银行ETF指数基金

Search documents

银行股全线上涨,银行ETF、银行ETF基金、银行ETF易方达、银行ETF南方涨超2%

Ge Long Hui· 2025-12-18 08:42

Group 1 - The banking sector experienced a significant rally, with bank stocks rising across the board, including Shanghai Bank and Chongqing Rural Commercial Bank, which both increased by over 3% [2] - The China Securities Bank ETF and various bank ETFs saw gains of over 2%, indicating strong investor interest in the banking sector [2] - A total of 32 listed banks announced plans for mid-term dividends, with an average dividend payout ratio of 24.9%, amounting to a total dividend distribution of 264.57 billion yuan, a 2.55% increase from the previous year [2] Group 2 - The banking sector is projected to deliver excess returns from the end of 2022 to mid-2025, with the price-to-book (PB) ratio expected to rise from 0.5 times to 0.7 times by December 2025 [3] - Institutional funds, including insurance and northbound capital, are expected to drive the banking sector's performance in 2024, while trading funds may exhibit volatility [3] - Long-term capital, represented by insurance funds, continues to increase its holdings in the banking sector, enhancing pricing efficiency and valuation reconstruction [4] Group 3 - The valuation of Chinese banks is considered undervalued compared to the US and Japan, with a mismatch between PB and return on equity (ROE) [4] - The banking sector is expected to provide absolute and relative returns in the first and fourth quarters, reflecting seasonal characteristics in stock performance [4]

银行ETF基金、银行ETF、银行AH优选ETF上涨,Q3险资加力布局银行板块

Ge Long Hui A P P· 2025-11-20 04:08

Core Viewpoint - The A-share market has seen a significant rise in bank stocks, with notable increases in major banks such as China Bank and Construction Bank, indicating a positive sentiment towards the banking sector [1][4]. Group 1: Stock Performance - China Bank rose over 5%, Construction Bank over 4%, and Postal Savings Bank over 3%, with several other banks also showing gains of over 2% [1]. - Bank ETFs, including various Southern and E-Fund ETFs, have also experienced upward movement, reflecting the overall positive trend in the banking sector [3]. Group 2: ETF Insights - Bank ETFs track the China Securities Bank Index, with nearly 30% of their holdings in major state-owned banks like Industrial and Agricultural Bank, while about 70% focuses on high-growth banks [3]. - The Bank AH Preferred ETF tracks the Bank AH Index, utilizing a monthly security category conversion strategy based on AH prices [4]. Group 3: Institutional Investment Trends - As of Q3 2025, insurance capital has increased its holdings in the banking sector, with a holding ratio of 27.95% and a market value accounting for 3.99% of circulating A-shares [5]. - Insurance capital has increased its positions in 23 banks, with 10 banks seeing increased holdings, indicating a growing interest in the banking sector [6]. Group 4: Market Dynamics - The A-share market is experiencing a style shift, influenced by factors such as the approaching end-of-year assessments for institutions and the central bank's implementation of a moderately loose monetary policy [4]. - The decline in the proportion of bank holdings among public funds suggests a potential opportunity for reallocation towards undervalued financial stocks [4]. Group 5: Future Outlook - The insurance sector is expected to continue increasing its investment in banks, driven by stable dividends and low valuations, with a focus on high ROE small and medium-sized banks [6]. - The ongoing improvement in net profits for banks and the potential for valuation reconstruction through increased capital inflows are seen as positive indicators for the banking sector's future [6].

银行ETF逆势上涨;债券ETF规模破7000亿元丨ETF晚报

2 1 Shi Ji Jing Ji Bao Dao· 2025-11-04 14:04

ETF Industry News - The three major indices experienced fluctuations and declines, with the Shanghai Composite Index down by 0.41%, the Shenzhen Component down by 1.71%, and the ChiNext down by 1.96. However, several bank sector ETFs saw gains, including Tianhong Bank ETF (515290.SH) up by 2.24%, Bank ETF Index Fund (516210.SH) up by 2.22%, and E Fund Bank ETF (516310.SH) up by 2.21. In contrast, multiple ETFs in the power equipment sector declined, with Battery 50 ETF (159796.SZ) down by 3.61% [1][4][6] ETF Market Expansion - As of October 31, the total scale of the ETF market reached 5.7 trillion yuan, an increase of nearly 2 trillion yuan compared to the end of 2024, representing a growth rate of approximately 53%. The main contributors to this expansion were stock and bond ETFs, which increased by 831.18 billion yuan and 526.07 billion yuan, respectively. Cross-border ETFs also showed rapid growth, contributing 472.22 billion yuan to the scale increase [2] Bond ETF Milestone - The bond ETF market has reached a significant milestone, with its scale surpassing 700 billion yuan, now at 700.44 billion yuan. At the beginning of the year, the scale was less than 180 billion yuan, indicating a rapid growth trend and strong investor recognition of bond ETFs as an innovative investment tool [3] Market Performance Overview - On November 4, the A-share market and major overseas indices collectively declined, with the Shanghai Composite Index closing at 3960.19 points, the Shenzhen Component at 13175.22 points, and the ChiNext at 3134.09 points. The top performers among the indices included CSI 300, STAR 50, and CSI 800, with respective daily declines of -0.75%, -0.97%, and -1.0% [4] Sector Performance - In the sector performance for the day, the banking, public utilities, and social services sectors ranked highest, with daily increases of 2.03%, 0.24%, and 0.15%, respectively. Conversely, the non-ferrous metals, power equipment, and pharmaceutical sectors ranked lowest, with declines of -3.04%, -2.05%, and -1.97% [6] ETF Performance Summary - The average daily performance of various ETF categories showed that money market ETFs performed the best with an average change of 0.00%, while thematic stock ETFs had the worst performance with an average decline of -1.55% [9] Top Performing ETFs - The top three performing stock ETFs for the day were Tianhong Bank ETF (515290.SH) with a gain of 2.24%, Bank ETF Index Fund (516210.SH) with a gain of 2.22%, and E Fund Bank ETF (516310.SH) with a gain of 2.21% [11] ETF Trading Volume - The top three ETFs by trading volume included CSI 300 ETF (510300.SH) with a trading volume of 5.709 billion yuan, A500 ETF Fund (512050.SH) with 4.827 billion yuan, and CSI A500 ETF (159338.SZ) with 4.634 billion yuan [14]

银行板块走强,银行ETF易方达、银行ETF南方、银行ETF天弘涨超2%,三季度公募基金减仓银行

Ge Long Hui A P P· 2025-11-04 04:45

Market Overview - The A-share market experienced a collective decline in the morning session, with the Shanghai Composite Index down 0.19% to 3969.05 points, the Shenzhen Component Index down 1.27%, and the ChiNext Index down 1.51% [1] - The total trading volume in the Shanghai and Shenzhen markets was 123.11 billion yuan, a decrease of 16.74 billion yuan compared to the previous day, with over 3600 stocks declining [1] Banking Sector Performance - The banking sector showed strength, with various banking ETFs rising over 2%, including the Bank ETF Index Fund, E Fund Bank ETF, Southern Bank ETF, and Tianhong Bank ETF [1] - Specific banking ETFs had the following daily gains: Bank ETF Index Fund +2.15%, E Fund Bank ETF +2.14%, Southern Bank ETF +2.05%, and Tianhong Bank ETF +2.04% [2] Fund Holdings and Institutional Activity - As of Q3 2025, the proportion of bank holdings in funds decreased to 1.49%, down 2.41 percentage points from Q2, indicating a larger underweight compared to the industry benchmark [2] - The total market value of bank stocks held by funds was 30.8 billion yuan, with a total market value of heavy holdings at 2061.6 billion yuan [2] Individual Bank Stock Performance - Major banks with significant holdings included China Merchants Bank, Ningbo Bank, Chengdu Bank, Hangzhou Bank, and Jiangsu Bank [3] - Notable increases in holdings were seen in Qilu Bank (+0.33 billion yuan) and Ruifeng Bank (+0.15 billion yuan), while significant decreases were noted for China Merchants Bank (-7.349 billion yuan) and Jiangsu Bank (-5.059 billion yuan) [3] Financial Performance of Listed Banks - For the first three quarters of 2025, listed banks reported a revenue increase of 0.9% year-on-year and a net profit increase of 1.5%, with core revenue showing marginal improvement despite a slowdown in investment-related income [4] - Total assets of listed banks grew by 9.3% year-on-year, with loans increasing by 7.8%, although credit growth showed slight deceleration [4] Interest Margin and Asset Quality - The overall net interest margin for listed banks was 1.35%, down 12 basis points year-on-year, with the decline in asset pricing slowing and improvements in funding costs supporting the margin [4] - The non-performing loan ratio remained stable at 1.23%, with a decrease in the provision coverage ratio to 236% [4] Dividend Announcements and Insurance Investments - Several banks announced interim dividend plans, including Industrial Bank, Zhangjiagang Bank, and Wuxi Bank, marking their first interim dividends [4] - Multiple insurance institutions increased their holdings in banks during Q3, with notable new entries in major banks' top shareholder lists [4]

ETF午间收盘:科创半导体ETF鹏华涨2.30% 日经225ETF跌4.53%

Sou Hu Cai Jing· 2025-11-04 04:21

Group 1 - The ETF market showed mixed performance on November 4, with some ETFs experiencing gains while others faced declines [1][2] - Notable gainers included the Penghua Semiconductor ETF (589020) which rose by 2.30%, and the Innovation Semiconductor ETF (588170) which increased by 2.15% [1][2] - Significant decliners included the Nikkei 225 ETF (513880) which fell by 4.53%, and the China-Korea Semiconductor ETF (513310) which dropped by 4.34% [1][2] Group 2 - The latest prices and percentage changes for the top performing ETFs were: - Penghua Semiconductor ETF (589020) at 1.155 with a 2.30% increase - Innovation Semiconductor ETF (588170) at 1.423 with a 2.15% increase - Bank ETF Index Fund (516210) at 1.427 with a 2.15% increase - Bank ETF E Fund (516310) at 1.384 with a 2.14% increase [2] - The latest prices and percentage changes for the worst performing ETFs included: - Nikkei 225 ETF (513880) at 1.874 with a 4.53% decrease - China-Korea Semiconductor ETF (513310) at 2.708 with a 4.34% decrease - NASDAQ Biotechnology ETF (513290) at 1.431 with a 3.90% decrease [2]

ETF午间收盘:科创半导体ETF鹏华涨2.30% 日经225ETF跌4.53% 视讯

Shang Hai Zheng Quan Bao· 2025-11-04 04:08

Core Viewpoint - The ETF market showed mixed performance on November 4, with some ETFs experiencing gains while others faced declines [2] Group 1: ETF Performance - The following ETFs saw increases: - Penghua Sci-Tech Semiconductor ETF (589020) rose by 2.30% - Sci-Tech Semiconductor ETF (588170) increased by 2.15% - Bank ETF Index Fund (516210) gained 2.15% - E Fund Bank ETF (516310) went up by 2.14% [2] - Conversely, the following ETFs experienced declines: - Nikkei 225 ETF (513880) fell by 4.53% - China-Korea Semiconductor ETF (513310) decreased by 4.34% - NASDAQ Biotechnology ETF (513290) dropped by 3.90% [2]

银行股早盘持续走强,相关ETF涨约2%

Mei Ri Jing Ji Xin Wen· 2025-11-04 03:10

Core Viewpoint - Bank stocks showed strong performance in early trading, with notable increases in shares of Xiamen Bank, Shanghai Bank, and other major banks, indicating a positive market sentiment towards the banking sector [1]. Group 1: Bank Stock Performance - Xiamen Bank rose over 6%, while Shanghai Bank increased by more than 3%, and other banks such as China Merchants Bank, Industrial Bank, Industrial and Commercial Bank of China, and Agricultural Bank of China saw gains exceeding 2% [1]. - Related bank ETFs also experienced a rise of approximately 2% [1]. Group 2: ETF Performance - Specific bank ETFs showed the following performance: - Tianhong Bank ETF (515290) at 1.503, up 2.04% - Index Fund Bank ETF (516210) at 1.425, up 2.00% - Southern Bank ETF (512700) at 1.691, up 1.87% - E-Fund Bank ETF (516310) at 1.381, up 1.92% - Bank ETF Fund (515020) at 1.776, up 1.89% - Bank ETF (512800) at 0.838, up 1.82% - Leading Bank ETF (512820) at 1.468, up 1.80% - Index Bank ETF (512730) at 1.716, up 1.78% [2]. Group 3: Market Insights - Institutions suggest that in a low interest rate and asset scarcity environment, dividend-paying assets with stable ROE capabilities may remain resilient and attractive, potentially serving as a key option for medium to long-term funds amid increased market volatility [2]. - Following interest rate cuts, the downward space for risk-free interest rates has opened up, and the National Financial Regulatory Administration is promoting the entry of insurance funds into the market, highlighting the dividend value of state-owned banks [2].

农业银行走出14连阳,10月超90亿资金冲进银行ETF,华宝银行ETF、银行ETF易方达和银行ETF天弘“吸金”居前

Sou Hu Cai Jing· 2025-10-22 08:30

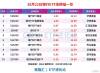

Core Insights - The A-share market is witnessing a rise in bank stocks, with notable increases in shares of banks such as Zhejiang Commercial Bank and Agricultural Bank, which has reached a historical high with a year-to-date increase of nearly 56% [1][5] - Hong Kong bank stocks are also on an upward trend, with Agricultural Bank achieving a 10-day consecutive rise and other banks like China Merchants Bank and Industrial and Commercial Bank of China showing gains [1] - Bank ETFs are experiencing positive performance, with various funds recording increases in value, indicating strong investor interest in the banking sector [1][3] Market Performance - A-share bank index has decreased by 4% since early July, underperforming the CSI 300 index by 19.3 percentage points, while the H-share bank index has slightly increased by 2.2%, lagging behind the Hang Seng index by 5.2 percentage points [5] - The average price-to-book (PB) ratio for A-share banks is 0.71, placing it in the 42.4% percentile over the past three months and 77.7% over the past year, while H-share banks have a PB ratio of 0.5, in the 46% and 73.6% percentiles respectively [5] Investment Trends - There is a growing preference for bank stocks due to their low valuations and high dividend yields, as investors seek safety and stable returns amid rising market risk aversion [5] - Since October 21, a total of 93.14 billion yuan has flowed into 10 bank-themed ETFs, with significant inflows into funds managed by Huabao and E Fund [6][8] - Morgan Stanley anticipates a favorable investment opportunity for domestic bank stocks in the fourth quarter and early next year, supported by upcoming dividend distributions and stable interest rates [10]

农业银行涨超5%,再创历史新高,银行ETF、银行ETF基金涨超1%

Ge Long Hui A P P· 2025-09-04 08:18

Core Viewpoint - A-shares experienced a collective decline, with major indices falling significantly, while bank stocks showed resilience, particularly Agricultural Bank of China reaching a historical high [1] Group 1: Market Performance - The Shanghai Composite Index fell by 1.25% to 3765 points, the Shenzhen Component Index dropped by 2.83%, the ChiNext Index decreased by 4.25%, and the STAR 50 Index declined by 6.08% [1] - Bank stocks, including Agricultural Bank of China and Postal Savings Bank, saw gains, with Agricultural Bank rising over 5% to a new historical high [1] Group 2: ETF Performance - Bank ETFs and related funds saw increases of over 1%, with specific funds like Bank ETF and Bank ETF Fund rising by 1.04% and 1.02% respectively [3] - The Bank ETF tracks the CSI Bank Index, which includes 42 listed banks, focusing on high dividend opportunities and growth potential [4] Group 3: Financial Metrics - In the first half of 2025, listed banks reported a total operating income of 2.92 trillion yuan, a year-on-year increase of 1.0%, and a net profit attributable to shareholders of 1.10 trillion yuan, up 0.8% [4] - The net interest margin for listed banks decreased by 14 basis points year-on-year to 1.41%, with expectations of a slight narrowing in the decline due to policy changes [4] Group 4: Asset Quality and Growth - Asset quality pressure has slightly increased, with rising overdue rates and non-performing loan generation rates, particularly in the retail sector [5] - Total assets of listed banks grew by 9.6% year-on-year as of the end of Q2 2025, indicating a recovery in growth rates [5] Group 5: Future Outlook - The banking sector is expected to see a bottoming out in 2025, with potential for revenue and profit growth to turn positive in 2026, driven by policy support and improved asset quality [6] - The emphasis on long-term investment in the banking sector remains strong, with recommendations for diversified allocations focusing on banks with high dividend yields and solid asset quality [6]

ETF收评:创业板50ETF华夏领涨6.89%,800现金流ETF领跌1.66%

Jing Ji Guan Cha Wang· 2025-08-13 07:08

Group 1 - The ETF market showed mixed performance with the ChiNext 50 ETF (华夏, 159367) leading gains at 6.89% [1] - The Communication ETF (515880) and Communication Equipment ETF (159583) both increased by 6.45% [1] - The 800 Cash Flow ETF (563990) experienced the largest decline, dropping by 1.66% [1] Group 2 - The Coal ETF (515220) fell by 1.08% [1] - The Banking ETF Index Fund (516210) decreased by 0.95% [1]