环保工程及服务

Search documents

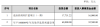

联泰环保:第三季度净利润同比减少49.16%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-30 09:05

Core Insights - The company reported a decline in revenue and net profit for the third quarter and the first three quarters of the year [1] Financial Performance - In Q3, the company achieved operating revenue of 239.2041 million yuan, a year-on-year decrease of 10.74% [1] - The net profit attributable to shareholders for Q3 was 29.2153 million yuan, down 49.16% year-on-year [1] - For the first three quarters, the company recorded operating revenue of 756.1111 million yuan, a year-on-year decline of 6.34% [1] - The net profit attributable to shareholders for the first three quarters was 113.6914 million yuan, reflecting a year-on-year decrease of 31.74% [1]

万邦达前三季度实现净利润2499.23万元

Zheng Quan Ri Bao Wang· 2025-10-30 08:44

Core Insights - The company reported a revenue of 1.784 billion yuan for the first three quarters of the year, a decrease of 5.56% year-on-year [1] - The net profit attributable to shareholders reached 24.9923 million yuan, showing a significant increase of 390.47% year-on-year [1] Group 1: Financial Performance - Revenue for the first three quarters was 1.784 billion yuan, down 5.56% compared to the previous year [1] - Net profit attributable to shareholders was 24.9923 million yuan, up 390.47% year-on-year [1] Group 2: Corporate Actions - The company reached an agreement to acquire an additional 0.5% stake in its subsidiary, Huizhou Isco New Materials Technology Development Co., Ltd., increasing its ownership to 73.5% [1] - The acquisition process has been completed with the registration of changes in business operations [1] Group 3: Project Developments - The company’s subsidiary, Guangdong Isco New Materials Technology Development Co., Ltd., has successfully initiated trial production for certain facilities in the Jieyang C4 and C5 project [1]

金达莱:第三季度净利润1192.11万元,同比下降70.75%

Xin Lang Cai Jing· 2025-10-30 08:01

Core Insights - The company reported a significant decline in revenue and net profit for the third quarter and the first three quarters of the year [1] Financial Performance - Third quarter revenue was 67.35 million, a year-on-year decrease of 34.18% [1] - Third quarter net profit was 11.92 million, a year-on-year decrease of 70.75% [1] - Revenue for the first three quarters was 236 million, a year-on-year decrease of 23.50% [1] - Net profit for the first three quarters was 75.47 million, a year-on-year decrease of 30.14% [1]

赛恩斯拟发不超5.7亿可转债 前3季净利降半IPO募4.5亿

Zhong Guo Jing Ji Wang· 2025-10-30 06:29

Core Viewpoint - The company Sains (688480.SH) has announced a plan to issue convertible bonds to raise a total of up to 565 million yuan, which will be used for various projects and to supplement working capital [1][2]. Group 1: Convertible Bond Issuance - The total amount to be raised from the issuance of convertible bonds is capped at 565 million yuan, which includes the principal amount [1]. - The net proceeds after deducting issuance costs will be allocated to three main projects: the expansion of the flotation reagent project, the construction of a high-efficiency flotation reagent project with an annual production capacity of 100,000 tons, and to supplement working capital [1][2]. - The bonds will be issued at par value, with a face value of 100 yuan each, and the total number of bonds to be issued will not exceed 5,650,000 [2][3]. Group 2: Financial Performance - For the first three quarters of 2025, the company reported a revenue of 677 million yuan, representing a year-on-year increase of 15.81% [3]. - The net profit attributable to shareholders decreased by 48.32% to 74 million yuan, while the net profit excluding non-recurring gains and losses fell by 10.78% to 72 million yuan [3]. - The net cash flow from operating activities was reported at 37 million yuan [3]. Group 3: Previous Fundraising and Stock Performance - The company was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on November 25, 2022, raising a total of 454.69 million yuan, with a net amount of 399.24 million yuan after costs [4]. - The stock price reached a new high of 64.99 yuan on October 14, 2025, marking the highest price since its listing [5].

上海洗霸(603200.SH):2025年三季报净利润为1.19亿元

Xin Lang Cai Jing· 2025-10-30 02:26

Financial Performance - The company's total operating revenue is 354 million yuan, ranking 65th among disclosed peers, a decrease of 20.67 million yuan compared to the same period last year, representing a year-on-year decline of 5.52% [1] - The net profit attributable to shareholders is 119 million yuan, with net cash inflow from operating activities at 40.48 million yuan, ranking 55th among disclosed peers [1] Financial Ratios - The latest debt-to-asset ratio is 35.93%, an increase of 4.03 percentage points from the previous quarter and a slight increase of 0.01 percentage points from the same period last year [3] - The latest gross profit margin is 33.49%, down 4.58 percentage points compared to the same period last year [3] - The latest return on equity (ROE) is 11.01% [3] Efficiency Metrics - The diluted earnings per share are 0.68 yuan [4] - The latest total asset turnover ratio is 0.21 times, a decrease of 0.04 times year-on-year, representing a decline of 15.18% [4] - The latest inventory turnover ratio is 2.01 times, ranking 75th among disclosed peers, down 0.50 times compared to the same period last year, a decline of 20.03% [4] Shareholder Information - The number of shareholders is 48,800, with the top ten shareholders holding 99.23 million shares, accounting for 56.55% of the total share capital [4] - The largest shareholder is Ren Wei, holding 40.83% of the shares [4]

万邦达(300055.SZ):2025年三季报净利润为2499.23万元

Xin Lang Cai Jing· 2025-10-30 02:03

Core Insights - Wanbangda (300055.SZ) reported a total operating revenue of 1.784 billion yuan for Q3 2025, ranking 18th among disclosed peers, which is a decrease of 105 million yuan or 5.56% year-on-year [1] - The company's net profit attributable to shareholders was 24.99 million yuan, ranking 13th among peers [1] - The net cash flow from operating activities was -63.99 million yuan, ranking 17th, a decrease of 34.19 million yuan compared to the same period last year [1] Financial Ratios - The latest debt-to-asset ratio is 36.63%, an increase of 3.13 percentage points from the previous quarter and 5.59 percentage points from the same period last year [3] - The latest gross profit margin is 9.67%, ranking 13th among peers [3] - The latest return on equity (ROE) is 0.48%, ranking 14th among peers [3] Earnings and Turnover - The diluted earnings per share (EPS) is 0.03 yuan, ranking 13th among peers [4] - The total asset turnover ratio is 0.21 times, ranking 23rd, a decrease of 0.04 times or 15.42% year-on-year [4] - The inventory turnover ratio is 6.11 times, ranking 13th, a decrease of 1.09 times or 15.13% year-on-year [4] Shareholder Structure - The number of shareholders is 32,200, with the top ten shareholders holding 358 million shares, accounting for 42.83% of the total share capital [4] - The largest shareholder is Wang Piaoyang, holding 32.46% of the shares [4]

青达环保(688501.SH):2025年三季报净利润为1.24亿元

Xin Lang Cai Jing· 2025-10-30 02:01

Core Insights - Qingda Environmental Protection (688501.SH) reported a total revenue of 1.47 billion yuan and a net profit attributable to shareholders of 124 million yuan for Q3 2025 [1] - The company experienced a negative cash flow from operating activities amounting to 16.78 million yuan, ranking 13th among disclosed peers [1] - The latest asset-liability ratio stands at 60.85%, placing the company 20th among its peers [3] Financial Performance - The gross profit margin is reported at 26.64%, which is a decrease of 5.00 percentage points compared to the same period last year [3] - The return on equity (ROE) is recorded at 11.62% [3] - The diluted earnings per share (EPS) is 1.01 yuan [4] Operational Efficiency - The total asset turnover ratio is 0.50 times [4] - The inventory turnover ratio is 1.24 times, ranking 13th among disclosed peers [4] Shareholder Structure - The number of shareholders is 4,404, with the top ten shareholders holding a total of 57.90 million shares, accounting for 46.61% of the total share capital [4] - The largest shareholder is Wang Yong, holding 17.29% of the shares [4]

兴蓉环境(000598):业绩稳步增长 项目投产带来增长潜力

Xin Lang Cai Jing· 2025-10-30 00:33

Core Viewpoint - The company's core business shows steady growth, with performance meeting expectations. In the first three quarters of 2025, the company achieved operating revenue of 6.548 billion yuan, a year-on-year increase of 5.39%, and a net profit attributable to shareholders of 1.764 billion yuan, a year-on-year increase of 8.49% [1][2]. Revenue and Profit Growth - The company reported a non-recurring net profit of 1.735 billion yuan in the first three quarters, reflecting a year-on-year growth of 8.29%. In Q3 alone, the company achieved operating revenue of 2.356 billion yuan, up 6.85%, and a net profit of 789 million yuan, up 13.09% [2]. - The growth in performance is primarily driven by an increase in sewage treatment service fees and a rise in business volume, with the core water supply and sewage treatment business contributing steadily [2]. Major Projects and Future Growth - Several major construction projects are progressing smoothly, laying a solid foundation for future growth. The Chengdu central urban area kitchen waste harmless treatment project (Phase III) has entered the material testing phase, while the Wanjing Phase III waste incineration power generation project is gradually undergoing system debugging, with a waste processing capacity of 5,100 tons/day [3]. - The project is expected to be operational by 2026 and will help Chengdu achieve "zero landfill" for municipal waste, with pricing for treatment fees being a key factor for future profitability [3]. - Additional sewage treatment projects are expected to be operational in the next 1-2 years, which may further drive up sewage treatment service fees under the existing pricing mechanism [3]. Capital Expenditure and Cash Flow - The peak of capital expenditure is nearing its end, with cash flow improvement and dividend potential expected. The current investment cycle is approaching its conclusion, with capital expenditure projected to peak in 2025 and decline thereafter [3]. - In the first three quarters, cash payments for fixed asset purchases were 2.659 billion yuan, significantly reduced from 3.417 billion yuan in the same period last year [3]. - The company's operating cash flow remains strong, with a net amount of 2.399 billion yuan in the first three quarters, a year-on-year increase of 11.74%. With declining capital expenditure and stable cash flow from operations, the company is expected to achieve positive free cash flow by 2026, providing a solid foundation for increasing dividend ratios [4]. Profit Forecast - The company is projected to achieve operating revenues of 9.551 billion yuan, 10.277 billion yuan, and 11.068 billion yuan for 2025-2027, with year-on-year growth rates of 5.55%, 7.60%, and 7.70%, respectively. The net profit attributable to shareholders is expected to be 2.167 billion yuan, 2.327 billion yuan, and 2.556 billion yuan, with growth rates of 8.54%, 7.39%, and 9.85% [4].

浙江卓锦环保科技股份有限公司 2025年第三季度报告

Zheng Quan Ri Bao· 2025-10-29 22:44

Core Viewpoint - The company, Zhejiang Zhuojin Environmental Technology Co., Ltd., has announced the use of its own funds to pay personnel costs for fundraising projects and will replace these amounts with raised funds, ensuring compliance with regulations and maintaining operational efficiency [7][9][12]. Financial Data - The company reported that the total amount raised from its initial public offering was RMB 251.099 million, with a net amount of RMB 200.792 million after deducting issuance costs [7]. - The company has implemented a special account management system for the raised funds, ensuring that all expenditures are made from this account [7]. Fund Usage - The company has decided to conclude the "Enterprise Technology R&D Center Project" and redirect surplus funds from the "Branch Construction Project" to the "Industrial Three Wastes Comprehensive Treatment and Resource Utilization R&D Project" [8]. - The company plans to use its own funds to cover personnel costs during the implementation of fundraising projects, which will later be replaced with raised funds to comply with banking regulations [9][10]. Approval Process - The decision to use self-owned funds for personnel costs and subsequently replace them with raised funds was approved by the company's board and audit committee [11][12]. - The sponsor institution has reviewed and agreed that this arrangement does not affect the normal implementation of fundraising projects and complies with relevant regulations [12][13].

\t绿色动力(601330.SH):前三季度净利润6.26亿元,同比增长24.39%

Ge Long Hui· 2025-10-29 19:42

Core Viewpoint - Green Power (601330.SH) reported a slight increase in revenue and a significant rise in net profit for the first three quarters of 2025, indicating positive financial performance despite a modest revenue growth [1] Financial Performance - The company achieved an operating revenue of 2.582 billion yuan for the first three quarters, reflecting a year-on-year growth of 1.49% [1] - The net profit attributable to shareholders reached 626 million yuan, marking a year-on-year increase of 24.39% [1] - Basic earnings per share were reported at 0.45 yuan [1]