading statements, marking a significant shift in regulatory scrutiny within the capital market [1][5][16]. Group 1: Company Background - Aihuilong, a star listed company on the Sci-Tech Innovation Board, was founded by Hu De Ming in 2008 and has been led by his son, Hu Kunhui, since 2012 [9][10]. - The company gained prominence during the COVID-19 pandemic, achieving a revenue of 39.81 billion yuan and a net profit of 10.22 billion yuan in 2022, but has since faced a significant decline in performance [12][13]. Group 2: Recent Events - Aihuilong held a celebratory annual meeting on February 3, 2026, shortly before the CSRC announced the investigation on February 6, highlighting a stark contrast between the company's optimistic public image and its regulatory challenges [2][5][4]. - Following the announcement of the investigation, Aihuilong's stock price plummeted to a historical low of 13.53 yuan, representing a 69.9% decrease in market value since its IPO [5][12]. Group 3: Regulatory Environment - The CSRC's investigation into Aihuilong is part of a broader trend of intensified regulatory scrutiny in the Chinese capital market, with an average of one company being investigated every five days since the beginning of 2026 [1][16]. - The regulatory response to Aihuilong's misleading announcement regarding a partnership in brain-computer interface technology reflects a zero-tolerance approach to information disclosure violations [6][17]. Group 4: Financial Performance - Aihuilong's financial performance has deteriorated sharply, with a projected net profit drop of 90.05% to 93.37% for 2025, attributed to a decline in COVID-related business and market demand [12][13]. - The company's international business has shown some growth, with overseas revenue reaching 2.08 billion yuan in the first three quarters of 2025, a 39.39% increase year-on-year [12].

盛典刚落幕,惊雷已炸响!亚辉龙90后少帅的阴影和烦恼 | 大A避雷针

Quan Jing Wang· 2026-02-25 10:03

Core Viewpoint - The company Aihuilong is under investigation by the China Securities Regulatory Commission (CSRC) for allegedly misleading statements, marking a significant shift in regulatory scrutiny within the Chinese capital market [1][5][16]. Group 1: Company Background - Aihuilong, a star listed company on the Sci-Tech Innovation Board, was founded by Hu De Ming, who transitioned from a public servant to a businessman, establishing the company in 2008 [9]. - Hu Kunhui, the 35-year-old chairman and CEO, took control of the company at the age of 21 due to family circumstances and has since positioned himself as a prominent figure in the industry [9][10]. - The company experienced explosive growth during the COVID-19 pandemic, with revenue soaring to 39.81 billion yuan in 2022, but has since faced a significant decline in performance [12]. Group 2: Recent Events - Aihuilong held a celebratory annual meeting on February 3, 2026, just days before the CSRC announced the investigation, highlighting a stark contrast between the company's optimistic public image and its underlying issues [2][4][5]. - Following the announcement of the investigation on February 6, the company's stock price plummeted to a historical low of 13.53 yuan, representing a 69.9% decrease in market value since its IPO [5][12]. Group 3: Regulatory Environment - The investigation into Aihuilong is part of a broader trend of intensified regulatory scrutiny in the Chinese capital market, with an average of one company being investigated every five days since the beginning of 2026 [1][16][17]. - The CSRC's actions reflect a "zero tolerance" approach to misleading disclosures, aiming to reshape the market's regulatory landscape [1][17]. Group 4: Financial Performance - Aihuilong's financial performance has deteriorated sharply, with a projected net profit drop of 90.05% to 93.37% for 2025, attributed to a decline in demand and adverse market conditions [12][13]. - The company's international business has shown some resilience, with overseas revenue increasing by 39.39% in the first three quarters of 2025, indicating potential for future growth despite domestic challenges [12]. Group 5: Shareholder Actions - Amid declining stock prices, significant shareholders, including Hu Kunhui, initiated a plan to reduce their holdings, raising concerns about the company's future prospects [14][15]. - The timing of these share reductions during a market rally has led to speculation regarding the motivations behind these actions, suggesting a cautious outlook on the company's short-term future [15].

最懂炒股的医疗公司?九安医疗:主业躺平,投资躺赢,市值躺枪

Xin Lang Cai Jing· 2026-01-30 10:13

Core Viewpoint - Jiuan Medical (002432.SZ) is expected to achieve a net profit of 2.02 billion to 2.35 billion yuan in 2025, representing a year-on-year growth of 21.05% to 40.83% primarily driven by strong performance in asset management business [1][13]. Financial Performance - For the first three quarters of 2025, Jiuan Medical reported revenue of 1.069 billion yuan, but net profit reached 1.589 billion yuan, with total operating costs exceeding revenue at 1.276 billion yuan [3][15]. - Investment income for the same period was 562 million yuan, and fair value changes contributed 1.251 billion yuan, totaling over 1.8 billion yuan in income from these sources [3][15]. - The company’s net profit attributable to shareholders is projected to grow by 21.05% to 40.83% compared to the previous year [2][14]. Asset Management - As of the end of Q3 2025, Jiuan Medical held trading financial assets worth 10.362 billion yuan, primarily in wealth management products, along with fixed-income securities and equity investments totaling 13.877 billion yuan [4][16]. - The total assets under management reached 24.122 billion yuan, indicating a significant contribution from asset management to overall profitability [5][18]. Product Performance - The iHealth product line, which includes smart medical devices, has seen a significant decline in revenue, with a 50% drop in the first half of 2025 compared to the previous year [8][21]. - Overall revenue from the iHealth series decreased by 49% in the first three quarters of 2025 [9][20]. Market Position - Jiuan Medical's price-to-book (PB) ratio is currently at 0.89, indicating it is trading below its book value [11][23]. - The company has substantial cash-like assets totaling 27.6 billion yuan, with short-term borrowings of only 2.334 billion yuan, suggesting a strong liquidity position [11][23].

最懂炒股的医疗公司?九安医疗:主业躺平,投资躺赢,市值躺枪

市值风云· 2026-01-30 10:09

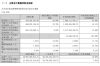

Core Viewpoint - The performance of asset management is impressive, while the core business is experiencing losses [1][19]. Financial Performance - Jiuan Medical (002432.SZ) forecasts a net profit attributable to shareholders of 2.02 billion to 2.35 billion yuan for 2025, representing a year-on-year growth of 21.05% to 40.83% [4][5]. - For the first three quarters of 2025, Jiuan Medical reported revenue of 1.069 billion yuan, but net profit reached 1.589 billion yuan, indicating that total operating costs of 1.276 billion yuan exceeded revenue [7][13]. - Investment income for the first three quarters was 562 million yuan, with fair value changes contributing 1.251 billion yuan, totaling over 1.8 billion yuan in investment-related income [7]. Asset Management - As of the end of Q3 2025, Jiuan Medical held trading financial assets worth 10.362 billion yuan, primarily in wealth management products, and other investments totaling 13.877 billion yuan, leading to a total asset management portfolio of 24.122 billion yuan [8][10]. - The contribution of asset management to Jiuan Medical's profits is increasing, allowing the company to achieve significant profitability despite a decline in core business revenue [13]. Core Business Challenges - The iHealth product line, which includes smart medical devices, has seen a significant revenue decline, with a 50% drop in revenue to 601 million yuan in the first half of 2025, and a 49% decline in total revenue for the first three quarters [15][16]. - The overall revenue from the iHealth series has decreased from 1.859 billion yuan in 2021 to 601 million yuan in 2025 [17]. Market Reaction - Following the earnings forecast, Jiuan Medical's stock price remained relatively stable, with a price-to-book ratio of 0.89, indicating it is trading below its book value [18].

九安医疗前三季营收“腰斩” 净利却逆势增长16.11%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 12:46

Core Insights - The core observation is that despite a significant decline in revenue, Jiuan Medical has managed to achieve a growth in net profit, indicating a fundamental shift in its profit structure [1][3]. Financial Performance - Jiuan Medical reported a revenue of 1.069 billion yuan for the first three quarters, a year-on-year decrease of 48.89% [2][4]. - The net profit attributable to shareholders was 668.89 million yuan, reflecting a year-on-year increase of 16.11% [2][5]. - The company experienced a negative cash flow of 34.07 million yuan, a decline of 104.90% compared to the previous year [4]. - Investment income reached 937 million yuan, up 84.99% year-on-year, contributing significantly to the net profit growth [5][6]. Business Transformation - Jiuan Medical is transitioning from a reliance on traditional medical device sales to a dual business model that includes both healthcare operations and large asset investment [6][7]. - The company is focusing on expanding its internet healthcare and chronic disease management sectors, particularly through a new diabetes care model [7][8]. - The firm has increased its investment in research and development, with management expenses rising by 26.66% and R&D expenses by 25.91% [5][6]. Investment Strategy - Jiuan Medical has engaged in significant investments in various sectors, including technology and healthcare, and has established partnerships with venture capital firms [8][9]. - The company has launched a new venture capital fund with a total scale of 701 million yuan, aiming to make financial investments [10]. - Jiuan Medical's investment activities are primarily conducted through its wholly-owned subsidiary, Jiuan Hong Kong, focusing on long-term returns in emerging technology fields [8][9].