银行股投资机会

Search documents

利好!上市银行迎“增持潮”!

证券时报· 2025-11-24 00:13

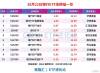

Core Viewpoint - The A-share market is experiencing fluctuations, yet several listed banks are seeing increased holdings, with bank stocks performing well against the market trend. Notably, Nanjing Bank and Chengdu Bank have received significant share increases from major shareholders, indicating a shift in investment strategies from defensive to proactive market management [1][2]. Group 1: Shareholder Activities - Nanjing Bank announced that BNP Paribas (QFII) increased its holdings by approximately 128 million shares, raising its total stake from 17.02% to 18.06% [1]. - Chengdu Bank reported that its two major shareholders collectively increased their holdings by about 34.247 million shares, with a total investment of approximately 611 million yuan. Their planned increase is expected to be between 700 million yuan and 1.4 billion yuan [1]. Group 2: Market Performance - The banking sector has shown resilience amid market volatility, with 17 bank stocks recording positive returns over the past month. Agricultural Bank of China leads the sector with a year-to-date increase of 57.84% [2]. - Among 42 listed banks, 35 reported year-on-year profit growth in the first three quarters, with seven banks achieving double-digit profit increases [2]. Group 3: Analyst Insights - Multiple brokerage analysts have reiterated that there are investment opportunities within the banking sector, citing strong fundamentals and favorable market conditions, including risk-averse sentiment and long-term capital preferences from insurance companies [2]. - Smaller insurance institutions are seeking long-term equity investment opportunities in smaller banks, suggesting that quality city commercial banks may see increased allocations [2].

银行股增持潮涌 逆市走强彰显投资新逻辑

Zheng Quan Shi Bao· 2025-11-23 18:43

Core Viewpoint - The A-share market is experiencing fluctuations, yet several listed banks are seeing increased holdings, with bank stocks performing well against the market trend [1][2] Group 1: Bank Stock Performance - Nanjing Bank's foreign major shareholder increased its stake by 128 million shares, raising its holding ratio to a record high of 18.06% [1] - Chengdu Bank's two major shareholders jointly increased their holdings by approximately 34.247 million shares, with a total investment of about 611 million yuan [1] - As of November 21, 17 bank stocks have shown positive cumulative growth over the past month, with Agricultural Bank of China leading the sector with a 57.84% increase year-to-date [2] Group 2: Market Trends and Analyst Insights - Since October, there has been a "buying wave" among listed banks, particularly in city commercial banks and rural commercial banks, which account for over 80% of the increases [1] - Analysts note a shift in buying strategies from defensive to proactive market value management, driven by expectations of economic recovery and stable interest margins [1] - 35 out of 42 listed banks reported year-on-year profit growth in the first three quarters, with 7 banks achieving double-digit growth [2] - Analysts emphasize the resilience of the banking sector's fundamentals, supported by market risk aversion and strong long-term capital allocation preferences from insurance companies [2]

真金白银出手!上市银行,增持潮起!

券商中国· 2025-11-23 02:32

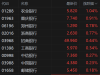

Core Viewpoint - The recent trend of share buybacks by major shareholders and executives in A-share listed banks, particularly city commercial banks and rural commercial banks, indicates strong confidence in the long-term development prospects of these institutions [1][4]. Group 1: Shareholder and Executive Buybacks - Multiple listed banks, including Nanjing Bank and Chengdu Bank, have announced significant share buybacks by major shareholders and executives, reflecting a growing trend since October [2][3]. - Chengdu Bank's major shareholders invested approximately 611 million yuan to buy back nearly 34.247 million shares, with plans for further purchases totaling between 700 million and 1.4 billion yuan [2]. - Nanjing Bank's largest shareholder, BNP Paribas, increased its stake by approximately 12.8 million shares, raising its total holding to 18.06%, marking a new high [3]. Group 2: Market Performance and Investor Sentiment - Despite overall market volatility, the A-share banking sector has shown resilience, with major banks like Bank of China and Industrial and Commercial Bank of China reaching new historical highs [1][6]. - In the past month, 17 banking stocks have recorded positive cumulative gains, with Bank of China leading at a 13.74% increase [6]. - The overall valuation of A-share listed banks remains low, with a median price-to-book ratio of approximately 0.6, indicating potential for further appreciation [6]. Group 3: Analyst Insights and Future Outlook - Analysts from various brokerage firms have reiterated investment opportunities in the banking sector, highlighting the sector's high dividend yield and low valuation as attractive features [7]. - The shift in investment logic from "pro-cyclical" to "weak-cyclical" suggests that during periods of economic stagnation, banking stocks will remain appealing due to their consistent high dividends [7]. - There is an expectation that medium-sized insurance companies will increasingly seek long-term equity investments in smaller banks, further supporting the sector's growth [7].

农业银行走出14连阳,10月超90亿资金冲进银行ETF,华宝银行ETF、银行ETF易方达和银行ETF天弘“吸金”居前

Sou Hu Cai Jing· 2025-10-22 08:30

Core Insights - The A-share market is witnessing a rise in bank stocks, with notable increases in shares of banks such as Zhejiang Commercial Bank and Agricultural Bank, which has reached a historical high with a year-to-date increase of nearly 56% [1][5] - Hong Kong bank stocks are also on an upward trend, with Agricultural Bank achieving a 10-day consecutive rise and other banks like China Merchants Bank and Industrial and Commercial Bank of China showing gains [1] - Bank ETFs are experiencing positive performance, with various funds recording increases in value, indicating strong investor interest in the banking sector [1][3] Market Performance - A-share bank index has decreased by 4% since early July, underperforming the CSI 300 index by 19.3 percentage points, while the H-share bank index has slightly increased by 2.2%, lagging behind the Hang Seng index by 5.2 percentage points [5] - The average price-to-book (PB) ratio for A-share banks is 0.71, placing it in the 42.4% percentile over the past three months and 77.7% over the past year, while H-share banks have a PB ratio of 0.5, in the 46% and 73.6% percentiles respectively [5] Investment Trends - There is a growing preference for bank stocks due to their low valuations and high dividend yields, as investors seek safety and stable returns amid rising market risk aversion [5] - Since October 21, a total of 93.14 billion yuan has flowed into 10 bank-themed ETFs, with significant inflows into funds managed by Huabao and E Fund [6][8] - Morgan Stanley anticipates a favorable investment opportunity for domestic bank stocks in the fourth quarter and early next year, supported by upcoming dividend distributions and stable interest rates [10]

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]