糖尿病诊疗照护'O+O'新模式

Search documents

九安医疗(002432) - 002432九安医疗投资者关系管理信息20251027

2025-10-27 12:56

Group 1: Business Strategy and Investment - The company has established a dual business model focusing on medical health operations and large asset allocation investments, aiming for stable profits and cash flow [2][3] - The asset allocation strategy is inspired by Yale University's endowment model, targeting a long-term return of 6%-10% per year [3] - As of mid-2025, the company's private equity assets accounted for 12.6% of its total assets, with significant investments in hard technology and healthcare sectors [3][4] Group 2: Product Development and Market Expansion - The company plans to launch a four-in-one respiratory test product, currently in clinical trials, to address seasonal respiratory diseases [5] - The three-in-one test product has achieved stable sales in the consumer market, with a focus on expanding sales channels [8] - The company is actively developing AIoT diabetes management tools, aiming to enhance chronic disease management through technology [12][23] Group 3: Financial Performance and Shareholder Value - The company has conducted five share buyback programs since 2021, totaling approximately ¥2.88 billion, with a sixth program currently underway [7][20] - As of Q3 2025, the company reported a revenue of ¥3.04 billion, a 17.8% increase from the previous quarter, driven by iHealth products and internet medical services [24][25] - The company has committed to distributing at least 30% of its cumulative net profit as dividends over the next three years [20][21] Group 4: Market Challenges and Future Outlook - The company faces challenges in the U.S. market due to tariff issues, but has established overseas production capabilities to mitigate these impacts [29] - The diabetes care service model has expanded to approximately 50 cities and 424 hospitals, managing over 366,000 patients in China [10][22] - The company anticipates significant growth in the diabetes care market, with a target of managing 1 million patients within three years [22]

九安医疗前三季营收“腰斩” 净利却逆势增长16.11%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 12:46

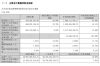

Core Insights - The core observation is that despite a significant decline in revenue, Jiuan Medical has managed to achieve a growth in net profit, indicating a fundamental shift in its profit structure [1][3]. Financial Performance - Jiuan Medical reported a revenue of 1.069 billion yuan for the first three quarters, a year-on-year decrease of 48.89% [2][4]. - The net profit attributable to shareholders was 668.89 million yuan, reflecting a year-on-year increase of 16.11% [2][5]. - The company experienced a negative cash flow of 34.07 million yuan, a decline of 104.90% compared to the previous year [4]. - Investment income reached 937 million yuan, up 84.99% year-on-year, contributing significantly to the net profit growth [5][6]. Business Transformation - Jiuan Medical is transitioning from a reliance on traditional medical device sales to a dual business model that includes both healthcare operations and large asset investment [6][7]. - The company is focusing on expanding its internet healthcare and chronic disease management sectors, particularly through a new diabetes care model [7][8]. - The firm has increased its investment in research and development, with management expenses rising by 26.66% and R&D expenses by 25.91% [5][6]. Investment Strategy - Jiuan Medical has engaged in significant investments in various sectors, including technology and healthcare, and has established partnerships with venture capital firms [8][9]. - The company has launched a new venture capital fund with a total scale of 701 million yuan, aiming to make financial investments [10]. - Jiuan Medical's investment activities are primarily conducted through its wholly-owned subsidiary, Jiuan Hong Kong, focusing on long-term returns in emerging technology fields [8][9].

最新!九安医疗2025年半年度业绩预告

思宇MedTech· 2025-07-16 04:26

Core Viewpoint - The company, Jiuan Medical, is expected to achieve significant growth in net profit for the first half of 2025, with projections indicating an increase of 46.24% to 62.86% compared to the same period last year [2]. Financial Performance - The forecasted net profit attributable to shareholders is between 880 million yuan and 980 million yuan, compared to 601.76 million yuan in the same period last year [2]. - The expected net profit after deducting non-operating gains is projected to be between 860 million yuan and 960 million yuan, up from 697.55 million yuan year-on-year, reflecting a growth of 23.29% to 37.63% [2]. - Basic earnings per share are anticipated to be between 2.0129 yuan and 2.2416 yuan, compared to 1.3788 yuan in the previous year [2]. Growth Drivers - In Q1 2025, Jiuan Medical reported a revenue of 507 million yuan, a decline of 33.49% year-on-year, but managed to achieve a net profit of 266 million yuan, an increase of 7.62% year-on-year, due to effective cost control and market strategies [3]. - The sales of home testing kits have seen significant growth through channels like Amazon, CVS, and Walmart, contributing to the overall performance boost [10]. Company Overview - Jiuan Medical, established in 1995, focuses on the research and production of health-related electronic products and smart hardware, and has transitioned to a mobile internet model since 2010 [4]. - The company has launched a range of personal health wearable devices and has received strategic investment from Xiaomi, becoming a partner in its ecosystem [4][6]. - Jiuan Medical operates in multiple sectors, including medical devices, electronic products, and smart devices, with a diverse product portfolio [7]. Business Operations - The company sells its products through various channels, including direct sales under its iHealth brand, ODM/OEM sales, and new retail partnerships with brands like Xiaomi and XPeng [9]. - Jiuan Medical has established subsidiaries in key global markets and has made strategic acquisitions to enhance its capabilities in remote monitoring and mobile healthcare [6]. Future Plans - The company aims to continue expanding its core healthcare business and technology initiatives, focusing on the "O+O" (Offline + Online) model for diabetes care and enhancing new retail channels [11]. - Jiuan Medical is actively collaborating with investment institutions to invest in cutting-edge technologies and applications in fields such as healthcare, artificial intelligence, and new materials [11].

【私募调研记录】保银投资调研可孚医疗、九安医疗

Zheng Quan Zhi Xing· 2025-04-30 00:10

Group 1: Key Points on 可孚医疗 (Cofe Medical) - In 2024, Cofe Medical will deepen its core category strategy, focusing on hearing aids and dressing materials, with some products having a high market share [1] - The medical care and health monitoring segments experienced growth in Q1, while the respiratory support segment declined, with national subsidy policies boosting sales [1] - A new generation of respiratory machines is planned for launch in 2025 to enhance product performance, and AI technology will be applied in dynamic blood glucose meters and blood pressure monitors to improve intelligence [1] - The medical care segment is expected to see an 8% year-on-year revenue growth in 2024, with a focus on cultivating dressing products [1] - The overseas business is in a strategic cultivation phase, with foreign trade revenue increasing in Q1 [1] Group 2: Key Points on 九安医疗 (Jiuan Medical) - Jiuan Medical's core strategy revolves around iHealth products and a new "O+O" model for diabetes care, with projected revenue of 76.16 million yuan in 2024 from diabetes care services [2] - The company has launched various medical health products in both the US and domestic markets, including a tri-test reagent kit and nasal wash [2] - Jiuan Medical is making strategic investments across various asset classes, including fixed income, equity, and hard technology, particularly in AIoT diabetes home assistance and continuous glucose monitoring projects [2] - The company is committed to R&D investments, especially in AI smart hearing aids [2] - Jiuan Medical is enhancing market confidence through stock buybacks and promoting its core strategy to boost employee morale [2]