银行ETF龙头

Search documents

ETF收评 | A股16连阳,时隔10年站上4100点,成家额突破3万亿,AI应用板块爆发,文娱传媒ETF涨8%

Ge Long Hui· 2026-01-09 13:58

Group 1 - The Shanghai Composite Index rose by 0.92%, surpassing 4100 points for the first time in ten years, marking a 16-day consecutive increase [1] - The ChiNext Index increased by 0.77%, driven by a surge in AI application themes, with sectors like film, short dramas, and gaming leading the gains [1] - The market's trading volume exceeded 3.1 trillion yuan, indicating strong investor activity [1] Group 2 - In the ETF market, AI application sectors saw significant growth, with the Huaxia Fund's Entertainment Media ETF, and the ChiNext Software ETFs from Huaxia and Fuguo rising by 8.41%, 7.2%, and 6.73% respectively [1] - The commercial aerospace sector continued its strong performance, with the China Merchants Fund's Satellite Industry ETF, and the EasyWin and Yongying Fund's Satellite ETFs increasing by 6.41%, 6.28%, and 6.27% respectively [1] - In contrast, the overnight performance of U.S. tech stocks showed a decline, with the S&P Biotechnology ETF and Nasdaq Biotechnology ETF dropping by 1% [1]

银行股全线上涨,银行ETF、银行ETF基金、银行ETF易方达、银行ETF南方涨超2%

Ge Long Hui· 2025-12-18 08:42

Group 1 - The banking sector experienced a significant rally, with bank stocks rising across the board, including Shanghai Bank and Chongqing Rural Commercial Bank, which both increased by over 3% [2] - The China Securities Bank ETF and various bank ETFs saw gains of over 2%, indicating strong investor interest in the banking sector [2] - A total of 32 listed banks announced plans for mid-term dividends, with an average dividend payout ratio of 24.9%, amounting to a total dividend distribution of 264.57 billion yuan, a 2.55% increase from the previous year [2] Group 2 - The banking sector is projected to deliver excess returns from the end of 2022 to mid-2025, with the price-to-book (PB) ratio expected to rise from 0.5 times to 0.7 times by December 2025 [3] - Institutional funds, including insurance and northbound capital, are expected to drive the banking sector's performance in 2024, while trading funds may exhibit volatility [3] - Long-term capital, represented by insurance funds, continues to increase its holdings in the banking sector, enhancing pricing efficiency and valuation reconstruction [4] Group 3 - The valuation of Chinese banks is considered undervalued compared to the US and Japan, with a mismatch between PB and return on equity (ROE) [4] - The banking sector is expected to provide absolute and relative returns in the first and fourth quarters, reflecting seasonal characteristics in stock performance [4]

银行ETF基金、银行ETF、银行AH优选ETF上涨,Q3险资加力布局银行板块

Ge Long Hui A P P· 2025-11-20 04:08

Core Viewpoint - The A-share market has seen a significant rise in bank stocks, with notable increases in major banks such as China Bank and Construction Bank, indicating a positive sentiment towards the banking sector [1][4]. Group 1: Stock Performance - China Bank rose over 5%, Construction Bank over 4%, and Postal Savings Bank over 3%, with several other banks also showing gains of over 2% [1]. - Bank ETFs, including various Southern and E-Fund ETFs, have also experienced upward movement, reflecting the overall positive trend in the banking sector [3]. Group 2: ETF Insights - Bank ETFs track the China Securities Bank Index, with nearly 30% of their holdings in major state-owned banks like Industrial and Agricultural Bank, while about 70% focuses on high-growth banks [3]. - The Bank AH Preferred ETF tracks the Bank AH Index, utilizing a monthly security category conversion strategy based on AH prices [4]. Group 3: Institutional Investment Trends - As of Q3 2025, insurance capital has increased its holdings in the banking sector, with a holding ratio of 27.95% and a market value accounting for 3.99% of circulating A-shares [5]. - Insurance capital has increased its positions in 23 banks, with 10 banks seeing increased holdings, indicating a growing interest in the banking sector [6]. Group 4: Market Dynamics - The A-share market is experiencing a style shift, influenced by factors such as the approaching end-of-year assessments for institutions and the central bank's implementation of a moderately loose monetary policy [4]. - The decline in the proportion of bank holdings among public funds suggests a potential opportunity for reallocation towards undervalued financial stocks [4]. Group 5: Future Outlook - The insurance sector is expected to continue increasing its investment in banks, driven by stable dividends and low valuations, with a focus on high ROE small and medium-sized banks [6]. - The ongoing improvement in net profits for banks and the potential for valuation reconstruction through increased capital inflows are seen as positive indicators for the banking sector's future [6].

银行股早盘持续走强,相关ETF涨约2%

Mei Ri Jing Ji Xin Wen· 2025-11-04 03:10

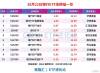

Core Viewpoint - Bank stocks showed strong performance in early trading, with notable increases in shares of Xiamen Bank, Shanghai Bank, and other major banks, indicating a positive market sentiment towards the banking sector [1]. Group 1: Bank Stock Performance - Xiamen Bank rose over 6%, while Shanghai Bank increased by more than 3%, and other banks such as China Merchants Bank, Industrial Bank, Industrial and Commercial Bank of China, and Agricultural Bank of China saw gains exceeding 2% [1]. - Related bank ETFs also experienced a rise of approximately 2% [1]. Group 2: ETF Performance - Specific bank ETFs showed the following performance: - Tianhong Bank ETF (515290) at 1.503, up 2.04% - Index Fund Bank ETF (516210) at 1.425, up 2.00% - Southern Bank ETF (512700) at 1.691, up 1.87% - E-Fund Bank ETF (516310) at 1.381, up 1.92% - Bank ETF Fund (515020) at 1.776, up 1.89% - Bank ETF (512800) at 0.838, up 1.82% - Leading Bank ETF (512820) at 1.468, up 1.80% - Index Bank ETF (512730) at 1.716, up 1.78% [2]. Group 3: Market Insights - Institutions suggest that in a low interest rate and asset scarcity environment, dividend-paying assets with stable ROE capabilities may remain resilient and attractive, potentially serving as a key option for medium to long-term funds amid increased market volatility [2]. - Following interest rate cuts, the downward space for risk-free interest rates has opened up, and the National Financial Regulatory Administration is promoting the entry of insurance funds into the market, highlighting the dividend value of state-owned banks [2].

四季度波动加剧!应如何资产配置?基本面、资金面最新分析!

Xin Lang Cai Jing· 2025-10-23 02:25

Market Overview - The market has experienced increased volatility since October, particularly in the technology sector, with renewed interest in dividend assets due to heightened risk aversion stemming from escalating trade tensions [1] - The uncertainty from trade disputes may lead to a rotation of funds from crowded trades, resulting in fluctuations in high-valuation growth sectors and a rebound in undervalued sectors [1] Asset Allocation Strategy - In the current market context, focus on sectors with positive earnings forecasts such as semiconductor technology, battery, and non-ferrous metals during the third-quarter earnings reporting period [2] - From a funding perspective, main funds are flowing into AI technology sectors like electronics and communications, while southbound funds are notably directed towards dividend sectors like banking [2] Sector Performance Semiconductor Sector - The semiconductor sector is experiencing high growth, with a significant number of companies reporting strong earnings during the third-quarter disclosures [2] - Notable companies include Cambrian, which reported a net profit of 1.605 billion yuan, marking its first profitable quarter, and Haiguang Information, with a net profit of 1.961 billion yuan, up 28.56% year-on-year [2] Non-Ferrous Metals and Battery Sectors - The non-ferrous metals sector is showing signs of recovery, with expected profit growth of 50% by 2025, driven by various favorable factors including supply-side policies and global economic conditions [4] - The battery sector, previously affected by price wars, is expected to see a turnaround with a projected profit growth of 36% by 2025, supported by demand for energy storage and advancements in solid-state battery technology [7] AI and Technology Trends - The AI sector is catalyzing growth across various industries, with significant investments from major companies like Oracle and domestic tech giants increasing their AI capabilities [8] - The Hong Kong market is well-positioned to benefit from the AI narrative, with a complete domestic AI industry chain and major tech companies included in the Hong Kong Technology ETF [8] Funding Trends - Main funds are showing a "barbell" strategy, focusing on both technology sectors and undervalued dividend sectors like banking and consumer goods [12] - Recent data indicates significant net inflows into electronic and communication sectors, with banking also receiving attention as a defensive investment [12] Conclusion - The current market dynamics suggest a strategic focus on sectors with strong earnings potential and favorable growth forecasts, particularly in technology and dividend-paying sectors, as investors seek stability and returns in a volatile environment [1][2][4][7][12]

农业银行走出14连阳,10月超90亿资金冲进银行ETF,华宝银行ETF、银行ETF易方达和银行ETF天弘“吸金”居前

Sou Hu Cai Jing· 2025-10-22 08:30

Core Insights - The A-share market is witnessing a rise in bank stocks, with notable increases in shares of banks such as Zhejiang Commercial Bank and Agricultural Bank, which has reached a historical high with a year-to-date increase of nearly 56% [1][5] - Hong Kong bank stocks are also on an upward trend, with Agricultural Bank achieving a 10-day consecutive rise and other banks like China Merchants Bank and Industrial and Commercial Bank of China showing gains [1] - Bank ETFs are experiencing positive performance, with various funds recording increases in value, indicating strong investor interest in the banking sector [1][3] Market Performance - A-share bank index has decreased by 4% since early July, underperforming the CSI 300 index by 19.3 percentage points, while the H-share bank index has slightly increased by 2.2%, lagging behind the Hang Seng index by 5.2 percentage points [5] - The average price-to-book (PB) ratio for A-share banks is 0.71, placing it in the 42.4% percentile over the past three months and 77.7% over the past year, while H-share banks have a PB ratio of 0.5, in the 46% and 73.6% percentiles respectively [5] Investment Trends - There is a growing preference for bank stocks due to their low valuations and high dividend yields, as investors seek safety and stable returns amid rising market risk aversion [5] - Since October 21, a total of 93.14 billion yuan has flowed into 10 bank-themed ETFs, with significant inflows into funds managed by Huabao and E Fund [6][8] - Morgan Stanley anticipates a favorable investment opportunity for domestic bank stocks in the fourth quarter and early next year, supported by upcoming dividend distributions and stable interest rates [10]

ETF午评:电池ETF嘉实领涨6.98%

Nan Fang Du Shi Bao· 2025-09-05 04:30

Group 1 - The ETF market showed mixed performance with battery ETFs leading gains, specifically 嘉实 ETF (562880) up 6.98%, battery ETF (561910) up 6.97%, and battery 50 ETF (159796) up 6.56% [2] - The banking ETFs experienced declines, with the leading drop from banking ETF (159887) down 1.25%, followed by 南方 banking ETF (512700) down 1.06%, and banking ETF 龙头 (512820) down 1.02% [2] - The total trading volume of ETFs reached 2169.41 billion yuan, with stock ETFs accounting for 1099.98 billion yuan, bond ETFs 568.06 billion yuan, money market ETFs 184.13 billion yuan, commodity ETFs 33.33 billion yuan, and QDII ETFs 283.90 billion yuan [2] Group 2 - The highest trading volumes among non-money market ETFs were recorded by 广发中证香港创新药 (513120) at 73.52 billion yuan, 易方达中证香港证券投资主题 ETF (513090) at 64.87 billion yuan, and 易方达创业板 ETF (159915) at 48.10 billion yuan [2]

ETF午间收盘:电池ETF嘉实涨6.98% 银行ETF跌1.25%

Shang Hai Zheng Quan Bao· 2025-09-05 03:49

Group 1 - The core viewpoint of the article highlights the mixed performance of ETFs on September 5, with significant gains in battery ETFs and declines in banking ETFs [1] Group 2 - The battery ETF managed by Jiashi (562880) increased by 6.98% [1] - The battery ETF (561910) rose by 6.97% [1] - The battery 50 ETF (159796) saw a gain of 6.56% [1] - The banking ETF (159887) experienced a decline of 1.25% [1] - The Southern banking ETF (512700) decreased by 1.06% [1] - The leading banking ETF (512820) fell by 1.02% [1]

农业银行涨超5%,再创历史新高,银行ETF、银行ETF基金涨超1%

Ge Long Hui A P P· 2025-09-04 08:18

Core Viewpoint - A-shares experienced a collective decline, with major indices falling significantly, while bank stocks showed resilience, particularly Agricultural Bank of China reaching a historical high [1] Group 1: Market Performance - The Shanghai Composite Index fell by 1.25% to 3765 points, the Shenzhen Component Index dropped by 2.83%, the ChiNext Index decreased by 4.25%, and the STAR 50 Index declined by 6.08% [1] - Bank stocks, including Agricultural Bank of China and Postal Savings Bank, saw gains, with Agricultural Bank rising over 5% to a new historical high [1] Group 2: ETF Performance - Bank ETFs and related funds saw increases of over 1%, with specific funds like Bank ETF and Bank ETF Fund rising by 1.04% and 1.02% respectively [3] - The Bank ETF tracks the CSI Bank Index, which includes 42 listed banks, focusing on high dividend opportunities and growth potential [4] Group 3: Financial Metrics - In the first half of 2025, listed banks reported a total operating income of 2.92 trillion yuan, a year-on-year increase of 1.0%, and a net profit attributable to shareholders of 1.10 trillion yuan, up 0.8% [4] - The net interest margin for listed banks decreased by 14 basis points year-on-year to 1.41%, with expectations of a slight narrowing in the decline due to policy changes [4] Group 4: Asset Quality and Growth - Asset quality pressure has slightly increased, with rising overdue rates and non-performing loan generation rates, particularly in the retail sector [5] - Total assets of listed banks grew by 9.6% year-on-year as of the end of Q2 2025, indicating a recovery in growth rates [5] Group 5: Future Outlook - The banking sector is expected to see a bottoming out in 2025, with potential for revenue and profit growth to turn positive in 2026, driven by policy support and improved asset quality [6] - The emphasis on long-term investment in the banking sector remains strong, with recommendations for diversified allocations focusing on banks with high dividend yields and solid asset quality [6]

ETF市场日报 | 金融科技相关ETF领涨!下周一将有5只产品新发

Sou Hu Cai Jing· 2025-08-15 08:33

Market Performance - The A-share market showed strong performance with the Shanghai Composite Index rising by 0.83%, the Shenzhen Component Index increasing by 1.60%, and the ChiNext Index up by 2.61% as of August 15, 2025 [1] - The trading volume in the Shanghai and Shenzhen markets exceeded 2 trillion yuan for three consecutive days, reaching 22,446 billion yuan today [1] ETF Performance - The STAR Market Growth ETF (588070) had the highest increase, rising by 11.77% [2] - Other notable ETFs included the Financial Technology ETFs, which saw increases of over 6% [2] Financial Technology Sector - According to GF Securities, the financial technology sector is experiencing upward momentum driven by both policy and funding [3] - A projected 500 billion yuan of new funds is expected to enter the market by 2025, enhancing the attractiveness and inclusivity of the domestic capital market [3] - This influx of funds, combined with regulatory optimizations, is anticipated to boost the performance of traditional brokerages and expand online trading and digital advisory services [3] Regulatory Environment - Financial regulatory bodies in regions such as Shanghai, Guangdong, Zhejiang, and Anhui have introduced measures to combat "involution" in the banking sector, targeting practices like loan rebates and disguised interest subsidies [6] - The focus is on promoting differentiated competition strategies to ensure sustainable development in the banking industry [6] ETF Trading Activity - The Hong Kong Securities ETF (513090) led in trading volume with 41.556 billion yuan [7] - The turnover rate for the Hong Kong Medical ETF (159366) was the highest at 200.94% [9] Upcoming ETF Issuance - Several ETFs are set to begin fundraising on August 18, 2025, including the Hong Kong Stock Connect Technology ETF and the A500 Dividend Low Volatility ETF [10] - These ETFs will track indices focusing on high-growth technology stocks and low-volatility dividend-paying stocks [10][11][12][13][14][15]