油气开采

Search documents

我国首个国家级深水油气应急救援基地在海南启用

Xin Lang Cai Jing· 2025-10-16 11:25

Core Points - The establishment of China's first national deep-water oil and gas emergency rescue base in Hainan Province marks a significant advancement in emergency response capabilities in southern maritime areas [1] - The base was jointly constructed by the Ministry of Emergency Management, Hainan Provincial Government, and China National Offshore Oil Corporation (CNOOC) [1] - The facility covers an area of over 11,000 square meters and includes emergency workshops and training exercise areas [1] - It is equipped with China's first independently developed 3,000-meter underwater emergency well sealing device and an underwater oil spill recovery system, enhancing the ability to quickly seal wells and efficiently recover oil spills [1]

A股9月回购月报:中国巨石股价高位官宣回购,美的、宁德时代单月豪掷均超20亿元!

Mei Ri Jing Ji Xin Wen· 2025-10-16 10:57

Core Viewpoint - In September, A-share listed companies continued to implement share buybacks, with 22 companies announcing buyback plans, reflecting their recognition of self-value and commitment to shareholder rights and market confidence [1][2]. Group 1: Buyback Plans and Amounts - A total of 22 companies announced new buyback plans in September, a decrease of 37.14% from 35 in August, with a proposed maximum buyback amount of approximately 3.969 billion yuan, down from 10.007 billion yuan in August [1][2]. - Among the companies, China Jushi announced the highest proposed buyback amount of 880 million yuan, followed by Shougang Co. at 520 million yuan and China International Marine Containers at 500 million yuan [2]. - The buyback amount for Midea Group and CATL exceeded 2 billion yuan each in September, leading the buyback efforts for the month [1][5]. Group 2: Company-Specific Insights - China Jushi's stock price has been on an upward trend since June, with a maximum increase of over 60%, raising questions about the timing of its buyback announcement [2]. - The company stated that the buyback is a response to confidence in future stock prices and a commitment to shareholder interests, with the buyback amount representing about 6% of its liquid funds [2]. - Jian Sheng Group, a leading player in the knitted sportswear industry, announced a second buyback plan for the year, aiming to use 150 million to 300 million yuan for share cancellation [3]. Group 3: Market Reactions and Future Plans - Newpoint Software announced a buyback plan of 30 million to 50 million yuan for employee stock ownership plans, while also changing the purpose of a previous buyback to share cancellation [4]. - Despite a decrease in the number of companies announcing buybacks, the commitment to returning value to investors is evident, with companies like Midea and CATL showing significant buyback amounts [1][5]. - As of the end of September, approximately 379 companies had announced buyback progress, with 137 companies having met or exceeded their minimum buyback amounts [5][11].

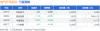

油气开采板块10月16日跌1.14%,*ST新潮领跌,主力资金净流出4493.35万元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

Core Points - The oil and gas extraction sector experienced a decline of 1.14% on October 16, with *ST Xinchao leading the drop [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Sector Performance - The closing prices and changes for key stocks in the oil and gas extraction sector are as follows: - Intercontinental Oil & Gas (600759): Closed at 2.33, unchanged - Blue Flame Holdings (000968): Closed at 7.18, down 0.28% - China National Offshore Oil Corporation (600938): Closed at 26.41, down 0.30% - *ST Xinchao (600777): Closed at 4.12, down 4.19% [1] Capital Flow - The oil and gas extraction sector saw a net outflow of 44.93 million yuan from main funds, with retail investors contributing a net inflow of 53.41 million yuan [1] - Detailed capital flow for specific stocks includes: - Intercontinental Oil & Gas (600759): Main funds net outflow of 3.92 million yuan, retail net inflow of 6.72 million yuan - Blue Flame Holdings (000968): Main funds net outflow of 5.87 million yuan, retail net inflow of 11.63 million yuan - China National Offshore Oil Corporation (600938): Main funds net outflow of 7.52 million yuan, retail net inflow of 17.56 million yuan - *ST Xinchao (600777): Main funds net outflow of 27.62 million yuan, retail net inflow of 17.50 million yuan [2]

洲际油气:关于以集中竞价交易方式首次回购公司股份的公告

Zheng Quan Ri Bao· 2025-10-15 14:10

Core Points - The company announced its first share buyback on October 15, 2025, through centralized bidding, repurchasing 4.7985 million shares, which represents 0.1157% of the total share capital [2] Company Summary - The share buyback is a strategic move by the company to enhance shareholder value and may indicate confidence in its financial position [2] - The total number of shares repurchased is 4.7985 million, reflecting a significant commitment to returning capital to shareholders [2] - The percentage of total share capital being repurchased is 0.1157%, which is a relatively small but notable portion [2] Industry Context - Share buybacks are often viewed as a positive signal in the market, suggesting that companies believe their shares are undervalued [2] - The trend of share repurchases has been prevalent in the industry, as companies seek to optimize their capital structure and improve earnings per share [2] - This move may align with broader industry practices aimed at enhancing shareholder returns amidst fluctuating market conditions [2]

青海油田气区日产量升至1520万立方米 保障甘青藏地区供暖需求

Zhong Guo Xin Wen Wang· 2025-10-15 13:00

今年以来,青海油田着力解决天然气自然递减加剧、问题井增多、设备运行压力增加等问题,为加强冬 供措施储备,加大长停井治理力度,提升调层、酸化、防砂等"短平快"措施力度。截至目前,涩北气田 已完成各类措施941井次,日增产472万立方米。通过最新科技手段,实现投产新井日增气81万立方米。 截至目前,青海油田涩北气田年产天然气已连续15年超50亿立方米,实现规模稳产。(完) 青海油田气区日产量升至1520万立方米 保障甘青藏地区供暖需求 中新网西宁10月15日电 (祁妙 焦玉娟 程鑫)受冷空气影响,甘青藏地区近期气温下降明显且陆续进入供 暖期,为全力保障天然气冬季保供高效运行,中国石油天然气集团公司青海油田分公司(以下称:"青海 油田")气区从9月份的日产1450万立方米已提升至目前的日产1520万立方米。 资料图为2024年9月25日,航拍青海油田涩北气田总站。马铭言 摄 青海油田地处柴达木盆地西北部,平均海拔超3000米,是世界上海拔最高的油田,油气勘探开发始于 1954年。涩北气田年产规模约占青海油田天然气总产量的80%,是保障甘青藏地区天然气供应的主要气 源地。 资料图为2024年9月25日,涩北气田总站工 ...

洲际油气(600759.SH):首次回购479.85万股股份

Ge Long Hui A P P· 2025-10-15 09:59

Group 1 - The company Intercontinental Oil and Gas (600759.SH) announced its first share buyback through centralized bidding on October 15, 2025, repurchasing 4.7985 million shares, which represents 0.1157% of the total share capital [1] - The buyback was conducted at a minimum price of 2.32 CNY per share and a maximum price of 2.35 CNY per share [1] - The total amount paid for the buyback was 11.191002 million CNY, excluding transaction fees [1]

油气开采板块10月15日跌0.09%,*ST新潮领跌,主力资金净流入3156万元

Zheng Xing Xing Ye Ri Bao· 2025-10-15 08:33

Core Points - The oil and gas extraction sector experienced a slight decline of 0.09% on October 15, with *ST Xinchao leading the losses [1] - The Shanghai Composite Index closed at 3912.21, up 1.22%, while the Shenzhen Component Index closed at 13118.75, up 1.73% [1] Sector Performance - The closing prices and performance of key stocks in the oil and gas extraction sector are as follows: - Intercontinental Oil & Gas (600759) closed at 2.33, up 0.43% with a trading volume of 1.1851 million shares - Blue Flame Holdings (000968) closed at 7.20, unchanged with a trading volume of 150,500 shares - China National Offshore Oil Corporation (600938) closed at 26.49, down 0.11% with a trading volume of 364,800 shares - *ST Xinchao (600777) closed at 4.30, down 0.23% with a trading volume of 946,800 shares [1] Capital Flow - The oil and gas extraction sector saw a net inflow of 31.56 million yuan from institutional investors, while retail investors experienced a net outflow of 59.26 million yuan [1] - Detailed capital flow for specific stocks includes: - China National Offshore Oil Corporation (600938) had a net inflow of 82.97 million yuan from institutional investors, but a net outflow of 88.86 million yuan from retail investors [2] - Blue Flame Holdings (000968) experienced a net outflow of 9.31 million yuan from institutional investors, with a net inflow of 6.47 million yuan from retail investors [2] - Intercontinental Oil & Gas (600759) had a net outflow of 9.69 million yuan from institutional investors, with a net inflow of 6.18 million yuan from retail investors [2] - *ST Xinchao (600777) faced a net outflow of 32.41 million yuan from institutional investors, with a net inflow of 16.95 million yuan from retail investors [2]

沪指收复3900点,汽车整车、机场航运涨幅居前

Guan Cha Zhe Wang· 2025-10-15 08:20

Core Viewpoint - The A-share market experienced a collective rise on October 15, with the Shanghai Composite Index recovering above 3900 points, indicating positive market sentiment and investor confidence [1]. Market Performance - The Shanghai Composite Index increased by 1.22%, closing above 3900 points - The Shenzhen Component Index rose by 1.73% - The ChiNext Index saw a gain of 2.36% - The North China 50 Index climbed by 1.62% - Total trading volume across Shanghai and Shenzhen markets reached 20,904 billion yuan, a decrease of 5,062 billion yuan compared to the previous day - Over 4,300 stocks in the market experienced an increase [1]. Sector Performance - Leading sectors in terms of growth included: - Automotive manufacturing - Airport and shipping - Electric grid equipment - Peek materials - Innovative pharmaceuticals - Automotive parts - Sectors that faced declines included: - Port shipping - Agricultural planting - Lithography machines - Rare earth permanent magnets - Oil and gas extraction [1].

油气开采板块10月14日涨1.71%,*ST新潮领涨,主力资金净流入412.52万元

Zheng Xing Xing Ye Ri Bao· 2025-10-14 08:46

Core Insights - The oil and gas extraction sector experienced a rise of 1.71% on October 14, with *ST Xinchao leading the gains [1] - The Shanghai Composite Index closed at 3865.23, down 0.62%, while the Shenzhen Component Index closed at 12895.11, down 2.54% [1] Sector Performance - The closing prices and performance of key stocks in the oil and gas extraction sector are as follows: - *ST Xinchao: Closed at 4.31, up 5.12% with a trading volume of 360,600 shares [1] - Blue Flame Holdings: Closed at 7.20, up 1.98% with a trading volume of 202,400 shares [1] - China National Offshore Oil Corporation: Closed at 26.52, up 0.76% with a trading volume of 407,500 shares [1] - Intercontinental Oil and Gas: Closed at 2.32, unchanged with a trading volume of 1,416,300 shares [1] Capital Flow - The oil and gas extraction sector saw a net inflow of 4.1252 million yuan from institutional investors, while retail investors experienced a net outflow of 7.45139 million yuan [1] - Detailed capital flow for key stocks includes: - *ST Xinchao: Net inflow from institutional investors was 6.118 million yuan, while retail investors had a net outflow of 2.2618 million yuan [2] - Intercontinental Oil and Gas: Net inflow from institutional investors was 0.9107 million yuan, with a net outflow from retail investors of 2.6767 million yuan [2] - China National Offshore Oil Corporation: Net inflow from institutional investors was 0.0817 million yuan, with a significant net outflow from retail investors of 85.6723 million yuan [2] - Blue Flame Holdings: Experienced a net outflow from institutional investors of 2.9852 million yuan, while retail investors had a net inflow of 10.7435 million yuan [2]

西南油气田公司前三季度产气量同比增长13.75%

Xin Lang Cai Jing· 2025-10-14 08:29

来源:中国石油西南油气田公司 今年以来,西南油气田公司加快推进产能建设,前三季度投产井数完成年度计划的109%。新建年产能 完成计划的107%,新井贡献产量完成计划的107%。常规气领域完试井中涌现多口百万方高产气井。致 密气投产井数超过百口,新建年产能规模可观。页岩气投产井数大幅超计划,新建年产能完成情况良 好。工程技术持续进步,钻井周期有效控制,压裂效率显著提升。老气田措施增产效果明显,实施工艺 措施井超千口,增产气量规模显著。 据中国石油西南油气田公司消息,今年1至9月,西南油气田公司天然气产量同比增长13.75%,刷新历 史同期纪录,为实现高质量上产500亿目标奠定坚实基础。 ...